June 2024

North America Liquid Packaging Market (By Packaging Type: Flexible, Rigid; By Raw Material: Plastics, Paper, Glass, Metal; By Technique: Aseptic Packaging, Modified Atmosphere Packaging, Intelligent Packaging, Vaccum Packaging; By End-Use: Food & Beverage, Pharmaceuticals, Chemicals, Personal Care, Petrochemicals) - Regional Outlook and Forecast 2025 to 2034

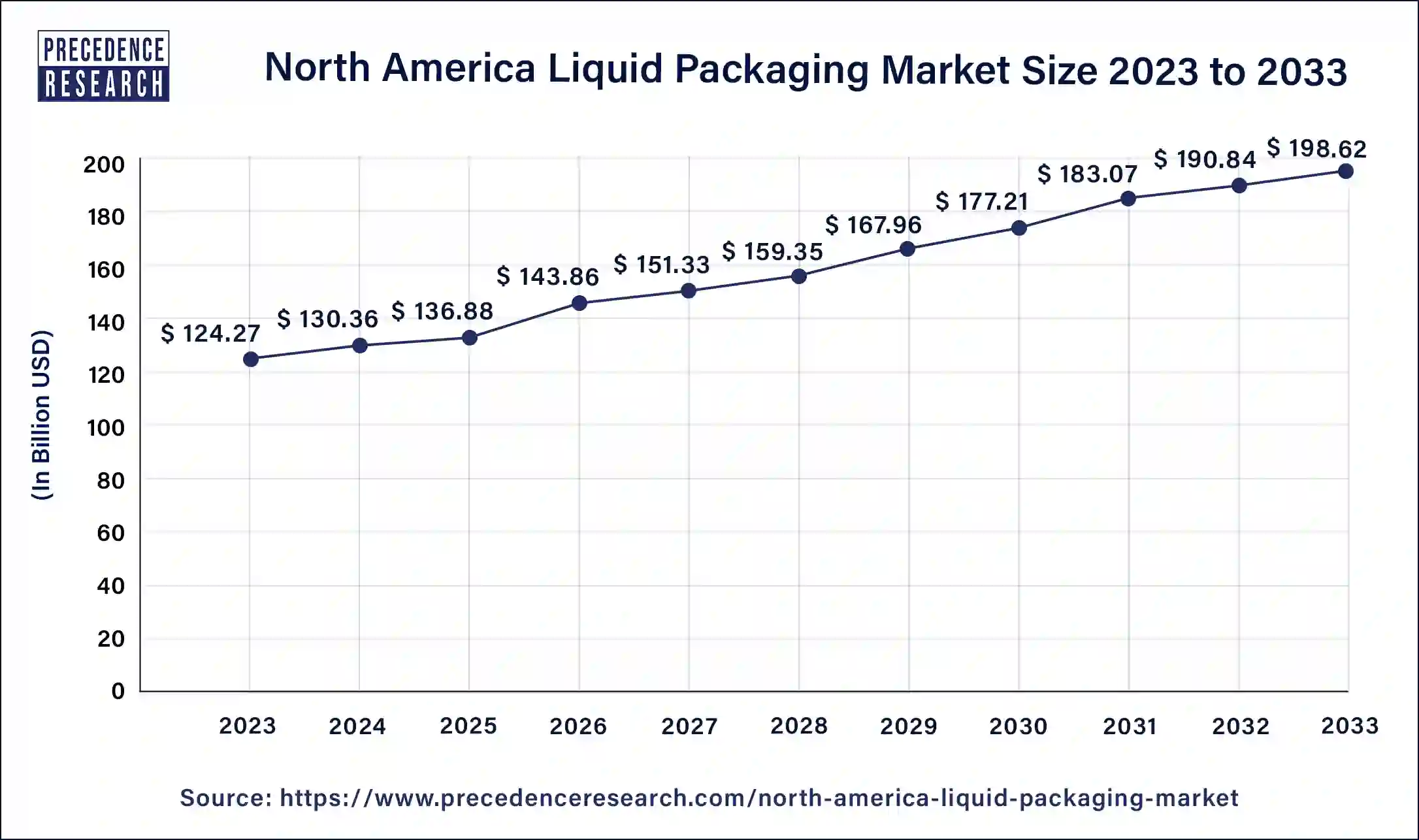

The North America liquid packaging market size was USD 124.27 billion in 2023, accounted for USD 130.36 billion in 2024, and is expected to reach around USD 198.62 billion by 2033, expanding at a CAGR of 4.80% from 2024 to 2033. The rising demand for efficient packaging solutions from the food and beverages industry is driving the growth of the market.

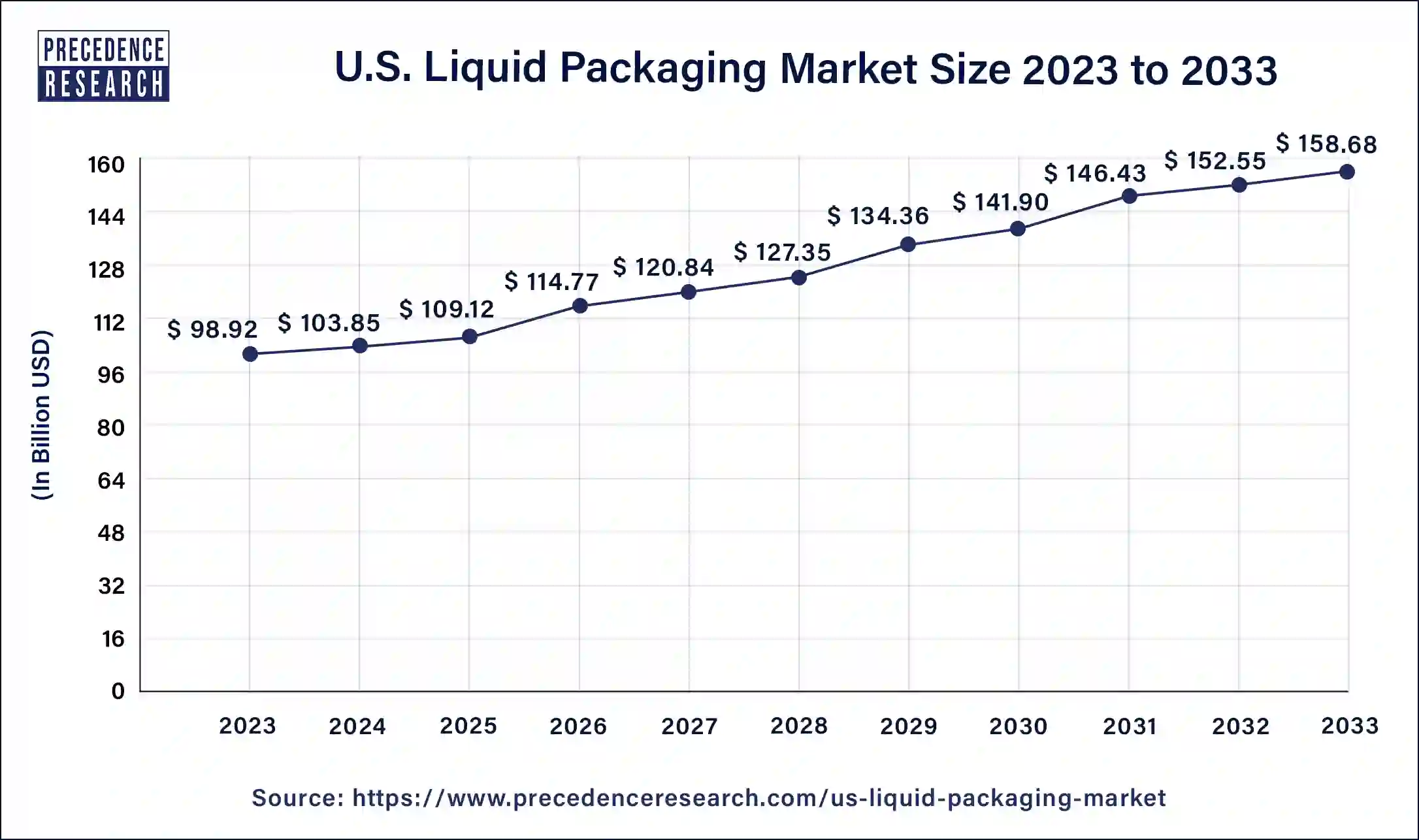

The U.S. liquid packaging market size surpassed USD 98.92 billion in 2023 and is projected to attain around USD 158.68 billion by 2033, poised to grow at a CAGR of 4.83% from 2024 to 2033.

The United States held the largest share in the North America liquid packaging market in 2023. The country is observed to sustain the position during the forecast period. The growth of the market is attributed to the rising demand for consumer goods in the population due to the increasing disposable income in the population and the rising industrialization is driving the demand for the packaging industry. The rising demand for the food and beverages industry pharmaceutical industry is driving the growth of the North America liquid packaging market.

Market Overview

The materials and packaging styles used in the packing, transportation, and storage of liquids and semi-liquids are referred to as liquid packaging. It is crucial to choose the right liquid packing in order to permit safe transportation and long-term storage. It covers both flexible and rigid packaging formats, such as films, stand-up pouches, squeezable tubes, cartons, and bag-on-box. Rigid packaging formats include bottles and containers.

A single substrate can be used for liquid packaging, or it can be a multi-layered laminate, as in the case of liquid cartons. They are employed in the packaging of both food goods and non-food items like chemicals. The North America liquid packaging market is also growing rapidly due to the increased demand for lightweight packaging goods. To address cost-related concerns throughout the value chain, a number of manufacturers have started employing lightweight packaging goods.

| Report Coverage | Details |

| North America Market Size in 2023 | USD 124.27 Billion |

| North America Market Size in 2024 | USD 130.36 Billion |

| North America Market Size by 2033 | USD 198.62 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 4.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Packaging Type, Raw Material, Technique, and End-Use |

The increasing demand for plastic packaging

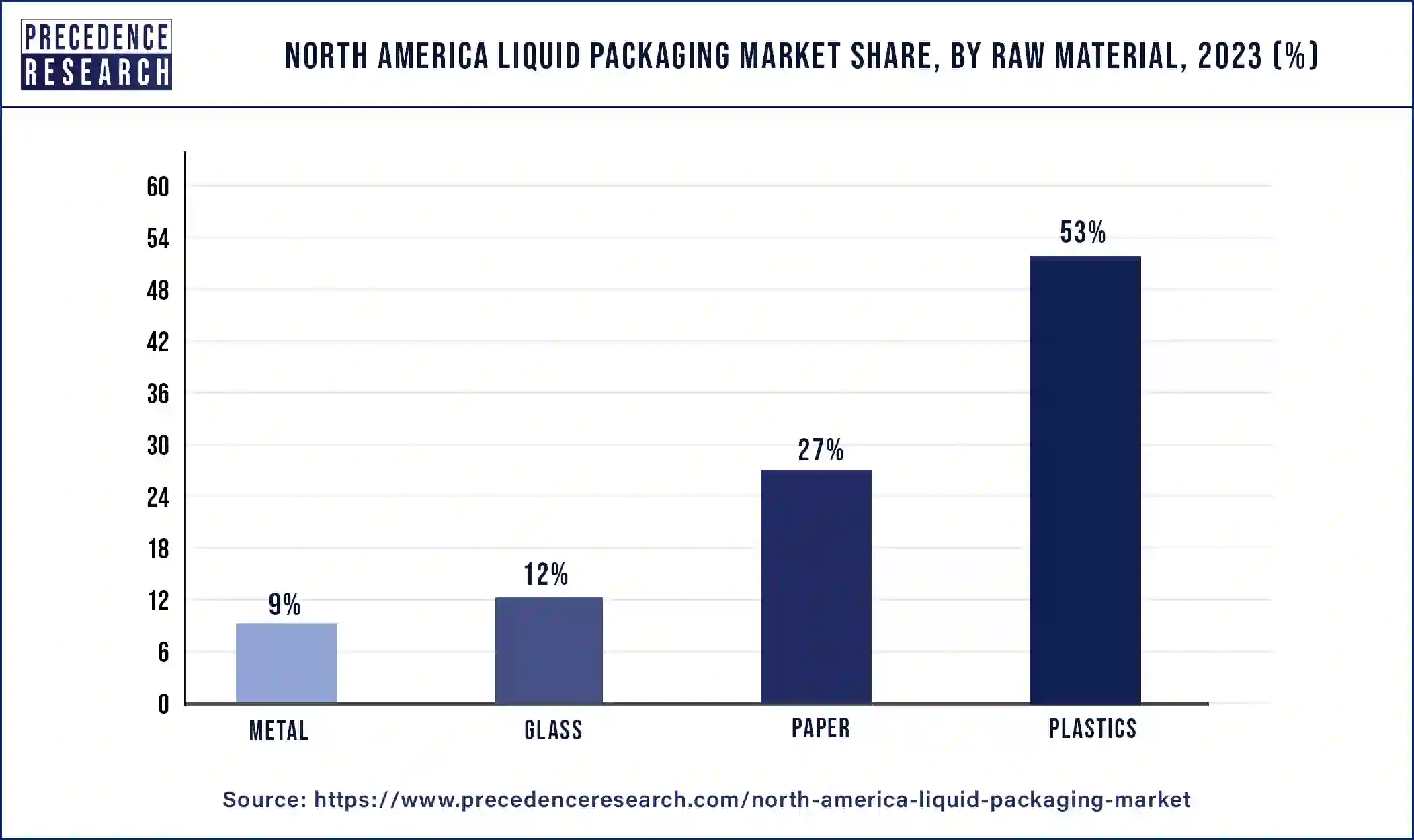

Since consumers prefer packaging that is portable and easy to carry, the use of plastics in packaging has increased due to the material's strength and light weight, which has also increased demand in the packaging sector. Manufacturers are favoring plastic packaging across industries due to its affordability and ability to extend product shelf life. Flexible plastic packaging is considered to be the ideal choice because of package reduction efforts, rising end-user demand, and improvements in global production processes.

It is anticipated that improvements in the healthcare, pharmaceutical, and cosmetics industries will increase demand for plastic packaging products. More than 60% of American consumers, according to the Flexible Packaging Association, are willing to pay more for practical and tangible packaging benefits, such as product protection, transportation friendliness, and supply chain efficiency, among others. This increases the demand for plastic packaging and, consequently, the packaging industry is contributing to the expansion of the North America liquid packaging market.

Fluctuation in raw material prices

The rising price of polypropylene results in the restriction in supply, slowing imports, and exports to Latin America. Additionally, the Mintec Global Packaging Index increased by four points to 96.3, suggesting that the average cost of plastic packaging materials is 55 cents per pound. Thus, the supply chain failure due to the spike in the price of raw materials is restraining the growth of the North America liquid packaging market.

Shifting toward renewable and innovative packaging solutions

Natural resources that are quick to replenish and are easy to grow are known as renewable raw materials. Innovative packaging solution providers have created effective, efficient, and environmentally friendly packaging solutions by fusing renewable raw materials with cutting-edge technology and creative design. Plastic and cardboard are common materials used in packaging today, and their value chains have been well-optimized.

Some renewable raw materials that can be utilized as sustainable packaging in place of traditional plastic are gaining popularity. Paper is sustainable, resource-saving, effective, and recyclable, thus cardboard and paper pulp have long been favorites. Thus, adoption of such material in the packaging industry is expected to set new opportunities over the upcoming years.

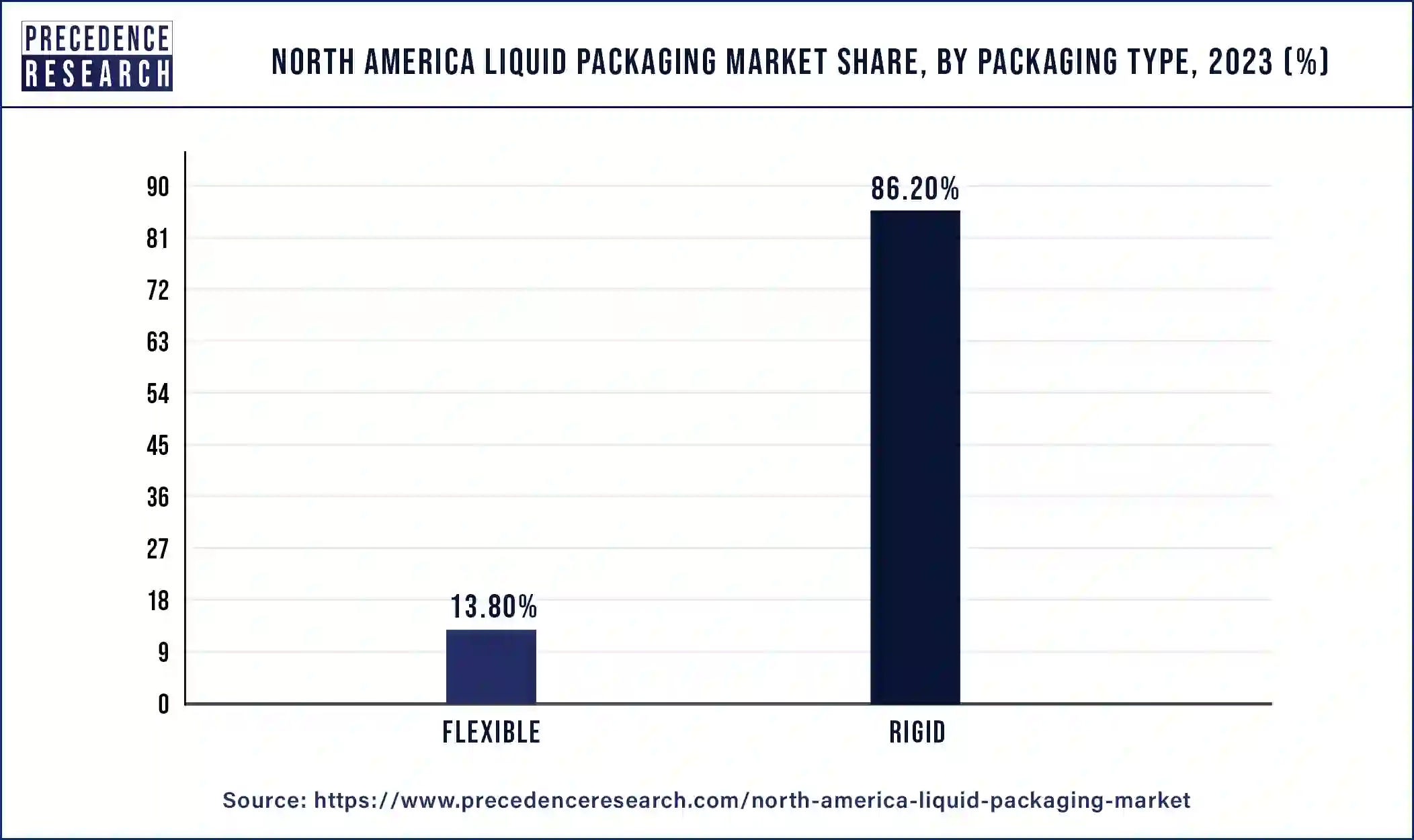

North America Liquid Packaging Market Revenue (USD Billion), By Packaging Type, 2020 - 2023

| Packaging Type | 2020 | 2021 | 2022 | 2023 |

| Flexible | 14.64 | 15.41 | 16.24 | 17.13 |

| Rigid | 93.59 | 97.82 | 102.33 | 107.14 |

The rigid segment dominated the market with the largest market share in 2023. Due to the widespread usage of glass and plastic bottles and containers, the rigid liquid packaging sector held the greatest market share. The greatest subset of rigid liquid packaging is plastics and PET bottles. Liquid products like water, fizzy drinks, wine, beverages, dairy products, and others are frequently packaged using them. The conventional packaging type for liquid items is rigid liquid packaging since it is chemically, impact, and moisture resistant as well as recyclable.

The flexible segment is observed to grow at a notable rate in the market during the forecast period. The rising adoption of flexible packaging as an alternative to rigid packaging in the wide range of consumer goods is contributing to the growth of the segment. The rising adoption of flexible packaging solutions by the personal care and cosmetics industry is expected to support the segment’s expansion.

The plastic segment held the largest market share in 2023 for the North America liquid packaging market. A polymer material with various properties that make it excellent for product packaging is polyethylene terephthalate (PET). The type of plastic that gets recycled the most globally is PET.

It is transparent, sturdy, chemically inert, eco-friendly, and lightweight, enabling the production of big, light, safe containers. It is also simple to embellish packaging made of it with printed patterns or effects to match the aesthetics of various goods or brands. Eco-PET 100 is entirely constructed of post-consumer recycled materials. PET is very adaptable, which is why the liquid packaging sector uses clear PET plastic.

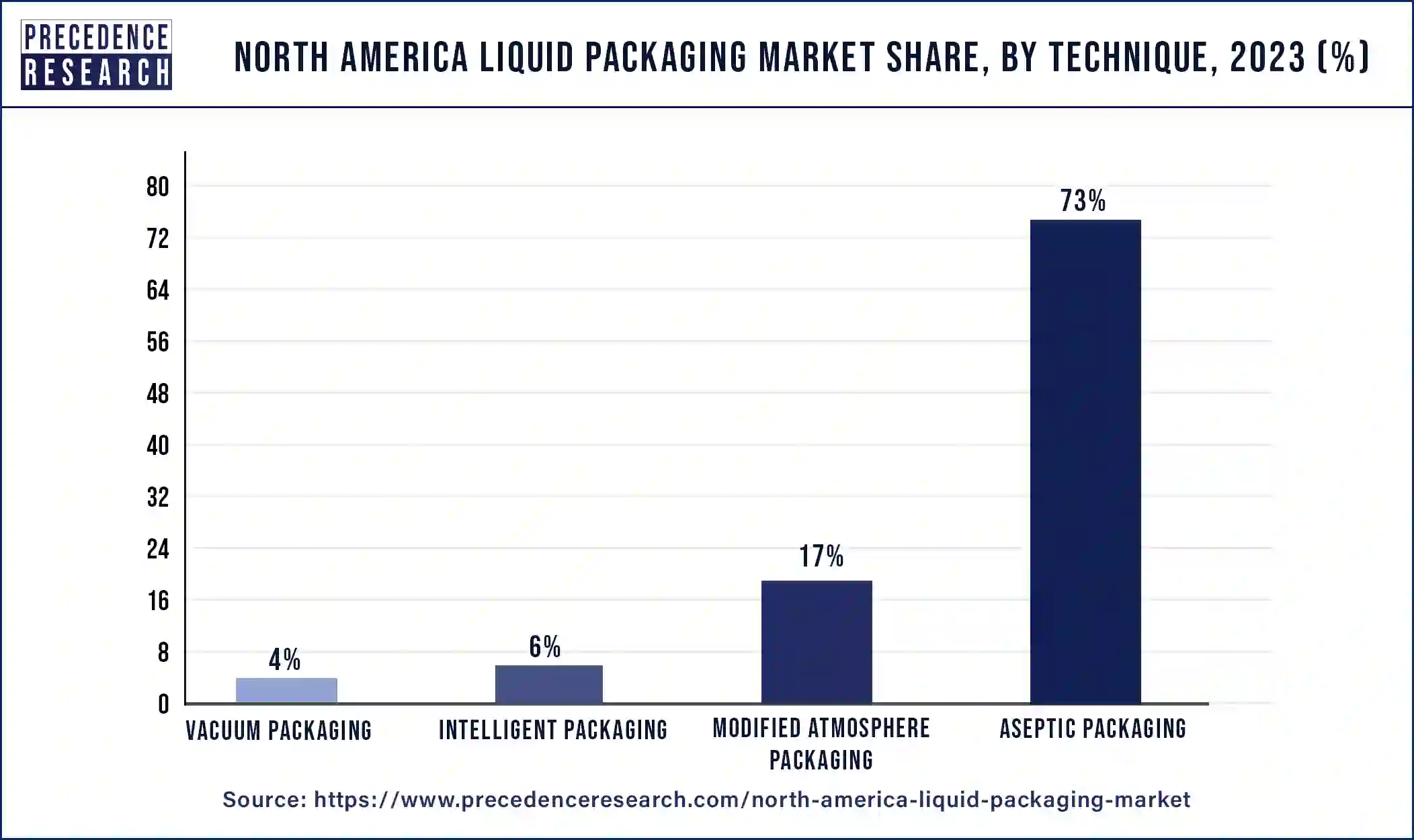

The aseptic packaging segment dominated the North America liquid packaging market with the largest market growth in 2023. The aseptic liquid packaging segment was the largest technique used in liquid packaging.

A commercially sterile product, such as a beverage, personal care item, pharmaceutical, or other product, is filled into a sterile container under aseptic conditions and hermetically sealed. This procedure is known as aseptic liquid packaging. In order to preserve the contents' freshness, extremely high temperatures are used. It works well to prolong product shelf life and preserve product quality.

The food and beverage segment dominated the North America liquid packaging market in 2023. Food & beverage is the largest end-use industry for liquid packaging. The food and beverage-associated businesses are expanding quickly, and its expansion is being aided by increased economic prosperity and population growth. Bag-in-box, stand-up pouch, plastic & PET bottles, cans, glass, films, paperboard, and cartons are some of the several packaging styles used for food & beverage packaging. These packaging options are used for liquid products like water, juices, dairy products, drinks, wine & spirits, detergents, and household cleaning supplies, among others.

The pharmaceutical segment is expected to grow at a significant rate in the market during the forecast period. The rising pharmaceutical and healthcare industry in the region, and the rising demand for the packaging material for pharmaceutical storage of drugs that fueling the growth of the segment in the market.

Recent Developments

Segments Covered in the Report

By Packaging Type

By Raw Material

By Technique

By End-Use

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

January 2025

November 2024

January 2025