January 2025

Automotive Adhesives Market (By Technology: Water-based, Solvent-based, Hot melt, Reactive & Others; By Vehicle: Passenger Cars, Light Commercial Vehicles, Heavy & Medium Commercial Vehicles; By Function: Bonding, NVH, Sealing/Protection; By Application: Exterior, Interior, Powertrain, Electronics, Body In White, Others; By Sales Channel: OEMs, Aftermarket) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

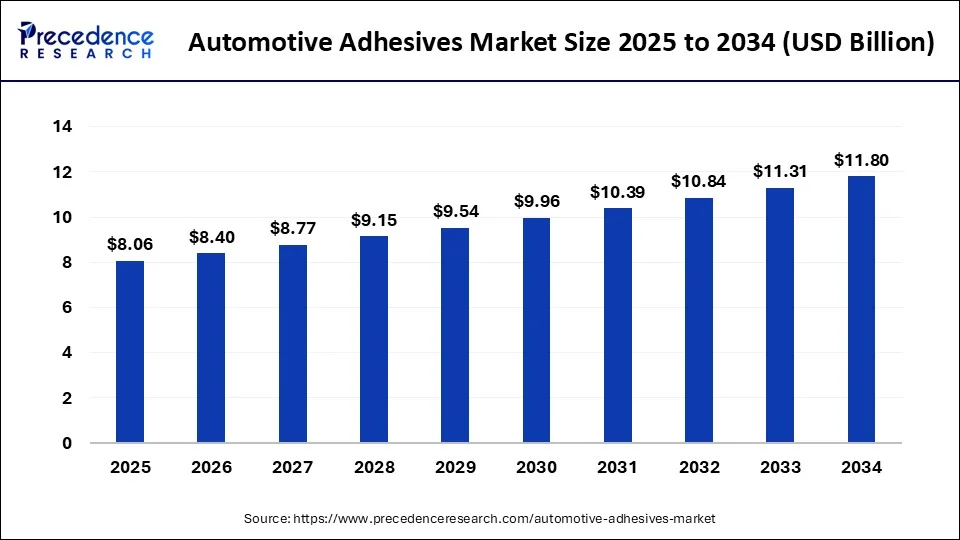

The global automotive adhesives market size was USD 7.40 billion in 2023, calculated at USD 7.72 billion in 2024 and is expected to reach around USD 11.80 billion by 2034, expanding at a CAGR of 4.42% from 2024 to 2034. The need for automotive adhesives is being driven by the increase in vehicle production worldwide, especially in emerging nations.

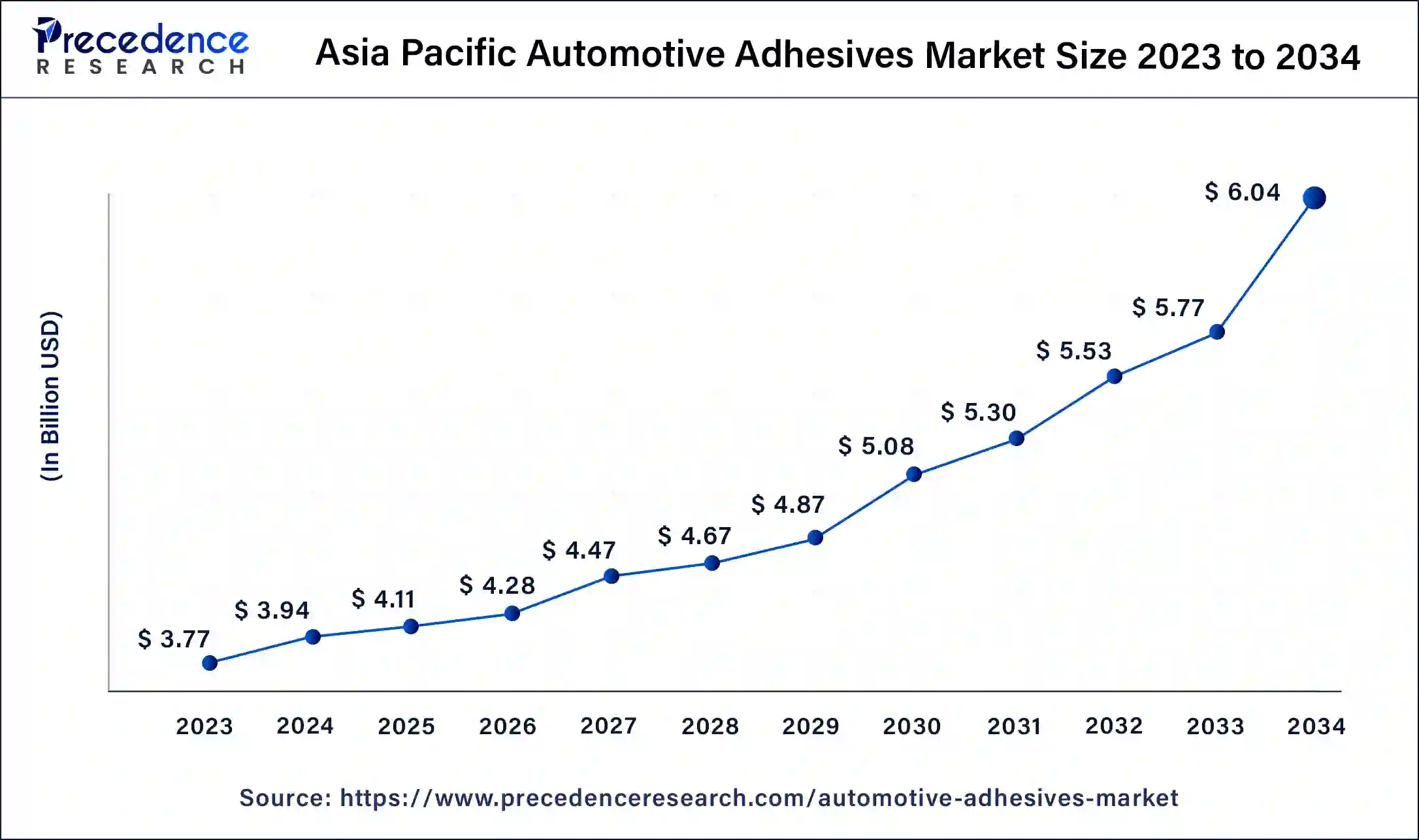

The Asia Pacific automotive adhesives market size was exhibited at USD 3.77 billion in 2023 and is projected to be worth around USD 6.04 billion by 2034, poised to grow at a CAGR of 4.37% from 2024 to 2034.

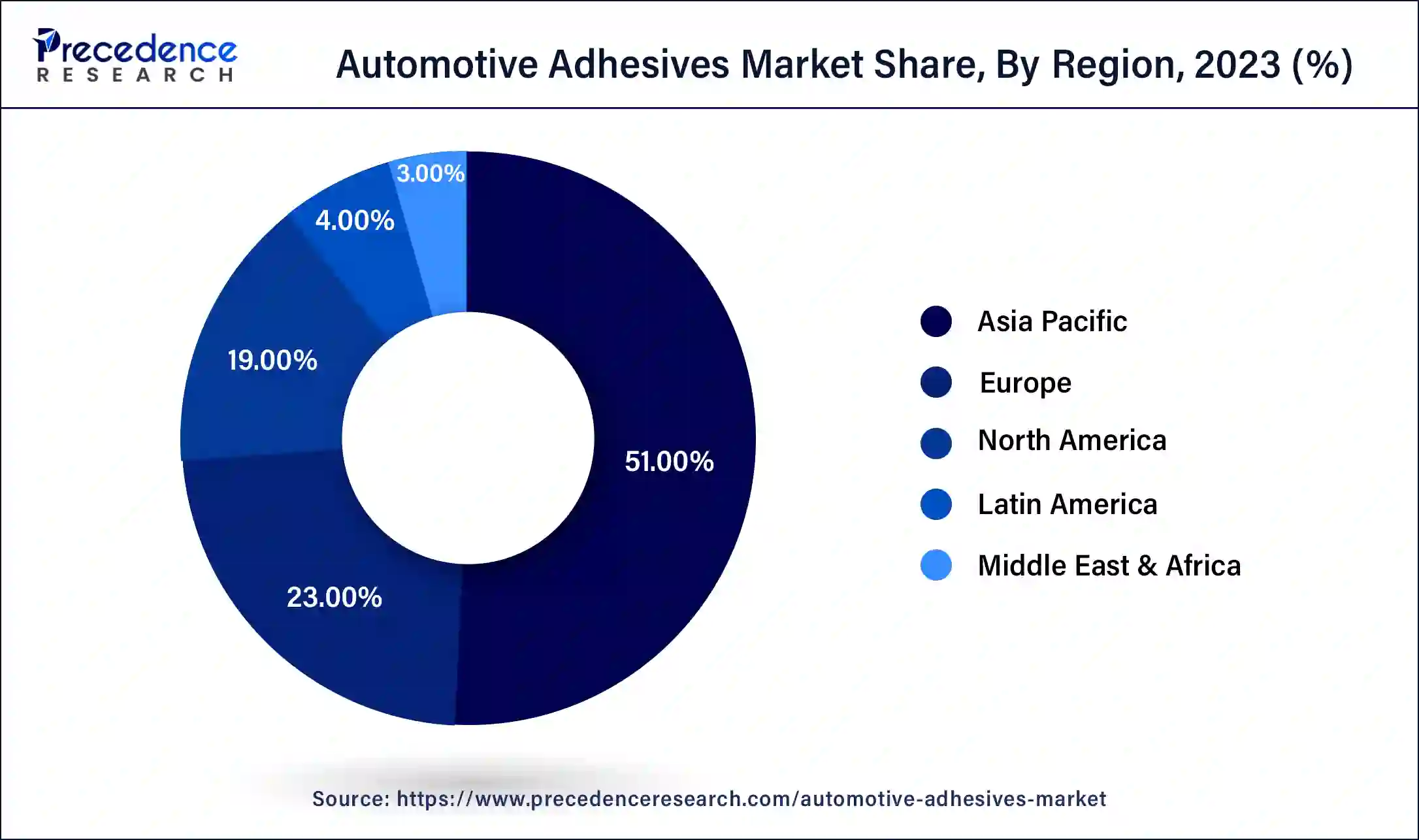

Asia Pacific dominated the automotive adhesives market in 2023. The manufacturing of automobiles is booming throughout the area, especially in China, Japan, South Korea, and India. The need for automotive adhesives is rising in these nations due to rising car ownership rates. New adhesive technologies are making it possible to create adhesives that are stronger, lighter, and more long-lasting. This is essential for the production of modern cars, which prioritizes the use of lightweight materials to increase fuel economy and lower emissions. The region's governments are enforcing strict laws pertaining to fuel economy and car emissions. Automotive adhesives facilitate the use of lightweight materials and improve vehicle performance, which are critical components in meeting these standards.

North America is expected to witness notable growth in the automotive adhesives market over the forecast period. The development of automotive technology, expanding vehicle production, and the growing desire for lightweight and fuel-efficient automobiles are the main drivers of the North American automotive adhesives market. Adhesives are being used more frequently than traditional attachment techniques like welding and riveting as a result of the drive for lighter automobiles that will increase fuel economy and lower emissions. In order to create lighter cars, adhesives are needed to join disparate components like metals and composites. The market is being driven by advancements in adhesive technologies, such as the creation of high-performance adhesives with improved bonding strength, endurance, and resistance to harsh environments.

Driven by the need for lightweight materials, better vehicle performance, and higher safety regulations, the automotive adhesives market is a significant sector of the automotive industry. Because of the strict environmental rules pushing for lightweight materials, the industry is likely to rise rapidly. There are several kinds of adhesives used in automobiles, including tapes, sealants, and structural adhesives (epoxy, acrylic, and polyurethane). When joining disparate materials, such as metals, composites, and plastics, structural adhesives are especially useful because they reduce vehicle weight and enhance crash safety.

The development of adhesive technologies, rising car production, and the trend toward electric vehicles (EVs) have all contributed to the steady growth of the automotive adhesives market. These adhesives are utilized in a number of automotive applications, including glass bonding, under-the-hood components, exterior trimmings, body in white (BIW), interior assembly, and so on. Particularly for BIW applications, structural adhesives' great strength and longevity are advantageous.

The main goals of adhesive formulation innovations are to improve cure periods, binding strength, and substrate compatibility. Adhesives with enhanced corrosion resistance and resilience to extreme temperatures are likewise becoming more and more popular. One significant trend influencing the automotive adhesives market is the growing use of lightweight materials (such as aluminum and composites) to increase fuel economy and lower emissions. Furthermore, the increasing need for specialty adhesives that can satisfy the particular needs of EV assembly is being influenced by the expanding popularity of electric vehicles.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.8 Billion |

| Market Size in 2023 | USD 7.40 Billion |

| Market Size in 2024 | USD 7.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.42% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Vehicle, Function, Application, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of advanced materials

Because innovative materials are being used more often, the automotive adhesives market is undergoing a major transition. The desire for increased productivity, sustainability, and efficiency in the car industry is what is causing this change. Automakers are always looking for ways to lighten vehicles in order to increase fuel economy and lower emissions. In order to accomplish these objectives, lightweight materials like carbon fiber, aluminum, and composites must be used, which is made possible by advanced adhesives.

Advanced adhesives offer superior bonding strength, longevity, and resistance to environmental conditions. These characteristics are essential to guaranteeing the safety and structural integrity of contemporary automobiles. Innovative manufacturing techniques like multi-material bonding and modular assembly are made possible by the use of sophisticated adhesives. These procedures improve overall vehicle quality, expedite production, and lower expenses.

High costs of advanced adhesives

More expensive, specialized raw ingredients are frequently needed in the manufacturing of sophisticated adhesives. These materials have been developed to deliver exceptional performance, including chemical resistance, high strength, and resistance to extreme temperatures. More expensive, complex manufacturing procedures might be needed to produce advanced adhesives. These procedures guarantee that the adhesives fulfill the strict requirements needed for automotive applications, including performance under pressure and durability. Costs are increased by complying with safety regulations and standards. In order for advanced adhesives to comply with environmental and safety laws, lengthy testing and certification procedures may be necessary. Because economies of scale aren't fully achieved, high-performance adhesives are sometimes produced in lower quantities than more typical adhesives, which raises the cost per unit.

Automotive electronics and interior

Due to the growing need for strong, lightweight cars, the automotive adhesives market is expanding significantly. Automotive adhesives are essential for improving the functionality and design of car interiors and electronics. Electronic components are mounted on circuit boards using adhesives to guarantee their functionality and longevity. The attachment of sensors and cameras—which are necessary for advanced driver assistance systems (ADAS) and autonomous driving technologies—requires adhesives. Adhesives offer endurance and clarity when attaching touchscreens and display panels together. Adhesives give inside moldings and trim a smooth, long-lasting bond, improving the vehicle's aesthetic appeal. When compared to conventional mechanical fasteners, adhesives can reduce the weight of vehicles, which improves performance and fuel efficiency.

The reactive segment held the largest share of the automotive adhesives market in 2023. Adhesives that cure through chemical reactions are included in the reactive category of the market. These adhesives are utilized in a variety of automobile applications and usually offer strong, long-lasting bonding. Used to preserve the longevity and visual quality of dashboards, panels, and other interior parts by bonding them together. Used in bonding components that require strong adhesion and weather resistance, such as spoilers, bumpers, and other exterior trim. High-strength adhesives are replacing mechanical fasteners in vehicles due to growing demand for lighter vehicles that increase fuel efficiency and lower pollution. Reactive adhesives are essential for battery assembly and thermal control, two areas where the EV market is expected to grow.

The water-based segment is expected to grow at the fastest rate in the automotive adhesives market during the forecast period. Water-based adhesives, which emit less emissions and are more environmentally friendly, are becoming increasingly popular due to strict limits on volatile organic compounds (VOCs). Adhesives based on water are thought to be more environmentally friendly than those based on solvents. They lessen the impact that adhesive application and disposal have on the environment. The handling and application of these adhesives are generally safer, lowering the health risks for workers in the car manufacturing industry. Technological developments have improved the efficacy of water-based adhesives, enabling a greater range of automotive uses, such as soundproofing, bonding, and sealing. Compared to solvent-based adhesives, water-based adhesives are typically less expensive to use since they are simpler to clean up after and require fewer protective gear.

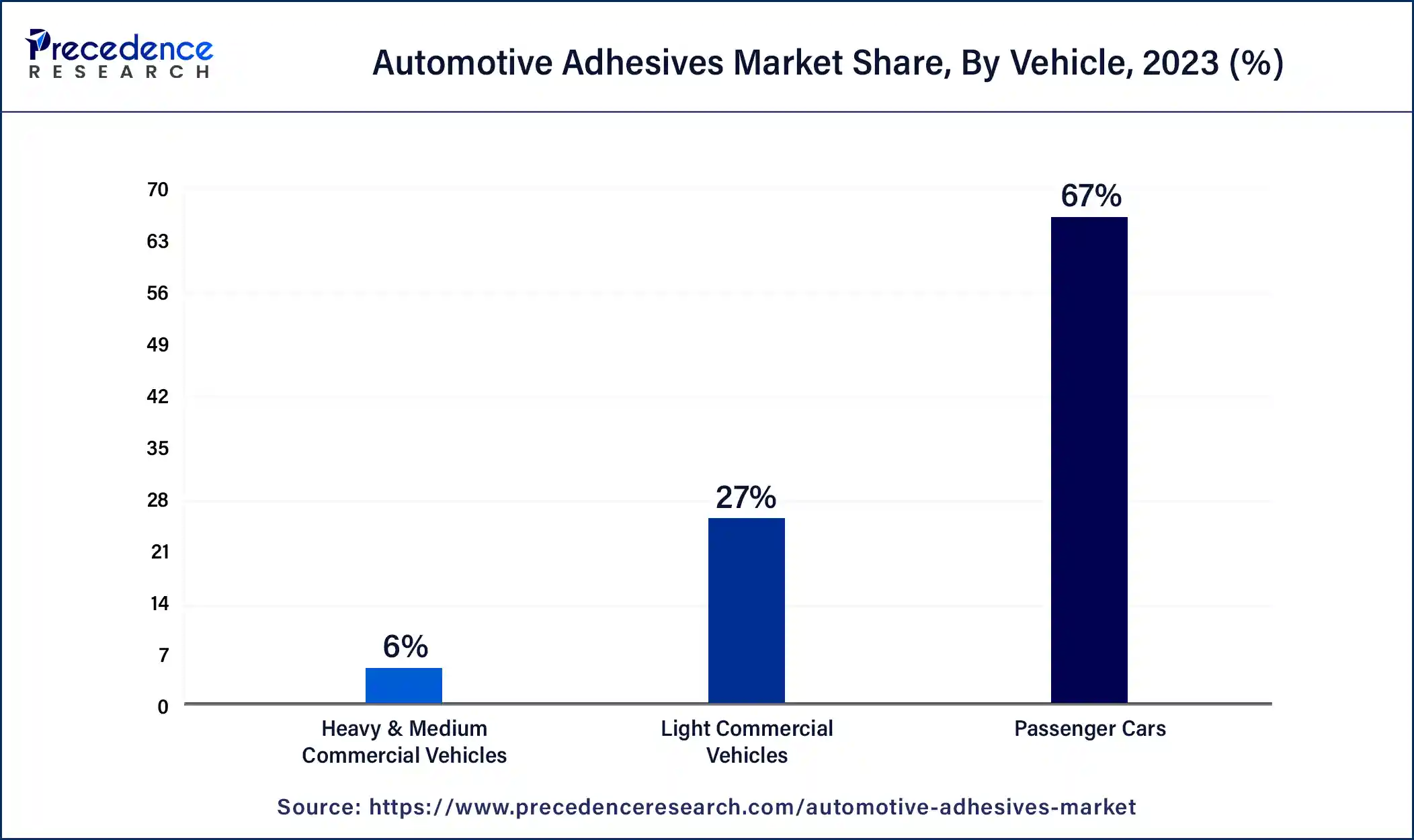

The passenger cars segment led the global automotive adhesives market in 2023. One major area of focus is the passenger automobile segment. The use of adhesives in passenger cars improves the functionality, safety, and appearance of the car. Various sections of passenger cars, such as body panels, windshields, trim, and interior components, are joined together using adhesives. They contribute to lighter vehicles, increased fuel economy, and enhanced NVH (noise, vibration, and harshness) management. Regional differences exist in the need for automotive adhesives in the passenger car market. Expanding car sales and an expanding automotive production base are important considerations in Asia Pacific. Specialized adhesives are becoming more and more popular in North America and Europe due to strict safety regulations and advances in automotive technology.

A commercial vehicle segment is expected to witness rapid growth in the automotive adhesives market over the forecast period. The need for effective and long-lasting adhesives in a variety of commercial vehicle applications is driving the expansion of the commercial vehicle segment in the automotive adhesives market. Panels, frames, and other structural elements are bonded together with adhesives to increase the vehicle's strength and decrease its weight. The attachment of dashboards, moldings, and emblems, as well as interior trims, depends heavily on adhesives. The application of adhesive technologies in commercial vehicles is growing thanks to advancements like high-performance epoxy and polyurethane adhesives. The use of cutting-edge adhesives that improve vehicle performance is being fueled by growing requirements pertaining to fuel economy and vehicle security.

The bonding segment led the automotive adhesives market in 2023. These adhesives offer high strength and durability when attaching structural components. They are utilized in applications like body-in-white components, chassis, and structural reinforcements where load-bearing capacity is required. Adhesives are used to attach body panels and components, like roofs, fenders, and doors. These adhesives improve the vehicle's aerodynamics and appearance while assisting in the achievement of a seamless and smooth finish. Adhesives are used to bind car glass to the body of the vehicle. These are essential for installing and repairing windshields since they guarantee adequate sealing and safety features. Adhesives are used to attach dashboards, trim, and upholstery to interior components. These adhesives offer a superior polish and guarantee that interior components are firmly attached.

The NHV segment is expected to grow at the fastest rate in the automotive adhesives market during the forecast period. The NVH (noise, vibration, and harshness) segments of the automotive adhesives market are devoted to adhesives that are used to reduce noise, vibration, and harshness in order to enhance vehicle performance and comfort. Damping vibrations and obstructing sound transmission to reduce cabin noise. Reducing vibrations' negative effects on car parts in order to improve driving comfort and lifetime. Improving the strength and stiffness of several car components to reduce rattling and enhance ride quality overall. Products including polyurethane, epoxy, and silicone-based adhesives are frequently used in NHV adhesives; these adhesives are selected for their flexibility, damping capacity, and longevity. Lowering vibration and noise in places like floor panels, dashboards, and doors.

The body in the white segment dominated the automotive adhesives market in 2023. The term ‘body in white’ in the automotive adhesives market describes adhesives that are used to assemble the car's body structure prior to painting. These adhesives offer strength and endurance when they are used to join structural components. They are essential for attaching components like the doors, side panels, and roof. Used to ensure a better fit and stop leaks between various automotive body elements by sealing joints and gaps. These are specialist adhesives with great strength and longevity that are used to join metal panels. Used to provide safety and structural integrity by adhering windshields and glass to the vehicle body. These adhesives contribute to a quieter ride by lessening noise and vibrations within the car.

The exterior segment is expected to witness rapid growth in the automotive adhesives market over the forecast period. The exterior divisions of the market usually comprise goods and applications intended for sealing and bonding vehicle exteriors. For car exteriors to be long-lasting, weather-resistant, and structurally sound, these sections are essential. Adhesives are used to join different body components, including fenders, doors, and hoods. Adhesives for side, rear, and windshield installation and sealing. Adhesives are used to join moldings, trim pieces, and bumpers to the body of the car. Headlights, taillights, and other exterior lighting components are secured with adhesives. Adhesives for attaching roof rails and sunroofs to one another. High-performance requirements for these adhesives must be met, including resistance to UV rays, harsh temperatures, and a variety of environmental factors.

Segment Covered in the Report

By Technology

By Vehicle

By Function

By Application

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

December 2024