June 2024

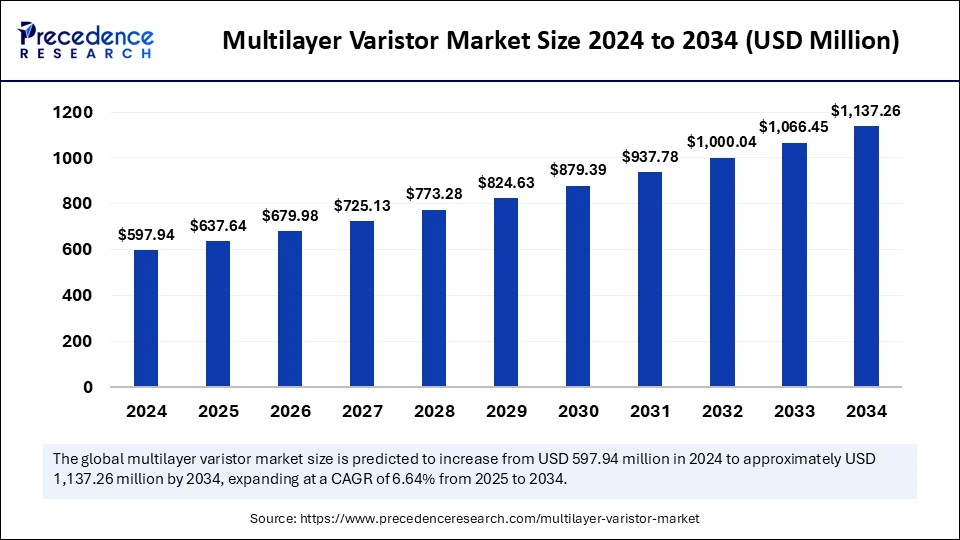

The global multilayer varistor market size is calculated at USD 637.64 million in 2025 and is forecasted to reach around USD 1,137.26 million by 2034, accelerating at a CAGR of 6.64% from 2025 to 2034.The market sizing and forecasts are revenue-based (USD billion/Million), with 2024 as the base year.

The global multilayer varistor market size accounted for USD 597.94 million in 2024 and is predicted to increase from USD 637.64 million in 2025 to approximately USD 1,137.26 million by 2034, expanding at a CAGR of 6.64% from 2025 to 2034. The growth of the multilayer varistor market is driven by the increasing demand for consumer electronics, advancements in automotive technologies, and the necessity for effective electrostatic discharge protection across various industrial sectors. MLVs are essential devices that protect sensitive electronics in vehicles from voltage spikes and transients. They are therefore crucial components in contemporary automobile systems, including electric vehicles and advanced driver assistance systems.

Artificial Intelligence is significantly transforming the multilayer varistor sector by improving design, manufacturing, quality assurance, predictive upkeep, and performance enhancement. As electronic devices continue to grow in complexity and miniaturization, AI technologies are increasingly incorporated into varistor manufacturing, circuit protection systems, and predictive analytics to boost efficiency, reliability, and sustainability. A major use of AI in the MLV sector is in automated design and simulation. Historically, engineers utilized trial-and-error techniques and extensive testing to create varistors with optimal voltage ratings, response durations, and material compositions.

Multilayer varistors or MLVs are engineered to safeguard circuits from the direct effect of voltage spikes, particularly transient voltages. MLVs play crucial roles in automobiles within the electronic control unit, sensors, lighting systems, and infotainment systems. Their components can absorb and dissipate voltages to protect sensitive parts from damage during surge events. Market growth has been attributed to the increasing complexity of automotive electrical systems, the rising demand for electric and hybrid vehicles, and more rigorous safety and reliability standards in electronic systems.

The multilayer varistor market is poised for significant growth driven by two primary factors: the rising complexity of automotive electronics and an increased demand for vehicle safety features. MLVs are essential devices that protect sensitive electronics in vehicles from voltage spikes and transients. They are therefore crucial components in contemporary automobile systems, including electric vehicles and advanced driver assistance systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,137.26 Billion |

| Market Size in 2025 | USD 637.64 Billion |

| Market Size in 2024 | USD 597.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.64% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising use of multilayer varistors in consumer electronics and IoT applications

A key factor driving the multilayer varistor market is the surging need for circuit protection in consumer electronics and IoT devices. With ongoing technological progress, electronic devices are becoming increasingly compact, powerful, and interconnected, heightening their exposure to electrical surges, voltage spikes, and electromagnetic interference. MLVs are vital in safeguarding these sensitive components, ensuring the reliability and longevity of devices. The growing prevalence of smartphones, tablets, wearables, smart home technologies, and industrial IoT applications significantly enhances the demand for high-performance, compact circuit protection solutions.

Performance Constraints

Although multilayer varistors are known for their high efficiency and reliability, they encounter limitations in managing extreme voltage surges, extended exposure to high temperatures, and rapid transient spikes. MLVs may deteriorate over time under excessive electrical stress, which can shorten their lifespan and lead to more frequent replacements in high-power settings. Additionally, MLVs face competition from other circuit protection elements, such as transient voltage suppression diodes, gas discharge tubes, and polymer-based ESD protection devices.

Advancements in AI-Enhanced Smart Circuit Protection and Predictive Maintenance

A significant opportunity within the multilayer varistor sector lies in the incorporation of Artificial Intelligence and predictive maintenance frameworks to boost circuit protection performance and dependability. AI-driven innovations are reshaping electronics manufacturing, industrial automation, and high-speed data workflows, which in turn raises the demand for intelligent surge protection technologies. AI-based real-time voltage monitoring systems can systematically assess electrical loads, transient surges, and operational conditions, fostering automated failure forecasting and adjustable circuit protection. Utilizing machine learning algorithms, AI-operated systems can identify early indicators of MLV wear, facilitating proactive maintenance and timely component changes before failures arise.

The standard multilayer varistor segment dominated the market with the largest market share, fueled by its extensive application across various sectors, such as consumer electronics, automotive, telecommunications, and industrial fields. Standard multilayer varistors deliver excellent transient voltage suppression, high reliability, and cost efficiency, making them the preferred option for shielding sensitive electronic circuits from voltage spikes and electrostatic discharge. Their capacity to offer consistent and reliable protection in compact electronic devices has driven their use in smartphones, tablets, laptops, household appliances, and industrial control systems.

The low capacitance multilayer varistors segment is the fastest growing segment with a significant CAGR during the forecast period, primarily due to the increasing need for high-speed data transmission, miniaturized electronic components, and electromagnetic interference suppression in advanced communication networks. Low capacitance MLVs are particularly well-suited for use in 5G networks, high-frequency RF circuits, IoT devices, and automotive radar systems, where it is essential to minimize signal distortion and preserve signal integrity.

The automotive segment dominated the market in 2024, reflecting the increasing reliance of vehicles on electronic components for enhanced performance, safety, and connectivity. Modern vehicles, particularly electric and hybrid types, necessitate comprehensive protection against transient overvoltage situations, power surges, and electrical noise interference, positioning MLVs as an essential component in vehicle electronics. Automotive-grade multilayer varistors are widely utilized in battery management systems, power distribution units, infotainment systems, electric power steering, and active safety functionalities.

With regulatory authorities enforcing strict safety and electromagnetic compatibility standards for vehicles, manufacturers are adopting high-performance MLVs to ensure compliance with safety regulations and to improve vehicle resilience. Additionally, automakers are partnering with semiconductor and circuit protection developers to create the next generation of AI-enhanced vehicle electronics, consolidating the automotive sector's leadership in the MLV market.

The consumer electronics is expected to be the fastest growing segment during the forecast period, due to the increasing mainstream adoption of smartphones, tablets, gaming consoles, Augmented Reality and Virtual Reality devices, and AI-powered personal assistants. The emergence of smart devices utilizing 5G technology, foldable screens, and hardware integrated with AI has driven up the need for high-speed, ultra-reliable circuit protection components.

Innovations in wireless charging, ultra-fast data transfer technologies like Wi-Fi 6 and USB 4.0, along with smart IoT ecosystems, are making multilayer varistors essential in next-generation consumer products. Additionally, the movement towards sustainable and energy-efficient electronics is encouraging manufacturers to incorporate low-power, thermally stable multilayer varistors, further propelling growth in the consumer electronics sector.

Asia Pacific Multilayer Varistor Market Trends

Asia Pacific dominated the multilayer varistor market with the largest market sharin 2024, largely due to its strong electronics manufacturing base, swift industrial advancement, and rising need for circuit protection in sectors such as consumer electronics, automotive, and telecommunications. This region hosts several of the leading electronics and semiconductor producers, positioning it as a crucial center for both MLV production and consumption.

The escalating adoption of 5G networks, IoT devices, and electric vehicles has led to a considerable increase in the demand for efficient and dependable circuit protection components across China, Japan, South Korea, India, and Taiwan. Moreover, government initiatives that support domestic semiconductor industries and electronic component manufacturing have bolstered the Asia-Pacific market's competitive stance in the global MLV sector.

Japan Multilayer Varistor Market Trends

Japan plays a significant role in the multilayer varistor market, boasting advanced semiconductor capabilities, top-notch electronics manufacturing, and considerable investments in research and development. The country is recognized for its precision engineering and high reliability standards, making its MLVs highly desirable in premium consumer electronics and automotive applications.

Moreover, Japan’s emphasis on miniaturized circuit protection solutions for next-generation automotive safety systems (ADAS) and sophisticated infotainment systems solidifies its position in the Asia-Pacific MLV market.

North America Multilayer Varistor Market Trends

North America is the fastest growing marketplace for the multilayer varistors market, fueled by the increasing need for advanced circuit protection in electric vehicles, aerospace and defense, industrial automation, and 5G communication networks. This region benefits from a dense concentration of technology companies, semiconductor manufacturers, and automotive leaders, driving the uptake of high-performance multilayer varistors.

Government measures that promote domestic semiconductor production, enhance EV adoption, and develop smart grid infrastructure are driving the demand for reliable overvoltage protection solutions. Additionally, the incorporation of AI and IoT into industrial automation is boosting the utilization of intelligent surge protection systems, where MLVs are essential for maintaining circuit stability and dependability.

United States Multilayer Varistor Market Trends

The multilayer varistor market is significantly influenced by the United States, which plays a crucial role in semiconductor research and development, electric vehicle manufacturing, and defense electronics. The country’s initiative to promote domestic semiconductor production, highlighted by the CHIPS and Science Act, is incentivizing investments in local component manufacturing, including MLVs for circuit protection in essential applications.

The automotive industry, with a particular emphasis on electric vehicles, is a vital area of growth, as companies such as Tesla, Ford, and General Motors are integrating advanced multilayer varistors into their power electronics, battery safety systems, and sensors for autonomous vehicles. Moreover, the advancement of 5G networks and cloud data centers is resulting in an increased demand for high-frequency, low-capacitance MLVs to safeguard sensitive communication equipment against transient voltage spikes.

Canada Multilayer Varistor Market Trends

In Canada, the adoption of multilayer varistors is steadily increasing, fueled by the growth in its automotive and renewable energy sectors. The nation’s dedication to electric vehicle adoption, sustainable transportation, and smart grid enhancements is leading to a rising need for high-voltage surge protection solutions in battery charging stations, power inverters, and smart energy management systems.

Canada’s aerospace and defense sectors also necessitate high-performance electronic components, including MLVs for radar technology, avionics, and critical communication networks. With rising investments in next-generation automotive electronics, AI-driven industrial automation, and 5G infrastructure, Canada is establishing itself as a robust market for multilayer varistors within North America.

Europe Multilayer Varistor Market Trends

Europe is considered to be a significantly growing area for the multilayer varistor market, driven by rigorous electronic safety standards, the proliferation of electric vehicle production, and rising investments in industrial automation and smart energy infrastructure. The region is recognized for its stringent automotive safety regulations, prompting manufacturers to incorporate advanced electronic protection components to bolster vehicle reliability and performance.

European nations are also advocating for sustainable energy initiatives, focusing on grid modernization, and the integration of wind and solar energy, as well as the expansion of electric mobility. This transformation is creating a heightened demand for high-performance multilayer varistors in power inverters, renewable energy storage solutions, and industrial control systems.

Germany Multilayer Varistor Market Trends

Germany stands as one of the foremost markets for multilayer varistors in Europe, backed by its robust automotive sector, advanced industrial automation, and leading-edge semiconductor research. As Europe’s principal electric vehicle manufacturer, Germany’s commitment to electrification and smart mobility is spurring the need for high-voltage surge protection solutions in powertrains, charging infrastructure, and autonomous driving technologies.

Major German automotive manufacturers, such as BMW, Volkswagen, and Mercedes-Benz, are making substantial investments in next-generation vehicle electronics by integrating MLVs into advanced driver-assistance systems, infotainment consoles, and high-performance power distribution systems. Additionally, Germany’s push towards Industry 4.0 and AI-enhanced manufacturing is contributing to the growing utilization of MLVs in automated production equipment and robotics.

France Multilayer Varistor Market Trends

France is experiencing an increasing demand for multilayer varistors across telecommunications, aerospace, and electric vehicle sectors. The nation is at the forefront of 5G implementation and satellite communication, where low-capacitance MLVs are essential for maintaining stable voltage regulation in high-frequency circuits. Additionally, France is significantly involved in expanding renewable energy, investing in smart grid technologies and solutions for electric mobility.

The country’s aim to lower carbon emissions through widespread electric vehicle adoption and green energy initiatives has heightened the demand for long-lasting, high-voltage multilayer varistors within solar inverters, wind turbine controllers, and electric vehicle charging networks.

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024