August 2024

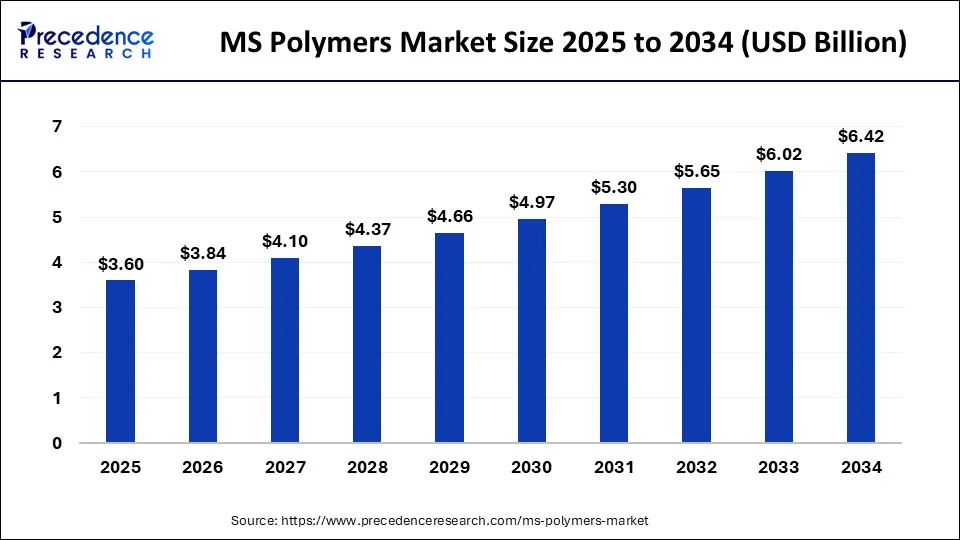

The global MS polymers market size accounted for USD 3.38 billion in 2024, grew to USD 3.60 billion in 2025 and is expected to be worth around 6.42 billion by 2034, with a CAGR of 6.63% between 2024 and 2034. The Asia Pacific MS polymers market size is predicted to increase from USD 1.45 billion in 2024 and is estimated to grow at a fastest CAGR of 6.75% during the forecast year.

The global MS polymers market size is worth around USD 3.38 billion in 2024 and is anticipated to reach around USD 6.42 billion by 2034, growing at a CAGR of 6.63% over the forecast period 2024 to 2034. The MS polymers market is driven by the product's flexibility in the construction and automotive industry.

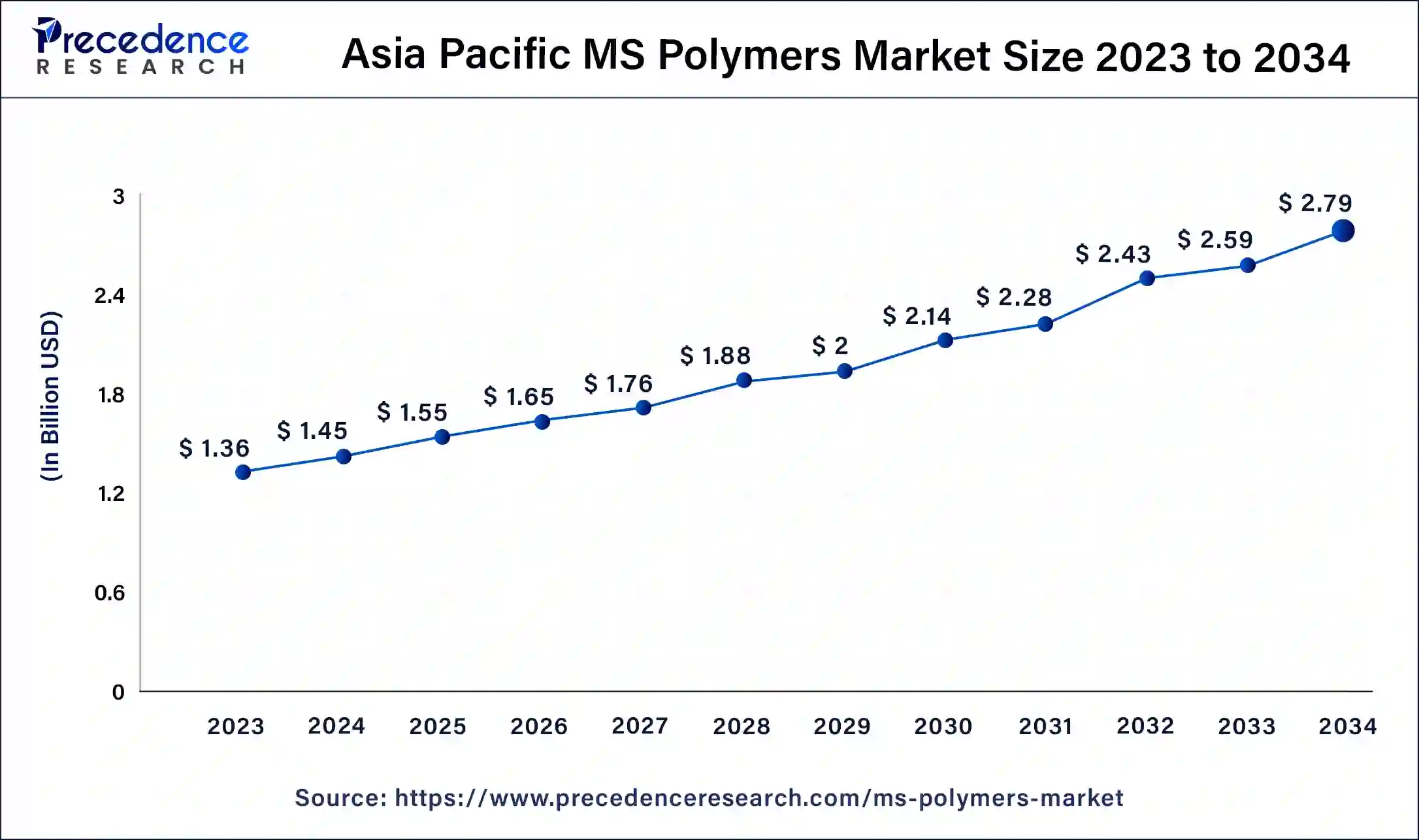

The Asia Pacific MS polymers market size was exhibited at USD 1.36 billion in 2023 and is projected to be worth around USD 2.79 billion by 2034, poised to grow at a CAGR of 6.75% from 2024 to 2034.

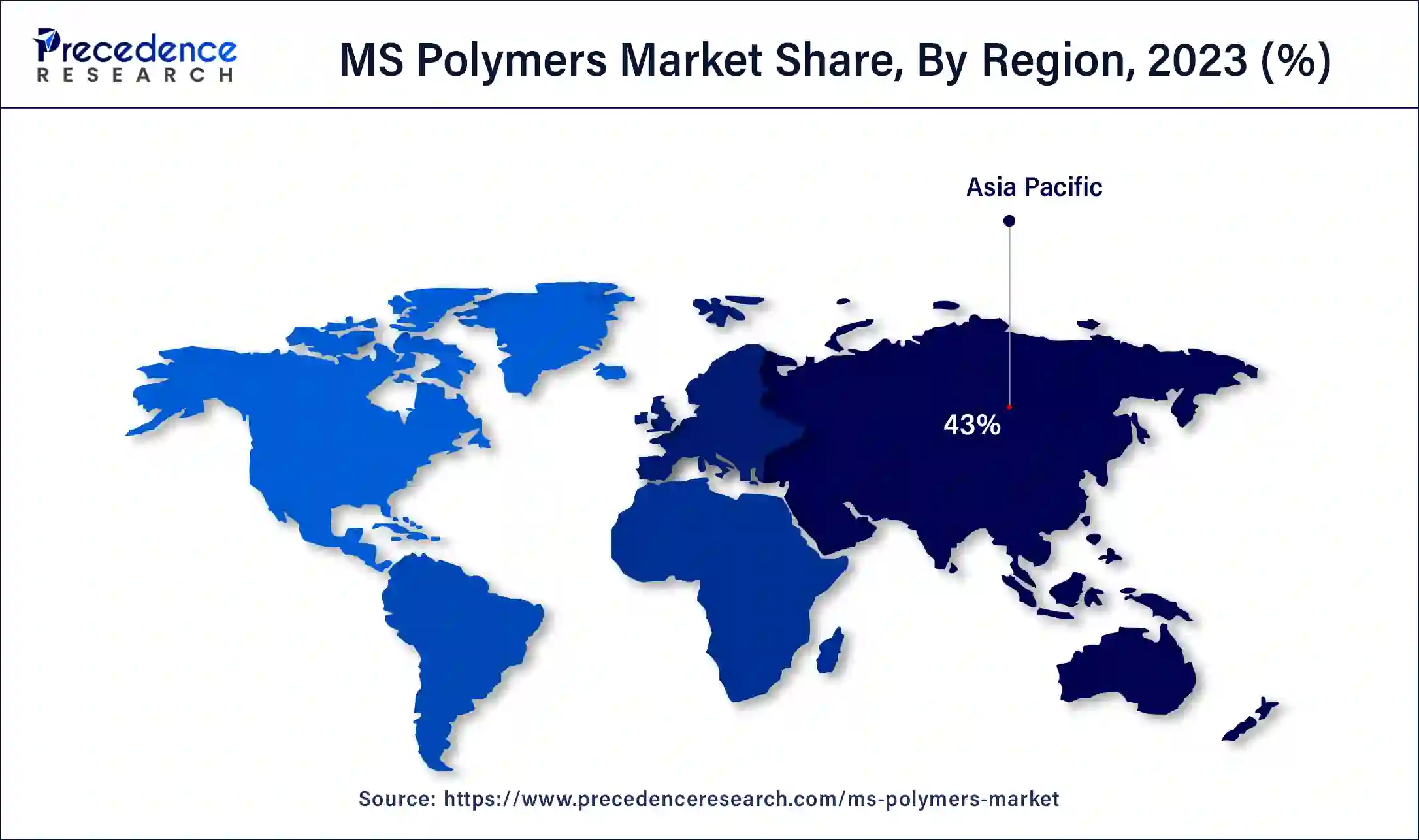

Asia Pacific accounted for the largest share of the MS polymers market in 2023, owing to industrialization and urbanization leading to growth in the construction, automotive, and electronics industries. Urbanization growth and investment in facility development in this region, such as China, India, Japan, and South Korea, drive the market. Asia Pacific is a major market for manufacturers, and there has been a growing concern for high-performance materials.

North America is anticipated to witness the fastest growth in the MS polymers market during the forecasted years because it can be widely applied to construction, automotive, and electronics. Growth in the innovation in polymer technology for eco-friendly products and growing infrastructure development. Strategic industry players and high investment in research and development help North American manufacturers continue to adapt to the current market improvements in the MS polymer applications. Besides, the region has also shown growth in innovation and performance improvement in manufacturing processes.

MS polymer, also known as modified silane polymer, is an adhesive and sealant technology that has features of silicone and polyurethane adhesive. It is a material that can be used in a vast number of applications and has strong bonding capability together with high flexibility and resistance to deterioration due to weather conditions. It is normally used in a solvent-free system with low VOC (volatile organic compound), and it has excellent UV and water resistance characteristics, making it suitable for various uses.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.42 Billion |

| Market Size in 2024 | USD 3.38 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing usage of MS polymers in emerging economies

MS polymers have been widely used in industrialized countries, which drives the MS polymers market. This material is a major component in construction sealants, automotive adhesives, marine sealants, and woodworking adhesives. In the construction industry, MS polymers have better weathering and aging characteristics and are used for sealing movement joints in buildings and structures. Among them, there is the necessity of bonding different components and parts, as well as excellent adhesion and flexibility, which can significantly increase the longevity of a vehicle and is widely used in the automotive industry.

The high water resistance of MS polymers makes marine applications that offer dependable sealing for boats and other products. The demand for sustainable and high-performance materials increases due to industrialization.

The major limitation that affects the MS polymers market is the volatility of raw materials, especially polyurethane silicone. These fluctuations can also be established in high costs of production that result in high costs of the final product. Also, factors such as trade wars, import-export duties or tariffs, and supply-demand fluctuations add more distortion to the prices. These uncertainties can prove a difficult environment in which to establish a consistent pattern of spending and pricing for manufacturing, leading to probable constraints in market advancement and profitability among manufacturers.

Demands for green and sustainable products

The most significant feature of MS polymers is that molten MS polymers are generally free of solvents, which greatly minimizes the emission of hazardous substances during use. It does not contain formaldehyde, isocyanate, and solvent. It is friendly to the environment and the human body. This characteristic not only helps to promote a healthier working condition but also complies with the current trend towards lower VOC emissions around the globe.

With the rise of consumer awareness of sustainable and environmentally friendly products, industries are adopting green products, mostly in the construction, automobile, and marine industries, and MS polymers can be used in different sectors.

The hybrid MS polymer segment contributed the biggest share of the MS polymers market in 2023. Hybrid MS polymer is versatile, high-performance, and easy to use. MS hybrid polymer combines the durability and stiffness of polyurethane with the insulation and flexibility of silicone and produces a unique adhesive product. Hybrid MS polymers do not include any materials that have toxic effects. They emit almost no VOCs during both their use. Hybrid MS polymers are, in many cases, the better choice for both sealing and bonding. Better adhesion, perfect processability, paintable, safe, environmentally friendly.

The pure MS polymer segment is anticipated to show rapid growth in the MS polymers market during the forecast period. MS polymer is chemically stable and flexible and has a high degree of adhesion and UV stability, making it ideal for various construction and automotive applications. On the other hand, segments in MS polymer may contain modified formulations with specific additives that donate versatile characteristics such as cure rate and strength.

The adhesives and sealants segment recorded the highest share of the MS polymers market in 2023. The demand for MS polymer hybrid adhesives and sealants is highly influenced by the growth of the building and construction industry due to the infrastructural developments globally. MS polymer adhesives are the new generation flexible adhesives and sealants that deliver a highly versatile bond across a wide range of applications. MS polymer sealant is a single-component building joint sealant that is formed by a high bond strength adhesive with higher elasticity and is chemically neutral.

The coatings segment is projected to witness the fastest growth in the MS polymers market during the forecast period. Polymer coatings that are specifically formed on the flat substrate as well as on irregular objects. Polymeric coatings are used for their adhesive qualities or in films for photography, anticorrosive protective type, and decorative (paints). They are also employed in the preparation of modified surfaces (paper coatings, hydrophobic coatings).

The construction & infrastructure segment dominated the global MS polymers market in 2023. Increased construction activities, both residential and commercial, have boosted the demand for MS polymer-based construction materials. Application in various construction areas, including bonding and sealing of metal, glass, and plastic panels in curtain wall systems. Installation and sealing of windows, doors, and other fenestration elements. The advantage of using MS polymer sealants compared to other technologies is that this technology usually becomes the choice in sealing façades, floors, wall panels, and biogas tanks. Besides, MS polymers are also preferred for sealing transits to ensure they are fireproof and smoke-resistant and for making air ducts airtight.

The automotive segment is projected to witness the fastest growth in the market during the forecast period. The applications of MS polymers in the automotive industry include body panel bonding, glass bonding, and interior fixtures. As the automobile manufacturing industry looks for lightweight and long-lasting materials for car assembly, the uptake of MS Polymers is expected to increase. The rising automotive production, along with the growing preference for lightweight and electric vehicles (EVs), is likely to propel the growth of MS polymer hybrid adhesives. These products are used in floor sealing, component sealing, body sealing, chassis sealing, external sealing, and internal sealing. Furthermore, the products are also used in assembly, windscreens, side windows, sunroofs, windscreens, side panels, and trailers.

Segments Covered in the Report

By Product Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

February 2025

December 2024