What is the MedicalPackaging Films Market Size?

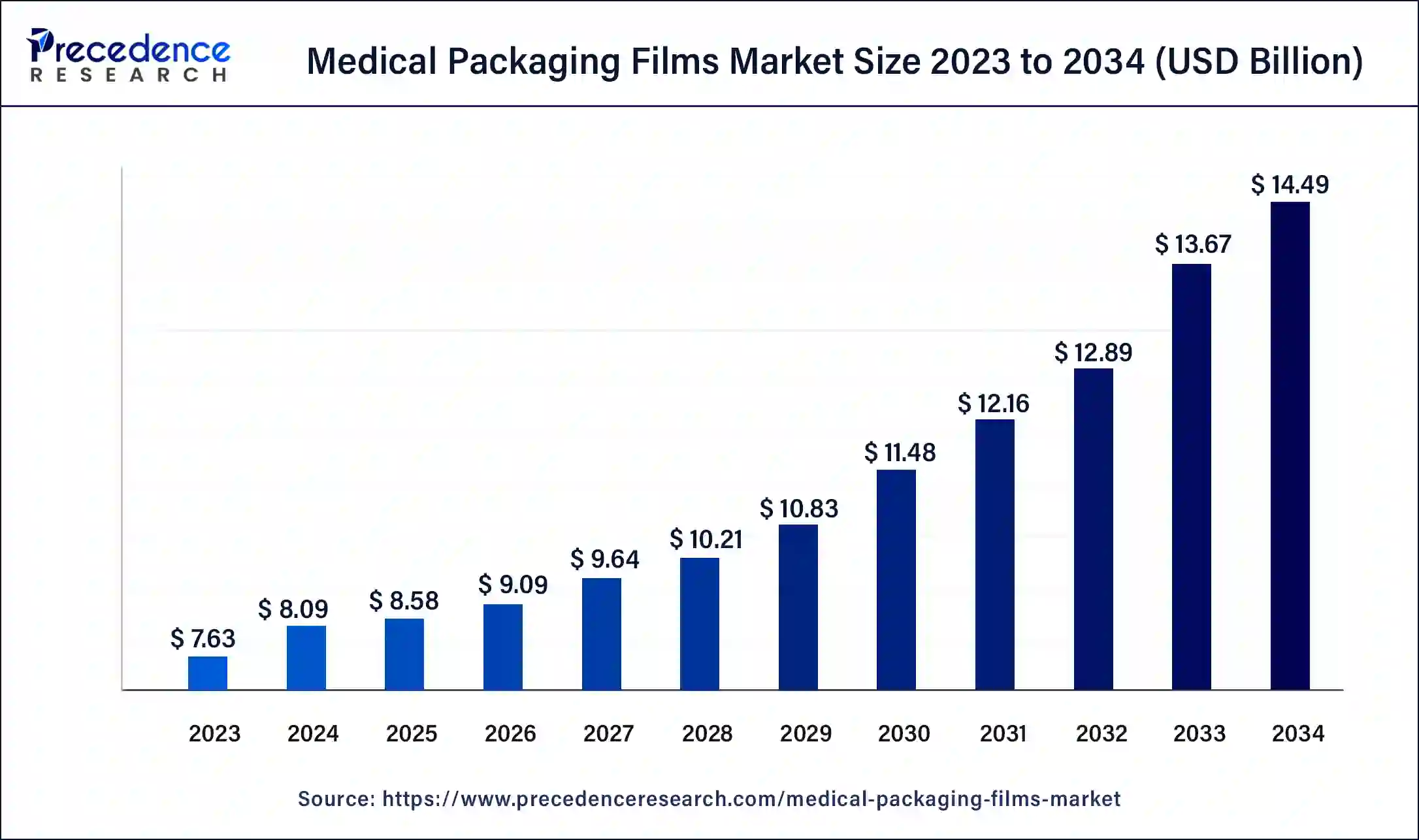

The global medical packaging films market size is valued at USD 8.58 billion in 2025 and is predicted to increase from USD 9.09 billion in 2026 to approximately USD 15.31 billion by 2035, expanding at a CAGR of 5.96% from 2026 to 2035.

Medical Packaging Films Market Key Takeaways

- Asia Pacific captured the maximum revenue share of the market in 2025.

- By material, the polypropylene segment will likely see a significant increase in market share in the medical packaging films market in the coming years.

- By type, the thermo-formable segment is expected to register a significant revenue share in the medical packaging films market during the forecast period.

- By application, the bags application category has the largest revenue share. It is anticipated to develop fastest in the worldwide medical packaging films market during the forecast period.

- By end-user, the pharmaceutical businesses segment held the largest share of revenue in the global market for medical packaging films.

Market Overview

Pharmaceutical packaging involves the use of medical packaging films as a product. Pharmaceutical items are covered and protected by packaging that is intended for consumer use. Medical packaging films are used for various medical and pharma products, including pills, tablets, implantable devices, capsules, diagnostic kits and unit dose medications in the form of sterile and specialized bags packaging. Depending on the application, these films are typically plastic, but product innovation and material advancement has started offering medical packaging films in metallic material. The market for medical packaging films is growing considerably and will continue to do so in the forecast period owing to the ease of production and the innovation of sustainable packaging materials.

Amcor plc., one of the industry leaders, had total sales of $ 14,544 million in 2022. The company had a $14.97 billion revenue in 2022, which, when compared to the revenue of 2021, which was $13.58 B, had increased substantially.

How is AI Impacting the Medical Packaging Films Market?

AI is transforming the medical packaging films market by enhancing quality control and defect detection through advanced image recognition and real-time monitoring systems. It optimizes production processes, improving efficiency, reducing material waste, and ensuring consistent product quality. AI also aids in predictive maintenance of packaging machinery and supply chain management, minimizing downtime and improving operational reliability. Additionally, it supports R&D for developing advanced films with improved barrier properties and durability, accelerating innovation in medical packaging solutions.

Medical Packaging Films Market Growth Factors

Rising healthcare costs and the prevalence of chronic illnesses significantly influence the global market for medical packaging films. With the emergence of new diseases and the expansion of regulatory standards globally, the pharmaceutical industry is also witnessing a growth in medications and medical equipment, which will increase the demand for medical packaging films in the upcoming period. The increasing prevalence of chronic illnesses that require ongoing vaccination is another vital reason fueling the rise in the global market for medical packaging films. The vaccines are typically pre-filled syringes, which is anticipated to positively impact the market prospects for polypropylene and polyethylene films.

Other significant factors for the growth of the market are the rising demand for implantable devices and the increased use of medical bags for cheap packaging in the pharma sector. The market for medical packaging films is predicted to expand quickly due to the rising popularity of sustainable packaging materials, which is projected to present new lucrative prospects. The medical technology industry is rapidly integrating sustainable technologies in its different divisions, creating fresh growth prospects for the global market for medical packaging films. Additionally, possibilities for expanding the demand for medical packaging films will arise from the rising use of bioplastic materials in the packaging sector. Other changes can be found in the bi-axially oriented film industry, which is gaining popularity due to its many advantages, including superior heat and strong impact resistance.

Market Outlook

- Market Growth Overview: The medical packaging films market is expanding due to increasing demand for safe, sterile, and durable packaging solutions in the healthcare and pharmaceutical sectors.

- Global Expansion: The market is growing worldwide as emerging regions expand pharmaceutical manufacturing and healthcare infrastructure, creating opportunities for advanced packaging solutions that ensure product safety and shelf life.

- Major Investors: Major investors include pharmaceutical companies, packaging material manufacturers, and venture capital firms, providing funding, technology development, and production capacity to drive market growth and innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.58 Billion |

| Market Size by 2035 | USD 15.31 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.96% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material Type, By Type, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

The rapidly growing pharmaceutical sector

The market for medical packaging films has a sizable possibility due to the rapid development of biopharmaceuticals. Due to their effectiveness in treating various ailments, including cancer, autoimmune disorders, and chronic conditions, biopharmaceuticals, including protein-based medications, vaccines, and biosimilars, are in high demand. Biopharmaceuticals are much more susceptible to environmental conditions than traditional small-molecule medications, including temperature, light, and oxygen. They need specialized packaging solutions to guarantee their stability, potency, and effectiveness throughout the manufacture, storage, and shipping operations. Pharma packaging films are essential for preserving the quality and safeguarding the protection of biopharmaceutical medicines. These films offer exceptional barrier qualities against moisture, oxygen, and UV radiation to protect fragile biologics from deterioration and preserve their therapeutic efficiency. The safety and security of biopharmaceuticals can be further improved by incorporating features like temperature-controlled packaging, anti-counterfeiting safeguards, and tamper-evident seals in advanced packaging films.

As the market for biopharmaceuticals grows, there is an increasing demand for specialized packaging options that can meet the particular needs of these advanced medication compositions. This creates profitable prospects for the market for medical packaging films to develop and provide cutting-edge films specially made for biopharmaceutical applications. Additionally, the growing use of targeted and personalized medicines increases demand for biopharmaceuticals and expands the market for pharmaceutical packaging films. Customized packaging films can efficiently meet the smaller batch sizes, specialized package shapes, and distinct labeling needs frequently needed for personalized pharmaceuticals.

Restraint

Continuously fluctuating and rising prices of raw materials

Specialized materials that offer excellent barrier qualities, chemical resistance, and compatibility with varied drug formulations are needed to produce packaging films for pharmaceutical applications. Aluminum foil, polyethylene, polypropylene, polyvinyl chloride and polyethylene terephthalate are examples of these materials. These raw materials' costs fluctuate because of things like changes in the price of oil, demand and supply dynamics, and geopolitical occurrences. Cost increases for raw materials directly impact how much it costs to make pharmaceutical packaging films, which puts pressure on manufacturers' and suppliers' profit margins.

To provide affordable substitutes or to optimize the formulation of films for packaging without giving up on quality and performance, manufacturers must invest in research and development. The price of pharmaceutical items could be impacted by increased raw material costs, which may affect patients' access and affordability. This is a problem, particularly in areas with constrained healthcare resources or in poor nations where having access to reasonably priced pharmaceuticals is essential. Market actors investigate tactics, including strategic sourcing, supplier alliances, and process optimization, to lessen the effects of changes in raw material prices to alleviate this constraint. Investing in recyclable and sustainable packaging materials can also assist in saving expenses overall and address environmental issues.

Opportunity

The rising production of bioplastics for packaging purposes

The production and utilization of biodegradable, sustainable, and eco-friendly packaging materials are expected to offer many opportunities for the market's growth during the forecast period. The introduction of bioplastics is observed as a dynamic shift in the market. A bio-based, bio-degradable plastic known as bioplastics can be created using natural resources, including different starches and vegetable oils. Compared to conventional petrochemical-based plastic, bioplastics produced using renewable raw materials provide a biodegradable alternative that is more secure for the environment and less dependent on fossil fuels. In the upcoming years, the market for medical packaging films is anticipated to increase due to the rising use of bioplastic in producing different goods and materials. As the overall packaging industry is focusing on the use of sustainable packaging solutions, the demand for bioplastics will also boost in the upcoming years by acting as a driver for the market's growth.

Additionally, the rising government efforts to promote sustainable and eco-friendly packaging, along with favorable regulations for the adoption of such materials, will encourage the utilization of bioplastics. Multiple market players are focused on the development of bioplastic packaging solutions, especially for the medical industry; this element will accelerate the growth of the market during the predicted timeframe.

Material Insights

The plastic segment holds a significant share of the market, the segment will continue to grow at a noticeable rate during the forecast period. The availability of the material, ease of production and cost-effectiveness of the plastic material promote the segment's growth. The innovation in plastic material for packaging solutions is expected to accelerate the growth of the plastic segment.

The polypropylene segment will likely see a significant increase in market share in the medical packaging films market during the period analyzed. This results from polypropylene's many advantages, including its stability and heat resistance. Additionally, production packaging for pharmaceutical and healthcare products generally employs it. The most widely used PE materials are HDPE and LDPE. Due to its low density, LDPE is well recognized for being extensively utilized in plastic bags. Polypropylene (PP) enjoys a sizable market share in the material sector. Due to its higher melting point than polyethylene, it is more suited for applications needing high-temperature sterilization. Metalizing PP can enhance the gas barrier qualities necessary for a longer product shelf life.

Type Insights

During the forecast period, the thermo-formable segment is expected to register a significant revenue share in the medical packaging film market. The thermoforming film packaging technology has produced positive benefits for the packaging sector. For the medical industries, they are perfect for packaging both consumable and non-consumable items. Thermoformable films have benefits such as product protection, affordability, sustainability, quick turnaround, reduced waste, and more. Due to the low cost of the materials, thermoforming is a financially advantageous choice. Thermoformed plastic products can be up to 15% less expensive than plastic packaging created using injection molding. Additionally, the technique has a rapid turnaround period, which can reduce labor expenses.

Application Insights

The bags application category has the largest revenue share and is anticipated to develop fastest in the worldwide medical packaging films market during the forecast period. The segment's growth is attributed to the wide range of applications of medical bags. Medical bags are used more frequently as inexpensive packaging for huge volumes. They also provide simple transportation and product safety.

The tube segment will see significant growth during the anticipated time frame. During the projection period, several breakthroughs, including the creation of eco-friendly tubes, are expected to expand significantly the potential for the segment's growth. Additionally, the rising utilization of aseptic tubes for packing multiple surgical instruments that offers safe handling accelerates the development of the segment. Moreover, the development of tailored and customized tubes for medical purposes will propel the segment's growth.

End-user Insights

By end-user category, the pharmaceuticals segment held the largest share of revenue in the global market for medical packaging films in 2023. The rising drug development activities across the globe has promoted the growth of the pharmaceutical segment. The rising demand for packaging solutions such as blister packaging for precision and personalized medicine highlights the development of the segment for the upcoming years.

On the other hand, the medical devices segment is expected to grow at the fastest rate while being the attractive segment of the market. The rising emphasis on offering sterile and aseptic packaging solution for medical devices has been promoting the segment's growth. The packaging solutions for medical devices have become crucial due to the rising number of cell and gene therapies and surgeries that require unopened and sterile packaging.

Regional Insights

Asia Pacific held the largest share of the market in 2025, the region is expected to sustain its dominance during the forecast period. The growing awareness for sanitary and aseptic healthcare devices and equipment is promoting the market's growth in the region. The overall growth of the packaging industry along with multiple significant innovations promote the growth of the market in Asia Pacific. The top pharmaceutical packaging firms in the world are also based in the area, and due to the accessibility of raw materials and cheap manufacturing costs, the Asia Pacific region is expected to have significant expansion in this industry.

China Market Trends

The medical packaging films market in China is growing due to the rapid expansion of the pharmaceutical and healthcare sectors, increasing demand for sterile and safe packaging, and rising pharmaceutical exports. Strong government support for healthcare infrastructure, coupled with investments in advanced packaging technologies, further drives market growth. Additionally, growing awareness of product safety and compliance with international quality standards is boosting the adoption of high-performance medical packaging films.

North America is another lucrative marketplace for the medical packaging film industry. The rising emphasis on the development and utilization of bioplastics and other sustainable packaging solutions in the industry is expected to highlight the growth of the market in North America during the forecast period. Moreover, the presence of major key players in the region contributes to the growth of the market.

U.S. Market Trends

The medical packaging films market in the U.S. is growing due to increasing demand for safe, sterile, and tamper-evident packaging in the pharmaceutical and healthcare sectors. Rising investments in advanced packaging technologies, coupled with strict regulatory requirements from the FDA, drive adoption of high-quality films. Additionally, growth in pharmaceutical production, biologics, and medical devices fuels the need for durable and reliable medical packaging solutions.

Value Chain Analysis of the Medical Packaging Films Market

- Raw Material Sourcing

This stage involves sourcing essential polymers, resins, and specialty materials used to manufacture medical packaging films.

Key players: Dow Inc., DuPont, and BASF. - Film Manufacturing & Production

Raw materials are processed into medical packaging films using techniques such as extrusion, co-extrusion, and lamination, ensuring uniformity, strength, and compliance with healthcare standards.

Key players: Berry Global, Amcor, and Constantia Flexibles. - Printing & Conversion

In this stage, films are printed with labels, instructions, or branding, and converted into final packaging formats such as pouches, blister packs, or rolls for pharmaceutical and medical applications.

Key players: Sealed Air, Bemis Company, and WestRock. - Distribution & Logistics

Finished films and packaging solutions are transported to pharmaceutical manufacturers, hospitals, and distributors, ensuring timely and safe delivery.

Key players: DHL Supply Chain, UPS Healthcare, and FedEx Logistics.

Top Companies in the Medical Packaging Films Market & Their Offerings

- Polifilm Group: Polifilm Group provides specialized films for medical & pharmaceutical packaging, including PE interlayers for label films, blister packs, and bundling films for grouping items such as medicine boxes, aiming for reliability, safety, and recyclability.

- Cosmo Films Ltd.: Cosmo Films offers specialty films such as BOPP, CPP, and BOPET for medical packaging.

Medical Packaging Films Market Companies

- Amcor plc

- Berry Global Inc.

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Holdings Corporation

- Constantia Flexibles Group GmbH

- Uflex Ltd.

- Klöckner Pentaplast Group

- Jindal Poly Films Limited

- Tekni-Plex, Inc.

- SABIC

- Wipak Group

- Bemis Company, Inc.

- Toray Industries, Inc.

- Polifilm Group

- Cosmo Films Ltd.

- Bilcare Limited

- Schott AG

- Sealed Air Corporation

- Flex Films (USA) Inc.

- Mondi Group

Recent Developments

- In March 2023,a customized Tyvek sterilizable packaging solution was added by Cleanroom Film and Bags. The new packaging solution is a part of flexible packaging solution from the company. The Tyvek packaging aims to offer excellent puncture resistance, exceptional tear strength and microbiological barrier for multiple medical devices. The new packaging solution satisfies the sterilization standards which are offered in the form of peelable pouches and header bags.

- In August 2022,At FachPack 2022, the Coveris Group unveiled a new line of environmentally friendly technologies to promote its No Waste objective. Coveris concentrated its innovation efforts on creating cutting-edge, high-performance package solutions with recycled content and simple recyclability to complete the cycle. The expanded CPP Cleancast Films line of products for duplex and triplex laminate options on a polypropylene foundation was one of the significant advances at FachPack. The capacity to endure re-shrinking at high temperatures (0% at 150°C) made these cast unoriented polypropylene films an alternative packaging material and was the main factor in their outstanding performance. They also promote the circular economy by being more recyclable. Coveris proposed two new ways to increase recycling and recovery in a circular economy. rPET, PET bottles, and containers can now utilize new wash-off labels with DPG-approved security inks1.

- In May 2023,DuPont acquired Spectrum Plastics Group (Spectrum), a medical device manufacturer. The deal was worth $1.75 billion, and the net price after taxes is $1.72 billion. Subject to governmental permissions and other closing requirements, it is anticipated to close by the third quarter of 2023. Spectrum specializes in the advanced manufacturing of components and medical devices, focusing on important fast-growing therapeutic areas like electrophysiology, structural heart, cardiovascular, and surgical robotics. Following the acquisition, healthcare is expected to account for about 10% of DuPont's total sales. Medical devices and advanced component manufacturing is Spectrum's area of expertise, with a strategic focus on vital, quickly developing therapeutic fields such as structural heart, electrophysiology, surgical robotics, and cardiovascular. The acquisition is intended to advance DuPont's strategic goal of offering specialized products and services to end markets experiencing long-term secular development. This also applies to its presence in medical packaging.

Segments Covered in the Report

By Material Type

- Plastic

- Polypropylene

- Polyethylene

- Polystyrene

- Aluminium

- Polyamide

- Oxide

By Type

- High Barrier Films

- Coated Films

- Metallized Films

- Co-extruded Films

- Thermoformable Films

- Formable Films

- Formable Films

By Application

- Blister Packs

- Bags & Pouches

- Lidding

- Sachets

- Tubes

- Others

By End-use

- Pharmaceuticals

- Medical Devices

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content