December 2024

Non-opioid Pain Treatment Market (By End User: NSAIDs, Acetaminophen, Local Anesthetics, Others; By Administration Analysis: Chronic Pain, Post-operative Pain, Cancer Pain, Others; By Route of Administration: Oral, Topical, Injectable, Others; By Distribution Channel: Hospital Pharmacy, Retail Pharmacy, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

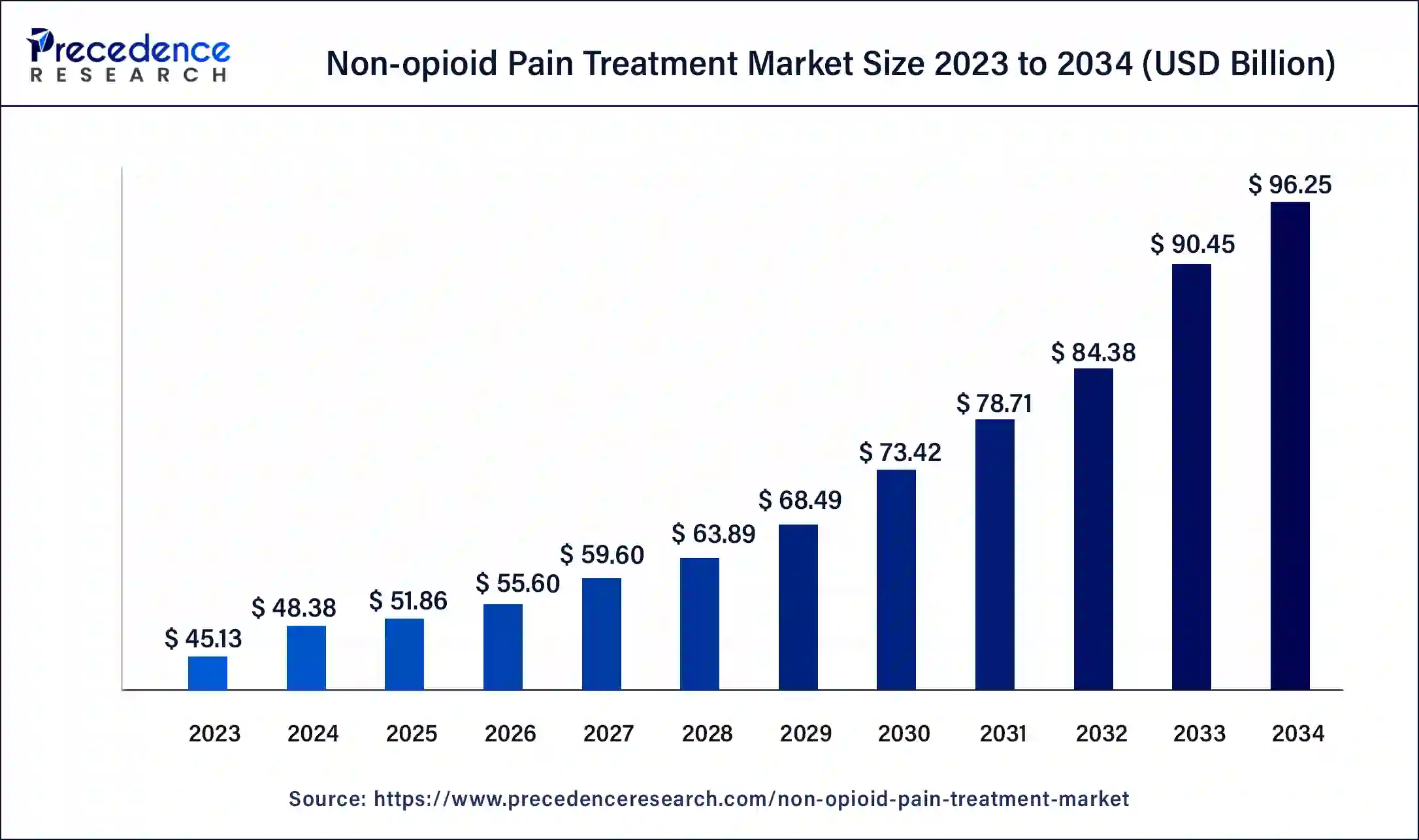

The global non-opioid pain treatment market size is estimated at USD 48.38 billion in 2024 and is expected to reach around USD 96.25 billion by 2034 expanding at a CAGR of 7.12% from 2024 to 2034.

Both prescription drugs and over-the-counter (OTC) drugs are non-opioid analgesics, which are used to treat pain. As a desirable, efficient, and secure first-line therapeutic alternative to opioid drugs for chronic pain and mild to moderate acute pain, they have increasingly gained emphasis in a variety of clinical situations.

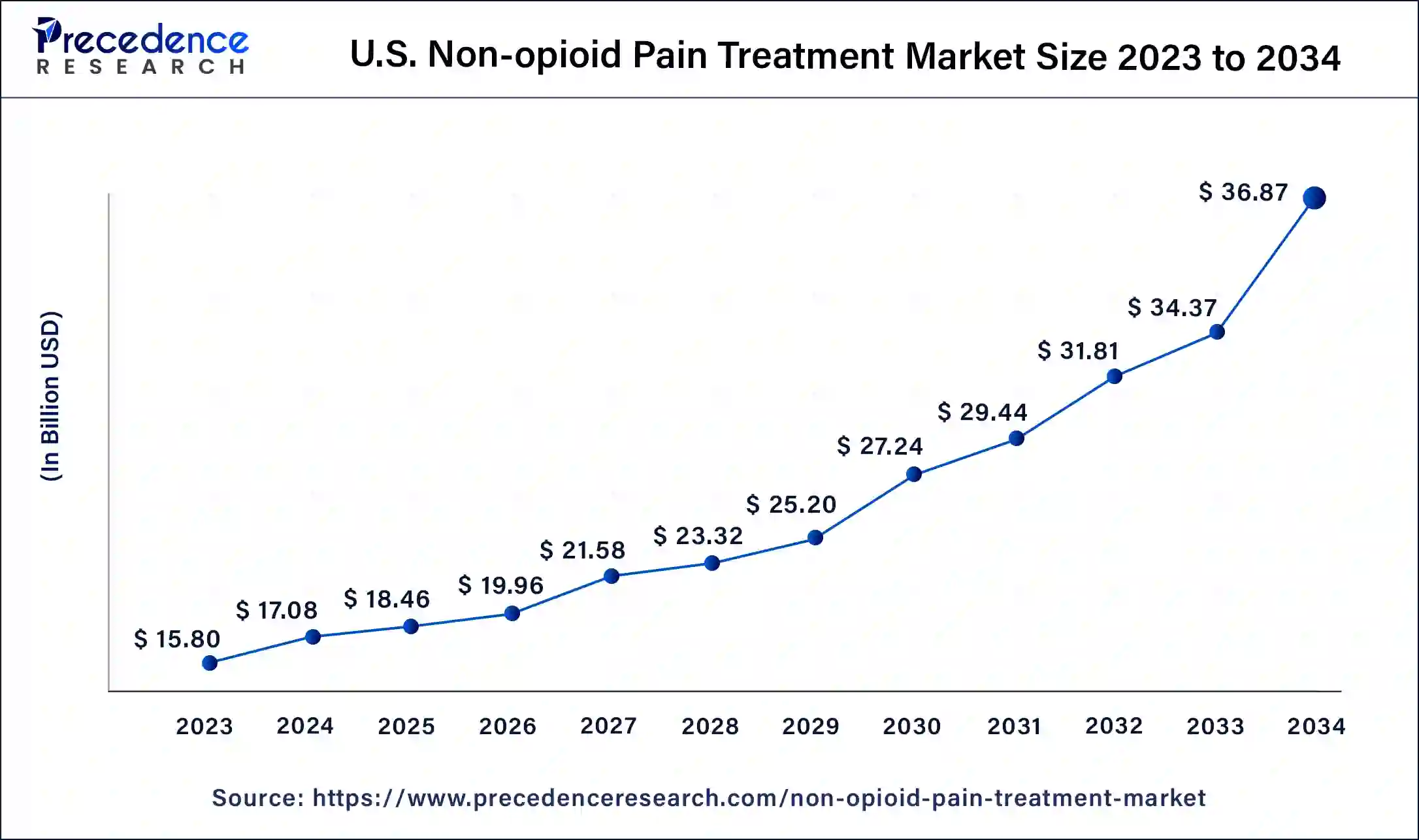

The U.S. non-opioid pain treatment market size was valued at USD 15.80 billion in 2023 and is predicted to be worth around USD 36.87 billion by 2034, at a CAGR of 8% from 2024 to 2034.

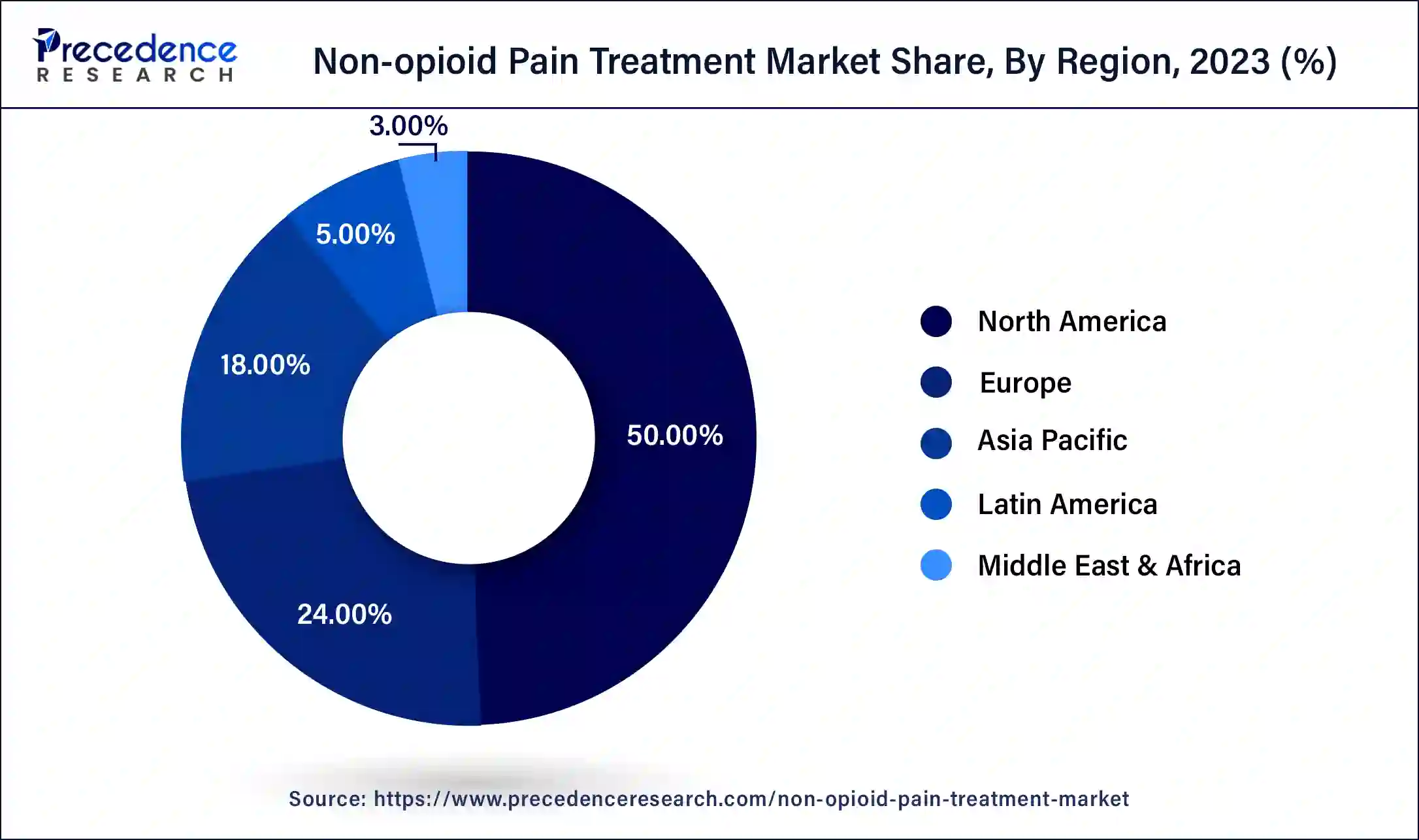

North America dominated the market for non-opioid pain treatment market in 2023. The strong demand for NSAIDs, vigorous government initiatives to reduce opioid usage, advancements in the healthcare infrastructure, and the existence of significant businesses are all factors that contribute to this dominance. Government measures that encourage spending and reimbursement are likely to fuel market expansion.

During the projection period, the Asia Pacific region is anticipated to see the quickest growth rate. The region's non-opioid analgesic development and commercialization efforts by key firms are responsible for the high growth rate. An exclusive licensing and partnership agreement for the commercialization of NRD.E1 to treat patients with neuropathic pain in Singapore and China was announced by NeuroFront Therapeutics and Novaremed AG in July 2022.

The industry's expansion may be ascribed to the leading companies' growing R&D expenditures for the creation of innovative non-opioid analgesic medications as well as the efforts of public and private groups to introduce beneficial programs and raise knowledge of the therapies that are available. Due to the low hospitalization rate and decreased sales of non-opioid analgesics for treatment during the early stages of the COVID-19 pandemic, the market for NSAIDs saw a mildly negative impact. Governments instituted a nationwide lockdown to stop the spread of illness, which limited people's access to pharmacy and medical services including operations and decreased demand for NSAIDs.

The National Library of Medicine reports that there has been a roughly 91% decrease in the number of elective procedures carried out in hospitals. The lack of ibuprofen during the epidemic, however, had led to an upsurge in the sales of acetaminophen medications like Tylenol. Significant prospects for the market for non-opioid analgesic medications are created by the growing restrictions on the use of opioid analgesic products for the treatment of pain.

Opioid addiction and prescription drug of abuse testing, such as abusing oxycodone and fentanyl, are important global problems that have a negative influence on people's health as well as their economic and social well-being. The CDC anticipated that opioid-related overdose fatalities will account for around 93,665 deaths in the United States in 2021.

Additionally, according to Medicare report statistics, due to dangerous side effects and stringent government rules, oncologists' prescriptions for opioids decreased by 21% and by 23% from those of other doctors in the previous ten years. The National Cancer Institute reports that in 2021, the same pattern was seen among cancer patients who were in their latter stages of the disease. The sector now has a tremendous possibility for expansion because it is expected that this trend will continue throughout the projection period.

| Report Coverage | Details |

| Market Size in 2023 | USD 45.13 Billion |

| Market Size in 2024 | USD 48.38 Billion |

| Market Size by 2034 | USD 96.25 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drug Class, Pain Type, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing osteoarthritis prevalence

The demand for non-opioid pain relief patches is anticipated to increase due to the increasing prevalence of osteoarthritis worldwide, which is being fueled by the aging population, joint injuries, obesity, repetitive stress on the joint, genetics, metabolic illnesses, and abnormalities in bone density. The knees, hips, and hands are the joints most frequently affected by this form of arthritis, which is the most common type.

Approximately 54.4 million individuals in the United States have some kind of arthritis, and that figure is expected to increase to 78 million by 2040, according to the Osteoarthritis Action Alliance (OAAA). In the United States, 32.5 million people suffer from osteoarthritis. In many parts of the world, this trend is anticipated to persist in the next years, advancing the market.

Increasing cases of cancer

The sector will advance as more incidences of breast, bowel, colorectal, and lung cancer are expected in the coming years. The market is anticipated to profit from improved government knowledge of the availability of cutting-edge, non-opioid heat patches for the treatment of cancer-related pain in several nations.

The World Health Organization (WHO) predicts that 10 million people will die from cancer globally in 2020. In the same year, lung cancer killed 1.80 million lives, while liver cancer took 8,30,000 and breast cancer over 6,85,000. This demonstrates how the market will be driven by the impending rapid rise in the occurrence of cancer.

Lack of knowledge

High cases of chronic pain-related conditions

The non-opioid pain patch market in South Asia is anticipated to grow due to the increased prevalence of chronic pain in India. The industry is anticipated to gain from the government's growing investments in the development of an established healthcare system to address illnesses connected to pain. In order to comprehend the impact and scope of chronic pain throughout Southeast Asia, researchers from the Homi Bhabha National Institute and the All India Institute of Medical Sciences, for instance, conducted a study in December 2018.

A total of 4326 Indian patients were examined, and 836 of them answered a questionnaire on their discomfort. The incidence was greater in females (25.2%) than in men, and the frequency rose sharply in those 65 and older. The numbers are predicted to increase soon, which would increase India's need for non-opioid heat patches.

The nonsteroidal anti-inflammatory medicines (NSAIDs) segment has led the market in 2023. Due to the extensive availability of affordable, effective NSAID drugs and safer treatment options than opioids, the market is expected to continue to dominate over the projected period. NSAIDs are widely used, and some examples include Cambia, Cataflam, Dyloject, Zipsor, Zorvolex, Advil, Motrin, and Aleve.

The ongoing dominance during the projection period is also influenced by improvements in medicine formulation and greater uptake of new drugs. For instance, the Advil Dual Action medication was given FDA approval in March 2020 to treat patients with tooth pain. This medication, which was made available over-the-counter (OTC) in the United States for dentistry patients, combined acetaminophen and ibuprofen.

Due to the widespread availability of anticonvulsants and antimigraine medications as well as the existence of prospective pipeline candidates to address the unmet requirements for non-opioid-based therapeutics, the other sector is predicted to see the highest increase throughout the projection period.

Due to the rising prevalence of chronic pain, such as neuropathic pain and pain brought on by inflammatory conditions like osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and others, as well as the rising demand for non-opioid analgesic medications, the chronic pain segment dominated the market in 2023. The National Library of Medicine estimates that 7% of people worldwide experience neuropathic pain. Therefore, it is projected that the incidence of NSAID prescriptions would rise as illness prevalence rises.

During the projected period, it is anticipated that the other category would grow profitably. The rise in unintentional or accidental injuries and acute pain can be blamed for the segment's expansion. The CDC reports that 24.8 million people sought medical attention for accidents-related injuries. Thus, when unintentional accidents rise, so does the need for painkillers like non-opioid analgesics to manage their pain, propelling the market's expansion.

Due to the approval and introduction of novel oral NSAIDs for pain treatment, the oral sector led the market in 2023. Advil is offered as tablets that are taken orally to treat a variety of pains, including headache, menstrual cramps, tooth pain, and muscular aches.

Due to factors such as technical developments in drug delivery, the launch of innovative IV products, and the rising use of local anesthetic products for surgical operations, the injectable sector is predicted to increase at the quickest pace, 9.3%, throughout the forecast period. For instance, the first and only acetaminophen injection created by B Braun Medical for the treatment of pain disorders brought on by various diseases was authorized by the U.S. FDA in February 2021.

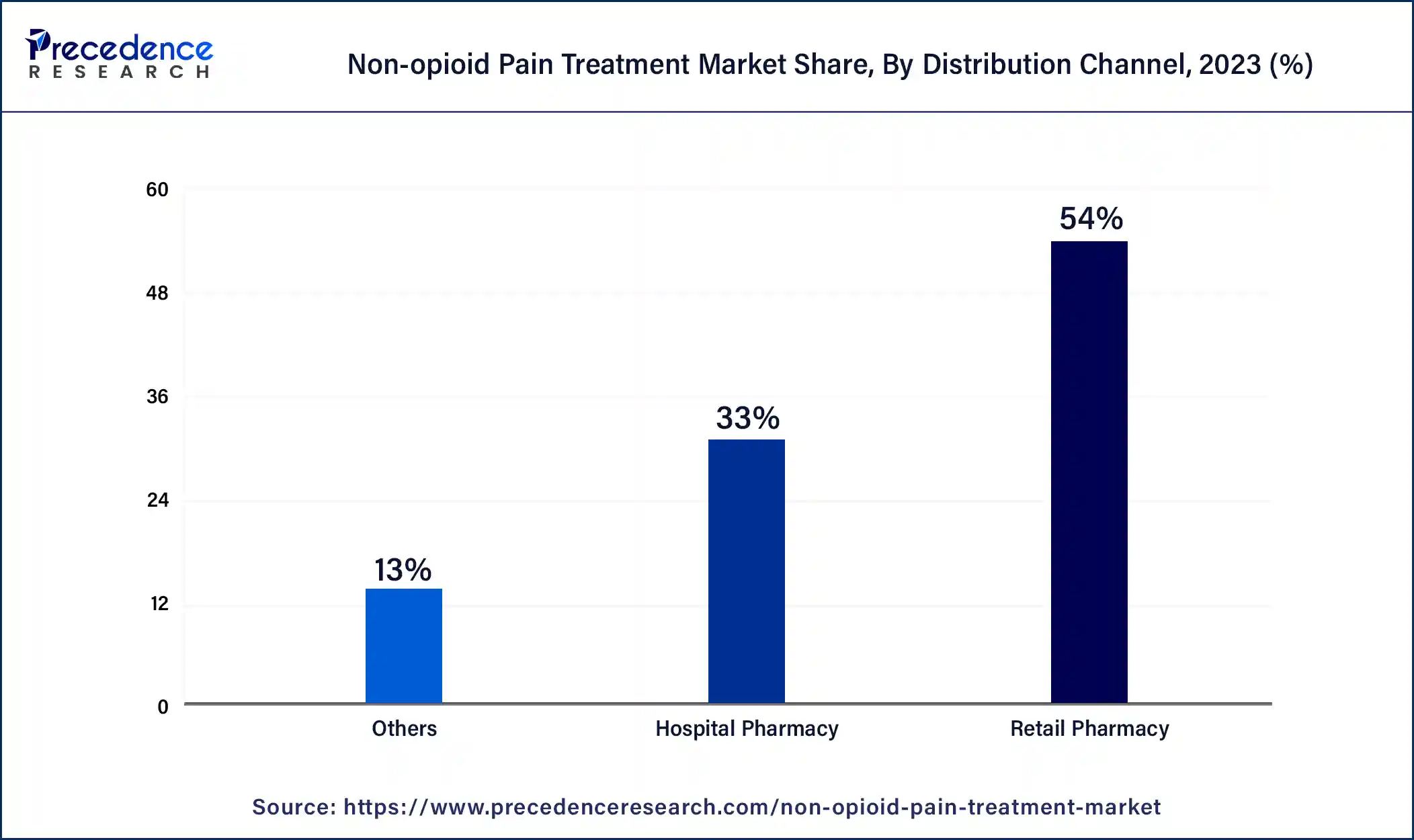

Due to the widespread availability of non-opioid analgesic medications and patients' simple access to medications, the retail pharmacy sector led the non-opioid pain treatment market in 2023. Walgreens Boots Alliance, Inc., CVS Health, Ahold Delhaize, Rite Aid Corporation, and Albertsons Companies, Inc. are the main retail pharmacies that provide non-opioid analgesics. The sales of over-the-counter analgesics outside and internally reached USD 1,286 million and USD 4,640 million, respectively, in 2021, according to the Consumer Healthcare Products Association (CHPA).

In terms of revenue, the hospital pharmacy segment will rank second in 2023. The extensive use of non-opioid analgesics for the management of hospitalized patients can be linked to this. Additionally, the growth of the segment during the projection period would be accelerated by the increase of hospitals that execute a variety of ambulatory procedures for the treatment of a variety of ailments.

Recent Developments

Market Segmentation

By Drug Class

By Pain Type

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

October 2024

October 2024