October 2024

The global military displays market size is calculated at USD 1.40 billion in 2025 and is forecasted to reach around USD 2.30 billion by 2034, accelerating at a CAGR of 5.63% from 2025 to 2034. The North America market size surpassed USD 520 million in 2024 and is expanding at a CAGR of 5.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. Military Displays Market Size and Forecast 2025 to 2034.

The global military displays market size accounted for USD 1.33 billion in 2024 and is expected to exceed around USD 2.30 billion by 2034, growing at a CAGR of 5.63% from 2025 to 2034. Technological advancements in defense sectors across the globe are the key factor driving the military displays market. Also, increasing investment in new digital communications coupled with innovative display technologies can further fuel market growth.

Artificial intelligence (AI) is emerging as an important area of development. The army is using AI to improve logistics, battlefield awareness, and combat effectiveness. Furthermore, AI-driven unmanned ground vehicles (UGVs) can transport supplies and perform reconnaissance with no or minimal human help: AI systems can manage and monitor soldiers' physiological data to improve combat performance.

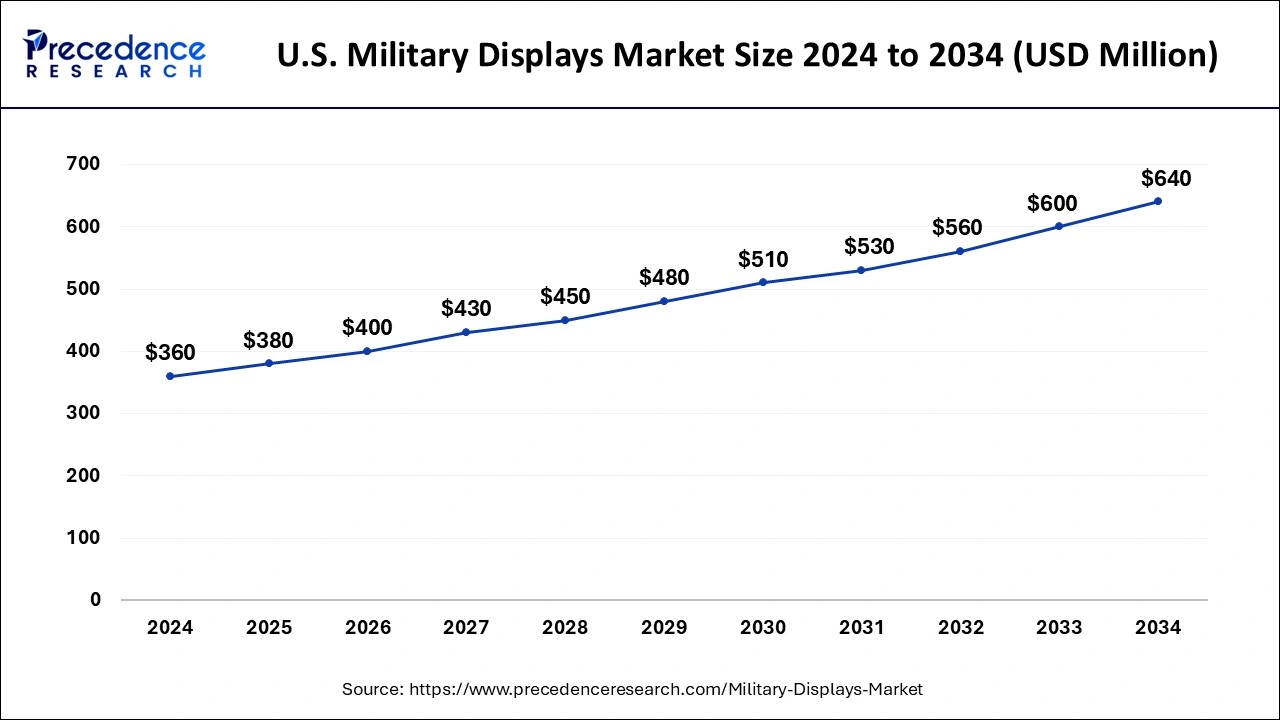

The U.S. military displays market size was exhibited at USD 360 million in 2024 and is projected to be worth around USD 640 million by 2034, growing at a CAGR of 5.92% from 2025 to 2034.

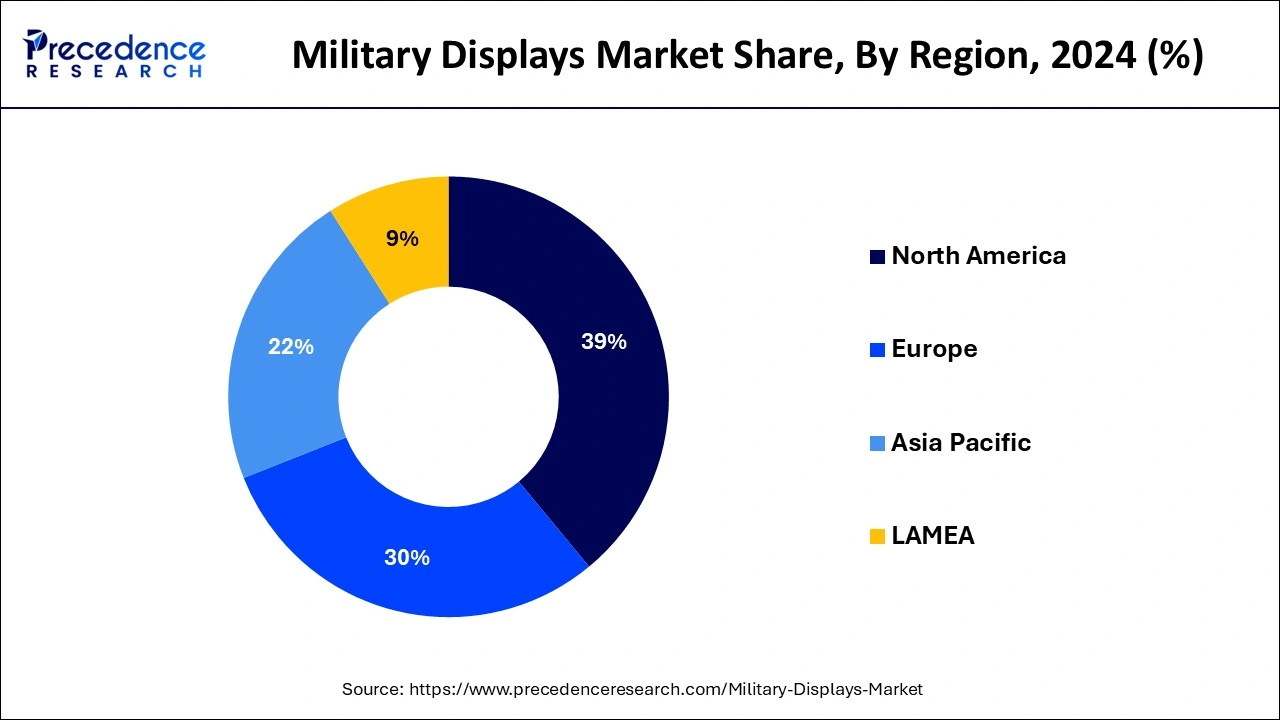

North America dominated the global military displays market in 2024. The dominance of the region can be attributed to the increasing demand for high-performance and integrated systems that improve both combat readiness and operational efficiency. However, in North America, the U.S. led the market, owing to the incorporation of innovative technologies like mixed reality to develop interactive displays.

Asia Pacific is expected to grow at the fastest rate in the market over the studied period. The growth of the region can be linked to the increasing demand for displays that offer real-time data, high resolution, and flexibility while swiftly integrating with different defense systems. Furthermore, in Asia Pacific, China led the market owing to the strong presence of key market players who manufacture high-brightness displays for remote operations.

Military displays are created for harsh climatic conditions and mission-oriented applications. These displays are designed to withstand vibration, shock, dirt, dust, and extreme temperatures. Special features are also included such as night vision compatibility, high brightness, and anti-reflective coatings. Military vehicles like aircraft, tanks, and armed personnel carriers use these displays to offer crucial information to vehicle crews. Military displays are referred to as command-and-control displays.

Military Expenditure by Country 2024

| Country | Expenditure (USD billion) |

| United States | 939 |

| China | 373 |

| Russia | 225 |

| India | 132 |

| South Korea | 65.1 |

| Report Coverage | Details |

| Market Size by 2024 | USD 1.33 Billion |

| Market Size in 2025 | USD 1.40 Billion |

| Market Size in 2034 | USD 2.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in defense budgets

In the era of ongoing security threats, governments across the globe are focusing more on their defence sector. The heavy investment of funds in the advancement of military programs has a positive influence on the demand for an innovative military display market. In addition, the surge in defense budgets enables the military to invest in advanced display technologies.

Tedious procurement processes

Lengthy and tedious procurement processes can lengthen the installation of innovative display technologies, hampering the military displays market growth. Military displays have to undergo strict testing to fulfill the requirement for safety standards. Moreover, hurdles in allocating enough funds to military budgets can constrain market growth.

Increasing focus on cybersecurity

Military displays are becoming more integrated with essential systems, hence the concerns regarding cyberattacks are increasing. Military displays market players are emphasizing strong cybersecurity measures to protect these displays to ensure system and data integrity. Furthermore, innovative military displays provide new design possibilities for combining displays into many military platforms, enhancing the space utilization within cockpits.

The computer displays segment dominated the military displays market in 2024. The dominance of the segment can be attributed to the increasing requirement for convenient visual technologies by armed forces for real-time data delivery in crucial environments. Additionally, the integration of computer displays with sonar equipment, radar systems, and other communication networks facilitates improved situational awareness for further operations.

The handheld segment is anticipated to grow at the fastest rate in the military displays market over the forecast period. The growth of the segment can be linked to the growing use of handheld devices in military applications as they are lightweight, portable, and give good battery backup. Moreover, the developers have to consider many factors before the direct implementation of these devices in military applications including efficiency, performance, and safety.

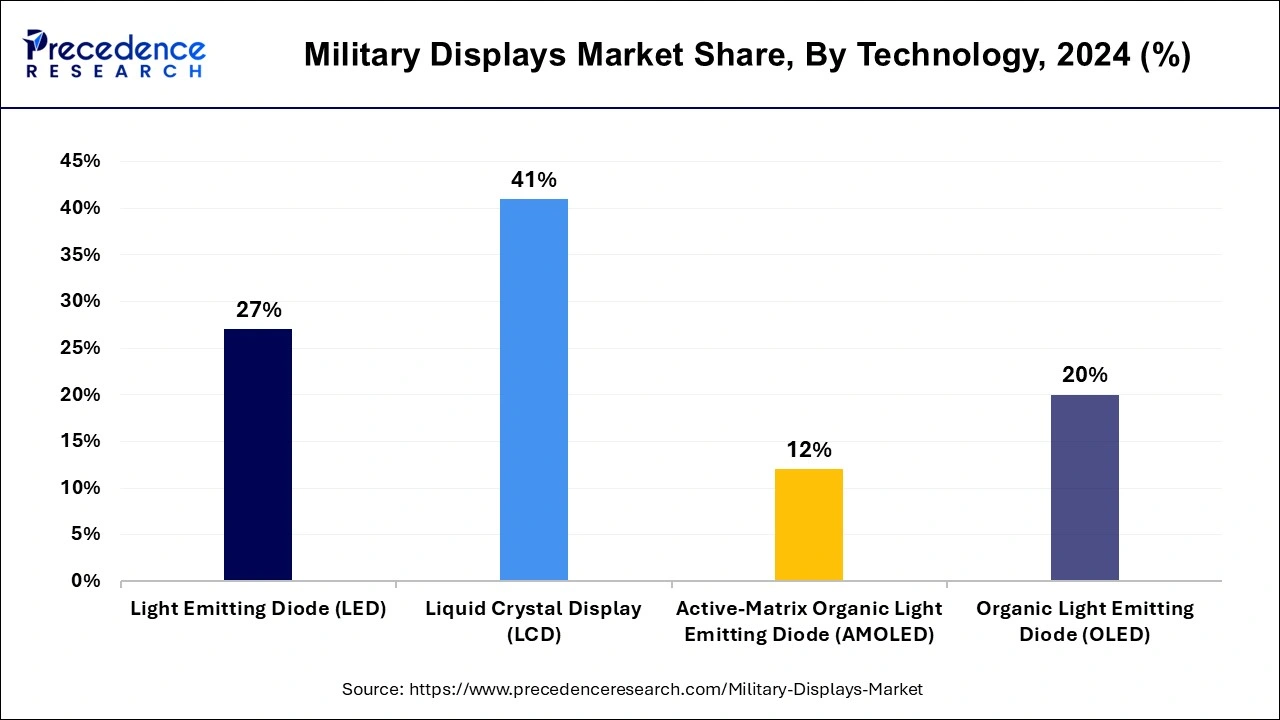

The liquid crystal display (LCD) segment led the global military displays market in 2024. The dominance of the segment can be credited to the surge in the use of LCD technology while manufacturing military displays because it provides convenience of space and cost. This display consumes less power as compared to other displays and is also flexible in nature. LCD displays offer excellent brightness, resolution, and contrast to make clear picture quality.

The OLED segment is expected to grow at the fastest rate in the military displays market over the forecast period. The growth of the segment can be driven by the growing investment by military forces in innovative display technologies to improve situational awareness. This technology offers enhanced contrast ratios, superior color accuracy, and decreased power consumption as compared to conventional displays. Also, the launch of bendable and flexible OLED displays has facilitated smooth integration into various applications.

In 2024, the land segment held the largest military displays market share. The dominance of the segment is owing to innovations in technology and transforming the landscape of contemporary warfare. Armed military forces depend on these displays for situational awareness, simulated drills, and tactical strategizing. Furthermore, armed forces are focusing on enhancing operational processes.

The airborne segment is estimated to grow rapidly in the military displays market over the projected period. The growth of the segment can be linked to the growing use of these displays in airborne systems due to their cost-effectiveness, versatility, and easy deployment. In addition, they are also used for reconnaissance, surveillance, and strike missions.

By Product

By Technology

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2024

August 2024