Nickel Alloys Market Size and Forecast 2025 to 2034

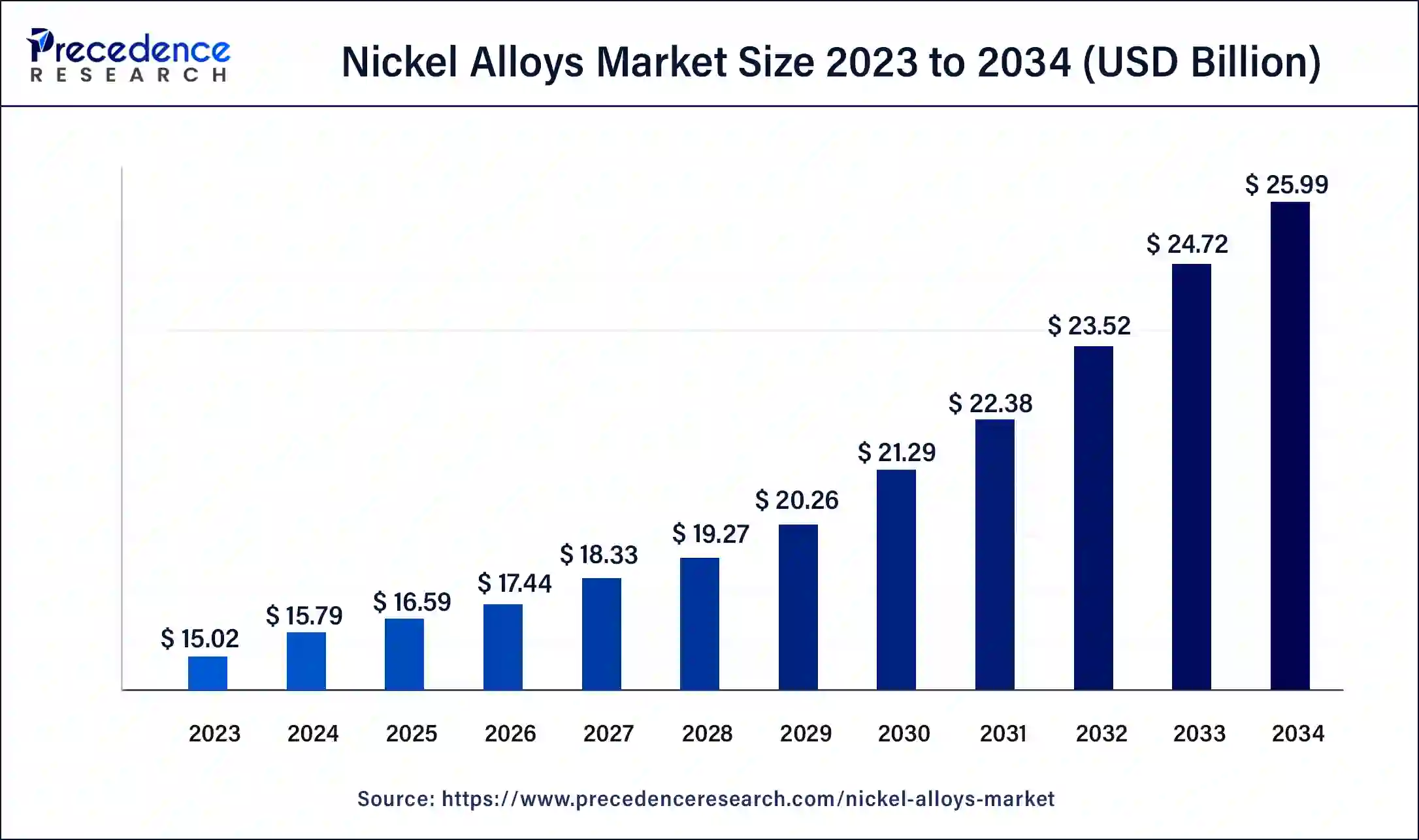

The global nickel alloys market size is projected to be worth around USD 25.99 billion by 2034 from USD 15.02 billion in 2024, at a CAGR of 5.11% from 2025 to 2034. The global nickel alloys market is expanding with the increasing demand from the aerospace, automotive, and defense sectors.

Nickel Alloys Market Key Takeaways

- The global nickel alloys market was valued at USD 15.02 billion in 2024.

- It is projected to reach USD 25.99 billion by 2034.

- The nickel alloys market is expected to grow at a CAGR of 5.11% from 2025 to 2034.

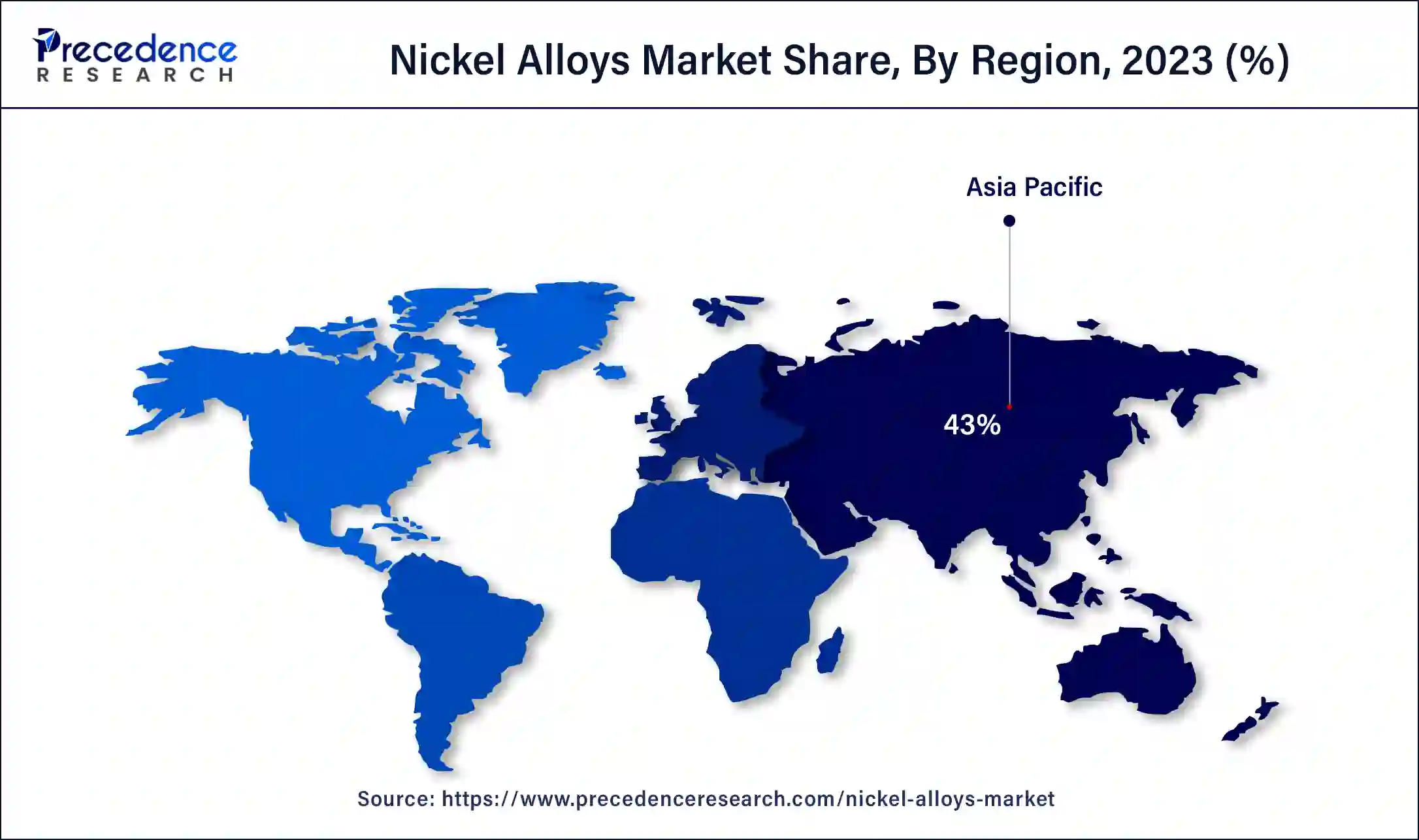

- Asia Pacific dominated the global nickel alloys market with the largest market share of 43% in 2024.

- North America is expected to show the fastest growth in the market during the projected period.

- By type, the nickel-copper alloys segment dominated the market in 2024.

- By type, the nickel-iron alloys segment is expected to grow at the fastest rate in the market over the forecast period.

- By function, the corrosion resistant segment led the global market in 2024.

- By application, in 2023, the automotive segment dominated the global market.

- By application, the chemical & petrochemical segment is expected to witness significant growth in the market during the projected period.

How AI is Changing the Nickel Alloys Market

AI can help to launch of new products in the nickel alloys market faster with accompanying environmental benefits. AI-based Alloy Development Support Software calculates the suitable chemical composition and microstructure along with the proper manufacturing process to get the desired properties needed for nickel-containing and other alloys. Furthermore, the software detects the patterns between multiple properties and structures, which allows the enhancement of the alloy's properties. AI can support and fuel the work of experienced developers in Japan and the U.S.

- In January 2024, the U.S. Department of Défense plans to develop an AI-based program to estimate prices and predict supplies of nickel, cobalt, and other critical minerals. This move aims to boost market transparency but introduces a new, uncertain variable into global metals markets. The program, which received little attention after it was announced on a Pentagon website in October, is part of Washington's broader efforts to jumpstart U.S. production of critical minerals used in weapons manufacturing and the energy transition.

Asia Pacific Nickel Alloys Market Size and Growth 2025 to 2034

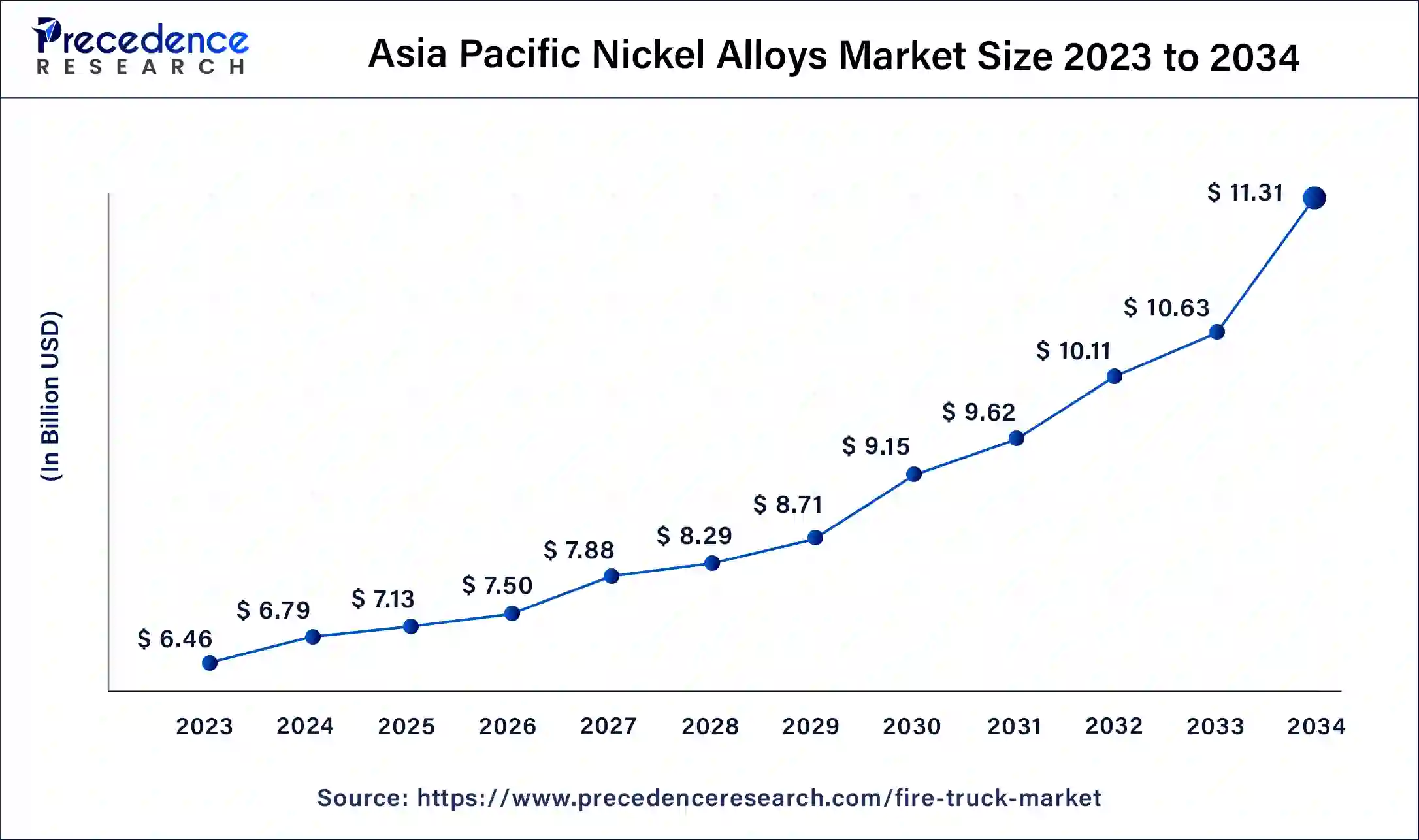

The Asia Pacific nickel alloys market size was exhibited at USD 6.79 billion in 2024 and is projected to be worth around USD 11.31 billion by 2034, poised to grow at a CAGR of 5.23% from 2025 to 2034.

Asia Pacific dominated the global nickel alloys market in 2024. The growth of the market in the region can be attributed to the rise in demand for nickel alloys in developing economies such as India and China. Furthermore, population growth in the region, along with the growing consumer preferences for the aerospace industry, are likely to contribute to the market expansion through the forecast period.

- In September 2022, Proterial Ltd, which was formerly Hitachi Metals, introduced a new product for metal additive manufacturing. Proterial's ADMUSTER C21P nickel-base alloy powder can offer superior resistance against corrosion.

North America is expected to show the fastest growth in the nickel alloys market during the projected period. The regional growth can be credited to the emergence of advanced engineering and manufacturing facilities along with the great demand for nickel alloys from industries like aerospace, automotive, and chemical processing. Moreover, the region's focus on high-performance and quality materials can further help the region's market growth.

Top 10 crude steel production countries (million metric tonnes)

| Rank | Country | 2023 |

| 1. | China | 1,019.1 |

| 2. | India | 140.2 |

| 3. | Japan | 87.0 |

| 4. | United States | 80.7 |

| 5. | Russia | 75.8 |

| 6. | South Korea | 66.7 |

| 7. | Turkey | 33.7 |

| 8. | Germany | 35.4 |

| 9. | Brazil | 31.9 |

| 10 | Iran | 31.1 |

Market Overview

Nickel alloys have greater strength, structural integrity, and lightweight nature. Hence, they are particularly used for heavy-duty manufacturing, such as turbines used in aircraft engines, turbines used in steam engines and furnaces, automotive engines, etc. Developing economies have become the hub of industrial development and global investment. Due to this growth, these Countries are providing many attractive growth opportunities to the market players, which can be beneficial for the nickel alloys market growth.

Nickel Alloys Market Growth Factors

- The growing use of Heat-resistant and corrosion-resistant alloys in several industries is expected to drive the nickel alloys market growth shortly.

- Rising demand for nickel alloys from the aerospace, automotive, and defense sectors can fuel the nickel alloys market growth further.

- Increasing global demand for renewable energy will likely help in the nickel alloys market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 25.99 Billion |

| Market Size in 2025 | USD 16.59 Billion |

| Market Size in 2024 | USD 15.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.11% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Function, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Applications in oil and gas exploration

Nickel Alloys exhibit remarkable resistance properties to high temperatures, mechanical stress, and corrosion. The oil and gas industry is a key industry driving the demand for nickel alloys, specifically in production and exploration activities. Additionally, nickel alloys are utilized in drilling and extraction instruments that work under high temperatures and high-pressure conditions. Therefore, this crucial property of the nickel alloys market products can increase its applications in oil and gas exploration.

- In September 2022, Extreme Coatings, a leading global supplier of wear-resistant coating solutions for plastics, rubber, oil, and gas industries, announced the launch of a new internal diameter high-velocity oxygen fuel (HVOF) coating system for oil and gas and industrial components. The internal diameter HVOF coating is also corrosion-resistant and crack-free.

Restraint

Intense competition and pressure among manufacturers

The market competition is fierce, with various manufacturers competing for the nickel alloys market share. This high-intensity competition can lead to price wars. The low-cost manufacturers often provide nickel alloy products at lower prices. Which ultimately puts pressure on manufacturers in higher-cost areas. Which creates a dissonance state among players and affects the overall growth of the market.

Opportunity

Growing demand for electric vehicles (EVs)

As the world shifts towards electric vehicles (EVs), there is a substantial opportunity for the nickel alloys market. Nickel is the main component in lithium-ion batteries utilized in EVs, especially in the cathode material. The growing demand for EVs fuelled by consumer preference and government initiatives for cleaner transportation boosts the demand for nickel alloys used in battery production, which is anticipated to increase significantly during the studied period.

- In April 2024, VDM Metals entered a partnership with metal 3D printing service provider Rosswag Engineering. VDM Powder Alloy 699 XA is a nickel-chromium-aluminium alloy and has been developed for use in highly corrosive environments within the petrochemical industry. Due to its highly corrosion-resistant properties, the material has been used in synthesis gas processes to produce hydrogen, ammonia, and methanol or in the cooling of synthesis gas in the production of e-fuel.

Type Insights

The nickel-copper alloys segment dominated the nickel alloys market in 2024. This is because nickel-copper alloy has brilliant properties like good corrosion resistance, high strength, and flexibility, which can directly be leveraged by end-use industry heat resistance characteristics of the nickel-copper alloy and can contribute to the segment expansion in the market further.

- In February 2024, EOS, the global leader in metal additive manufacturing (AM) solutions, released a new copper-nickel alloy for powder bed fusion (PBF) applications. EOS developed the material, EOS CopperAlloy CuNi30, in partnership with Phillips Federal and Austal USA, specifically in connection with the work of the latter two organizations on the U.S. Navy's submarine industrial base (SIB) program.

The nickel-iron alloys segment is expected to grow at the fastest rate in the nickel alloys market over the forecast period. Nickel-iron alloys are a subgroup of nickel alloys that are utilized in many fields and environments. It has exceptional corrosion resistance properties, particularly to seawater, and hence is used in marine applications. The growth of the segment is attributed to the use of this alloy in naval as well as in commercial shipping.

Function Insights

The corrosion resistant segment led the global nickel alloys market in 2024. The dominance and growth of the segment can be linked to the increasing utilization of corrosion resistance alloys in different marine products such as pumps, valves, and fittings, which can maintain high corrosion resistance in harsh climates.

Application Insights

The automotive segment dominated the global nickel alloys market in 2024. The automotive segment has many applications for nickel alloys, which include electronics and electrical, energy and power, aerospace and defense, and oil and gas. Moreover, the use of nickel alloys for diesel valves, spark plugs, plates, and thermostats can increase the demand for nickel alloy in the automotive sector, which in turn drives this segment growth in the market.

- In July 2024, Aubert & Duval, an advanced metallurgical solutions company, and Alloyed, an alloy and process design technologies company, released Alloyed's new nickel superalloy ABD-1000AM, the latest in its range of alloys developed specifically for additive manufacturing, which can also be used within the aerospace, power, automotive, defense, and space industries.

The chemical & petrochemical segment is expected to witness significant growth in the nickel alloys market during the projected period. Electroplated nickel alloys offer greater corrosion resistance, which makes them convenient for numerous chemical processing and petrochemical applications. Additionally, rising demand for safety, durability, and efficient performance from the market players is expected to propel the growth of the segments soon.

Nickel Alloys Market Companies

- AMETEK, Inc. (U.S.)

- Polymet (U.S.)

- Ulbrich Stainless Steels and Special Metals Inc. (U.S.)

- NIPPON STEEL CORPORATION (Japan)

- Acciaierie Valbruna S.p.a. (Italy)

- Rolled Alloys Inc. (U.S.)

- JLC Electromet Pvt. Ltd. (India)

- HAYNES INTERNATIONAL (U.S.)

- thyssenkrupp AG (Germany)

- voestalpine AG, (Austria)

- Alloy Wire International (U.K.)

- Precision Castparts Corp. (U.S.)

- Aperam (Luxembourg)

- ATI (U.S.)

- Sandvik AB (Sweden)

- CRS Holdings, LLC (U.S.)

Recent Developments

- In July 2023, Aperam Recycling, by its American subsidiary ELG Utica Alloys (ELG), and IperionX Limited, entered into an agreement that will lead to the development of a low-carbon 100% closed-loop titanium supply chain.

- In June 2023, Rolled Alloys Inc. received a new certification for its quality management system. This certification is specifically for the company's manufacturing and distribution of heavy metals mill products made from stainless steel and nickel alloys. The recognition highlights the company's commitment to quality, which is expected to boost its overall sales

- In April 2022, Sandvik launched a new product as a part of its product lineup of high-performing nickel alloys. The new super alloy named Sanicro 625 bar (UNS 06625) can withstand temperatures up to 600 degrees Celsius while offering excellent corrosion resistance.

Segments Covered in the Report

By Type

- Nickel-chromium-Iron Alloys

- Nickel-chromium Alloys

- Nickel-chromium-Molybdenum Alloys

- Wrought Nickel

- Nickel-chromium-Cobalt Alloys

- Nickel-copper Alloys

- Nickel-iron Alloys

- Nickel-molybdenum Alloys

- Nickel-titanium Alloys

By Function

- High Performance & Electronics Grade

- Heat Resistant

- Corrosion Resistant

By Application

- Electrical & Electronics

- Automotive

- Energy & Power

- Oil & Gas

- Chemical & Petrochemical

- Aerospace & Defense

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting