January 2025

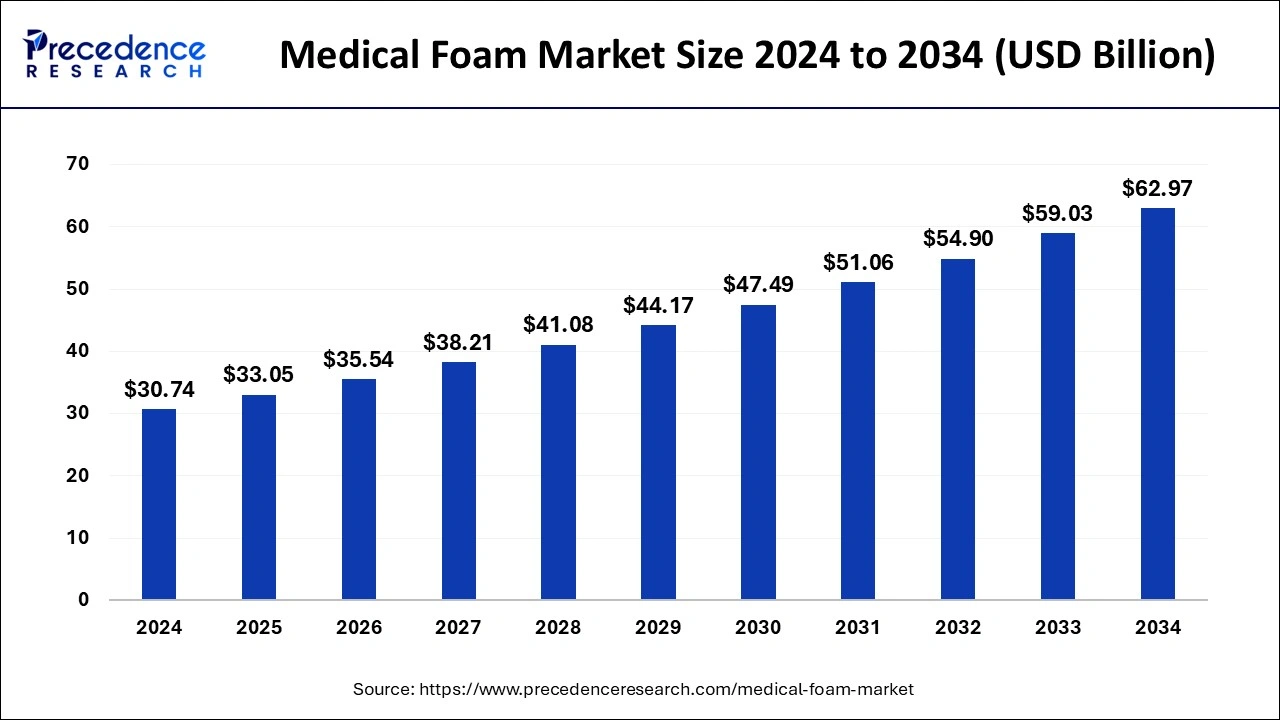

The global medical foam market size is accounted at USD 33.05 billion in 2025 and is forecasted to hit around USD 62.97 billion by 2034, representing a CAGR of 7.43% from 2025 to 2034. The North America market size was estimated at USD 10.76 billion in 2024 and is expanding at a CAGR of 7.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical foam market size was calculated at USD 30.74 billion in 2024 and is predicted to increase from USD 33.05 billion in 2025 to approximately USD 62.97 billion by 2034, expanding at a CAGR of 7.43% from 2025 to 2034. This growth is attributed to various factors, which include a rising geriatric population, an increase in global health expenditure, and the rapid expansion of the medical devices sector.

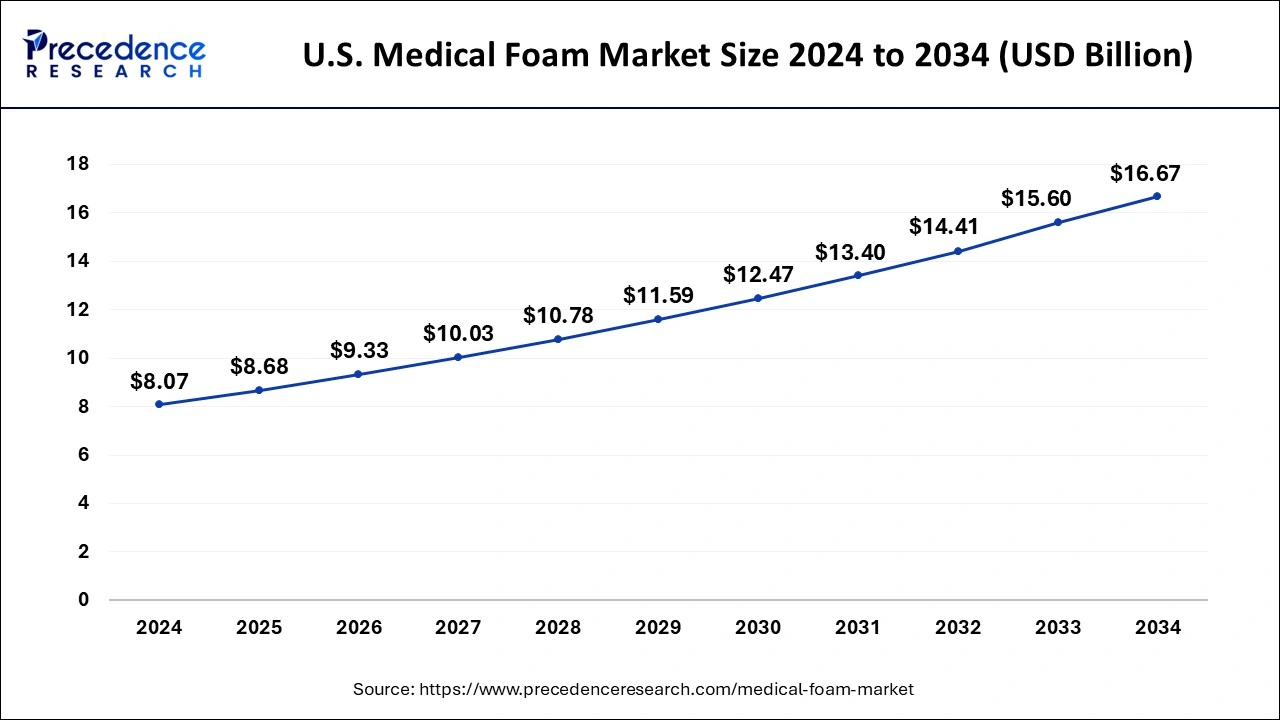

The U.S. medical foam market size was exhibited at USD 8.07 billion in 2024 and is projected to be worth around USD 16.67 billion by 2034, growing at a CAGR of 7.52% from 2025 to 2034.

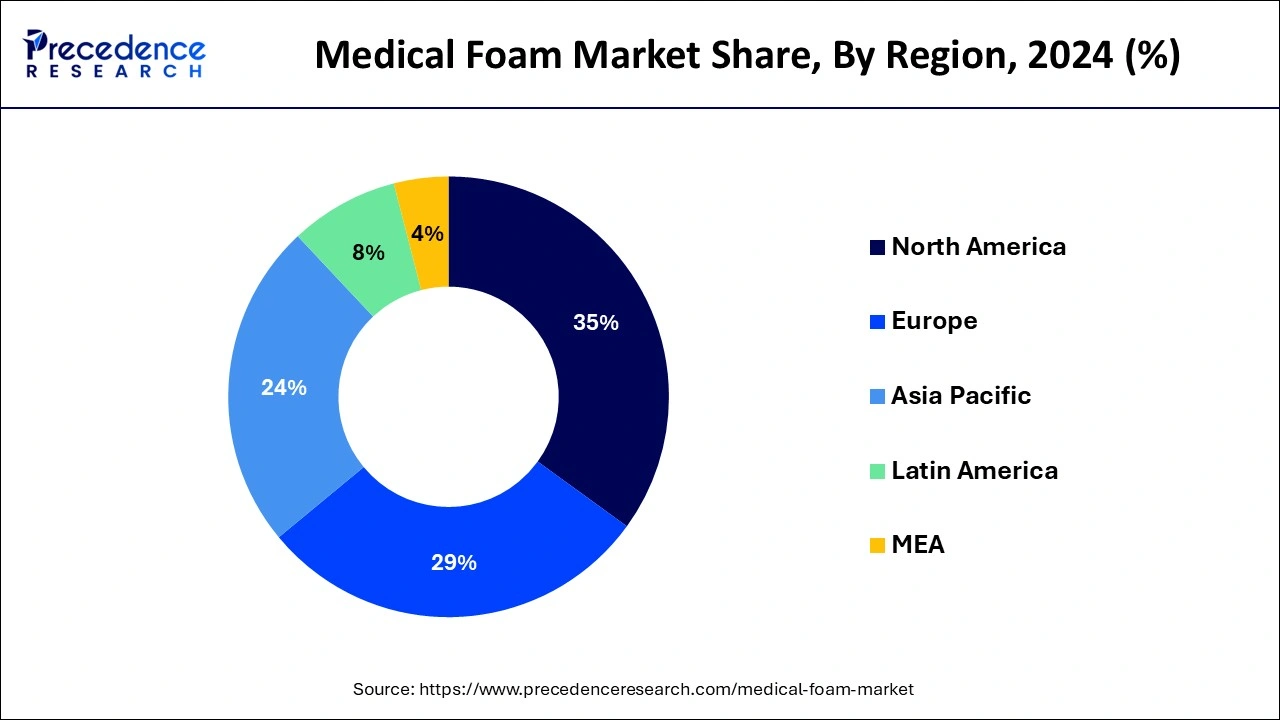

North America dominated the medical foam market in 2024. The demand for medical equipment is expected to soar in the coming years due to increased healthcare spending per person in the U.S. This is likely to lead to a higher demand for medical foam in the region. One of the main factors influencing the North American market is the rise in healthcare spending per person in the United States, mainly through health insurance. Also, the increasing healthcare spending per person through health insurance in the U.S. has been a significant trend affecting the North American market.

Asia Pacific is experiencing rapid growth in the medical foam market, driven by increased awareness, higher disposable income, and improved access to healthcare services. With large populations, especially in countries like China and India, there's a growing demand for better medical solutions, including medical foam. Additionally, infrastructure development, supportive government policies, and increased investments in healthcare are further driving the growth of the medical foam market in the region.

Medical foam serves various medical purposes, like orthopedics, prosthetics, wound care, surgery, and patient positioning. It's crafted from materials like polyurethane, silicone, or latex and is tailored to have specific traits such as flexibility, resilience, and antimicrobial properties. It is found in wound dressings to shield, absorb fluids, and aid healing, as well as in orthopedic devices like splints and braces for support and immobilization of injured limbs. Medical foam is additionally utilized in crafting prosthetic limbs to establish comfortable and personalized connections between artificial and residual limbs. In surgical settings, it's used for padding during patient positioning, cushioning on operating tables, and managing bleeding. Moreover, there are ongoing developments in foam-based drug delivery systems for administering medications externally or internally.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.43% |

| Market Size in 2025 | USD 33.05 Billion |

| Market Size in 2024 | USD 30.74 Billion |

| Market Size by 2034 | USD 62.97 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Foam Type, Product, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for medical-grade foams in dressing and cushioning applications

Medical-grade foams are extensively used in the healthcare industry for various applications such as wound dressings, medical supports, and braces. These foams are valued for their softness, durability, flexibility, and lightweight and water resistance properties, which makes them ideal for protective packaging. They're also employed in customized orthotics, prosthetic padding, and ostomy sealing equipment. In medical breathing devices, they serve as heat and moisture exchange materials, while in wound care, they aid in healing and scar prevention. Commonly used types include polyethylene and cross-linked polyethylene for equipment protection and polyurethane and Metallocene foams for other medical applications.

Stringent regulations associated with foam manufacturing processes

A significant challenge for the medical foam market is the strict regulations governing the manufacturing of foam. Making and using medical foam requires meeting rigorous quality standards and regulatory rules to ensure patient safety and product reliability. This can be tough for manufacturers, who must invest in advanced technology, quality control, and extensive testing, which leads to higher production costs and makes it harder for smaller companies to enter the market.

Rising use of medical foam in spinal implants

The use of medical foam in medical devices and components is on the rise due to increasing demand. Medical foam offers better biocompatibility and is cost-effective compared to other options. Furthermore, the growing emphasis on health and hygiene among consumers is boosting market growth. Global population growth is also driving up demand for medical foam. Moreover, medical foam is increasingly being used in spinal implants due to its strength, biocompatibility, and performance. These implants are designed to mimic cancellous bone by providing interconnected porosity throughout the implant. This increased usage of spinal implants will shortly propel the medical foam market growth.

The flexible foam segment dominated the medical foam market in 2023. The growth of the flexible foam segment is driven by its increasing use in cushioning, wound dressing, bedding, and medical packaging. Flexible medical foam possesses qualities suitable for various applications. Particularly, the demand for spray foam type is expected to surge due to its usage in prosthetics and wound care, like instant bandages. Spray foams are also widely employed in medical devices and packaging applications for coatings, filling, insulation, and sealing, which can further fuel segment growth.

In the medical foam market, the spray segment is anticipated to grow at the fastest rate over the forecast period. The flexible foam segment is growing because of its expanding role in prosthetics, wound care like instant bandages, and as coatings, fillers, insulators, and air seals in medical devices and packaging. This usage trend is expected to continue driving segment growth in the future.

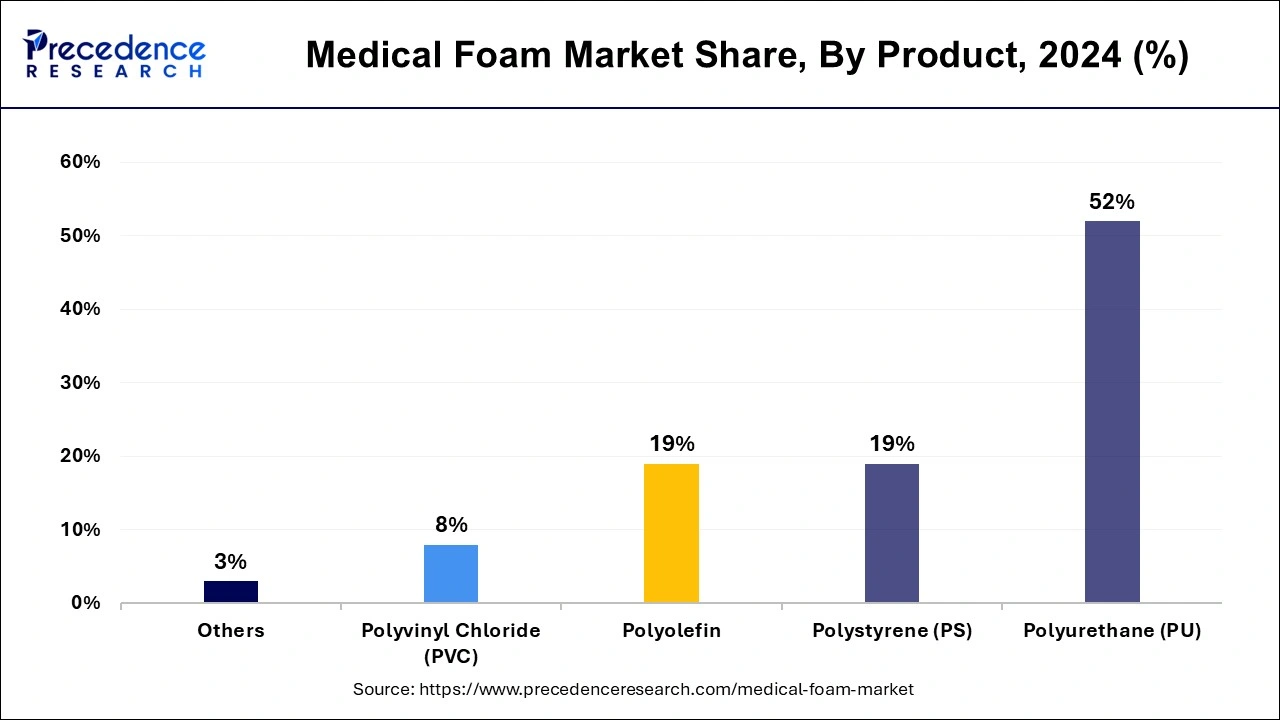

The polyurethane segment dominated the medical foam market in 2023. The segment is set to grow because of its broad range of uses in bedding, cushioning packaging, prosthetics, and wound care. Additionally, the application of rigid medical foams in podiatric, orthotics, wheelchair pads, hip protector pads, and hygienic seating for support and protection is expected to drive further growth in this segment during the forecast period

The polyolefin segment is projected to be the fastest-growing segment in the medical foam market during the projected period. The market is primarily growing because more people prefer flexible packaging over rigid packaging. Flexible foam is also easy to make and can support heavy loads, which helps companies save money on packaging by using less material.

The bedding & cushioning segment dominated the medical foam market in 2023. Medical foam used for bedding and cushioning is commonly found in hospitals, clinics, and home healthcare setups. It provides great support, helps distribute pressure, and ensures comfort, which is crucial for improving patient care and recovery. These foam solutions are used in mattresses, pillows, wheelchair cushions, and similar products to give maximum comfort and reduce the chances of pressure ulcers.

In the medical foam market, the medical devices & components segment is expected to grow at the fastest rate over the studied period. Medical foam is becoming more popular in medical device production due to growing demand. It's favored for its good biocompatibility and cost-effectiveness. Manufacturers often blend various plastics like polystyrene (PS) and polyethylene to create medical foam with the desired properties for use in these devices.

By Foam Type

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025