January 2025

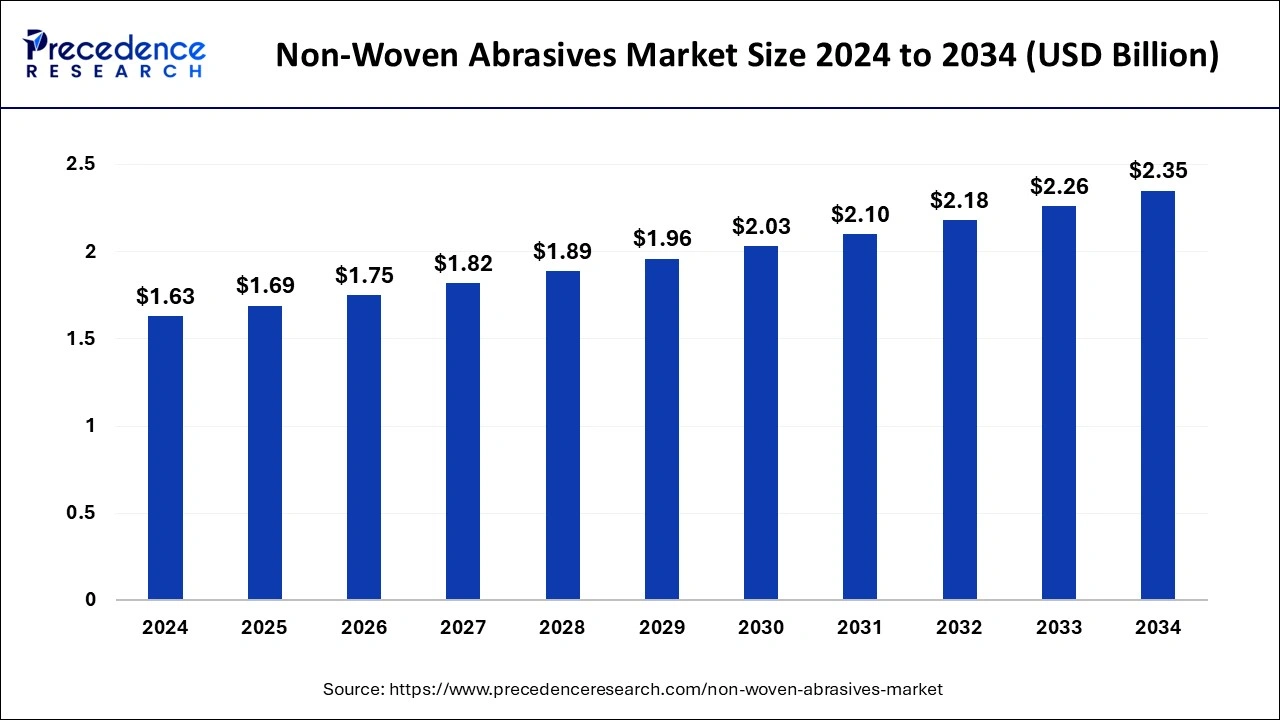

The global non-woven abrasives market size is evaluated at USD 1.69 billion in 2025 and is forecasted to hit around USD 2.35 billion by 2034, growing at a CAGR of 3.72% from 2025 to 2034. The Asia Pacific market size was accounted at USD 600 million in 2024 and is expanding at a CAGR of 3.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global non-woven abrasives market size accounted for USD 1.63 billion in 2024 and is expected to exceed around USD 2.35 billion by 2034, growing at a CAGR of 3.72% from 2025 to 2034. The rising need for superior surface finishes in different industries is the key factor driving market growth shortly. Also, a rise in disposable income in emerging economies coupled with the surge in manufacturing and industrial activities can fuel the non-woven abrasives market growth further.

The integration of artificial intelligence is substantially revolutionizing the non-woven abrasives market. AI technologies are improving the accuracy of abrasives by giving good quality control and customization of abrasive products. Furthermore, AI in production processes optimizes the whole manufacturing process, enhances consistency in product quality, and decreases operational costs. This innovation contributes to the overall development of smarter abrasive solutions.

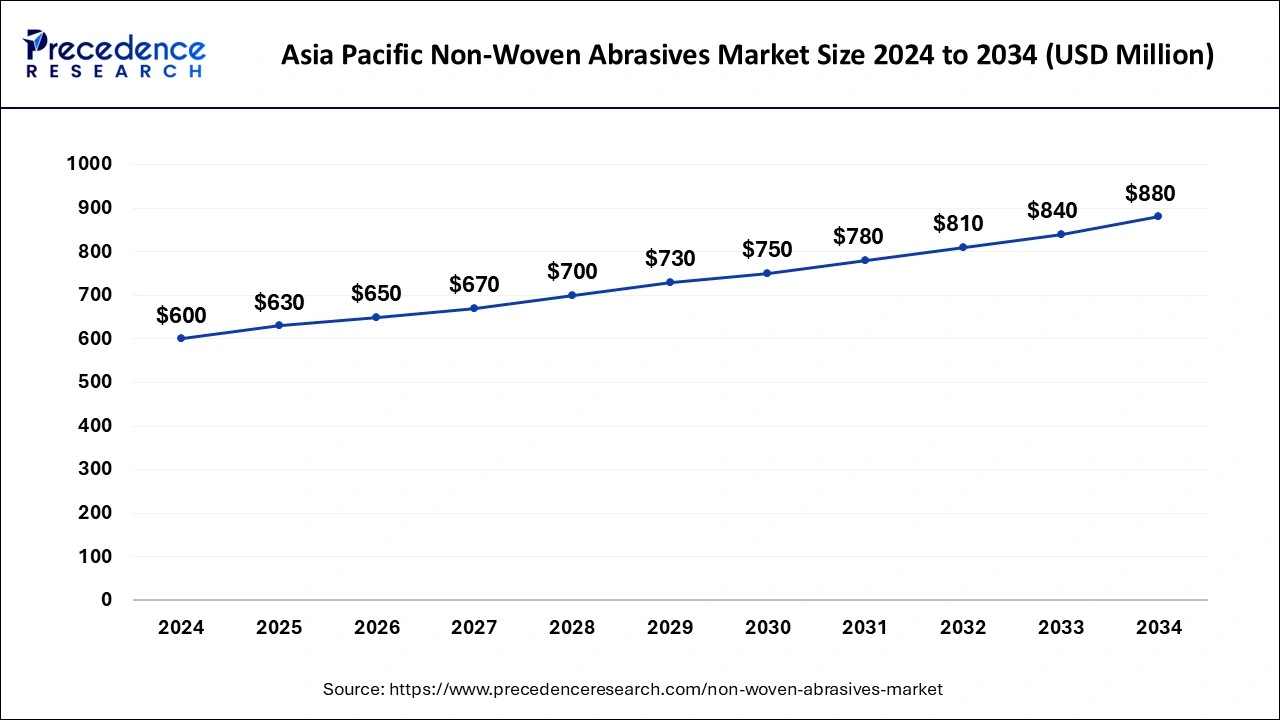

The Asia Pacific non-woven abrasives market size was exhibited at USD 600 million in 2024 and is projected to be worth around USD 880 million by 2034, growing at a CAGR of 3.90% from 2025 to 2034.

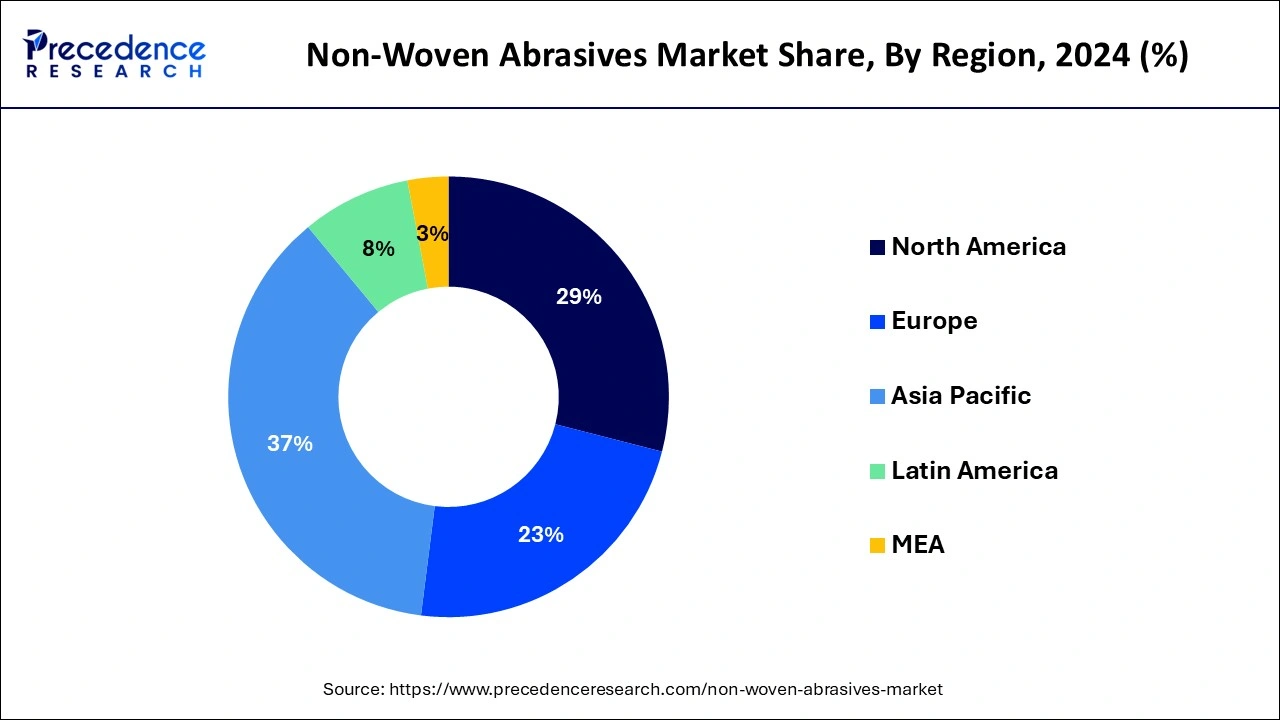

Asia Pacific led the global non-woven abrasives market in 2024. The dominance of the region can be attributed to the surging growth of the automotive industry, particularly in developing countries like India and China. In addition, the ongoing urbanization and industrialization in the region can impact market growth positively further.

North America is expected to grow at a faster rate in the non-woven abrasives market over the studied period. The growth of the region can be linked to the rising demand for durable, strong, and strict regulations including production processes facilitating the need for reliable abrasive solutions. Furthermore, in North American, the U.S. led the market owing to the strong presence of well-established industries that use non-woven abrasives in many applications, from construction to metalworking.

These are the 3D abrasive materials that are crafted when abrasives get connected with nylon in the presence of resin such as epoxy, phenolic, and others. They are designed from a nylon filament web made from carbides, diamonds, aluminum oxide, and zirconia. This abrasive has many advantages like water resistance, superior comfort, great resilience, etc. These materials are classified into coated, bonded, super abrasive materials, loose abrasive materials, and nonwoven materials.

Top 5 car companies in the world 2023

| Car Company | Market cap (USD billion) | Units sold globally in 2023 |

| Tesla | 998.90 | 1,808,581 |

| Toyota | 227.74 | 11,230,000 |

| BYD | 110.98 | 3,000,000 |

| Xiaomi | 89.34 | NA |

| Ferrari | 79.16 | 13,663 |

| Report Coverage | Details |

| Market Size by 2024 | USD 1.63 Billion |

| Market Size in 2025 | USD 1.69 Billion |

| Market Size in 2034 | USD 2.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.72% |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for high-quality surface finishes

The growing demand for standard surface finishes propels the non-woven abrasives market because of the preference for product beauty along with its performance across end-user industries. In addition, this abrasive provides a better solution that promises uniform and consistent finishes on surfaces. This ability of non-woven abrasives positively affects the strength of products, leading to customer satisfaction.

Availability of alternative materials

Competition from other alternative abrasive materials is the major factor hampering the growth of the non-woven abrasives market. The launches of more innovative and sophisticated abrasive technologies that give superior performance at a much lower cost grab the market landscape. Hence, diamond and ceramic abrasives become the first choice for efficient and tough applications.

Increasing demand for PSA-backed coated abrasives

Coated non-woven abrasives, a major segment of the non-woven abrasives market, are extensively used in many sectors, such as agriculture, Pre-engineered buildings, and metal fabrication industries. In the automobile industry, these abrasives are important for removing paint and blending welds. Furthermore, the surge of electric cars, along with the wide installation of charging stations, compels the use of coated abrasives in the production and designing of electric vehicle batteries and components of charging infrastructure.

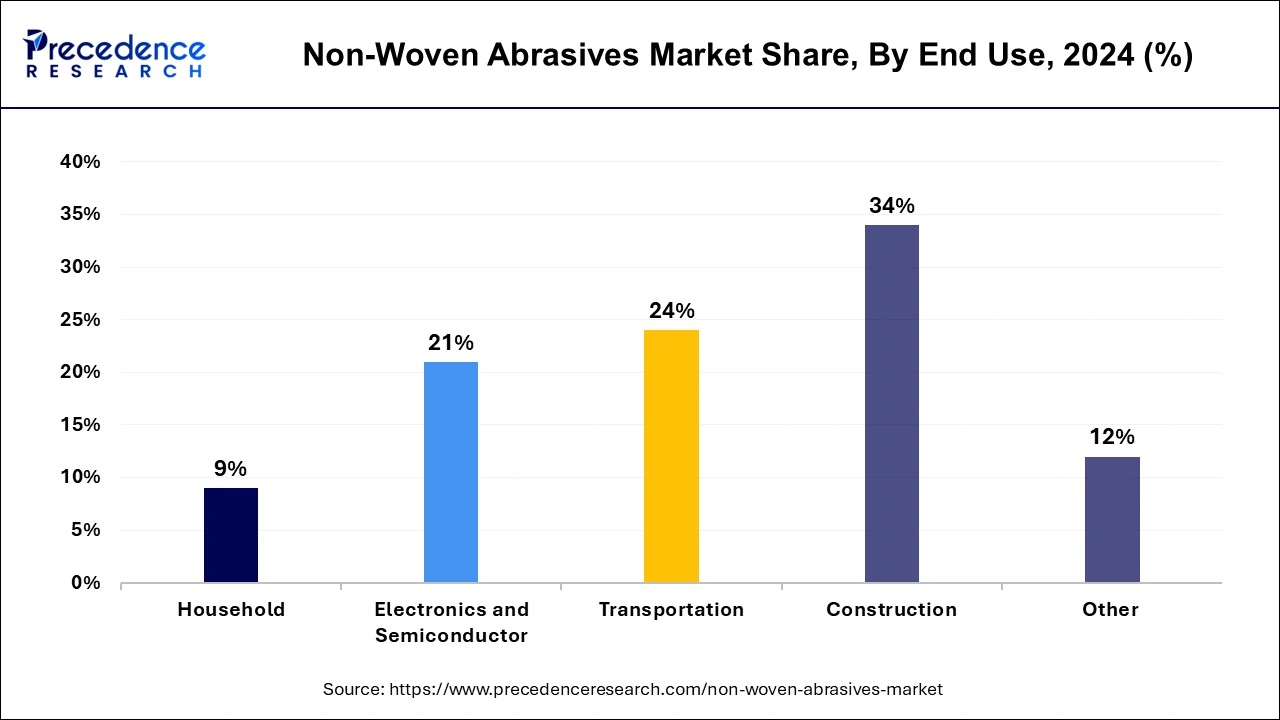

The hand pads and rolls segment dominated the non-woven abrasives market in 2024. The dominance of the segment can be attributed to the increasing utilization of hand pads& rolls for cleaning and manual finishing applications, particularly in sectors such as electronics and household. Additionally, these products are mainly manufactured for manual applications, providing convenience and flexibility in reaching difficult-to-access areas. This segment offers effective and versatile solutions across various industries.

The non-woven belts segment is expected to grow at a significant rate in the non-woven abrasives market over the forecast period. The growth of the segment can be linked to the increasing use of non-woven belts in heavy-duty applications. These belts are designed to bear extreme heat and high friction, which makes them convenient for applications such as metal finishing. Also, these belts possess some flexibility that enables them to comply with complex contours and shapes. Non-woven belts are the best fit for industries that require automated processes.

In 2024, the construction segment led the global non-woven abrasives market and is also expected to grow at the fastest rate over the forecast period. The dominance of the segment can be credited to the rising demand for aesthetically appealing and sustainable construction materials in the construction industry. In the construction market, these abrasives are utilized in many applications, from maintenance and repair to surface preparation. Moreover, these abrasives are robust in nature, which makes them suitable for handling heavy-duty materials like concrete, steel, and stone, which are mundane tasks in the construction sector.

The transportation segment is expected to expand considerably in the non-woven abrasives market over the projected period. The growth of the segment can be credited to the growing demand for high-performance and lightweight materials in the transportation sector for precision finishing, along with the developments in aerospace technology. Furthermore, these abrasives are increasingly being used in the production and maintenance processes of vehicles to ensure their proper functionality and durability.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

April 2025