Monitoring Tools Market Size and Forecast 2025 to 2034

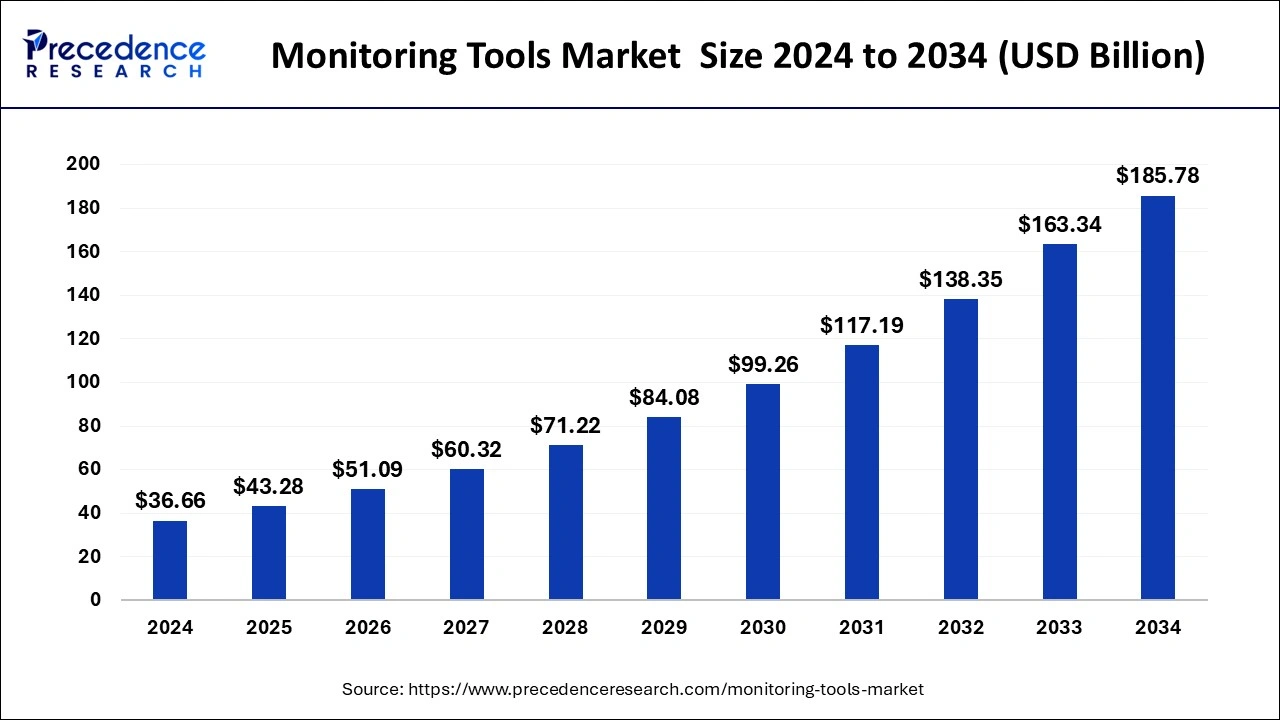

The global monitoring tools market size was estimated at USD 36.66 billion in 2024 and is predicted to increase from USD 43.28 billion in 2025 to approximately USD 185.78 billion by 2034, expanding at a CAGR of 17.62% from 2025 to 2034.

Monitoring Tools MarketKey Takeaways

- The global monitoring tools market was valued at USD 36.66 billion in 2024.

- It is projected to reach USD 185.78 billion by 2034.

- The monitoring tools market is expected to grow at a CAGR of 17.62% from 2025 to 2034.

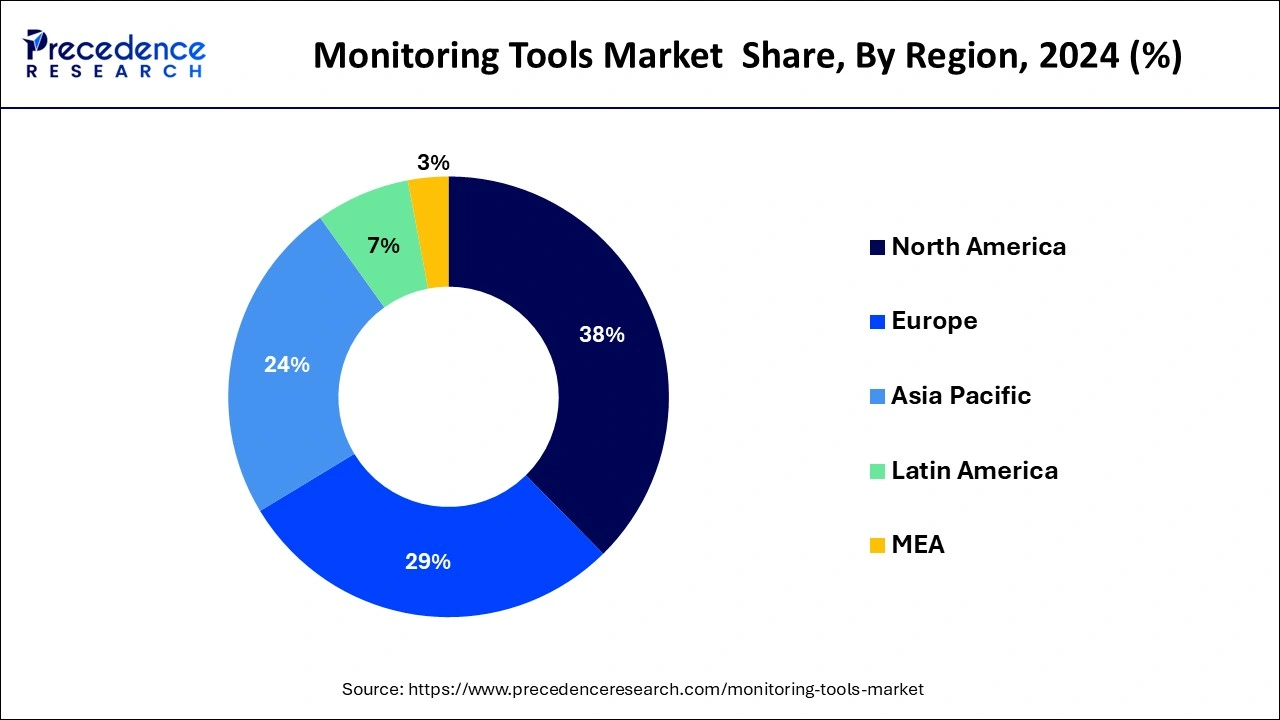

- North America contributed 38% of market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By component, the software segment has held the largest market share of 77% in 2024.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 19.7% between 2025 and 2034.

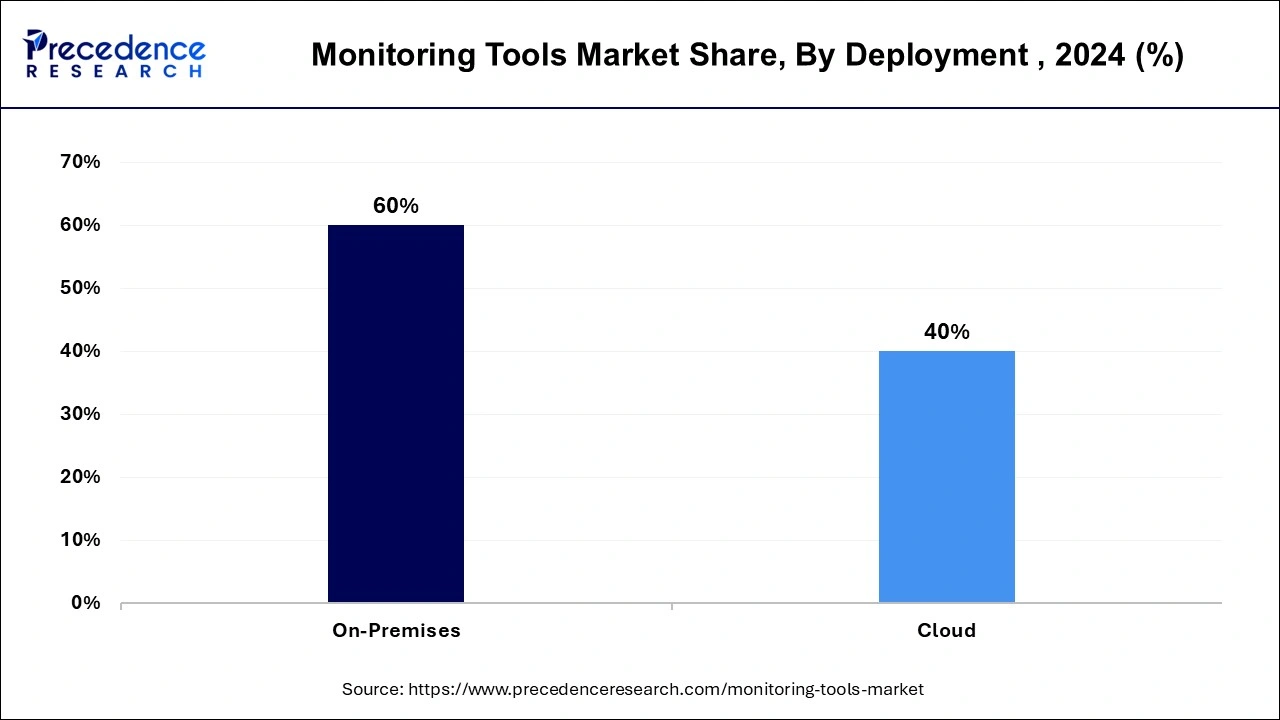

- By deployment, the on-premises segment has accounted over 60% of market share in 2024.

- By deployment, the cloud segment is expected to expand at the fastest CAGR over the projected period.

- By type, the security monitoring tools segment has generated over 38% of market share in 2024.

- By type, the infrastructure monitoring tools segment is expected to expand at the fastest CAGR over the projected period.

U.S.Monitoring Tools Market Size and Growth 2025 to 2034

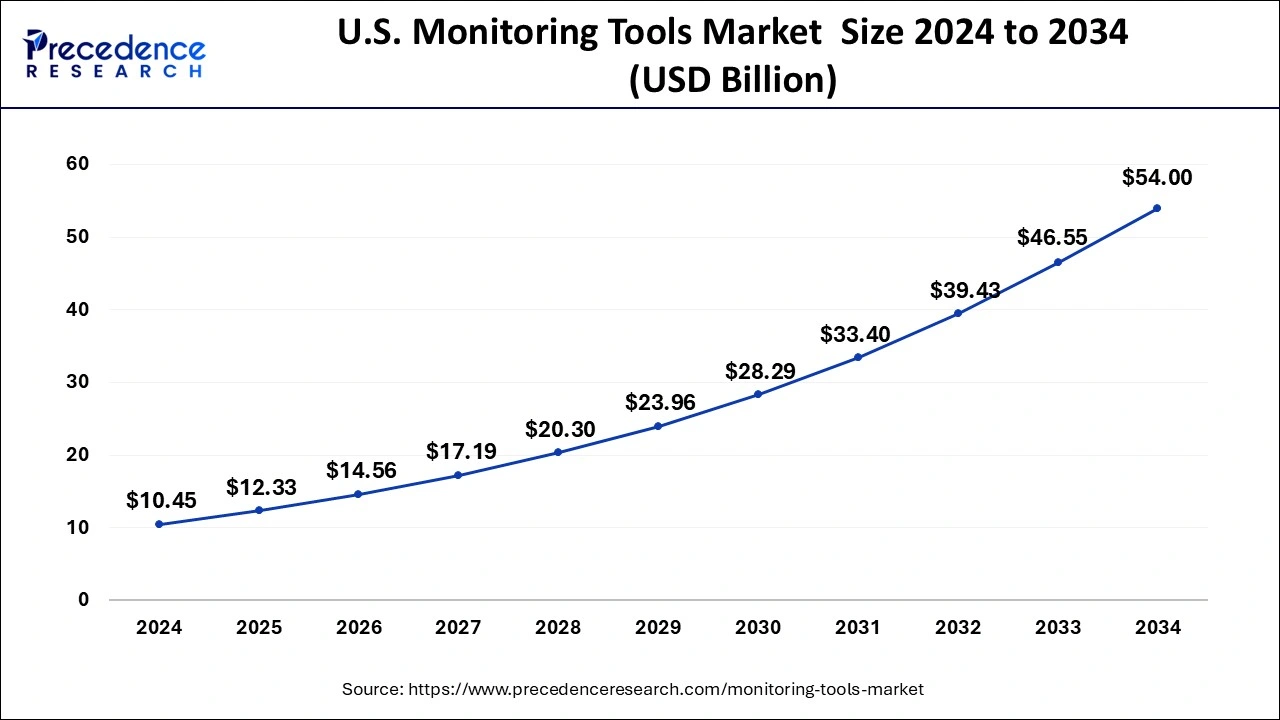

The U.S. monitoring tools market size was estimated at USD 10.45 billion in 2024 and is predicted to be worth around USD 54.00 billion by 2034 at a CAGR of 17.85% from 2025 to 2034.

North America held a share of 38% in the monitoring tools market in 2024due to several factors. Firstly, it houses many established technology companies and has a robust IT infrastructure. Secondly, North American businesses prioritize technological innovation and are early adopters of advanced monitoring tools. Additionally, the region's stringent regulatory requirements drive demand for compliance monitoring solutions. Furthermore, the presence of a skilled workforce and strong investment in research and development contribute to the dominance of North America in the monitoring tools market.

The Asia-Pacific region is poised for substantial growth in the monitoring tools market due to several factors. Rapid digital transformation across industries, coupled with increasing adoption of cloud computing and IoT technologies, drives the demand for monitoring solutions to ensure performance, security, and compliance. Moreover, the region's burgeoning IT infrastructure, expanding e-commerce sector, and rising investments in cybersecurity further fuel market growth. Additionally, the presence of emerging economies and a growing tech-savvy population offer vast opportunities for monitoring tool vendors to expand their presence and capitalize on this burgeoning market.

Meanwhile, Europe is experiencing notable growth in the monitoring tools market due to several factors. The region's increasing adoption of digital technologies across industries drives the demand for monitoring solutions to ensure efficient operations and optimal performance. Additionally, stringent regulatory requirements regarding data privacy and security compel organizations to invest in advanced monitoring tools. Moreover, the rising awareness of cybersecurity threats further fuels the market as businesses prioritize proactive monitoring to safeguard their digital assets. These factors collectively contribute to the significant expansion of the monitoring tools market in Europe.

Market Overview

Monitoring tools are software programs used to keep an eye on various aspects of computer systems, networks, applications, and other digital resources. These tools continuously observe and track metrics such as performance, availability, and security to ensure that everything is functioning smoothly. They provide real-time insights into the health and performance of IT infrastructure, allowing organizations to detect issues promptly and prevent potential disruptions. By monitoring key parameters and generating alerts or notifications when predefined thresholds are exceeded, monitoring tools help IT teams identify and address problems before they escalate.

Additionally, they enable businesses to analyze historical data, identify trends, and make informed decisions to optimize resource utilization and enhance overall efficiency. In essence, monitoring tools play a crucial role in maintaining the reliability, stability, and security of digital systems, ultimately supporting the seamless operation of businesses, and ensuring a positive user experience.

Monitoring Tools Market Data and Statistics

- According to Cybersecurity Ventures, global spending on cybersecurity products and services is projected to exceed $1 trillion cumulatively from 2017 to 2021, indicating a substantial market for cybersecurity monitoring tools.

- According to a survey by Datto, 91% of managed service providers reported that their clients experienced business disruptions due to cyber threats or other incidents in 2020, underscoring the need for robust monitoring solutions to safeguard against disruptions.

- A recent study by the IFPRI suggests that the population of South-Saharan countries is anticipated to grow 2.5 times by 2050. This population surge, alongside increasing income levels, is poised to elevate the demand for energy generation within the region.

- In June 2021, Morocco revised its UN climate commitment, vowing to slash its greenhouse gas emissions by 17-18 percent by 2030 compared to a business-as-usual scenario, with a more ambitious aim of achieving a 42-46 percent reduction, contingent upon international assistance.

- In August 2022, Perkin Elmer disclosed its agreement with New Mountain Capital to divest its Analytical and Enterprise Solutions divisions. This move was expected to yield significant opportunities for growth and strategic advancement upon completion.

- In July 2022, General Electric Company unveiled plans to transition into three independent and publicly traded entities, each focusing on healthcare, energy, and aviation, respectively. The rebranding also marked a fresh start, with GE's healthcare division adopting the name GE HealthCare, while its energy businesses, comprising Renewable Energy, Power, Digital, and Energy Financial Services, were consolidated under the new banner of GE Vernova. Additionally, GE Aerospace emerged as the designated name for its aviation sector.

Monitoring Tools MarketGrowth Factors

- The evolving IT landscape, characterized by hybrid infrastructures, cloud adoption, and diverse applications, has amplified the complexity of monitoring requirements. This complexity drives the demand for advanced monitoring tools capable of providing holistic visibility across diverse environments.

- Organizations worldwide are undergoing digital transformation initiatives to enhance agility, efficiency, and competitiveness. As businesses digitize their operations and services, the need for monitoring tools to ensure the performance, availability, and security of digital assets becomes indispensable, driving market growth.

- With the surge in cyber threats and data breaches, organizations are prioritizing cybersecurity measures. Monitoring tools play a crucial role in threat detection, incident response, and compliance management, driving their adoption as essential components of cybersecurity strategies.

- The proliferation of Internet of Things (IoT) devices across various sectors, including manufacturing, healthcare, and smart cities, generates vast amounts of data. Monitoring tools equipped to handle the unique challenges of IoT environments, such as device management, data analytics, and security monitoring, witness increased demand.

- Businesses are increasingly focused on optimizing the performance and efficiency of their IT infrastructure and applications. Monitoring tools provide insights into system performance, resource utilization, and application behavior, enabling organizations to identify bottlenecks, optimize resources, and enhance user experiences.

- Compliance regulations such as GDPR, HIPAA, and PCI-DSS impose stringent requirements on data security, privacy, and monitoring. Organizations must deploy monitoring tools to ensure compliance with regulatory standards, driving market growth as businesses seek solutions to meet compliance obligations effectively.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.62% |

| Market Size in 2025 | USD 43.28 Billion |

| Market Size by 2034 | USD 185.78 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Deployment, and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising complexity of IT environments

- A study by ManageEngine found that 86% of organizations face challenges managing hybrid environments, highlighting the demand for robust monitoring solutions to address this complexity.

The increasing complexity of IT environments, marked by the integration of cloud services, virtualization, containerization, and distributed architectures, significantly escalates the demand for monitoring tools. In these intricate environments, traditional methods of monitoring and managing resources become insufficient to ensure optimal performance, availability, and security. As organizations grapple with diverse technologies, platforms, and interdependencies, the need for comprehensive monitoring solutions becomes imperative.

Monitoring tools offer a centralized platform to monitor, analyze, and manage the entire IT infrastructure, providing real-time visibility into system health, performance metrics, and security incidents. By offering insights into resource utilization, network traffic, application performance, and security threats across hybrid environments, these tools empower IT teams to proactively identify issues, troubleshoot problems, and optimize resource allocation. Thus, the rising complexity of IT environments acts as a catalyst for the adoption of monitoring tools, driving market demand as businesses strive to maintain the reliability, efficiency, and security of their digital operations.

Restraint

Lack of skilled personnel for effective utilization

The lack of skilled personnel poses a significant restraint on the demand for monitoring tools in the market. Effective utilization of these tools requires expertise in understanding complex IT environments, configuring monitoring parameters, interpreting data insights, and taking proactive measures to address issues. However, there is often a shortage of qualified professionals with the necessary technical knowledge and experience to leverage monitoring tools to their full potential. Without skilled personnel, organizations may struggle to implement and maintain monitoring solutions efficiently, leading to underutilization or misconfiguration of the tools.

This can result in inaccurate monitoring data, missed alerts, and delayed incident responses, undermining the effectiveness of the monitoring strategy. Moreover, the shortage of skilled personnel may lead to increased reliance on manual processes, limiting the scalability and agility of monitoring operations. Overall, the lack of skilled personnel hampers the market demand for monitoring tools by hindering organizations' ability to harness the full capabilities of these solutions to optimize performance, ensure availability, and enhance security across their IT infrastructure.

Opportunity

Growth in demand for application performance monitoring (APM) solutions

The increasing demand for application performance monitoring (APM) solutions presents significant opportunities in the monitoring tools market. As businesses rely more heavily on digital applications to deliver services and engage with customers, the need to ensure optimal performance, availability, and user experience becomes paramount. APM solutions offer comprehensive monitoring capabilities, including real-time performance metrics, transaction tracing, and error detection, enabling organizations to identify and resolve performance bottlenecks quickly. Moreover, the proliferation of cloud-based and microservices architectures further drives the demand for APM solutions, as these environments introduce complexities that traditional monitoring tools struggle to address.

APM tools provide insights into the performance of individual application components, dependencies, and third-party services, facilitating proactive performance optimization and troubleshooting. With the continuous evolution of applications and the growing importance of digital experiences, the demand for APM solutions is expected to continue to rise, presenting lucrative opportunities for vendors in the monitoring tools market to innovate and expand their offerings to meet the evolving needs of businesses.

Component Insights

The software segment held the highest market share of 77% in 2024. In the monitoring tools market, the software segment comprises the various programs and applications that enable monitoring and analysis of IT infrastructure, networks, and applications. These software solutions encompass a wide range of functionalities, including real-time performance monitoring, log management, event correlation, and security incident detection. Trends in the software segment of monitoring tools include the adoption of cloud-based and AI-powered solutions, offering scalability, flexibility, and advanced analytics capabilities.

Additionally, there is a growing focus on integrated platforms that consolidate multiple monitoring functionalities to streamline operations and enhance efficiency for organizations managing complex IT environments.

The services segment is anticipated to witness rapid growth at a significant CAGR of 19.7% during the projected period. In the monitoring tools market, the services segment typically refers to the range of support, consulting, and implementation services offered by vendors to assist customers in deploying and optimizing monitoring solutions. These services encompass activities such as installation, configuration, training, troubleshooting, and ongoing technical support.

A notable trend in the services segment of the monitoring tools market is the increasing demand for managed services, where organizations outsource the management and maintenance of their monitoring infrastructure to third-party providers. This allows businesses to leverage the expertise of external specialists while focusing their internal resources on core operations. Additionally, there is a growing emphasis on value-added services such as consulting and advisory services, aimed at helping organizations maximize the benefits of their monitoring investments and address specific business challenges effectively.

Deployment Insights

The on-premises segment has held 60% market share in 2024. The on-premises deployment segment in the monitoring tools market refers to software solutions installed and operated within the organization's own physical infrastructure, rather than being hosted in a cloud environment. This deployment model offers greater control over data and security, making it suitable for industries with strict compliance requirements or concerns about data privacy.

Despite the growing popularity of cloud-based solutions, the on-premises segment continues to thrive, especially among enterprises with legacy systems or regulatory constraints. Additionally, some organizations prefer on-premises deployments for their perceived reliability and customizability, contributing to sustained demand and investment in monitoring tools tailored for on-premises environments.

The cloud segment is anticipated to witness rapid growth over the projected period. In the monitoring tools market, the cloud segment refers to solutions deployed and hosted in cloud computing environments. This includes software as a service (SaaS) offerings, where users access monitoring functionalities via the internet without the need for on-premises installations. Cloud-based monitoring tools offer scalability, flexibility, and ease of access, catering to businesses of all sizes. Recent trends show a shift towards cloud-native monitoring solutions, leveraging cloud infrastructure and services to provide enhanced performance, reliability, and cost-effectiveness.

Type Insights

The security monitoring tools segment has held a 38% market share in 2024. Security monitoring tools focus on detecting and preventing cyber threats across networks, systems, and applications. These tools analyze network traffic, log data, and user behaviors to identify malicious activities such as unauthorized access, malware infections, and data breaches. Recent trends in the monitoring tools market show an increasing emphasis on advanced threat detection capabilities, including behavioral analytics, anomaly detection, and threat intelligence integration. Additionally, there is a growing demand for integrated security monitoring solutions that offer holistic visibility and centralized management to combat evolving cyber threats effectively.

The infrastructure monitoring tools segment is anticipated to witness rapid growth over the projected period. Infrastructurere monitoring tools focus on tracking the health and performance of physical and virtual components of IT infrastructure, such as servers, networks, and storage devices. These tools provide insights into system availability, resource utilization, and potential issues to ensure smooth operations. A trend in the monitoring tools market is the integration of AI and machine learning for predictive analytics, enabling proactive problem detection and resolution. Additionally, cloud-native infrastructure monitoring solutions are gaining traction, offering scalability and flexibility for modern IT environments.

Monitoring Tools Market Companies

- SolarWinds

- Nagios

- Datadog

- Zabbix

- PRTG Network Monitor

- Splunk

- New Relic

- Dynatrace

- BMC Software

- Icinga

- AppDynamics

- ManageEngine

- Prometheus

- Microsoft System Center Operations Manager (SCOM)

- LogicMonitor

Recent Developments

- In February 2023, Tech Mahindra Limited, an Indian multinational information technology services and consulting company, introduced SANDSTORM, a robust tool designed to enhance customer experiences by providing real-time insights into device performance for businesses of all sizes.

- In June 2023, IBM completed the acquisition of Apptio, a move aimed at enhancing IBM's existing offerings in resource optimization, observability, and application management. This acquisition is expected to deliver increased value to clients and generate significant synergies across various growth areas within IBM.

- In March 2023, Cisco and Lightspin forged a strategic alignment with a shared objective of assisting customers in modernizing their cloud environments. Together, they aim to provide comprehensive security and observability solutions spanning from the initial build phase to runtime.

Segments Covered in the Report

By Component

- Software

- Services

By Deployment

- Cloud

- On-premises

By Type

- Infrastructure Monitoring Tools

- Network Monitoring

- Storage Monitoring

- Server Monitoring

- Cloud Infrastructure Monitoring

- Others

- Application Performance Monitoring Tools

- Database Monitoring

- Web Application Monitoring

- Mobile Application Monitoring

- Code Level Monitoring

- Others

- Security Monitoring Tools

- Intrusion Detection and Prevention Systems (IDPS)

- Log Monitoring and Analysis

- Vulnerability Assessment and Management

- Others

- End-user Experience Monitoring Tools

- Synthetic Monitoring

- Real User Monitoring

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content