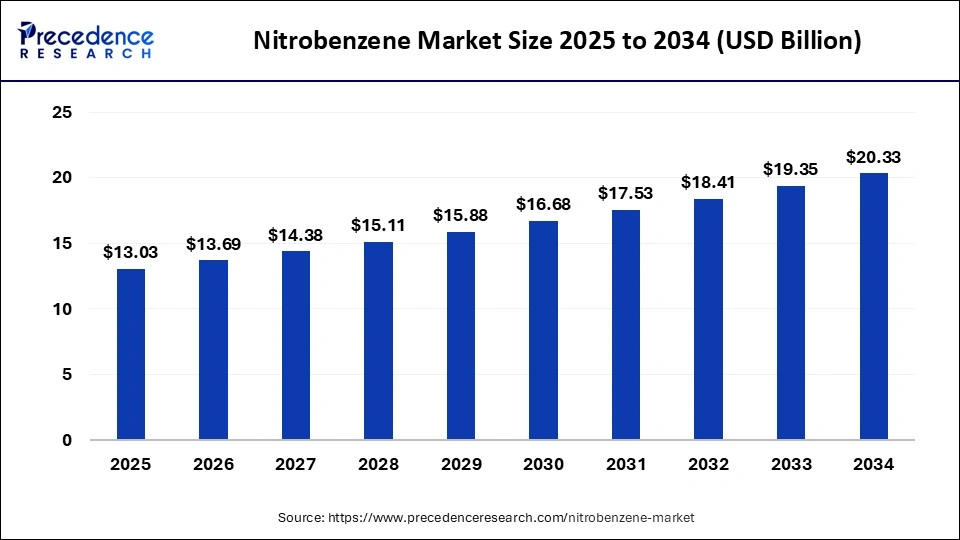

The global nitrobenzene market size accounted for USD 12.40 billion in 2024, grew to USD 13.03 billion in 2025, and is expected to be worth around USD 20.33 billion by 2034, poised to grow at a CAGR of 5.07% between 2024 and 2034.

The global nitrobenzene market size is expected to be valued at USD 12.40 billion in 2024 and is anticipated to reach around USD 20.33 billion by 2034, expanding at a CAGR of 5.07% over the forecast period from 2024 to 2034.

Market Overview

It is an organic substance, nitrobenzene. It smells like almonds and is an oily, yellowish liquid. The most common method of nitrobenzene production is liquid. It barely dissolves in water before evaporating into the atmosphere. The production of aniline, a chemical intermediary for dyes, agricultural products, polymers, etc., is the main usage of nitrobenzene. Additionally, lubricating lubricants for use in equipment and motors are produced using it. Nitrobenzene is a very minor component of the colors, medications, insecticides, and synthetic rubber manufacturing processes.

Aniline, which is used to make the synthetic rubber and MDI-based polyurethane foams used in the automotive industry, is created using nitrobenzene. Consequently, the worldwide nitrobenzene market is being driven by the growth of the automotive industry. The increase in the use of nitrobenzene in the manufacture of aniline for the automotive industry is one of the major factors anticipated to drive growth in the worldwide nitrobenzene market during the forecast period of 2024 to 2034, according to the most recent research report on the subject.

An important ingredient in the creation of aniline is the aromatic molecule nitrobenzene. As nitrobenzene serves as a precursor, it is also employed in the production of a wide range of derivatives for use in cosmetics, agriculture, and other industrial applications.

The nitrobenzene market is anticipated to expand in response to the rising demand for rubber in the automotive sector. Additionally, over the forecast period of 2024 to 2034, it is projected that the growth in aniline consumption and demand from the construction industry would serve as major drivers of the nitrobenzene market.

Additionally, the straightforward accessibility of raw materials and the quick development of medications, dyes, and chemicals are anticipated to favorably impact the growth of the nitrobenzene industry. Additionally, during the aforementioned forecast period, the nitrobenzene market is anticipated to benefit from a number of growth opportunities due to the accessibility of inexpensive labor, the rapid expansion of the agricultural sector, and the rising demand for fertilizers, as well as the low cost of raw materials.

Research on environmental remediation is important to reduce the negative effects of nitrobenzene exposure

Aniline, a key ingredient in the production of polyurethane, is predominantly made from nitrobenzene. Manufacturers in the nitrobenzene sector are finding new sources of income from dyes, medications, and insecticides. PlumeStop and RegenOx are two nitrobenzene products that have been designated by the Environmental Protection Agency (EPA) as Group D, which lowers the risks of human carcinogenicity. Regenesis, an expert in environmental remediation research, is developing a broad portfolio of these products.

Nitrobenzene exposure, both acute and chronic, can cause drowsiness, blurred vision, and, in severe circumstances, a coma. As a result, producers in the nitrobenzene market are abiding by the EPA's regulations to increase the use of nitrobenzene in insecticides, synthetic rubber, and lubricating oils. As a result, experts in the field of environmental remediation research are essential in lessening the negative effects of nitrobenzene on people.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.40 Billion |

| Market Size by 2034 | USD 20.33 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.07% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased consumer disposable income and urbanization have both fueled the growth of the automobile industry. Aniline, a chemical utilized in the production of Methylene Diphenyl Diisocyanate (MDI), which is used to create polyurethane (PU) foams and synthetic rubber, is largely produced from nitrobenzene. The automotive industry uses synthetic rubber and polyurethane (PU) foams.

The manufacture of many automobile interiors and parts of a car, including steering wheels, airbag covers, front and rear glass panes, and waterproof floor materials, uses MDI, which is made from nitrobenzene using the aniline process. The production of polyurethane, which is used to create PU foams and synthetic rubber, begins with the synthesis of aniline, which uses nitrobenzene as a basis.

The need for car tires is being driven by the expansion of the automotive sector. Because nitrobenzene is used to make synthetic rubber, this will probably increase production. As a result, nitrobenzene is becoming more and more in demand all over the world.

Due to nitrobenzene and its derivatives being very hazardous substances, anthropogenic activities release them into the environment. These discoveries are hindering the market's expansion for nitrobenzene. The synthesis of aniline requires a significant amount of nitrobenzene. However, phenol ammonolysis is also used as a method for producing aniline. This derivative can be viewed as the primary market inhibitor for nitrobenzene. Because of its ability to evaporate from water into the air, nitrobenzene has the potential to greatly increase air pollution. The market for nitrobenzene will probably suffer as a result.

The demand for nitrobenzene is driven by products like leather conditioners and floor polishes. Shoe polish odor is reduced by the use of nitrobenzene. To assure the efficacy and purity of nitrobenzene, manufacturers maintain high-quality requirements. Lubricants are helping manufacturers in the nitrobenzene industry grow their clientele.

In order to provide nitrobenzene and its derivatives to end users in the leather industry, Solvo Chem, an Indian chemical distributor, complies with strict quality criteria. Nitrobenzene is being used more frequently to cover up offensive scents that come from leather, floor polish, and shoes. The need for nitrobenzene is increasing as a result of the production of medications, synthetic rubber, and lubricating lubricants. All these factors create growth opportunities for the nitrobenzene market.

In 2023, the aniline production segment generated more than 87% revenue share. The rubber business is primarily utilized to produce MDI, antioxidants, activators, accelerators, and other compounds. Aniline is a small-scale ingredient used in the creation of fungicides and herbicides.

The substance is used directly as a pesticide ingredient in addition to aniline. Nitrobenzene is expected to increase plant energy and stimulate output, particularly in flowering plants, according to Greenwell Biotech.

The most widely used medication in the world, paracetamol, is made in the pharmaceutical sector using nitrobenzene. However, nitrobenzene is changed into aniline and then employed in the medication formulation for making paracetamol. Asia Pacific is the pharmaceutical industry's top user of aniline and, consequently, nitrobenzene due to the concentration of paracetamol production in China and India.

Due to the expanding need for various MDI-based products including adhesives and sealants, elastomers, and polyurethanes, the construction sector is the most important end-use market for nitrobenzene. Wood and furniture make a great binder. As a result of these considerations, 48% of the nitrobenzene generated globally is now consumed by the building industry. The primary obstacles for the construction market will be the current economic slowdown, the trade conflict, the pressure from Brexit, and rising input costs.

The sector is anticipated to have new growth over the future years, nonetheless, as a result of the expanding urban population. One of the global markets with the fastest growth is the pharmaceutical sector, particularly in the U.S. and Germany. Acetaminophen or paracetamol, which are used as analgesics, are frequently made using nitrobenzene. The most often used generic drug worldwide is paracetamol. It is commercially available in tablet, pill, and syrup versions for all age groups.

In terms of both consumption and production, Asia Pacific was the region with the greatest market for nitrobenzene in 2023. A variety of foreign corporations have relocated their manufacturing facilities in the area due to the region's low infrastructure and labor expenses. Production and consumption of nitrobenzene in the area have been significantly influenced in recent years by big aniline and MDI manufacturing enterprises expanding their production capacities. China is a significant market driver for nitrobenzene in the Asia-Pacific region. China produced more aniline than any other country in the world in 2018—more than 50%.

Wanhua Chemical, Shanghai Tian, SINOPEC, Dow Chemical, and FJ Pec are the top five shareholders of aniline in the Chinese market. Wanhua raised its capacity to generate aniline annually by 180 kilotons in 2018, making it one of the industry's top producers of the chemical. In 2023, Europe ranked second in terms of product consumption, with a volume share of almost 30.09% worldwide. The product's principal European markets were Belgium and Germany.

In Germany, the petrochemical sector accounts for one-fourth of all EU sales. Although businesses operating in the nation are concentrating on reducing costs brought on by numerous trade obstacles and the purchase of raw materials, it will slow down production activities to a certain extent. According to projections, the demand for various chemical intermediates will be driven by the construction and automotive industries.

Segments Covered in the Report

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client