September 2024

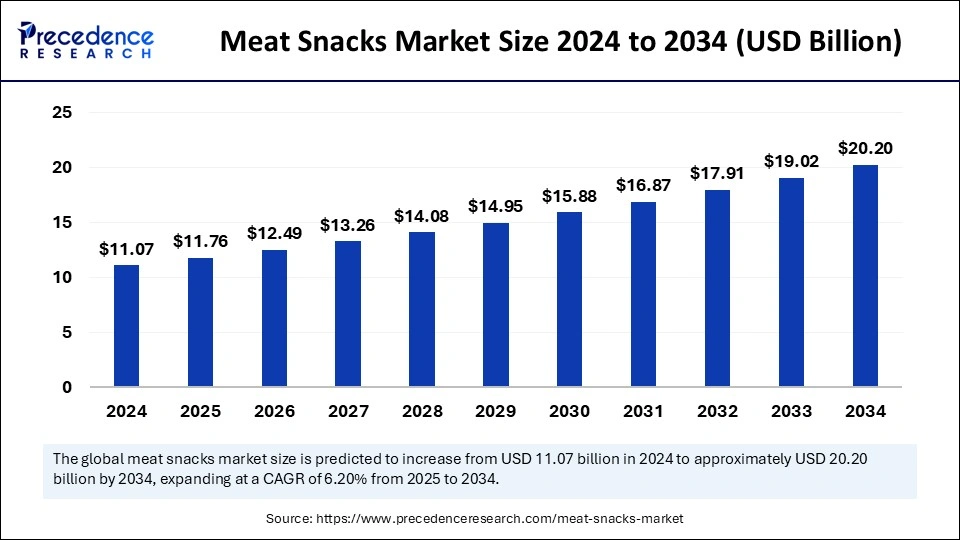

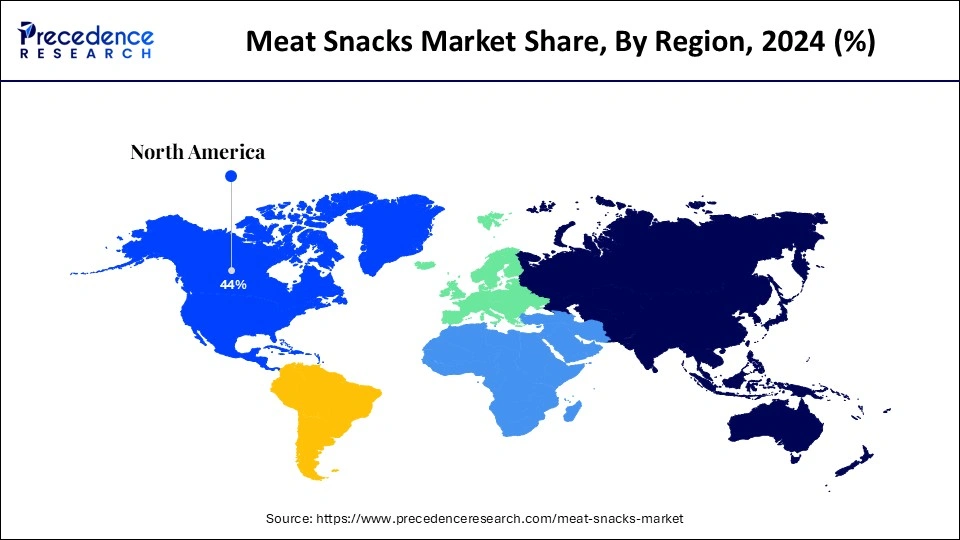

The global meat snacks market size is calculated at USD 11.76 billion in 2025 and is forecasted to reach around USD 20.20 billion by 2034, accelerating at a CAGR of 6.20% from 2025 to 2034. The North America market size surpassed USD 4.87 billion in 2024 and is expanding at a CAGR of 6.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global meat snacks market size was estimated at USD 11.07 billion in 2024 and is predicted to increase from USD 11.76 billion in 2025 to approximately USD 20.20 billion by 2034, expanding at a CAGR of 6.20% from 2025 to 2034. The global market growth is attributed to the increasing demand for protein-rich and healthier snack options and increasing availability across online retail channels.

Artificial Intelligence has the potential to enhance product quality and production quality in meat processing. Meat processors can detect meat quality with higher accuracy, automate various processing tasks, and accurately classify carcasses by implementing AI technology. AI enables real-time detection of characteristics such as texture, color, fat content, and freshness of meat snacks and improves the accuracy of quality assessment. Meat products can reach their destination faster, with AI speeding processes in the meat snacks products. AI-driven cutting robots are transforming the way meat is cut and deboned. These automated systems reduce waste, optimize cutting precision, and adjust their movements based on real-time analysis, which is further expected to revolutionize the growth of the meat snacks market.

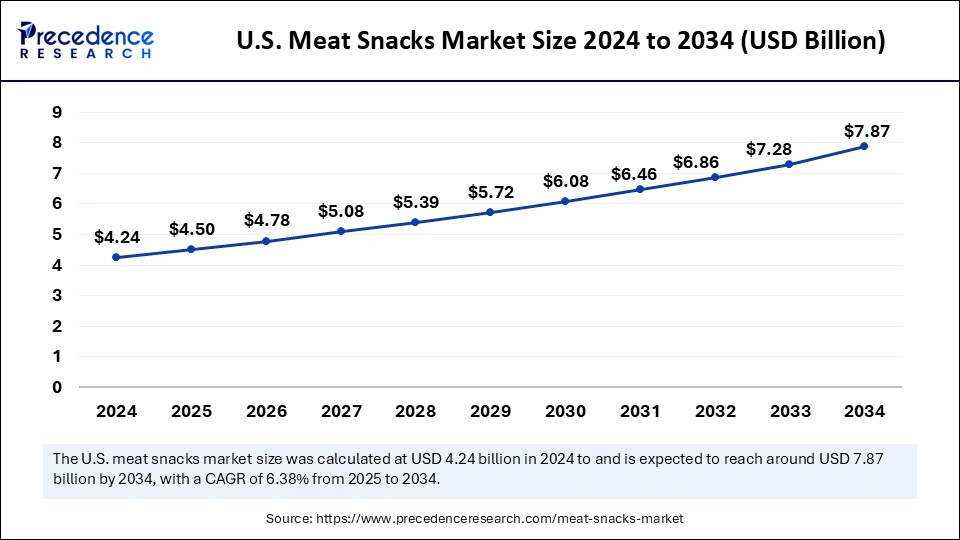

The U.S. meat snacks market size was exhibited at USD 4.24 billion in 2024 and is projected to be worth around USD 7.87 billion by 2034, growing at a CAGR of 6.38% from 2025 to 2034.

North America held the dominating share of the market in 2024 and is observed to sustain as a leader in the upcoming period. The market growth in the region is attributed to the increasing demand for meat and meat products, the increasing elderly population, and the increasing busy lifestyle. In addition, the increasing demand for on-the-go and protein-rich meat snacks and the large meat-consuming population is anticipated to drive the growth of the market in the region.

The U.S. dominated the market share in 2024. The market growth in the U.S. is propelled by the increasing demand for premium meat snacks, rising robust consumer need for protein-rich or convenient food options, and growing convenience stores, supermarkets, or e-commerce platforms. Various market players in the country are significantly emphasizing formulating products and flavor diversification to sustain a leading competitive edge, which further drives the meat snacks market.

The Asia Pacific is expected to grow fastest during the forecast period. The increasing demand for protein-rich and convenient meat snack options, growing urbanization, increasing consumer preference towards healthy lifestyles, and increasing popularity of meat snacks. In addition, increasing shifts in dietary preferences and rapid urban growth are further anticipated to drive the growth of the market. Furthermore, health-conscious individuals are seeking snacks that align with low-carb and high-protein diets, which further promote market growth in the region.

China Meat Snacks Market Analysis

China is the fastest-growing country driving market growth. The market growth in China is attributed to the increasing population and increasing demand for premium meat snacks products. In addition, the increasing popularity of healthy snacking, and the long working hours to avoid the adverse effects of junk food are further anticipated to drive the market growth in China.

Europe is observed to grow at a considerable growth rate in the upcoming period. The market in Europe is witnessing robust growth, attributed to evolving dietary trends and shifting consumer preferences. In this region, poultry is the most commonly consumed animal meat. This preference for poultry along with an increasing demand for low-carb and high-protein snacks, further drives the market demand. In addition, the demand for ready-to-eat and convenient solutions, paired with the increasing popularity of premium and clean-label products, further enhances the growth of the market in Europe.

The meat snacks market deals with snacks by marinating meat in a curing solution and drying it. Meat processed in this manner increases the shelf-life of meat snacks and provides a unique flavor. The manufacturing process of meat snacks includes preparation of the curing and processing, preparation of the curing solution, initial meat preparation and packaging, and quality check. In addition, various flavors added to meat products and increasing preference towards salty, spicy, and specific-flavored snacks are expected to drive the market growth.

The market is driven by increasing consumer preference towards high-protein and on-the-go snacks that serve active lifestyles and health awareness. In addition, intensifying the need for natural ingredient-derived and magnifying awareness regarding clean-label products, and minimally processed snacks further drives the market growth. Furthermore, increasing retail distribution and e-commerce platforms enhance product availability and are further expected to propel the market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 20.20 Billion |

| Market Size in 2025 | USD 11.76 Billion |

| Market Size in 2024 | USD 11.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Source, Flavor, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing on-the-go and convenience lifestyles

Contemporary lifestyles prioritize convenience, leading to a rise in ready-to-eat and portable food options like meat snacks. With their minimal prep time, easy transportability, and extended shelf life, meat snacks are perfect for consumers seeking quick bites while traveling, at work, or engaging in outdoor activities. To leverage this trend, manufacturers and retailers are introducing innovative packaging solutions, including resealable bags and single-serving packs, to meet the on-the-go demands of consumers. This strategy positions meat snacks as a significant segment of the growing market for convenient food products.

The increasing trend of vegetarian and vegan diet

The increasing trend of vegetarian and vegan diets is expected to hamper the market growth. Plant-based meat snacks are gaining traction among consumers. In addition, the high cost of production also creates major challenges in the meat snacks market. This market segment includes various intricate stages, from sourcing premium-quality meat to packaging, flavoring, processing, and distribution, each contributing significantly to increased production costs.

Rising premiumization trend

In the meat snacks market, the premiumization trend in the food and beverage market has significantly enhanced opportunities. There is a significant willingness to invest in products that meet these criteria, as consumer preferences shift towards higher-quality and healthier snack choices. In addition, various manufacturers are innovating with premium product lines that emphasize artisanal production techniques, natural ingredients, and top-grade meats. This strategic focus positions brands and aligns with evolving consumer preferences to capitalize on growing meat snacks consumption for premium meat snacks across the globe.

The jerky segment will dominate the meat snacks market in 2024. The segment growth in the market is attributed to the increasing versatile application in meal preparations, rising advancements such as exotic, grass-fed, and organic meat options, and the increasing variety of meat types and flavors available in jerky. In addition, the accessibility of jerky via e-commerce platforms has further accelerated the requirement and availability. Furthermore, jerky is favored for its long shelf life which makes it convenient for on-the-go and storage consumption.

The sticks segment is expected to grow fastest during the forecast period. A snack stick is a shelf-stable and small sausage and is an important part of meat snacks. There are many variations found in the sticks segment such as artificial ingredients, sugars used, and quality of meat.

The beef segment dominated the meat snacks market in 2024. The segment growth in the market is attributed to the increasing accessibility through traditional retail channels and e-commerce channels. Beef is commonly recognized for its high protein and rich flavor content, appealing to consumers satisfying snack options and seeking nutritious options. In addition, the portability and convenience of beef snacks allow consumers to enjoy protein-rich foods on the go and cater to busy lifestyles. Furthermore, to cater to the increasing demand and propel their sales, various major players are increasingly launching beef meat.

The pork segment is expected to grow fastest during the forecast period. Pork is the most commonly consumed meat across the globe. Pork is eaten both preserved and freshly cooked and the cure increases the shelf life of pork products. The pork sausage, bacon, gammon, and ham are the major instances of preserved pork. Pork is the most popular meat across the globe.

The peppered segment dominated the meat snacks market in 2024. The segment growth in the market is attributed to the growing popularity of convenient and portable food choices and the increasing trends toward flavorful and protein-rich snack options. In addition, peppered varieties provide a unique taste profile that requests customers to customers search for a more robust meat-snacking experience. In addition, peppered meat snacks offer both nutritional value and taste satisfaction and often cater to consumers looking for alternatives to traditional snacks, which further drives the segment's growth. Furthermore, the original segment is expected to grow fastest during the forecast period.

The hypermarkets and supermarkets dominated the meat snacks market in 2024. The segment growth in the market is driven by increasing strategic locations paired with competitive pricing and promotional activities, enhancing consumer awareness and product visibility. Hypermarkets and supermarkets play an important role in the market by offering diverse product selections and extensive shelf space to serve varying consumer preferences. In addition, to ensure efficient distribution and consistent availability, hypermarkets and supermarkets leverage their robust logistic networks, making them crucial in driving the market for meat snacks.

The online stores segment is expected to grow fastest during the forecast period. The segment growth in the market is attributed to the increasingly busy lifestyle of the consumers via online retail stores leading to its various advantages such as exchange policies, easy return, and doorstep delivery.

By Product Type

By Source

By Flavor

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

August 2024