January 2025

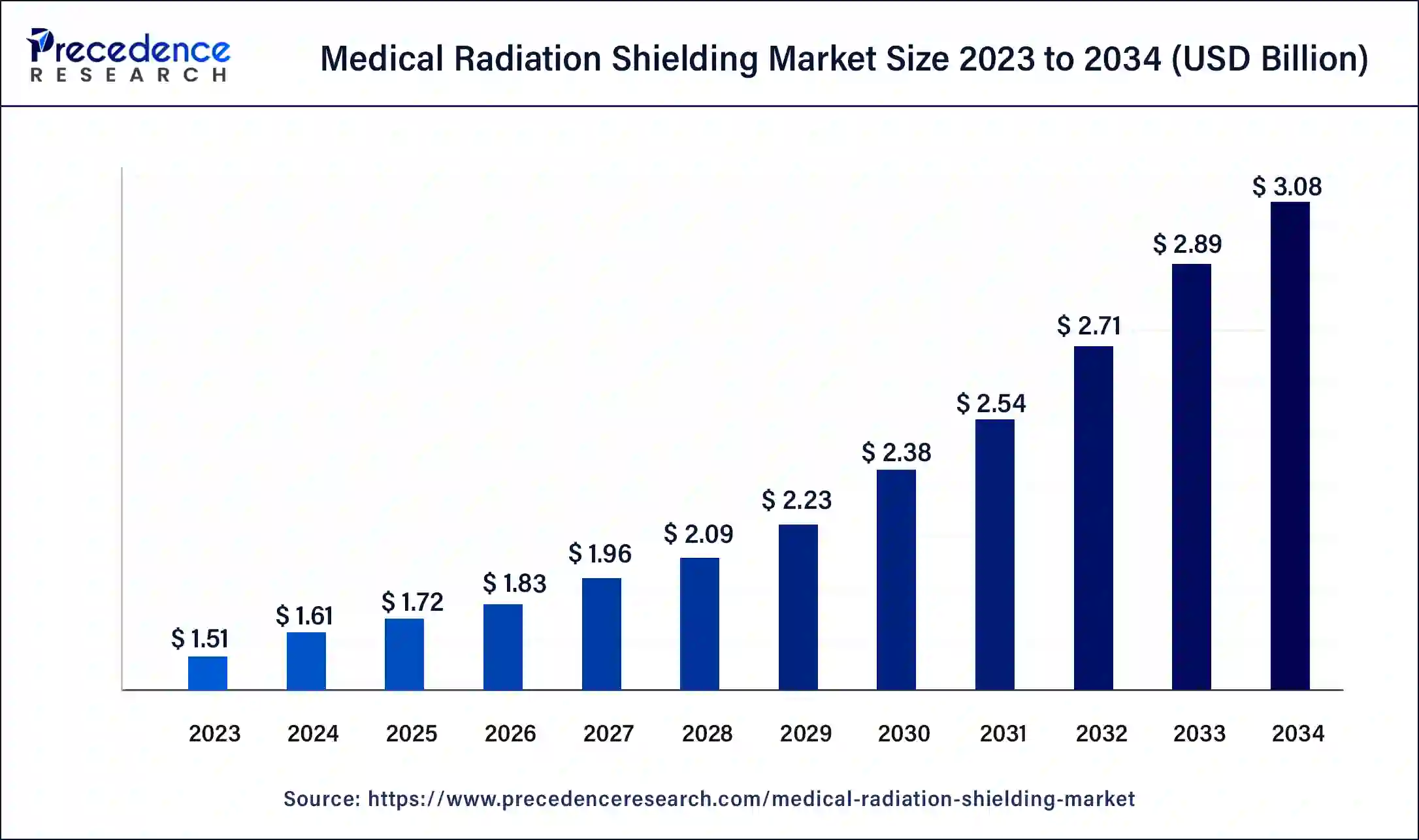

The global medical radiation shielding market size was USD 1.51 billion in 2023, calculated at USD 1.61 billion in 2024 and is expected to be worth around USD 3.08 billion by 2034. The market is slated to expand at 6.70% CAGR from 2024 to 2034.

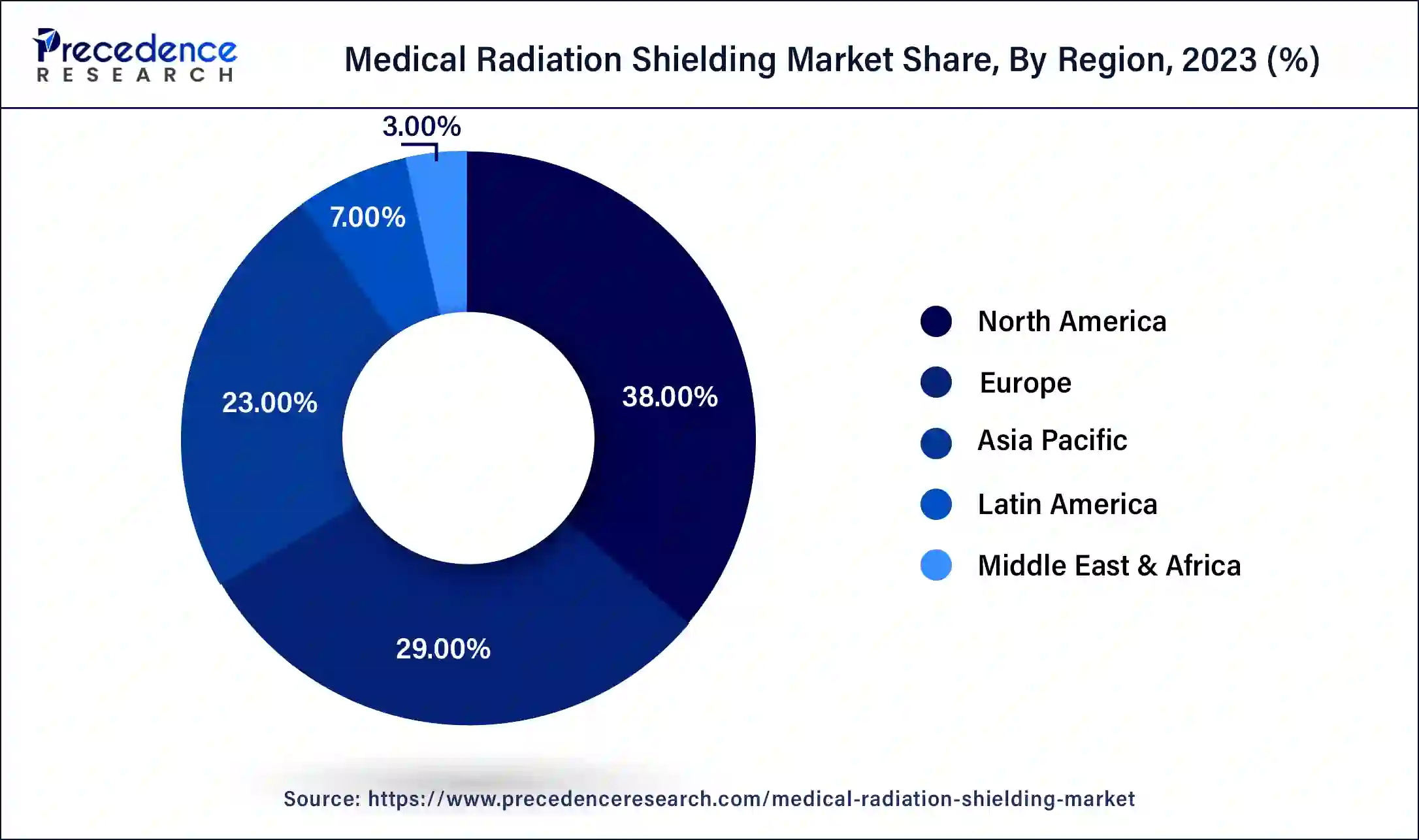

The global medical radiation shielding market size is projected to be worth around USD 3.08 billion by 2034 from USD 1.61 billion in 2024, at a CAGR of 6.7% from 2024 to 2034. The North America medical radiation shielding market size reached USD 570 million in 2023. The medical radiation shielding market is driven by rising investments in the healthcare infrastructure, especially by developing countries such as Asian countries. Additionally, integration of advanced technologies in the market creates potential for the market to grow.

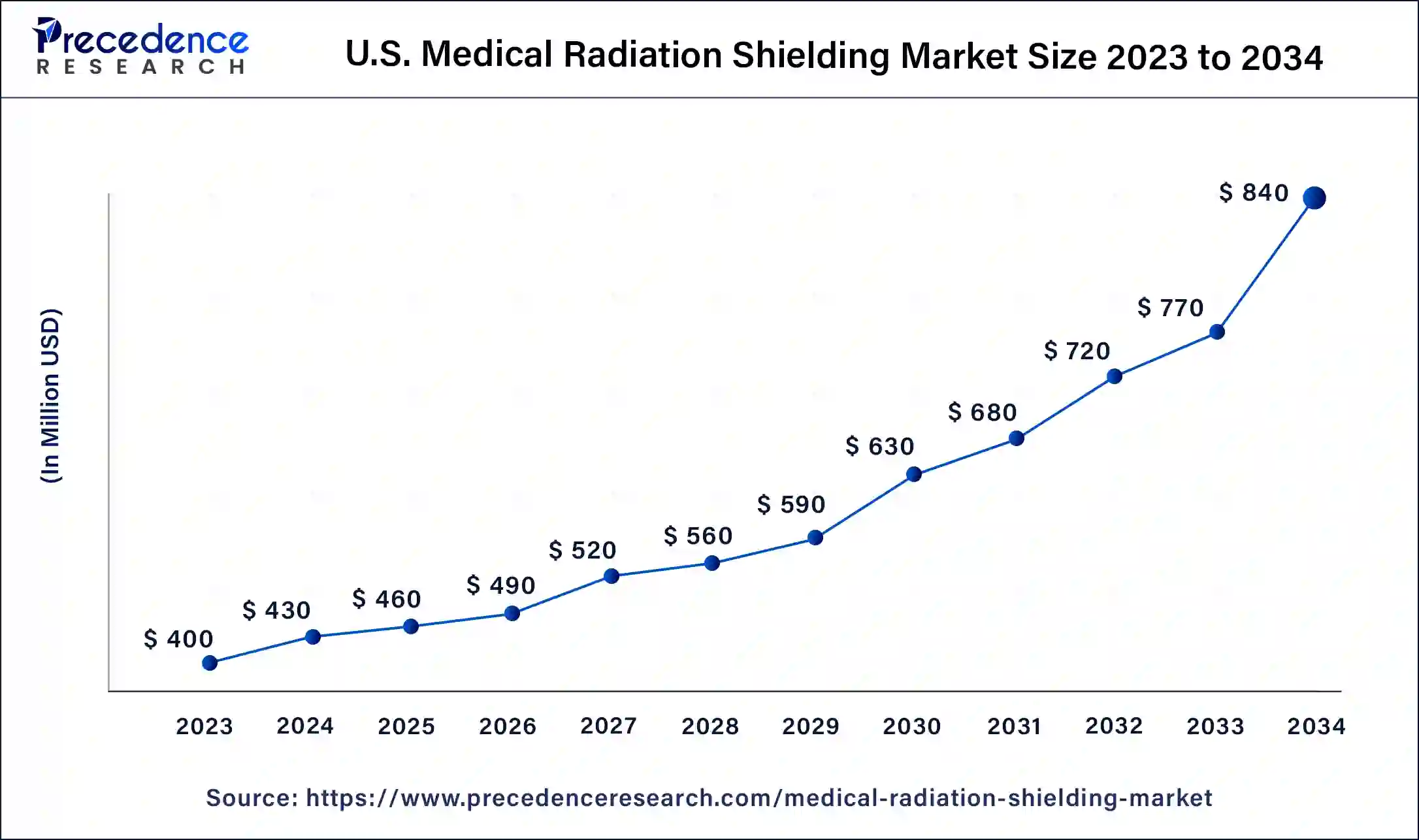

The U.S. medical radiation shielding market size was exhibited at USD 400 million in 2023 and is projected to be worth around USD 840 million by 2034, poised to grow at a CAGR of 6.97% from 2024 to 2034.

North America held the dominant share of the medical radiation shielding market in 2023. The region is observed to witness prolific growth during the forecast period. The growth of the region is attributed to the sophisticated healthcare infrastructure, increasing use of advanced diagnostic imaging and therapeutic technologies, an increasing number of hospitals and diagnostic centers, rising awareness regarding the benefit offered by medical radiation shielding solutions, and the rising prevalence of cancer have significantly increased the need for radiation therapy in the region.

The rising focus on R&D activities in radiation shielding materials, designs, and adoption of improved technologies is anticipated to boost the demand for more efficient solutions that are customized to the region’s healthcare requirements. Among all the countries, the United States is the major contributor to the market. The country has a robust network of clinics, hospitals, imaging centers, and research institutions that spurs the demand for radiation-shielding products to ensure both patient and employee safety.

Additionally, a rise in product approvals and rapid advancement in developing novel technologies for radiation protection is expected to accelerate the market's growth in the region. Furthermore, the region's robust focus on employee safety and regulatory compliance has increased the demand for innovative shielding solutions to mitigate radiation exposure during procedures. Thus, such factors are anticipated to propel the market’s growth in the region.

National Institutes of Health’s Recent Updates on Cancer Cases

Asia Pacific is observed to expand at a rapid pace during the forecast period in the medical radiation shielding market, owing to the rising healthcare expenditure, increasing demand for non-toxic and lead-free shielding materials, increasing number of imaging diagnostic systems, and increasing incidence of chronic diseases such as cancer and cardiovascular disease. Additionally, stringent government regulations for ensuring safety in medical facilities and several initiatives to modernize healthcare facilities led to the increasing adoption of efficient radiation protection solutions in the region.

Governments in developing nations such as India and China have been heavily investing in healthcare infrastructure and promoting the use of radiation-based therapies, fueling the demand for medical radiation shielding solutions. Therefore, these factors are expected to accelerate the adoption of medical radiation shielding systems to ensure safety during radiation therapy treatments in the Asia Pacific region.

Medical radiation shielding safeguards healthcare providers and patients from harmful ionizing radiation in several medical facilities such as X-rays, nuclear medicine, computed tomography (CT), and radiotherapy for treating cancer patients. Radiation shielding acts as a barrier between the area or person that needs to be protected and a radiation source. The radiation shielding assists in restricting radiation exposure. The use of medical radiation shielding solutions is considered important in medical facilities during radiation treatment to get protection from unnecessary exposure to harmful radiation. Medical radiation shielding is extensively used in several applications in the healthcare industry, including hospitals, diagnostic imaging centers, radiation treatment clinics, and others.

How AI is Integrated in Medical Radiation Devices?

Artificial intelligence has transformed several aspects of the medical and biotechnology fields. AI is also revolutionizing radiation protection and has the potential to change the way we approach safety in nuclear energy, telecommunications alongside healthcare. Artificial intelligence enhances medical radiation shielding by enabling real-time monitoring, triggering automated response systems in case of an adverse event, and offering predictive analysis for preventative maintenance. AI-based algorithms can detect changes in radiation levels, and provide timely alerts to mitigate exposure risk.

AI is also being used to optimize radiation shielding technology designs, enhance radiation therapy in the medical field, and develop more effective radiation protection protocols that enhance both patient and clinician safety. It also has applications in optimizing radiation therapy delivery for cancer patients, leading to improved treatment outcomes and reduced side effects.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.08 Billion |

| Market Size in 2023 | USD 1.51 Billion |

| Market Size in 2024 | USD 1.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.70% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Solution, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of cancer

The rising burden of cancer across the globe is expected to boost the growth of the medical radiation shielding market during the forecast period. Radiotherapy is a common treatment conducted by healthcare providers using ionizing radiation to restrict or eliminate the growth of cancerous cells in patients. Medical radiation includes exposure to radiation to healthcare professionals and patients due to radiography systems including X-rays, nuclear imaging, MRI, and others.

Medical radiation shielding assists in protecting radiation workers and patients from exposure to harmful radiation. Without shielding, the exposure of high levels of radiation outside regulated exposure limits can potentially lead to adverse health effects. Thus, the surge in cancer cases increases the demand for effective radiation shielding which is expected to fuel the market expansion in the coming years.

There were around 20 million new cases of cancer and approximately 9.7 million deaths in 2022. It is reported that about one in five people will develop cancer during970,000 their lifetime.

Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. The rapidly growing global cancer burden reflects both population aging and growth, as well as changes to people’s exposure to risk factors, several of which are associated with socioeconomic development. Tobacco, alcohol, and obesity are key factors behind the increasing incidence of cancer, with air pollution still a key driver of environmental risk factors.

High cost

The high cost associated with the shielding materials in medical radiation is anticipated to projected to hamper the market's growth. High initial investment is required for effective medical radiation shielding solutions due to the high cost of advanced materials and equipment. In addition, the reluctance of healthcare institutions to adopt medical radiation shielding due to budget constraints may restrict the expansion of the global medical radiation shielding market.

Stringent government regulations

The stringent government regulations are projected to offer lucrative opportunities to the medical radiation shielding market during the forecast period. Several Governments and healthcare regulatory agencies such as FDA (Food and Drug Administration), Ionising Radiation (Medical Exposure) Regulations (IR(ME)R), and others around the world have imposed stringent regulations and safety standards for radiation protection in medical facilities. These regulations mandate adequate shielding measures to mitigate radiation exposure to protect healthcare professionals and patients from the negative effects of radiation exposure during diagnostic and treatment procedures. Therefore, compliance with these regulations has significantly increased the adoption of effective radiation shielding solutions to ensure that medical facilities meet the required safety standards.

The X-ray shields segment accounted for the dominating share in the global medical radiation shielding market in 2023 owing to the rapid expansion of the healthcare industry. In medical diagnosis and treatment, X-ray rooms play an important role. The rising use of X-rays in hospitals and diagnostic centers is likely to propel the need for effective medical radiation shielding systems to enhance the safety of patients and healthcare personnel in X-ray rooms.

The MRI shields segment is observed to be the fastest growing in the medical radiation shielding market during the forecast period, owing to the rising demand for advanced MRI technologies in healthcare facilities around the world. Magnetic resonance imaging (MRI) shielding products play a crucial role in ensuring the safety of patients and medical professionals, better image quality, and the effective functioning of MRI equipment. Moreover, stringent adherence to safety standards and regulatory requirements is likely to boost the rapid advancements in MRI shielding. Thus, fueling the rapid expansion of the segment in the coming years.

The diagnostic shielding segment accounted for the dominating share in the medical radiation shielding market in 2023. The growth of the segment is majorly attributed to the rising prevalence of chronic diseases coupled with increasing awareness of early diagnosis and treatment which is anticipated to boost the diagnosis rate and increase the usage of diagnostic radiation shields. The diagnostic imaging systems including x-rays, mammography, fluoroscopy, computed tomography, and others are extensively used for accurate diagnosis, early detection, and monitoring of several health conditions. Thereby, driving the growth of the segment.

The radiation therapy shielding segment is expected to witness a significant share during the forecast period. The segment’s growth is majorly driven by the rising cases of cancer and rapid improvements in radiation therapy methods. Radiation therapy is gaining immense popularity for the treatment of cancer. Radiation therapy is used by specialists to kill cancerous cells in the cancer patient body by exposing them to ionizing radiation including gamma rays, X-rays, and high-energy electrons.

Radiation is crucial for patients who receive cancer treatment but harmful for the machine operators, medical personnel, or staff members. Frequent radiation exposure may lead to several side effects on health. Therefore, these factors increase the adoption of medical radiation shielding products and drive the segment’s growth.

The hospitals and diagnostic centers segment held the largest share of the medical radiation shielding market in 2023, this segment is expected to sustain the position throughout the forecast period. The growth of the segment is driven by the rising importance of the safety of healthcare providers, hospital management, and patients. Hospitals and diagnostic centers carry out a wide range of medical services that use radiation-based procedures for cancer treatment and diagnostic imaging (X-rays, CT, and MRI).

Hospitals and diagnostic centers are highly investing in advanced healthcare infrastructure and expanding their imaging and treatment capabilities. Thus, the rising cases of cancer diseases globally increase the need for diagnostic centers and hospitals which further creates a necessity for medical radiation shielding systems.

On the other hand, the research institutes segment is expected to grow significantly in the medical radiation shielding market during the forecast period. Medical radiation shielding is widely used by healthcare professionals in research institutes to reduce unnecessary radiation exposure and minimize the harmful effects of ionizing radiation while testing new medicines, technologies, and procedures that have the potential to benefit human health. Research institutes adhere to stringent rules regarding the use of radiation shielding to ensure safety. Thereby, boosting the segment’s growth.

Segments Covered in the Report

By Product Type

By Solution

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025