January 2025

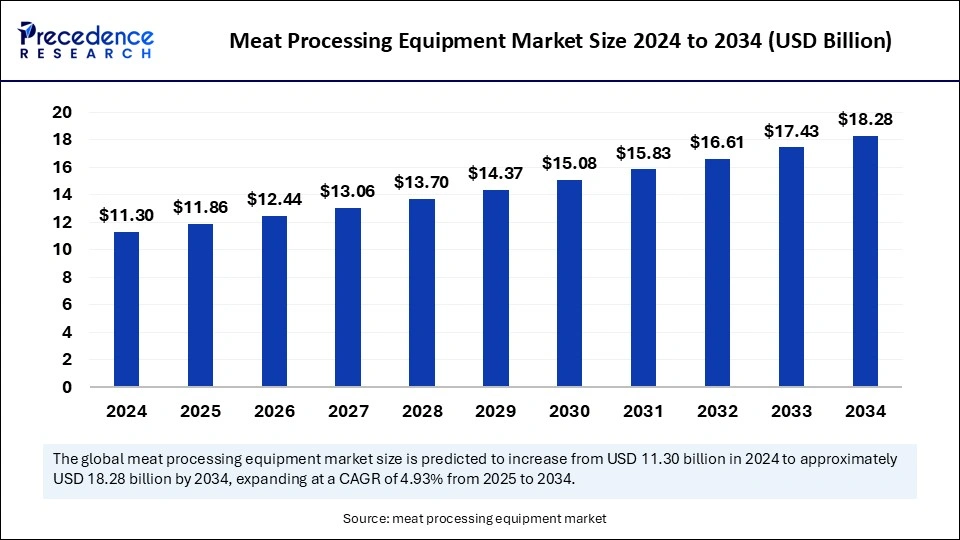

The global meat processing equipment market size is calculated at USD 11.86 billion in 2025 and is forecasted to reach around USD 18.28 billion by 2034, accelerating at a CAGR of 4.93% from 2025 to 2034. Asia Pacific market size surpassed USD 4.07 billion in 2024 and is expanding at a CAGR of 5.06% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global meat processing equipment market size was estimated at USD 11.30 billion in 2024 and is predicted to increase from USD 11.86 billion in 2025 to approximately USD 18.28 billion by 2034, expanding at a CAGR of 4.93% from 2025 to 2034. Rising demand for processed meat products is the key factor driving market growth. Also, increasing urbanization coupled with technological innovations in meat processing equipment can fuel market growth further.

Artificial intelligence is revolutionizing industrial machinery in many ways, and the meat industry is also one of them. The deployment of AI in the meat processing equipment market is changing the way meat products are manufactured, inspected, and managed, providing solutions that improve quality, efficiency, and safety. Furthermore, AI-driven computer vision uses innovative machine learning algorithms and cameras to inspect the quality of processed meat. This system can identify irregular cuts, defects, and contamination with high precision.

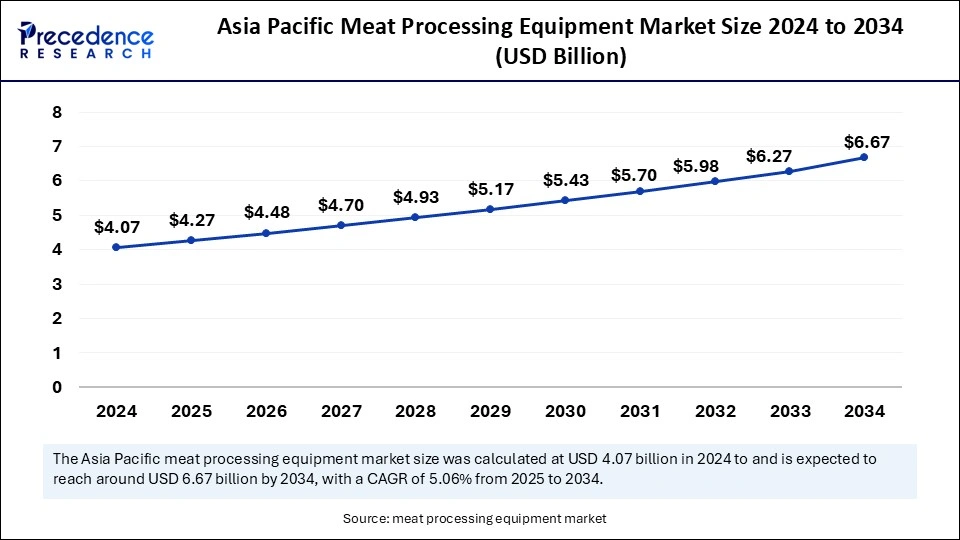

Asia Pacific meat processing equipment market size was exhibited at USD 4.07 billion in 2024 and is projected to be worth around USD 6.67 billion by 2034, growing at a CAGR of 5.06% from 2025 to 2034.

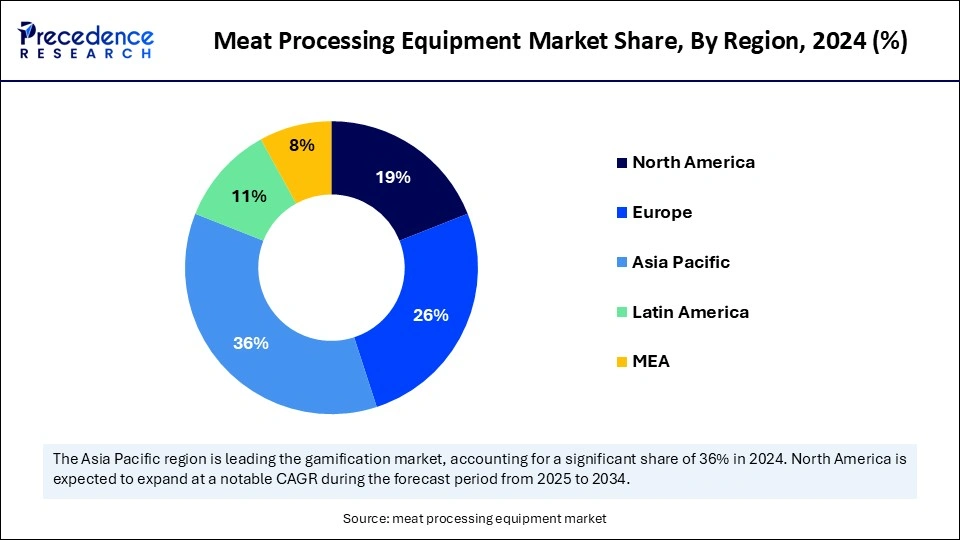

Asia Pacific held the largest share of the meat processing equipment market in 2024. The dominance of the region can be attributed to the escalating demand for processed meat coupled with the growing expenditure on meat processing plants. The region also boasts a strong presence in a major market. In Asia Pacific, India led the market owing to technological advancements, such as smart equipment and automation, that have enhanced product quality and production efficiency.

North America is expected to grow at the fastest rate in the meat processing equipment market over the studied period. The growth of the region can be credited to the increasing popularity of premium meat that optimizes the need for convenient processing solutions. The expansion of retail and food service sectors has boosted the adoption of flexible and scalable meat processing solutions. In North America, the U.S. dominated the market due to the increasing consumer preference for organic and premium meat products.

Meat processing equipment involves tools and machines that prepare and produce meat products. Operators utilize these tools for various operations such as cutting, grinding, slaughtering, packaging, and mixing. The main equipment consists of mixers, slicers, grinders, and packaging devices. Innovative systems include automated technologies to ensure hygiene and boost efficiency. Manufacturers in the meat processing equipment market design equipment to keep product consistency and stick to industry standards. This equipment can handle various meat types, such as poultry, pork, beef, and fish.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.28 Billion |

| Market Size in 2025 | USD 11.86 Billion |

| Market Size in 2024 | USD 11.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment, Meat, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Expansion of restaurant and multinational hotel chains

The expansion and growth of restaurants and multinational hotel chains are the major factors driving the meat processing equipment market. The expansion of multinational food supply chains and fast-food restaurants like McDonald's have boosted the demand for processed meat products due to the rising demand for chicken and beef globally. In addition, top market players are using advanced machinery with stability and strength to cut through meat, which is difficult to work with.

Limited availability of skilled labor

One of the significant factors constraining the meat processing equipment market is the inadequately skilled labor. There is a lack of experienced personnel and skilled labor who can operate and maintain this equipment. Moreover, the equipment is expensive and necessitates a high level of maintenance. This, in turn, results in high initial investments in the market, hindering market growth further.

Increasing awareness of high sources of nutrition in meat products

The growing awareness regarding the high sources of nutrition in poultry and meat products is the major factor creating lucrative opportunities for the meat processing equipment market. These products are vital sources of vitamins, proteins, omega-3, fatty acids, minerals, etc., which makes them crucial for maintaining a healthy diet. Furthermore, marinating machinery improves flavor, and Evisceration machines ensure the overall quality of meat. These machines play a significant role in processing these products.

The slicing segment dominated the global meat processing equipment market in 2024. The dominance of the segment can be attributed to the increasing popularity of processed and pre-packaged meat products. Consumers are increasingly searching for sliced meats for their convenience, which are important for easy-to-eat options such as salads and sandwiches. Additionally, advancements in slicing technology, including adjustable and automatic slicers, are improving manufacturing capabilities and fulfilling various consumer preferences.

The dicing equipment segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising demand for meat products that improve cooking consistency and presentation. Dicing enables various applications like convenience foods and ready-to-eat meals, which are gaining traction among the majority of consumers. Also, technological advancements are enabling more precise and efficient dicing processes, which makes it convenient for processors to reduce waste and fulfill quality standards.

In 2024, the pork segment led the meat processing equipment market by holding the largest share. The dominance of the segment can be driven by the rising popularity of pork as a major protein source in various regions, especially in Europe and Asia. Processed pork is cheaper than processed beef and also has a better taste than mutton. Hence, there is an extensive demand for pork in regions like North America and Europe. Furthermore, the growing demand for processed pork products such as cured meats, sausages, and ham is fuelling investments in this technology.

The beef segment is expected to grow at the fastest rate during the projected period. The growth of the segment can be linked to the growing global consumption of processed beef products like beef jerky and ground beef due to its convenience. Moreover, market trends favoring thin cuts of beef are impelling processors to adopt new technologies that enable better yield quality. The segment expansion, especially in emerging regions, further boosts market growth over the forecast period.

By Equipment

By Meat Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

February 2025