March 2025

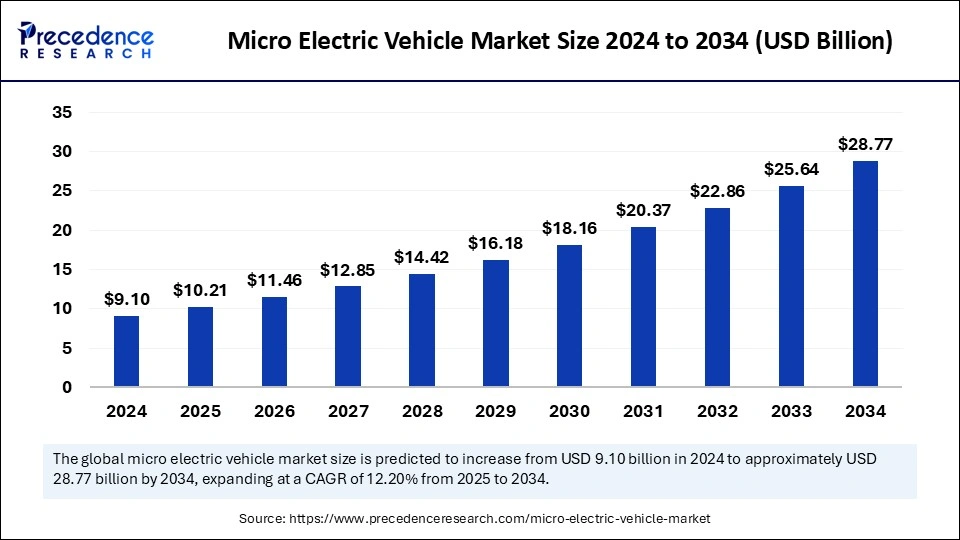

The global micro electric vehicle market size accounted for USD 9.10 billion in 2024 and is predicted to increase from USD 10.21 billion in 2025 to approximately USD 28.77 billion by 2034, expanding at a CAGR of 12.20% from 2025 to 2034. The growth of the market is driven by the increasing demand for lightweight vehicles and a more affordable mobility option, which is expected to meet the demand for micro EVs around the globe. Additionally, the rising trend of electrification is likely to impact technological advancements in future micro EVs.

Artificial Intelligence is transforming the micro electric vehicle market by improving autonomous driving features, smart energy management, predictive maintenance, and user experience. AI-enhanced autonomous navigation systems are being incorporated into micro EVs, allowing for self-driving functions, collision avoidance, and adaptive cruise control, making them well-suited for urban mobility, last-mile delivery, and shared transportation services.

AI-enabled battery management systems (BMS) enhance energy usage, charging efficiency, and battery longevity by examining real-time driving behavior, environmental factors, and energy requirements. This promotes longer driving ranges and better performance, addressing a significant challenge for micro EVs. As urban mobility transitions toward intelligent, sustainable solutions, the integration of AI in micro electric vehicles is predicted to speed up market expansion, enhance vehicle efficiency, and improve user convenience.

AI-powered predictive maintenance also boosts vehicle dependability by identifying potential mechanical or electrical problems before they lead to breakdowns, thus lowering repair expenses and minimizing downtime. It is also revolutionizing in-vehicle infotainment and user experience by providing voice-activated assistants, real-time traffic updates, and personalized driving suggestions. AI-driven fleet management systems allow companies to track, optimize routes and monitor energy usage for micro EV fleets, enhancing efficiency and enabling cost savings.

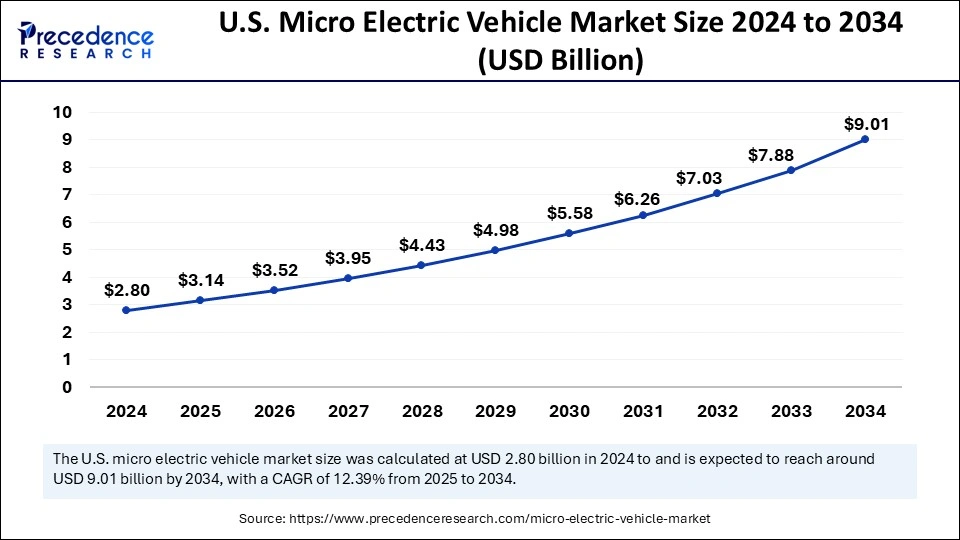

The U.S. micro electric vehicle market size was exhibited at USD 2.80 billion in 2024 and is projected to be worth around USD 9.01 billion by 2034, growing at a CAGR of 12.39% from 2025 to 2034.

North American Market Trends

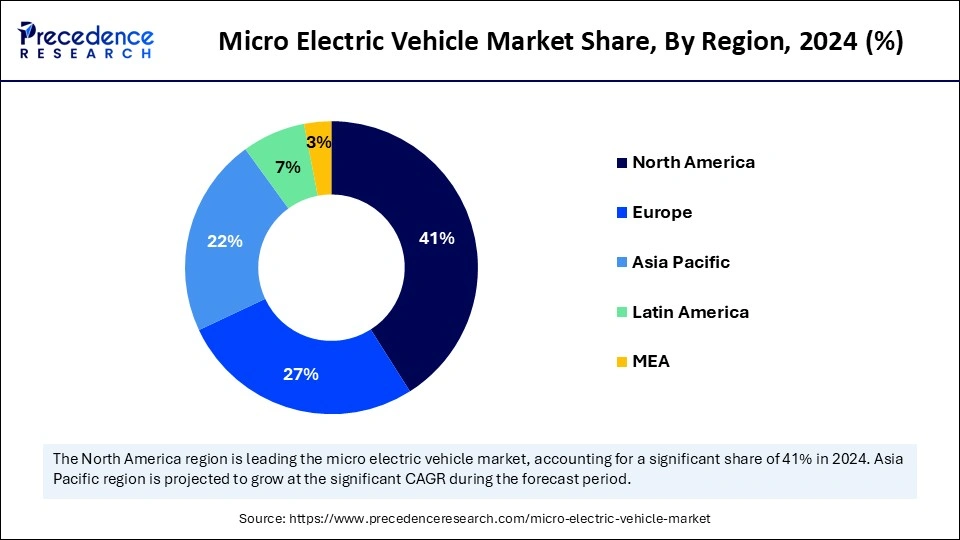

North America dominated the micro electric vehicle market with the largest share in 2024 due to heightened environmental awareness, growing government incentives, and an increasing shift toward urban electric transportation. The region's robust charging infrastructure, advanced battery technologies, and supportive regulatory climate have propelled the adoption of micro EVs. Government measures such as tax credits, grants, and subsidies for electric vehicles have also spurred consumer interest. The growth of last-mile delivery services, escalating fuel prices, and rising urban traffic congestion have increased the need for affordable, energy-efficient transportation alternatives like micro EVs.

United States

The United States stands at the forefront of the North American micro electric vehicle market, backed by effective regulatory frameworks and expanding electric mobility initiatives. The U.S. government has implemented zero-emission vehicle mandates, tax incentives, and investments in infrastructure to encourage EV adoption. Rising fuel prices and a growing appetite for sustainable urban transport have resulted in the wider acceptance of quadricycles, electric golf carts, and compact EVs for both commercial and personal purposes. Cities like New York, Los Angeles, and San Francisco are incorporating micro EVs into ride-sharing services and public transport fleets, thus broadening the market.

Canada

Canada is witnessing steady growth in the micro electric vehicle market, propelled by robust environmental policies, investments in clean transportation, and increasing urbanization. Canadian cities such as Toronto, Vancouver, and Montreal are enhancing low-emission transportation efforts, including incentives for electric vehicle purchases and developments in infrastructure. The surge in last-mile delivery services and micro-mobility solutions is generating an increased demand for micro EVs in urban environments, particularly within commercial applications like cargo transport and municipal services.

Asia Pacific Market Trends

Asia Pacific will host the fastest-growing market from 2025 to 2034. This growth is driven by swift urban development, governmental support for electric mobility, and a rising demand for cost-effective transportation options. The region's leadership in electric vehicle manufacturing and battery production has propelled market growth. The development of smart cities, shared mobility initiatives, and e-commerce logistics has further accelerated the uptake of micro EVs for urban travel and last-mile deliveries. The high density of urban populations, traffic congestion, and emission regulations have also increased the demand for small, energy-efficient vehicles.

China

China represents the largest market for micro electric vehicles, fueled by substantial governmental backing, extensive EV manufacturing capabilities, and rapidly evolving urban transportation requirements. The Chinese government provides significant subsidies, tax breaks, and infrastructure investment to promote the adoption of EVs. The presence of top micro EV manufacturers, progress in battery technology, and rising environmental regulations have driven the need for small electric vehicles for urban transportation and delivery services. Companies in shared mobility sectors in cities such as Beijing, Shanghai, and Shenzhen are incorporating micro EVs into their ride-sharing and delivery operations, further fostering market growth.

Japan

Japan has seen an increase in demand for micro electric vehicles, driven by strict emissions regulations, high fuel expenses, and a commitment to smart city development. Japanese manufacturers are producing compact, high-efficiency EVs specifically designed for urban commuting, particularly catering to aging demographics. The government’s advocacy for zero-emission transport has encouraged the use of electric quadricycles and golf carts for personal and commercial applications. With limited parking and escalating urban congestion, micro EVs have become a favored choice for short-distance travel in cities like Tokyo and Osaka.

Europe Market Trends

Europe is considered to be a significantly growing area in the micro electric vehicle market, bolstered by robust governmental policies addressing emissions reduction, initiatives for urban sustainability, and the rising adoption of shared electric mobility services. The European Union’s ambitious goals for carbon neutrality, investments in EV infrastructure, and limitations on internal combustion engine vehicles are enhancing the transition toward electric transportation, including micro EVs. The increasing focus on low-emission zones, ride-sharing services, and electrification of last-mile deliveries has further driven the demand for compact, energy-efficient electric vehicles.

Germany

Germany is leading the charge in electric mobility across Europe, spurred by government incentives, strong automotive innovation, and an expanding network of EV charging stations. The nation’s prioritization of sustainable urban mobility, combined with high fuel costs and strict emission standards, has boosted the need for micro EVs in urban commuting, logistics, and corporate fleets. Cities like Berlin, Hamburg, and Munich have incorporated micro EVs into their shared transportation systems, while automakers such as BMW and Volkswagen are investing in light electric vehicle solutions for personal and business use.

France

France has positioned itself as a significant market for micro electric vehicles, driven by government subsidies, urban mobility initiatives, and substantial consumer enthusiasm for eco-friendly transport options. The prohibition of gas-powered vehicles in low-emission zones has expedited the transition toward electric quadricycles, e-scooters, and small electric cars. The rise of car-sharing services, including micro EV rentals, has spurred their adoption in major cities like Paris, Lyon, and Marseille. In addition, France’s investment in battery production and charging networks is facilitating the growth of the micro electric vehicle market.

Micro electric vehicles are compact, mini-electric vehicles that generally have a range of around 200 km, with their maximum speed ranging from 60-100 km/h. These vehicles utilize a low-powered drivetrain and possess a low power output, functioning with a similar but more compact battery system. In addition, these mini EVs are constructed using carbon-based materials with biologically intricate composite bodies, making them lighter and smaller than conventional electric vehicles, which makes them particularly suitable for urban environments.

The rapid pace of urbanization and significant population growth may increase the global interest in compact commuting vehicles within metropolitan areas due to severe traffic congestion. Furthermore, the heightened demand for short-range cargo and transportation can be efficiently met by micro electric vehicles, as they consume less energy and perform significantly better than fossil-fueled vehicles. These elements are fostering a strong demand for micro EVs, attributable to their adaptable nature and wide range of applications.

| Report Coverage | Details |

| Market Size by 2034 | USD 28.77 Billion |

| Market Size in 2025 | USD 10.21 Billion |

| Market Size in 2024 | USD 9.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.20% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Battery Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for sustainable and compact urban transportation

The growing urban population and increasing traffic congestion are fueling the need for compact, energy-efficient transport solutions. Micro electric vehicles provide zero emissions, lower operating expenses, and enhanced maneuverability, making them perfect for short-distance commuting, shared mobility, and last-mile delivery services. Furthermore, governmental policies that encourage electric mobility, such as subsidies, tax breaks, and low-emission zones, are facilitating faster adoption. As municipalities enforce stringent environmental regulations and consumers look for affordable, space-efficient transportation options, the micro electric vehicle market is poised for significant growth in the coming years.

Constrained range and insufficient charging infrastructure

A primary limitation of the micro electric vehicle market is its restricted battery range and lack of adequate charging infrastructure, especially in developing areas. Many micro EVs have shorter driving ranges than conventional electric vehicles, limiting their practicality for longer journeys. Moreover, the scarcity of extensive fast-charging networks creates challenges for users who need quick recharging options. Without substantial investment in charging stations, the growth of adoption rates could be impeded, particularly in locations where convenient home or public charging is not readily available.

Growth of last-mile delivery and shared mobility services

The swift expansion of e-commerce, urban logistics, and shared mobility services represents a significant opportunity for the micro electric vehicle market. Companies are utilizing micro EVs for last-mile deliveries, cutting fuel expenses and carbon emissions while enhancing efficiency in densely populated urban settings. Additionally, the emergence of electric car-sharing platforms is increasing the demand for cost-effective and environmentally friendly transportation solutions. As smart city projects and sustainable transport initiatives gain traction, micro EVs are set to become crucial in urban mobility, last-mile logistics, and ride-sharing services.

The golf cart segment dominated the micro electric vehicle market in 2024 due to its extensive application in golf courses, gated communities, resorts, airports, and industrial sites. Golf carts are preferred for short-distance transportation because they offer low operating costs, user-friendliness, and minimal maintenance needs. Their use is increasingly spreading beyond recreational contexts, with a growing prevalence in commercial and hospitality industries. The surge in sustainable tourism and eco-friendly transportation options has further bolstered the demand for electric golf carts, reinforcing their market leadership.

Why did the Golf Cart Segment Dominate the Micro Electric Vehicle Market?

The golf cart segment dominated the micro electric vehicle market in 2024. The increasing applications like resorts, airports, last-mile delivery, residential communities, and airports increase the adoption of golf carts. The focus on reducing carbon footprint and cleaner air increases the adoption of golf carts, helping the market. The growth in rental services and shared mobility platforms fuels the adoption of golf carts. The innovations like lithium-ion batteries and growing commercial applications like transportation, maintenance, and groundskeeping increase demand for golf carts, driving the overall growth of the market.

The quadricycle segment will grow at a notable CAGR from 2025 to 2034, driven by heightened urban congestion, rising fuel prices, and increasing interest in compact, energy-efficient vehicles. Quadricycles provide superior mobility and affordability compared to traditional vehicles, making them suitable for urban commuting and last-mile transport. Governments are advocating for quadricycles as low-emission substitutes, with several manufacturers launching electric models designed specifically for city usage. Their compact structure, parking convenience, and reduced regulatory hurdles are pivotal in accelerating quadricycle adoption globally.

The lithium-ion battery segment dominated the micro electric vehicle market in 2024, attributable to its high energy density, extended lifespan, and quicker charging capabilities. Lithium-ion batteries are lighter and more efficient than lead-acid counterparts, enabling micro EVs to attain longer driving distances while lowering overall maintenance costs. The decreasing cost of lithium-ion technology, paired with advancements in battery performance and longevity, has further solidified their market stronghold. Globally, governments and automakers are focusing on lithium-ion batteries, investing in research and development, and expanding production to facilitate widespread electric vehicle adoption.

How Lithium-Ion Battery Segment Dominated the Micro Electric Vehicle Market?

The lithium-ion battery dominated the micro electric vehicle market in 2024. The rise in electric vehicles and shared mobility services increases demand for lithium-ion batteries. The focus on superior performance and longer driving ranges increases adoption of lithium-ion batteries. The increasing demand for reducing maintenance costs and higher lifespans fuels demand for lithium-ion batteries. The focus on reducing air pollution and greenhouse gas emissions increases demand for lithium-ion batteries. The technological advancements in lithium-ion batteries and the increasing demand for last-mile delivery support the overall growth of the market.

The lead acid battery segment is expected to grow at the fastest rate over the forecast period as it remains an economical choice for price-sensitive consumers. Although these batteries have lower energy density and shorter lifespans than lithium-ion batteries, they are commonly used in low-speed electric vehicles, golf carts, and fleet vehicles due to their cost-effectiveness and dependability. The demand for recyclable battery options and lower initial costs is fueling growth in emerging markets, where consumers favor affordable micro EVs over premium lithium-ion models.

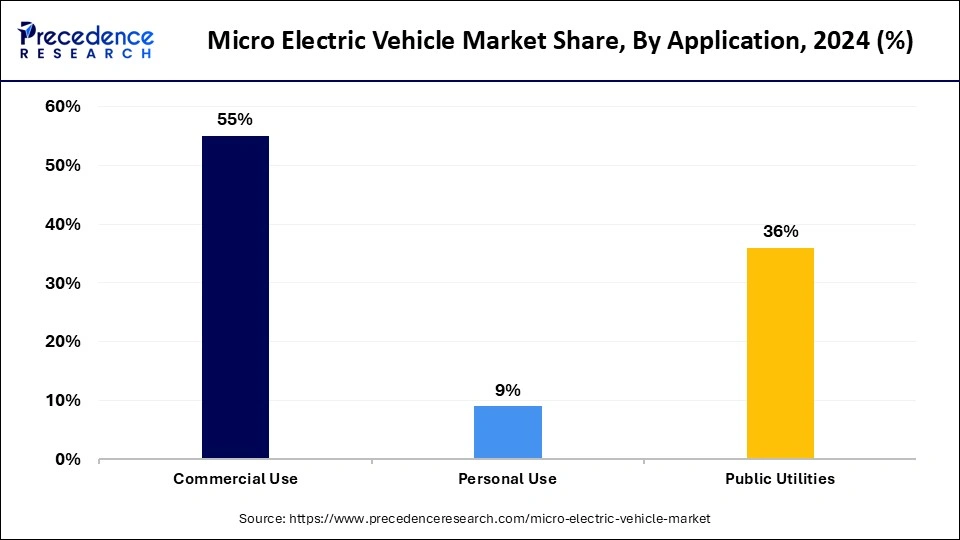

The commercial use segment dominated the micro electric vehicle market in 2024, driven by the increasing adoption of micro EVs in urban logistics, fleet management, and public transport. Businesses and local governments are progressively utilizing micro electric vehicles for last-mile deliveries, intra-city transportation, and facility operations, enjoying benefits such as reduced operational expenses, lower carbon emissions, and improved maneuverability. Sectors like e-commerce and food delivery are increasing the demand for compact, efficient electric vehicles, while micro EVs are being integrated into industrial sites and airports for on-site transportation, security, and maintenance tasks.

The personal use segment is expected to expand rapidly during the forecast period, supported by rising consumer awareness of environmentally friendly transportation, increasing urban congestion, and government support for electric mobility. As city officials encourage low-emission transport options, micro EVs are becoming practical and affordable solutions for short-distance commuting. Consumers appreciate compact designs, decreased parking challenges, and savings in fuel and maintenance expenses. Growth in this segment is further propelled by the rise of micro EV-sharing initiatives and a heightened interest in sustainable personal transportation.

By Type

By Battery Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

July 2025

August 2025

January 2025