February 2025

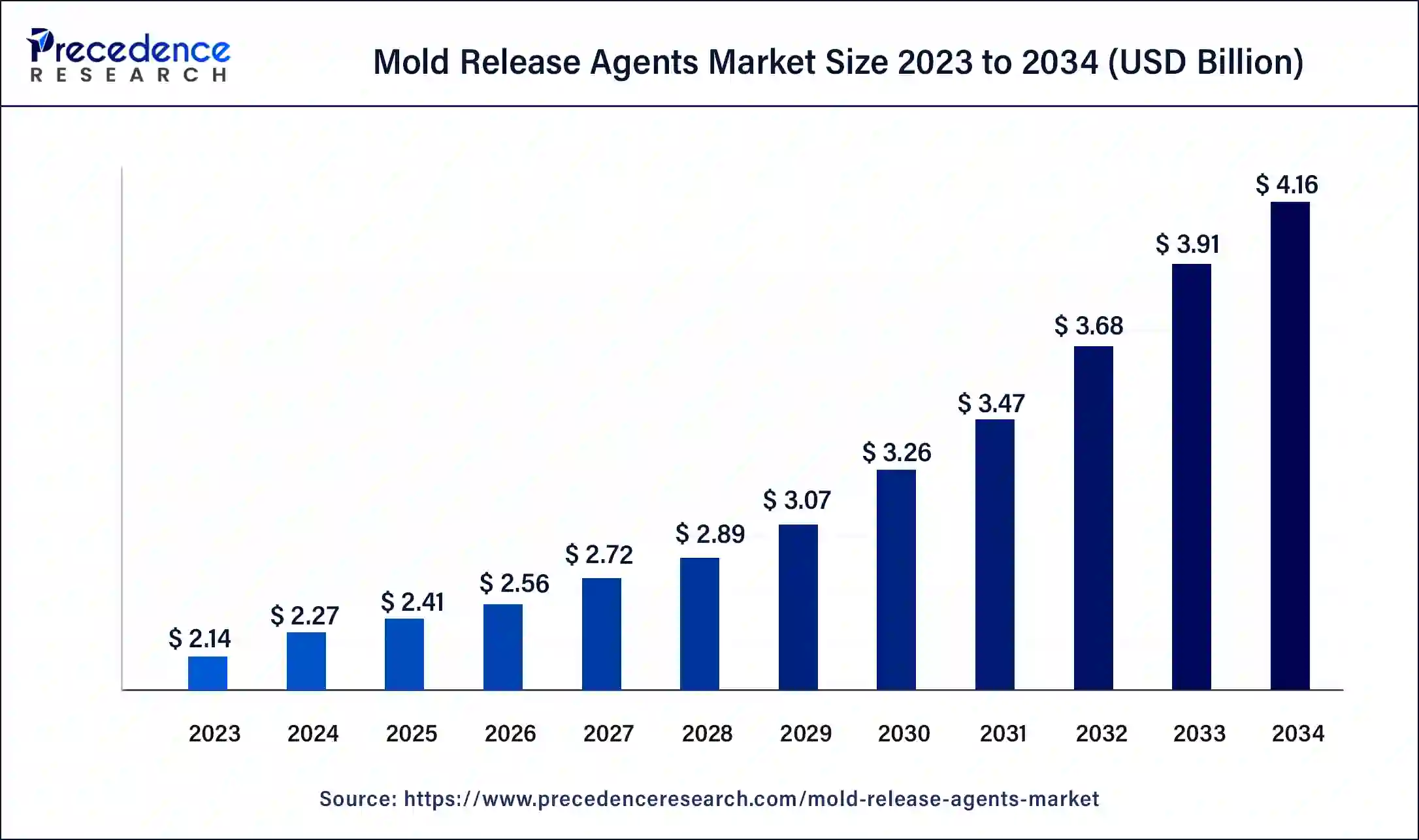

The global mold release agents market size surpassed USD 2.14 billion in 2023 and is estimated to increase from USD 2.27 billion in 2024 to approximately USD 4.16 billion by 2034. It is projected to grow at a CAGR of 6.22% from 2024 to 2034.

The global mold release agents market size is expected to be worth around USD 4.16 billion by 2034 from USD 2.27 billion in 2024, at a CAGR of 6.22% from 2024 to 2034.

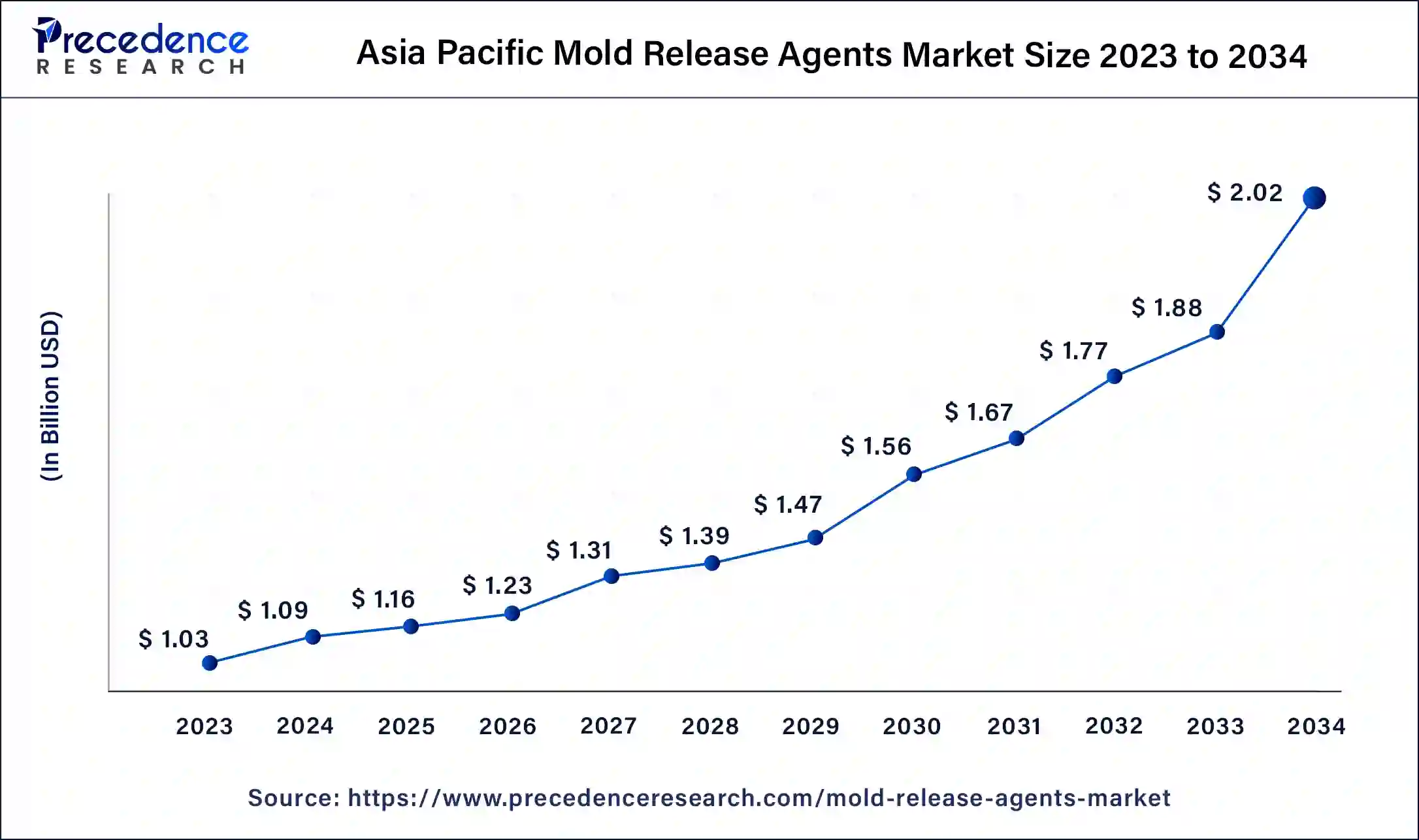

The Asia Pacific mold release agents market size was exhibited at USD 1.03 billion in 2023 and is projected to be worth around USD 2.02 billion by 2034, poised to grow at a CAGR of 6.31% from 2024 to 2034.

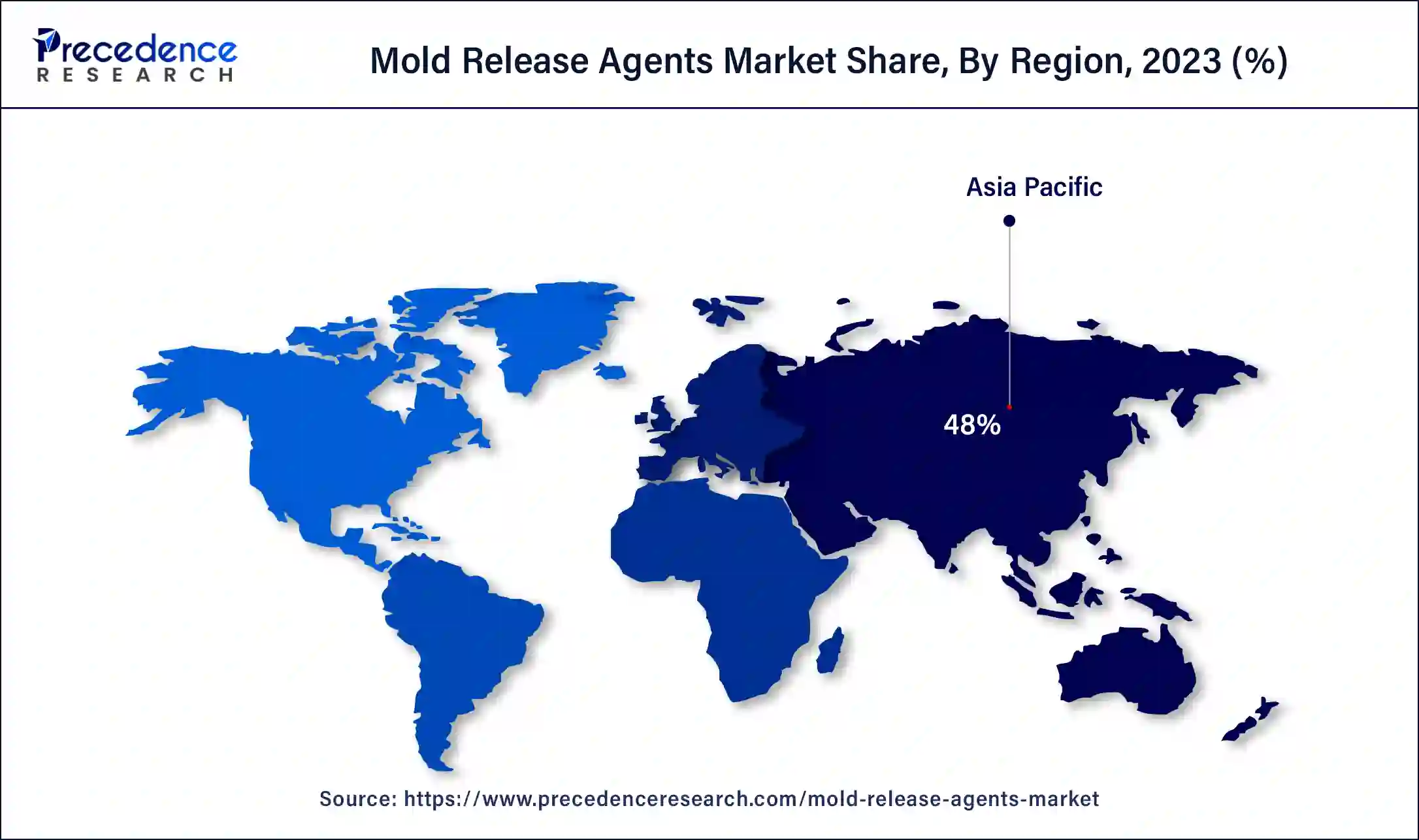

Asia Pacific held the dominant share of the mold release agents market in 2023. The region is observed to witness notable growth during the forecast period. The region is observed to witness prolific growth during the forecast period. The growth of the region is mainly attributed to surging industrialization, rising research and development activities, robust economic growth in the developing nations, easy availability of raw materials, stringent emission regulations, and growing demand for consumer electronics. The rising vehicle production, coupled with the increasing adoption of the die-casting technique for manufacturing metal body parts of numerous vehicles, acts as one of the major driving factors for this regional growth.

The fastest-developing economies in the region, such as China, India, Japan, and South Korea, are the major contributors to the mold release agents market. The rising demand from end-user industries, such as manufacturing, automotive, construction, and others, boosts the growth of the market. The steady growth in these sectors offers immense growth opportunities to the market due to the rising foreign investment, rapid industrialization, and industrialization. Furthermore, the increasing number of manufacturing plants and exponential rise in exports contribute to the growth of mold-release agents in the region.

North America is anticipated to grow notably in the mold release agents market during the forecast period. The region’s growth is driven by the presence of sophisticated industrial infrastructure, a significant rise in manufacturing activities, expansion of the construction sector, and strict execution of regulations by government entities to reduce volatile organic compound (VOC) emissions. Moreover, the rising demand for intricate and complex mold designs increases the demand for mold release agents to facilitate the demolding of complex parts.

Countries such as the United States and Canada represent a significant share of the mold release agents market, owing to the rising demand for a variety of items such as electronics, consumer goods, automotive components, and aerospace and defense parts, propelling the regional market’s growth. Additionally, the increasing presence of market players in the region appears to be highly fragmented and competitive. Such factors are bolstering the growth of the region's market during the forecast period.

A mold release agent is a chemical widely used to prevent molded parts from sticking to the surfaces of molds. It acts as a chemical barrier as the means of separation between the material being molded and the mold surface. Mold release agents find various applications in manufacturing industries and play an integral role, particularly those involving plastic, rubber, and other composite casting processes. The purpose is to ensure that the molded part can be easily removed from the mold without sticking to it, provide a seamless demolding process, and reduce the damaging risk of the finished product. The right mold release agent can save you money while reducing your overall production time.

Top 10 Countries in the Infrastructure Sector in the Calendar Year 2022

| China (Mainland) | 22.40% |

| United States | 18.20% |

| Taiwan, China | 4.70% |

| India | 4.60% |

| Japan | 4.10% |

| Germany | 4.00% |

| United Kingdom | 3.20% |

| Canada | 2.80% |

| France | 2.50% |

| Indonesia | 2.30% |

| Report Coverage | Details |

| Market Size by 2034 | USD 4.16 Billion |

| Market Size in 2023 | USD 2.14 Billion |

| Market Size in 2024 | USD 2.27 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.22%% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand from the automotive and construction industries

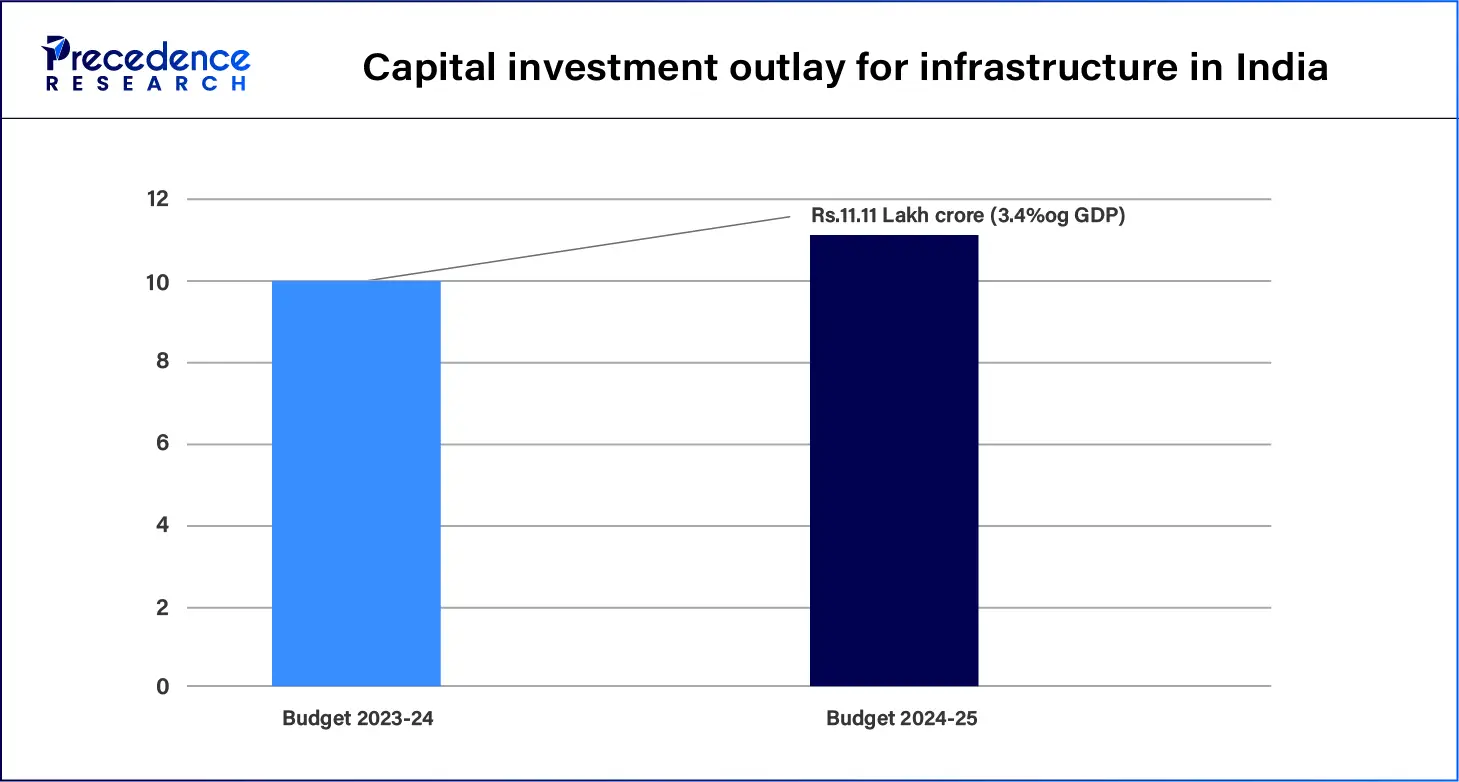

The increasing demand from the automotive and construction industries is expected to contribute to the growth of the mold release agents market. The demand for mold release agents is increasing in the automotive and construction industries owing to their ability to minimize costs and improve efficiency, making them an attractive option to increase their productivity. Mold release agents are extensively used in the construction industry for the production of concrete and other building materials. They help prevent sticking and ensure smooth surfaces.

The surge in the development of infrastructure, especially in developing nations, increases product demand significantly. Molds are mostly commonly used to shape rubber parts and accessories, including those found in various automotive applications. The use of mold-release products can improve production times and assist in preventing faults in molded products. Thus boosting the mold release agents market growth during the forecast period.

Growing concerns over the environmental impact

The growing concerns over the environmental impact are anticipated to hinder the global mold release agents market. The increasing concerns over the environmental impact and severe health hazards related to harmful chemicals led to strict regulatory constraints and an increase in the need for compliance. The product uses fluorocarbons as one type, which poses a threat to the environment.

The stringent regulations of the Government related to chemical usage increase the pressure to shift towards biodegradable and eco-friendly mold release agents, which results in high costs associated with research and development proficiencies to develop effective alternatives that offer sustainable environmental benefits. In addition, the high costs associated with developing and commercializing eco-friendly mold release agents pose a challenge for small and medium-sized manufacturers. Such factors are likely to restrict the expansion of the mold release agents market in the coming years.

Rising technological innovation

The significant rise in technological innovation is projected to offer immense growth opportunities for the mold release agents market during the forecast period. The rising integration of nanotechnology and biodegradable additives in mold release formulations provides improved surface finish quality and minimizes environmental impact. The rapid innovations enhance the production of more efficient, affordable, and versatile release agents that can tap into various application sectors. Therefore, the rapid expansion of end-user industries represents lucrative opportunities for the mold release agents market in the coming years.

The water-based segment accounted for the dominating share of the mold release agents market in 2023. Water-based release agents are increasingly being used as they offer several benefits such as being non-polluting, safer, less expensive, smooth casting surface, green environment protection, good release effect, causing no damage to the surface of the casting, and others. Water release agents are different from traditional solvent-based release agents such as mineral oil. Water-based agents are environmentally friendly due to the absence of volatile organic compounds (VOCs).

Water-based agents are widely used in medium- and high-temperature applications. It provides a combination of effective release performance and safeguards molds from rust over time. Water-based release agents are more efficient than oil-based release agents. Water-based release agents are less costly than powder-release agents. Water-based release agents can also be categorized as wax, silicone, or fatty acid, depending on the effective release substance in the release agent. Such supportive factors are driving the growth of the market during the forecast period.

The solvent-based segment is expected to witness significant growth in the mold release agents market during the forecast period. Solvent-based agents provide much faster drying time, making them suitable for high-volume manufacturing. These agents work by offering active silicone or wax ingredients onto mold surfaces. Solvents most commonly include xylene, acetone, mineral oil, and toluene. Solvent-based agents can be sprayed onto cloths for fast application by wiping and also on complex or large molds. However, It includes adverse effects on the environment and human health. It is supposed to be used with safety as it has flammable and combustible properties.

The composite molding segment held the largest share of the mold release agents market in 2023 and is expected to sustain its position throughout the forecast period. Composite manufacturing plays a crucial part in most modern manufacturing methods. Composite molding holds significance for automakers and small-part manufacturing. In composite molding, the product market is important for detaching the finished product from the mold. These agents act as non-stick agents that prevent the composite material from bonding or sticking to the mold and assist in ensuring a seamless demolding process.

The significant benefits offered by composite moldings, such as high strength-to-weight ratios, are essential for fuel efficiency and performance in various sectors, including aerospace and automotive. They provide excellent corrosion resistance, which makes them suitable for several marine applications. Their versatility also facilitates complex shapes and designs in engineering and architecture. These factors are anticipated to propel the expansion of the segment during the forecast period.

The die-casting segment is expected to grow significantly in the mold release agents market during the forecast period. The mold release agent plays an integral role in die casting to ensure the seamless separation of the casting from the mold. This agent assists in preventing the molten metal from sticking to the walls of the mold.

Die-release agents are most extensively used in industries such as aerospace, automotive manufacturing, consumer goods production, and others. Metal die-casting release agents are commonly utilized in several molding operations for magnesium, aluminum, zinc, and other metal materials. Thus bolstering the segment’s growth in the coming years.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

May 2024

July 2024

August 2024