May 2025

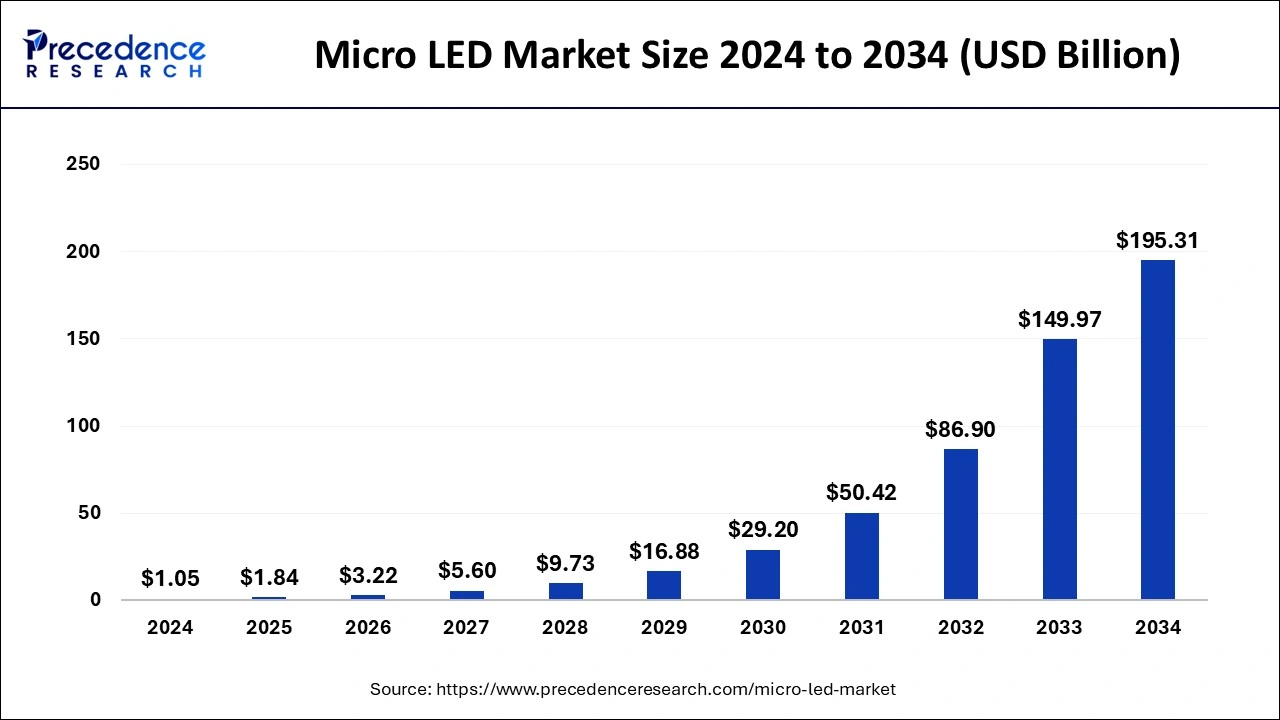

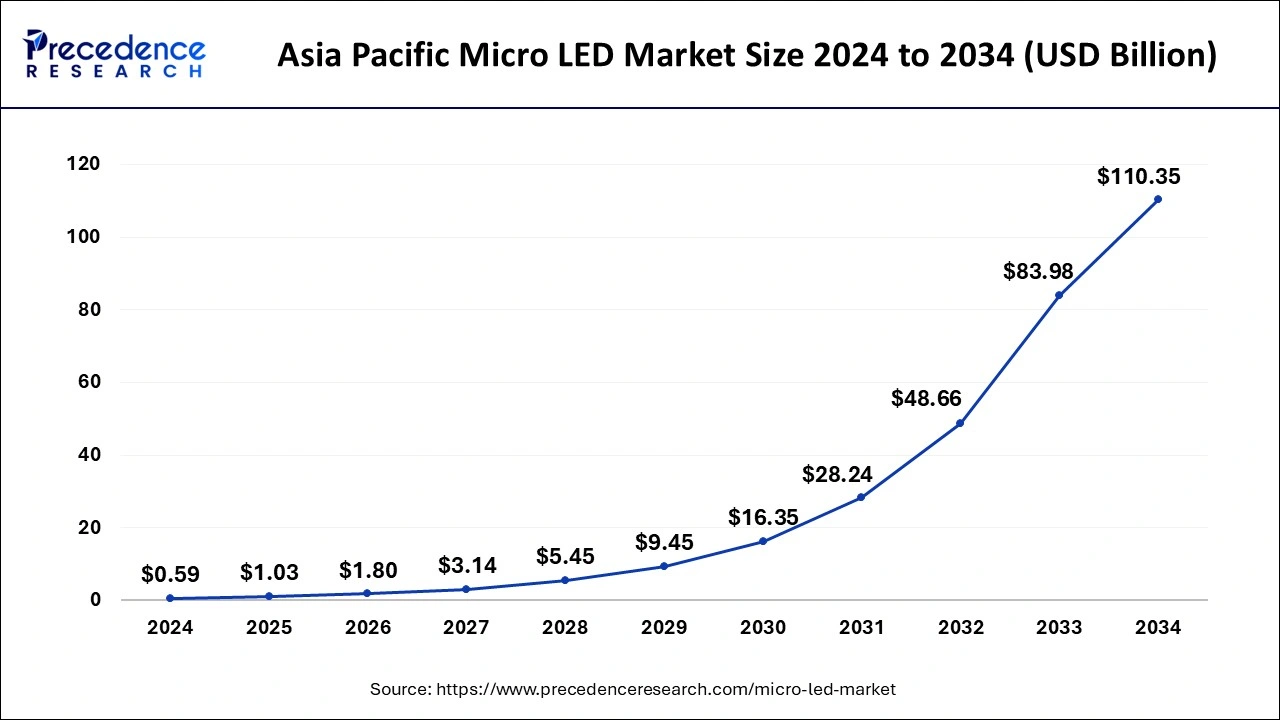

The global micro LED market size is calculated at USD 1.84 billion in 2025 and is forecasted to reach around USD 195.31 billion by 2034, accelerating at a CAGR of 68.64% from 2025 to 2034. The Asia Pacific micro LED market size surpassed USD 1.03 billion in 2025 and is expanding at a CAGR of 68.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global micro LED market size was estimated at USD 1.05 billion in 2024 and is predicted to increase from USD 1.84 billion in 2025 to approximately USD 195.31 billion by 2034, expanding at a CAGR of 68.64% from 2025 to 2034.

The U.S. micro LED market size was valued at USD 0.59 billion in 2024 and is anticipated to reach around USD 110.35 billion by 2034, poised to grow at a CAGR of 68.73% from 2025 to 2034.

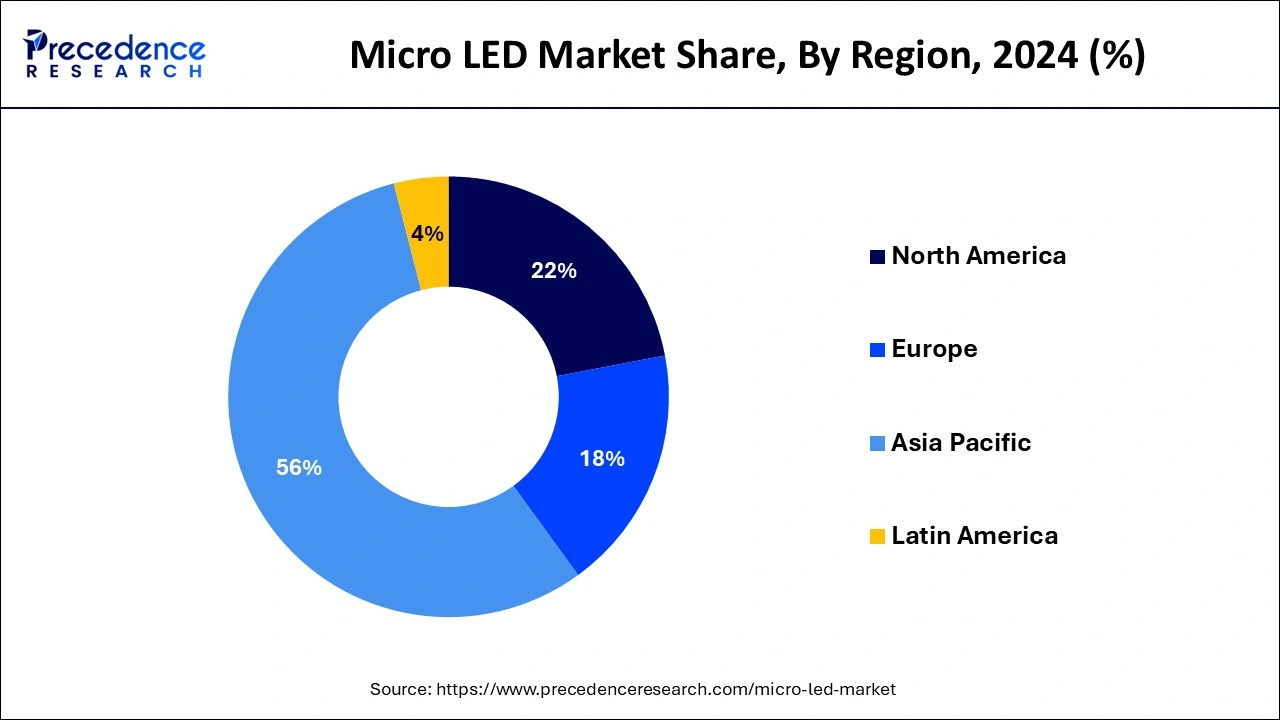

Asia Pacific held the largest share of the micro LED market due to various factors. It is a hub for major electronics manufacturers and suppliers, fostering technological innovation and production capabilities. Rising consumer demand for advanced display technologies, coupled with increased investments in research and development, drives the adoption of micro LEDs. Furthermore, the region's expanding consumer electronics market and the proliferation of applications like smartphones and smart TVs contribute to the substantial growth potential for micro LED technology in Asia-Pacific.

North America is observed to witness the fastest rate of expansion during the forecast period in the micro LED market due to robust technological infrastructure, strong consumer demand for advanced display technologies, and the presence of key industry players. The region's emphasis on innovation and early adoption of cutting-edge technologies has propelled the growth of micro LED applications in various sectors, including consumer electronics and automotive. Additionally, the region's high disposable income levels contribute to the demand for premium electronic devices, further driving the market's expansion in North America.

Meanwhile, Europe is experiencing notable growth in the micro LED market due to increasing demand for high-quality displays across various applications. The region's emphasis on technological innovation and a robust manufacturing ecosystem contributes to the adoption of micro LED technology. Furthermore, a rising trend in applications like automotive displays, smart wearables, and augmented reality (AR) devices fuels the market growth. European consumers' preferences for cutting-edge technology and the region's commitment to advancements in display technology position it as a key player in the expanding micro LED market.

Micro LED market offers services with the integration of technology and systems to streamline and enhance various processes within the retail industry. It involves the deployment of tools such as self-checkouts, robotics, and artificial intelligence (AI) to automate tasks traditionally performed by human workers. The primary goal of micro LED is to improve operational efficiency, reduce costs, and enhance the overall customer experience.

For example, self-checkout kiosks allow customers to scan and pay for their purchases independently, while robotics and AI are utilized in inventory management, order fulfillment, and even customer service. This transformation is driven by factors like rising labor costs, the need for faster and more accurate transactions, and the demand for a seamless and efficient shopping journey. Retailers adopting automation aim to stay competitive, optimize resource utilization, and adapt to the evolving expectations of modern consumers.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 68.64% |

| Market Size in 2024 | USD 1.05 Billion |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size by 2034 | USD 195.31 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-user and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Miniaturization and lightweight design

Miniaturization and lightweight design are key factors driving the increased demand for micro LED technology. As electronic devices, like smartphones and smartwatches, continue to evolve, consumers seek slimmer and more portable options. Micro LEDs enable the creation of displays that are not only smaller but also thinner and lighter. This appeals to users who value the convenience of compact and lightweight gadgets.

Moreover, the demand for wearable technology, such as smartwatches, benefits significantly from the miniaturization capabilities of micro LEDs. The technology allows for more streamlined and aesthetically pleasing designs without compromising on display quality. The combination of miniaturization and lightweight design in micro LED displays aligns with the modern consumer's preference for sleek, portable, and stylish devices, thus contributing to the growth of the micro LED market.

Complex integration in large displays

The integration of micro LED technology into large displays, such as TVs, presents challenges that can limit market demand. Making sure that micro LEDs are uniformly and flawlessly integrated across a sizable display area is no easy task. The complexity arises from the need to maintain consistent quality and reliability, as any defects or irregularities can significantly impact the overall performance of the display. Manufacturers face technical hurdles in achieving seamless integration, hindering the widespread adoption of the technology while hampering the micro LED market.

Moreover, the intricate nature of this integration process often leads to higher production costs. These challenges make it difficult for micro LED displays to compete with established technologies such as OLED and LCD, which have well-established manufacturing processes for large displays. As a result, the complex integration requirements in creating large micro LED displays act as a restraint, affecting market demand as manufacturers navigate these technical intricacies.

Increasing demand for wearable devices

The surge in the popularity of wearable devices is creating significant opportunities for the micro LED market. With the increasing demand for compact and versatile wearables like smartwatches and augmented reality (AR) glasses, Micro LED technology is well-positioned to meet the unique requirements of these devices. The miniaturization capabilities of micro LEDs allow for the creation of displays that are not only smaller in size but also energy-efficient, making them ideal for integration into wearable gadgets.

Consumers value the combination of high-quality visual experiences and portability, and micro LED displays align perfectly with these expectations, presenting an attractive proposition for manufacturers in the wearable technology space. Furthermore, as wearables become more sophisticated and diverse in their applications, micro LED's ability to deliver vibrant colors, high resolutions, and energy efficiency positions it as a key enabler for advanced wearable displays. This creates a symbiotic relationship, where the increasing demand for wearables drives the adoption of micro LED technology, while micro LEDs contribute to enhancing the overall user experience in these devices. The collaborative growth in the wearables market, fueled by the capabilities of micro LED displays, represents a noteworthy opportunity for innovation and expansion in the broader technology landscape.

Sustainability benefits of micro data centers

The display segment held the largest market share in 2024. In the micro LED market, the display segment primarily refers to the integration of micro LED technology into various devices such as smartphones, TVs, smartwatches, and AR/VR devices. The trend in this segment involves a growing demand for high-quality displays with vibrant colors, high resolutions, and energy efficiency. As consumers seek superior visual experiences, manufacturers are increasingly incorporating micro LED displays to meet these expectations, driving advancements in display technology and expanding the market presence of Micro LEDs across diverse applications.

The lighting segment is anticipated to witness rapid growth at a significant CAGR during the forecast period. The micro LED market, the lighting segment refers to the use of micro LED technology in various lighting applications. This includes the development of energy-efficient and high-brightness lighting solutions, such as micro LED-based bulbs and fixtures. The trend in this segment involves leveraging the unique characteristics of micro LEDs, such as their compact size and efficiency, to create innovative lighting products. These trends align with the growing demand for energy-efficient lighting solutions across industries, driving the adoption of micro LED technology for lighting applications.

The consumer electronics segment held the largest share in 2024. The consumer electronics segment in the micro LED market includes devices like smartphones, smartwatches, and TVs. These Micro LED displays offer superior brightness, color accuracy, and energy efficiency, enhancing the visual experience for users. A notable trend is the integration of micro LED technology in smartphones and smartwatches, contributing to sleeker designs and improved display performance. The demand for micro LED displays in consumer electronics is driven by a growing preference for high-quality visuals, compact devices, and advancements in display technology.

The automotive segment is anticipated to witness rapid growth over the projected period. The automotive segment in the micro LED market refers to the use of micro LED displays and technology in vehicles. This includes applications like infotainment systems, head-up displays (HUDs), and in-car lighting. A notable trend in this segment is the increasing integration of micro LED displays for their compact size, high brightness, and energy efficiency. As automotive manufacturers aim to enhance the driving experience with advanced features, micro LED displays offer a promising avenue for improving in-car visual interfaces and contributing to the overall innovation in automotive technology.

By Application

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

February 2025

October 2023

January 2025