August 2024

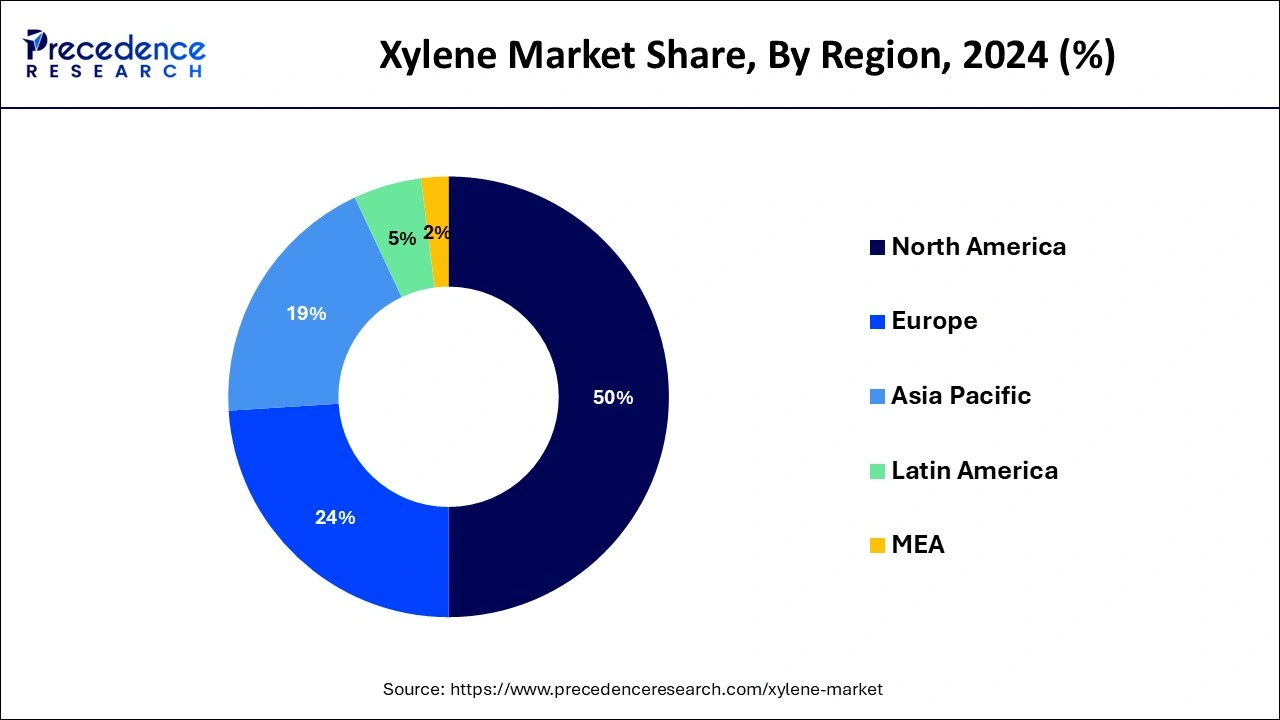

The global xylene market market size is accounted at USD 35.35 billion in 2025 and is forecasted to hit around USD 70.61 billion by 2034, representing a CAGR of 7.97% from 2025 to 2034. The North America market size was estimated at USD 16.40 billion in 2024 and is expanding at a CAGR of 8.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global xylene market size was valued at USD 32.80 billion in 2024 and is predicted to increase from USD 35.35 billion in 2025 to approximately USD 70.61 billion by 2034, expanding at a CAGR of 7.97% from 2025 to 2034.

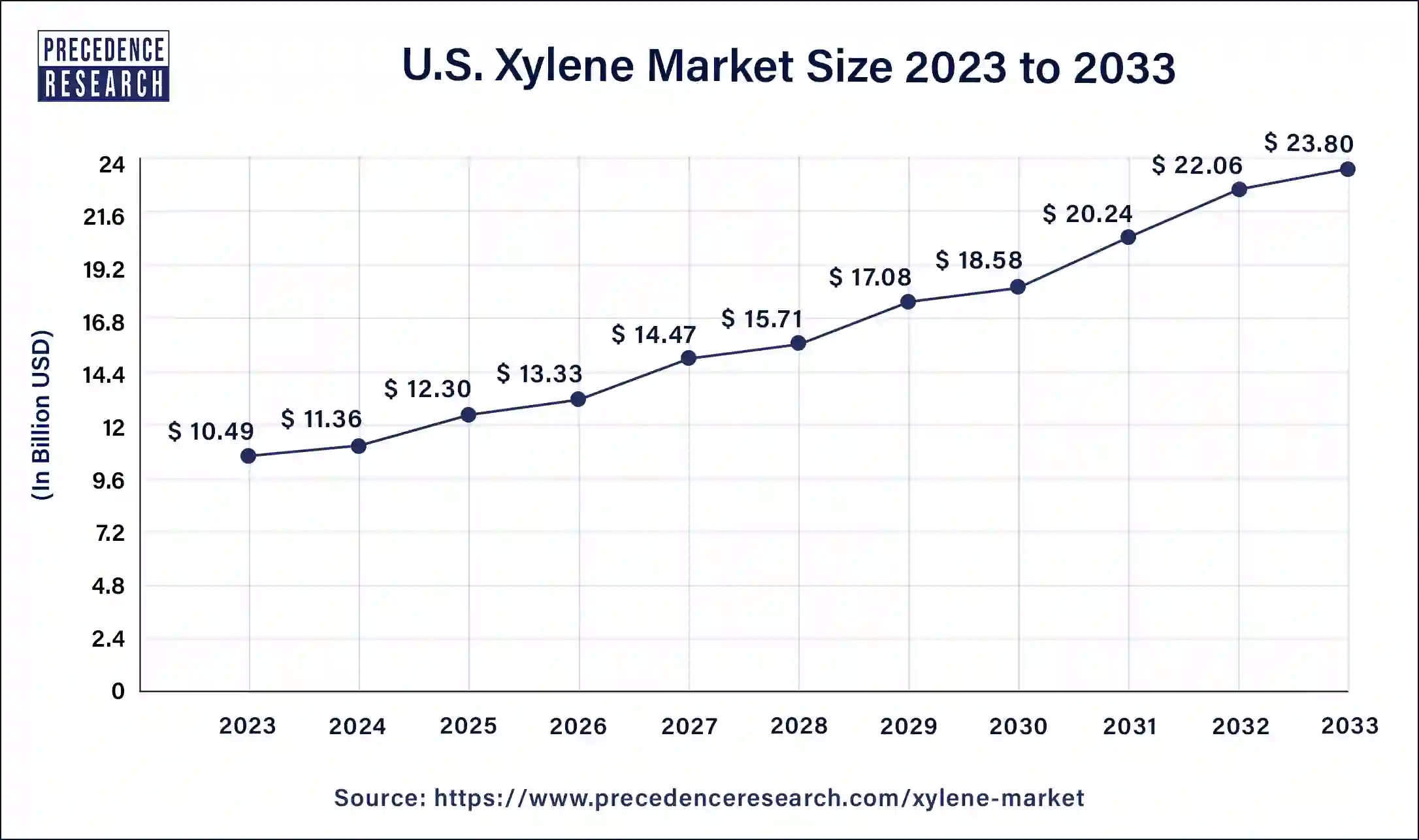

The U.S. xylene market size was exhibited at USD 11.36 billion in 2024 and is projected to be worth around USD 25.59 billion by 2034, growing at a CAGR of 8.46% from 2025 to 2034.

North America has held the largest revenue share 50% in 2024. In North America, the xylene market has experienced fluctuations driven by the impact of the COVID-19 pandemic. The early stages of the pandemic resulted in supply chain disruptions and reduced demand from end-use industries. However, as vaccination efforts progressed, industrial activities picked up, especially in the construction and automotive sectors, leading to a gradual recovery. North America is also witnessing a growing focus on sustainability and regulations that encourage the use of eco-friendly solvents, which is influencing the market dynamics.

Asia Pacific is estimated to observe the fastest expansion. This region has been a key growth driver for the xylene market. With the rapid industrialization and urbanization in countries like China and India, the demand for xylene in applications such as paints and coatings, plastics, and textiles has surged. The region is also witnessing significant investments in infrastructure projects, further boosting the demand for xylene. As a result, Asia Pacific remains a vibrant and competitive hub for xylene production and consumption.

In Europe, the xylene market exhibits a stable and mature outlook. The region has stringent environmental regulations that promote the use of eco-friendly solvents and restrict harmful emissions, which has influenced the market's dynamics. Additionally, the European market is characterized by a strong focus on sustainable practices and a gradual transition towards bio-based alternatives. While growth may be relatively slower compared to other regions, Europe remains a hub for innovation and sustainable solutions in the xylene industry.

The xylene market encompasses a group of aromatic hydrocarbons, primarily including three isomers: ortho-xylene, meta-xylene, and para-xylene. Xylene is a vital petrochemical compound used primarily in the production of plastics, synthetic fibers, and resins. It serves as a key raw material in the manufacture of purified terephthalic acid (PTA), a fundamental component in polyester production.

Additionally, xylene finds applications in various industries, including construction, paints and coatings, and chemicals. The market is driven by the increasing demand for polyester fibers, plastics, and paints, particularly in the construction and automotive sectors, and the expanding petrochemical industry's growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.97% |

| Market Size in 2025 | USD 35.35 Billion |

| Market Size by 2034 | USD 70.61 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and End-User Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth in the construction and automotive sector

Growth in the construction sector and expansion in the automotive industry are driving forces behind the increasing demand for xylene in the market. Xylene's demand surge is two-fold, driven by the construction and automotive sectors. In construction, xylene plays a fundamental role in creating essential components like insulation foams, adhesives, and sealants, integral for building materials and structures. With a constant upswing in construction projects, especially in emerging markets, the need for xylene-based products remains steady. With urbanization and infrastructure development on the rise, xylene plays a pivotal role in the construction industry's expansion.

Simultaneously, the automotive industry is in a phase of robust growth and innovation. Xylene is a linchpin in the production of coatings, plastics, and synthetic rubber, vital for manufacturing automotive components and parts. As the consumer demand for advanced, eco-friendly vehicles intensifies, so does the demand for xylene-based materials, underpinning its significance in the industry. This intersection of growth in construction and automotive sectors has propelled the xylene market forward, reflecting the compound's versatility and significance in these industries.

Health risks and substitution by alternatives

Health risks associated with xylene exposure pose a significant constraint on the market. Xylene can cause adverse health effects when inhaled, ingested, or absorbed through the skin. Prolonged exposure may lead to issues like respiratory irritation, headaches, dizziness, and even neurological problems. This raises concerns among workers, leading to increased scrutiny of workplace safety standards and the adoption of safety measures. Additionally, the potential environmental hazards linked to xylene misuse or discharge have triggered stricter regulations, forcing companies to invest in safer alternatives and waste management.

Substitution by eco-friendly alternatives is another factor impeding the xylene market. As environmental concerns gain prominence, industries seek alternatives that are less harmful and more sustainable. Bio-based solvents and safer substitutes have emerged as viable options, offering similar functionality without the health and environmental risks associated with xylene. This shift towards more environmentally responsible alternatives is compelling many manufacturers to reconsider their xylene usage, which, in turn, impacts the overall demand for xylene-based products. To overcome these challenges, the xylene industry is focusing on developing safer formulations, investing in research for alternative products, and adhering to stringent safety protocols.

High-purity xylene for electronics and growing paints & coatings industry

The xylene market experiences a surge in demand, owing to the increasing applications in high-purity xylene for electronics. As the electronics industry continues to innovate and create smaller, more powerful devices, the need for precise and reliable chemicals like high-purity xylene grows significantly. High-purity xylene is employed in the production of semiconductors and other electronic components, where even minor impurities can affect performance. This drives the demand for consistent, ultra-pure xylene to meet stringent electronic manufacturing standards.

Another key driver is the growing paints and coatings industry. Xylene is a vital component in formulating paints, coatings, and adhesives, enhancing their drying and binding properties. The xylene market witnesses increased demand, driven by the flourishing paints and coatings industry. With a thriving construction and infrastructure sector and a growing emphasis on architectural aesthetics, the paints and coatings industry is expanding. This results in an elevated requirement for xylene in the production of high-quality paints and coatings, further propelling the xylene market's growth.

Impacts of COVID-19

According to the type, the mixed-xylene segment held a 62% revenue share in 2024. Mixed xylene, a combination of isomers, including meta-xylene, is a vital product in the xylene market. It is a key ingredient in the production of various chemicals, including terephthalic acid and phthalic anhydride, which are used in the manufacturing of polyester fibers and resins. In the market, the trend for mixed xylene indicates robust growth due to its applications in the production of PET bottles and textiles, with a noticeable upswing in demand from the packaging and textile industries.

The meta-xylene segment is anticipated to expand at a significantly CAGR of 13.1% during the projected period. Meta-xylene, one of the isomers of xylene, is highly sought after in the xylene market. It is extensively used as a solvent in various industries, including coatings, chemicals, and agriculture. The market trends for meta-xylene highlight its growing application in the production of herbicides, which is bolstered by increasing agricultural activities. Additionally, its role as a precursor in the synthesis of isophthalic acid for polyester resins positions it as a pivotal component in the production of PET bottles and fiberglass. The steady demand for meta-xylene in these sectors continues to drive its prominence in the market.

Based on the application, the solvents segment is anticipated to hold the largest market share of 50% in 2024. In the xylene market, xylene's primary applications as a solvent and monomer play crucial roles in diverse industries. As a solvent, xylene is instrumental in dissolving and diluting various substances, making it a vital component in the paints and coatings industry. It's also extensively used in cleaning agents and adhesives. The increasing demand for high-quality paints, coupled with growing construction and infrastructure projects, has driven the solvent application.

On the other hand, the monomer segment is projected to grow at the fastest rate over the projected period. In terms of monomer usage, xylene is utilized in the production of various polymers, including polyester and polyethylene terephthalate (PET) resins. These polymers find applications in textiles, packaging materials, and beverage bottles. The surge in PET bottle production due to the booming beverage and packaging industry has significantly boosted xylene's role as a monomer. With an increasing focus on sustainable packaging and textiles, xylene continues to be a key component, contributing to the market's growth.

In 2024, the plastics and polymers segment had the highest market share of 52% on the basis of the end user. Xylene is used as a key solvent in the production of various plastics and polymers, including polyesters and polyurethanes. The increasing demand for plastics in packaging, automotive, and construction applications is fueling this segment. Moreover, the trend toward lightweight and high-performance materials in the automotive and aerospace industries is driving the need for xylene-based polymers.

The paints and coatings segment is anticipated to expand at the fastest rate over the projected period. The paints and coatings industry is another vital end-use sector for xylene. As the construction and infrastructure sectors expand worldwide, the demand for decorative and protective coatings is on the rise.

Xylene serves as a critical component in solvent-based paints and coatings, offering fast drying times and improved performance. The trend in this industry is shifting towards low-VOC (volatile organic compound) and eco-friendly coatings, pushing for innovative formulations while maintaining the high-quality properties that xylene-based coatings offer. This dynamic necessitates the development of sustainable alternatives and processes within the xylene market to align with these emerging trends.

By Type

By Application

By End-User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024