February 2025

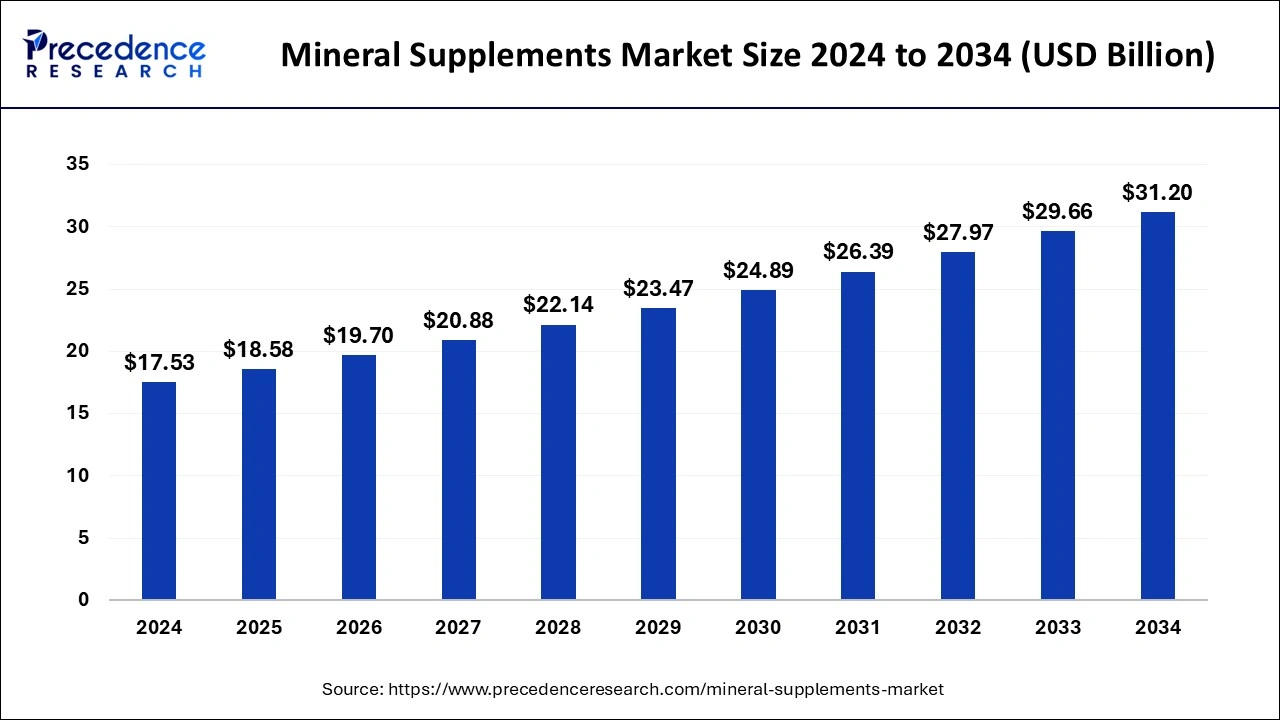

The global mineral supplements market size is estimated at USD 18.58 billion in 2025 and is predicted to reach around USD 31.20 billion by 2034, accelerating at a CAGR of 5.93% from 2025 to 2034. The Asia Pacific mineral supplements market size surpassed USD 7.43 billion in 2025 and is expanding at a CAGR of 5.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global mineral supplements market size was valued at USD 17.53 billion in 2024 and is estimated to hit around USD 31.20 billion by 2034 growing at a CAGR of 5.93% from 2025 to 2034. The mineral supplements market is driven by the growing number of elderly people.

Though it is not new, artificial intelligence (AI) is a more recent development in the field of nutrition and supplements. Generative AI (GEN AI) is becoming a game-changing tool for the supplement sector, which is always looking for new and creative methods to interact with consumers. The way supplement businesses engage with their customers is being revolutionized by GEN AI's capacity to scan large datasets, comprehend customer preferences, and produce tailored experiences. By forecasting the effectiveness of novel supplement formulations, GEN AI speeds up the research and development process. In addition to expediting product development, this raises the possibility of creating supplements that are both successful and commercially viable.

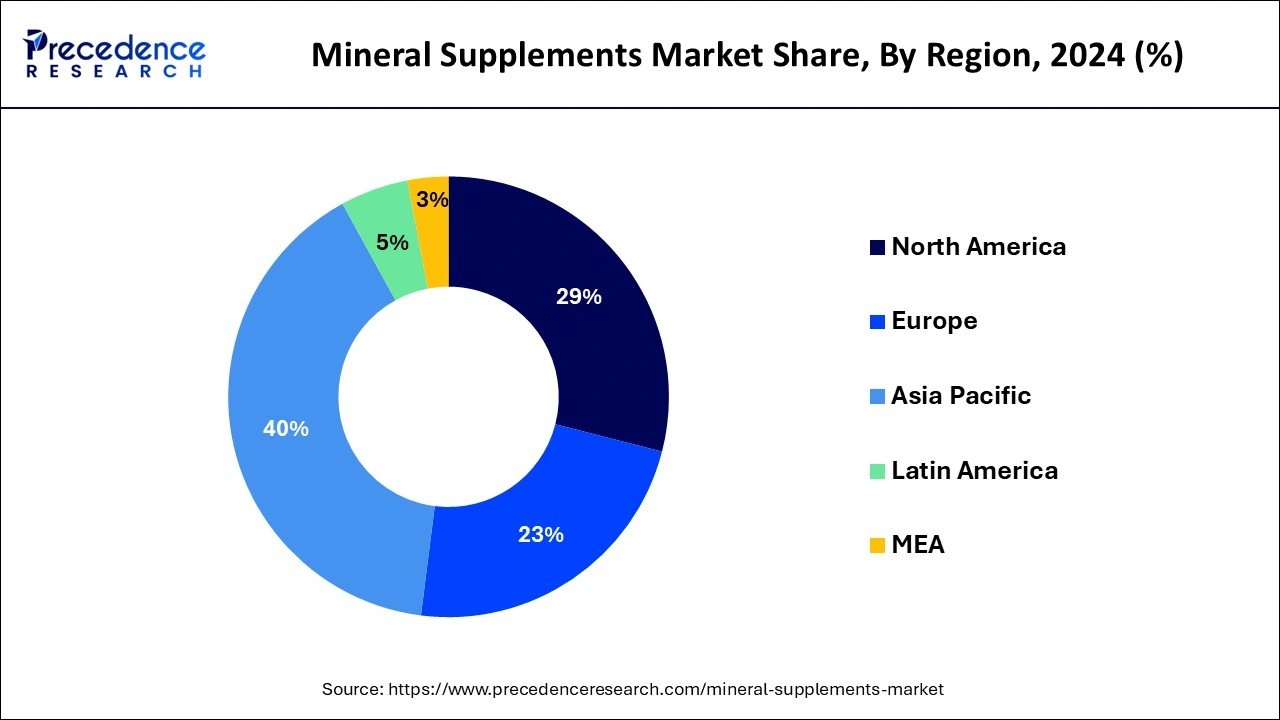

The Asia Pacific mineral supplements market size was valued at USD 7.01 billion in 2024 and is anticipated to reach around USD 12.48 billion by 2034, poised to grow at a CAGR of 5.94% from 2025 to 2034.

Asia Pacific led the market with the biggest market share of 40% in 2024. The region's expanding population and rising disposable income levels drive the market for health and wellness products, particularly mineral supplements. Furthermore, there's a growing acceptance of dietary supplements due to increased knowledge of the value of sustaining excellent health.

In addition, the Asia-Pacific area is rapidly industrializing and urbanizing, changing food preferences and lifestyles. People are more likely to take preventative healthcare measures, such as mineral supplements, as they become more health conscious.

Latin America is the fastest growing in the mineral supplements market during the forecast period. Consumer expenditure on health and wellness items, such as mineral supplements, has surged due to rising disposable incomes and improved living standards. The need for these supplements has also increased due to rising awareness of the value of preventative healthcare and nutritional inadequacies.

Furthermore, market penetration in the region has been aided by significant firms' growing distribution networks and strong marketing efforts. Lastly, efforts by the government to promote well-being and health considering an aging population are looking for preventative healthcare solutions.

Commercializing mineral supplements to customers makes up the global mineral supplements market. Products that include one or more minerals to enhance nutrition are called mineral supplements. The body requires trace levels of minerals and vital nutrients for optimal operation. There are numerous varieties of mineral supplements on the market, such as those for calcium, magnesium, iron, potassium, and zinc.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Global Market Size in 2025 | USD 18.58 Billion |

| Global Market Size by 2034 | USD 31.20 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Formulation, By Application, By End-Use, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of nutritional deficiencies

A growing number of people are experiencing nutritional deficiencies resulting from insufficient food consumption or poor absorption due to busy lifestyles, shifting eating habits, and food poverty. These inadequacies may result in reduced immune systems, compromised cognitive abilities, bone diseases, and other health problems. People are looking for mineral supplements to compensate for the nutritional gaps in their meals and preserve optimal health as awareness of these health hazards increases. Thereby, the rising prevalence of nutritional deficiencies acts as a driver for the mineral supplements market.

Availability of diverse product range

A wide variety of products are available to accommodate varying consumer preferences. These include differences in formulas (e.g., multivitamins, targeted minerals), flavors, and dosage forms (e.g., tablets, capsules, liquids). Customers' food preferences, lifestyles, and health objectives vary. Due to a wide selection of products, they can select supplements that suit their needs, be it organic, non-GMO, vegan-friendly, or gluten-free.

Disruptions in supply chains, production, and distribution

The manufacture of mineral supplements might be hampered by any interruption in the supply chain, such as a scarcity of raw materials or delays in transportation. Movement restrictions or trade barriers can make it more challenging to get mineral supplements to customers or retailers, which can cause shortages or delays in delivery. Supply chain interruptions can create uncertainty, making firms and customers hesitant. This can impact investment decisions and the expansion of the mineral supplements market.

Opportunities

Expansion into emerging markets with rising health consciousness

People are more likely to choose preventative healthcare practices as healthcare expenses rise. Demand for mineral supplements is increasing in emerging nations because they provide a practical and affordable means of promoting general health and well-being. Dietary imbalances and elevated stress levels are frequently caused by the rapid urbanization and lifestyle changes occurring in emerging markets. Mineral supplements provide focused nutritional support for good health, meeting the demands of people with busy lifestyles.

Innovative product development and personalized nutrition

Due to personalized nutrition, supplemental formulations can be customized for each person depending on their needs, preferences, and health objectives. This personalization may result in cutting-edge goods that address specific dietary needs or mineral deficits. Mineral supplements can be made with individualized nutrition to target health issues, such as elderly people, athletes, or expectant mothers. By taking a focused strategy, mineral supplements become more relevant and effective, which opens new mineral supplements market potential.

The calcium segment dominated the mineral supplements market with the largest share in 2024. The importance of calcium in preserving bone health is well known. There has been a notable increase in demand for calcium supplements due to increased awareness of osteoporosis and other bone-related concerns, particularly among older populations. The marketing of calcium supplements has been heavily pushed through several outlets, including print, web, television, and professional endorsements. These initiatives have successfully changed consumer behavior and increased awareness.

Regulatory organizations have guaranteed the safety and effectiveness of calcium supplements in numerous nations that have authorized and controlled their sale. Due to this regulatory support, customers feel more confident, and there is an increasing demand for calcium products.

The zinc segment shows a significant growth in the mineral supplements market during the forecast period. The market for zinc supplements is being driven by consumers' growing understanding of the significance of zinc in sustaining general health and well-being, particularly its involvement in immune function, wound healing, and metabolism.

Zinc supplementation is becoming more popular than traditional supplement formats because of the addition of zinc to functional foods and beverages that target health needs. Interest in zinc supplements is fueled by research showing the many health advantages of zinc consumption, including its ability to strengthen immunity, support growth and development, and help treat common illnesses like the common cold.

The tablet segment dominated the mineral supplements market with the largest share in 2024. A cost-effective and user-friendly method of supplementing with minerals is through tablets. Their ease of portability, lack of measuring or mixing, and easy swallowing make them a good choice for customers leading hectic lives. It makes it possible to precisely regulate dose, guaranteeing that each serving of minerals given to customers has the necessary amount. This precision is crucial to preserve optimum health and minimize the dangers of either over- or under-supplementing.

The liquid/gel segment witnessed lucrative growth in the mineral supplements market during the forecast period. Supplements in liquid and gel form are more accessible than those in pill form. Supplements in liquid or gel form are more convenient for consumers, particularly those with trouble swallowing tablets.

Supplements in liquid and gel form make it simpler to adjust dosages to suit each person's requirements and tastes. This adaptability appeals to customers looking for individualized dietary plans. Manufacturers have concentrated on developing novel formulations, tastes, and delivery systems in the liquid and gel market. This ongoing product development has drawn customers seeking cutting-edge, efficient supplement solutions.

The general health segment dominated the mineral supplements market in 2024. Many customers are drawn to general health-oriented mineral supplements, such as those who want to support different body functions, fill in nutritional shortages, and preserve general wellness. Widely accessible in a variety of forms, including pills, capsules, powders, and liquids, general health mineral supplements are easy for customers to include in their daily routines. To lower their chance of nutritional deficiencies and related health problems, many consumers utilize mineral supplements as part of a preventative health program.

The bone & joint health segment shows a notable growth in the mineral supplements market during the forecast period. Bone and joint health awareness is growing as the world's population ages. Diseases like osteoporosis and arthritis are more common in older people, there is a growing need for mineral supplements to maintain bone density and joint function. Bone and joint problems can be exacerbated by modern lifestyles marked by sedentary behaviors, poor food choices, and high levels of stress. Supplementing with minerals is a straightforward strategy to improve general musculoskeletal health and fill dietary gaps.

The adults segment dominated the mineral supplements market with the largest market share in 2024. As adults age, their concerns about their health and well-being increase, raising the need for supplements to make up for any dietary deficits. As part of preventative healthcare measures, many individuals use mineral supplements to enhance overall well-being and lower their risk of aging-related chronic diseases. Adults are being actively marketed to and educated about the advantages of mineral supplements through various outlets, such as advertising campaigns, websites, and medical professionals.

The geriatric segment shows a significant growth in the mineral supplements market during the forecast period. Age-related health issues, including osteoporosis, arthritis, and other mineral deficiencies, are becoming more common as the population ages, which is a growing demand for supplements that address these issues. The ever-increasing awareness among even older adults of the benefits of supplementing with minerals to maintain bone health, cognitive function, and general well-being is driving additional expansion in the market. Moreover, older adults are increasingly accepting and using mineral supplements due to improvements in healthcare and an emphasis on preventive healthcare practices.

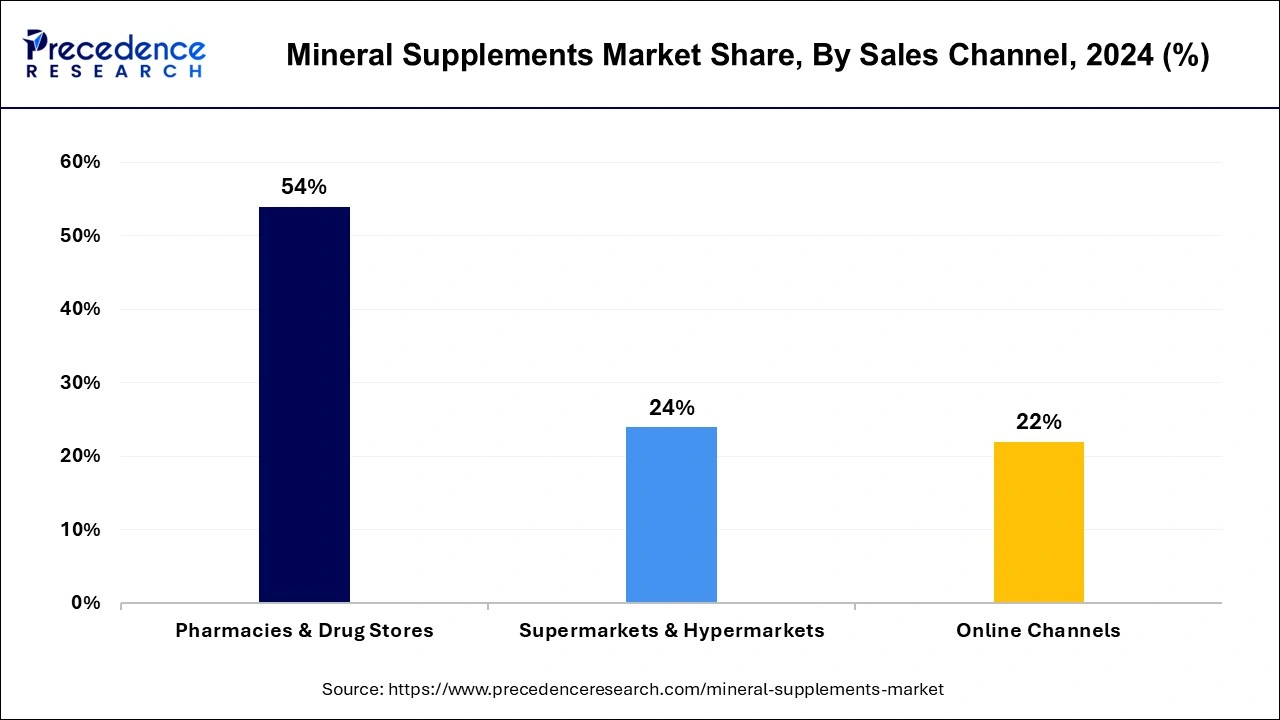

The pharmacies & drug stores segment dominated the mineral supplements market with the largest market share of 54% in 2024. Customers may easily find pharmacies and drug stores, frequently situated in easily accessible areas like shopping centers, malls, and residential neighborhoods. It is simpler for customers to buy mineral supplements, when necessary, because of this accessibility.

In the eyes of customers, they are usually linked to credibility and trust. They are regarded as trustworthy suppliers of medical supplies, especially dietary supplements, including minerals. Customers frequently purchase supplements from these places with greater confidence because of their professional reputation and compliance with legislation.

The online channels segment is the fastest growing in the mineral supplements market during the forecast period. Globally, people now have more access to and convenience with online shopping thanks to the growing popularity of smartphones and the internet. As a result, there has been a noticeable movement in consumer preferences toward online shopping for various goods, including dietary supplements containing minerals.

In addition, since people try to avoid crowded areas and limit in-person interaction, internet purchasing has become more popular due to the COVID-19 pandemic. Once people get used to the ease and security of online shopping, this trend toward e-commerce is predicted to continue long after the pandemic.

By Product

By Formulation

By Application

By End-Use

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2023

August 2024

October 2024