April 2025

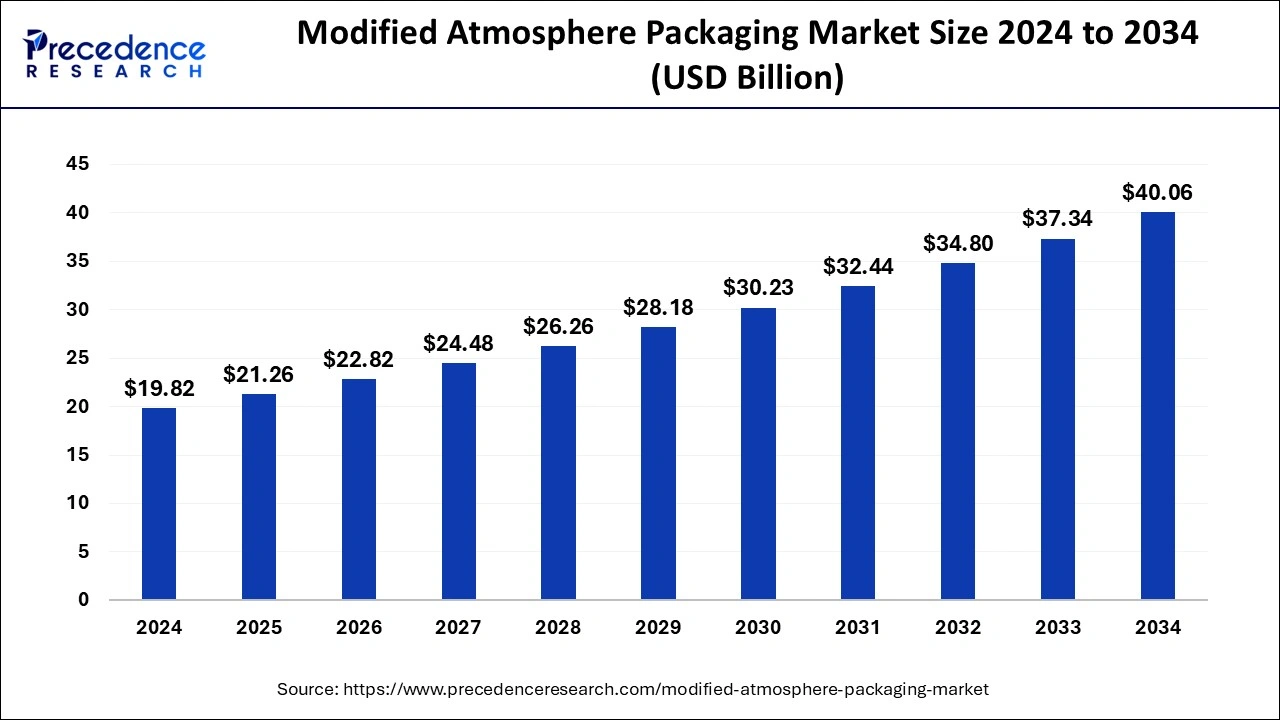

The global modified atmosphere packaging market size is accounted at USD 21.26 billion in 2025 and is forecasted to hit around USD 40.06 billion by 2034, representing a CAGR of 7.29% from 2025 to 2034. The Europe market size was estimated at USD 6.74 billion in 2024 and is expanding at a CAGR of 7.44% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global modified atmosphere packaging market size was calculated at USD 19.82 billion in 2024 and is predicted to reach around USD 40.06 billion by 2034, expanding at a CAGR of 7.29% from 2025 to 2034. Increasing demand for high-quality and fresh-quality foods is the key factor driving the growth of the modified atmosphere packaging market. Also, ongoing developments in packaging technologies coupled with the rise in demand for online food delivery can fuel market growth further.

Artificial Intelligence is playing a significant role in changing the modified atmosphere packaging market. AI-driven algorithms enable accurate gas composition control, improving the efficiency of packaging in maintaining the quality and freshness of the food product. Furthermore, AI optimizes production lines, reduces human error, and decreases overall labor costs, which in turn leads to enhanced operational efficiency.

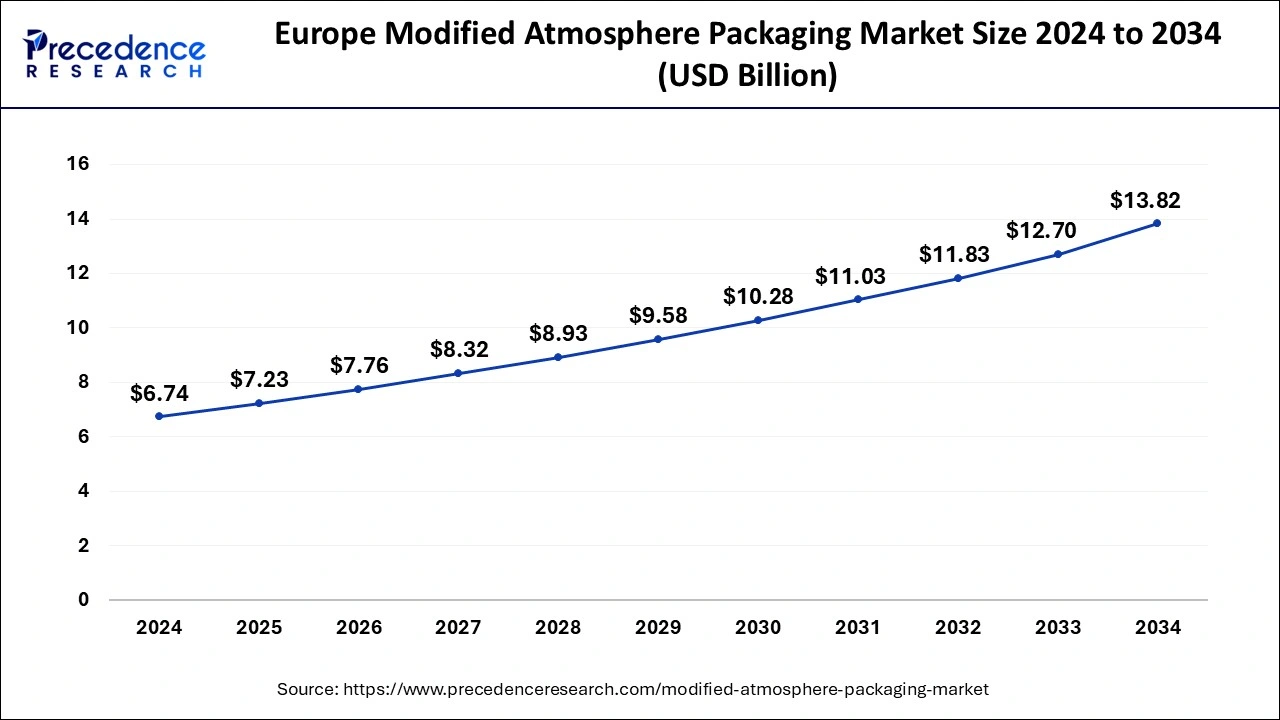

The Europe-modified atmosphere packaging market size was exhibited at USD 6.74 billion in 2024 and is projected to be worth around USD 13.82 billion by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

Europe dominated the modified atmosphere packaging market in 2024. The dominance of the region can be attributed to the rising investments in R&D activities by market players along with the surge in demand for packaged food products in the region. Furthermore, in Europe, the modified atmospheric conditions are ongoing trends in the storing and packaging of all sorts of food products. The surge in production and export of products like beef and pork aids market growth in the region.

North America is expected to grow at the fastest rate in the modified atmosphere packaging market over the studied period. The growth of the region can be linked to the increase in demand for frozen, packaged, and on-the-go food products in the country like the U.S. Moreover, the United States has a substantial amount of food waste because of inconvenient packaging along the supply chain. Which in turn results in the increasing adoption of these packaging solutions.

Modified atmosphere packaging (MAP) is a method to extend the shelf life of food products. The modified atmosphere packaging market is advantageous for delaying the primary state of food without manipulating the atmospheric temperature or exposing it to chemical substances, like dehydration, freezing, and others. MAP decreases the speed of the aging process of the product, safeguards a food from deterioration, and prolongs its shelf life. MAP trays, liners, and filters are being increasingly utilized in the food sector to strengthen the market share.

| Report Coverage | Details |

| Market Size by 2024 | USD 19.82 Billion |

| Market Size in 2025 | USD 21.26 Billion |

| Market Size in 2034 | USD 40.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.29% |

| Dominating Region | Europe |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing demand for longer shelf life

The products that are packaged in a protective manner spoil at a much lower rate than other products. In such cases, the modified atmosphere packaging market can substantially improve the shelf life and freshness of the food products. In addition, this type of packaging products keeps product quality for a longer period to ensure the best condition of the product when it reaches the customer. The latest trends, such as cutting trays for packaged foods, are becoming mainstream.

Use of alternative preservation methods

The increasing utilization of alternative preservation techniques due to high upfront cost costs associated with the MAP can hinder the modified atmosphere packaging market growth. The investment needed for gases, gas packaging machinery, and packaging material is very high. Moreover, the transport cost also rose because of the increased packaging volume, which shortly hampered market growth. In MAP packaging, bacteria can grow continuously in hotter temperatures.

Growing demand for ready-to-eat food items

There is a surge in demand for ready-to-eat food products in the modified atmosphere packaging market. The majority of the population in developing countries like China and India comprises a high number of adults and youngsters, which positively impacts the growing demand for convenient food products. Furthermore, the young population is the main target for ready-to-eat food manufacturing companies due to the convenience offered by these products.

The plastic material segment dominated the modified atmosphere packaging market in 2024. The dominance of the segment can be attributed to the features offered by plastic over other packaging materials, such as excellent barrier properties to protect the food from oxygen, moisture, or other gases that can potentially lead to discoloration or spoilage of food products. Additionally, plastic is compatible with many food products and gases, preventing spoilage further. This material is also a key option for MAP because of its cost-effectiveness.

The other material segment is expected to witness moderate growth in the modified atmosphere packaging market over the forecast period. The growth of the segment can be linked to the increasing environmental concerns and the latest sustainability trends. Also, the paperboard packaging is perceived as more environmentally friendly and natural as it carries a 'greener' image. Paperboard material also has a low carbon footprint.

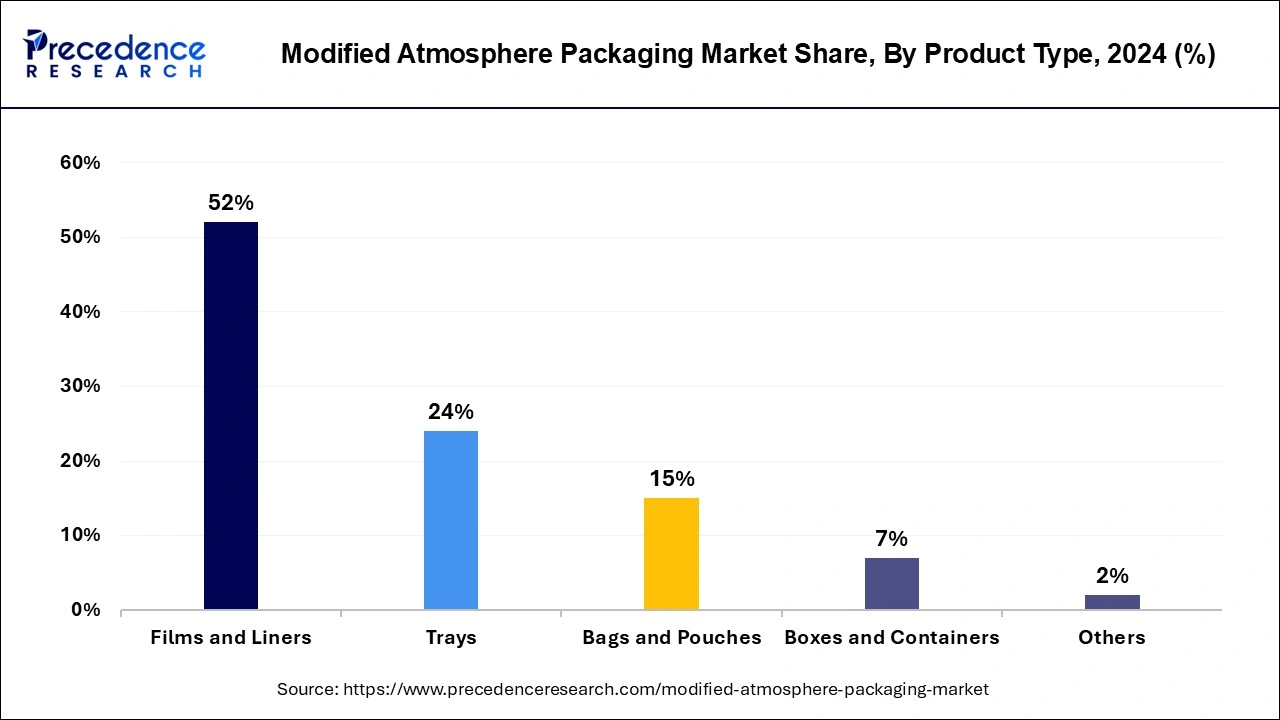

The films and liners segment led the modified atmosphere packaging market in 2024. The dominance of the segment can be credited to the increasing use of films and liners in the packaging of ready-to-eat meals and food products. It is also important for prolonging the shelf life of food products. However, films and liners improve the appearance of processed and fresh food products and remain fog-free during refrigeration.

The trays segment is anticipated to grow at the fastest rate in the modified atmosphere packaging market over the forecast period. The growth of the segment can be driven by the growing use of MAP trays in packaging, preserving, and prolonging the shelf life of seafood, meat, and other types of meals. Additionally, market players are increasingly investing and innovating in R&D to create enhanced MAP tray solutions. Advancements in technology are facilitating the development of cost-effective tray solutions.

The healthcare segment is expected to experience the fastest growth in the modified atmosphere packaging market over the projected period. The growth of the segment is due to the rising use of MAP to keep the authentic quality of medical devices and pharmaceutical products. Furthermore, the MAP trays can be used to carry and preserve critical pharmaceutical formulations in a convenient and safe manner. Hospitals and other healthcare facilities are also demanding this packaging solution for the convenience it offers.

Top 5 Packaging Companies in the U.S. by 2023 Revenue

| Company | 2023 Revenue |

| WestRock | USD 20.3 billion |

| International Paper | USD 18.9 billion |

| Ball Corporation | USD 14 billion |

| Berry Global | USD 12.6 billion |

| Crown Holdings | USD 12.01 billion |

By Material

By Product Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

March 2025