December 2024

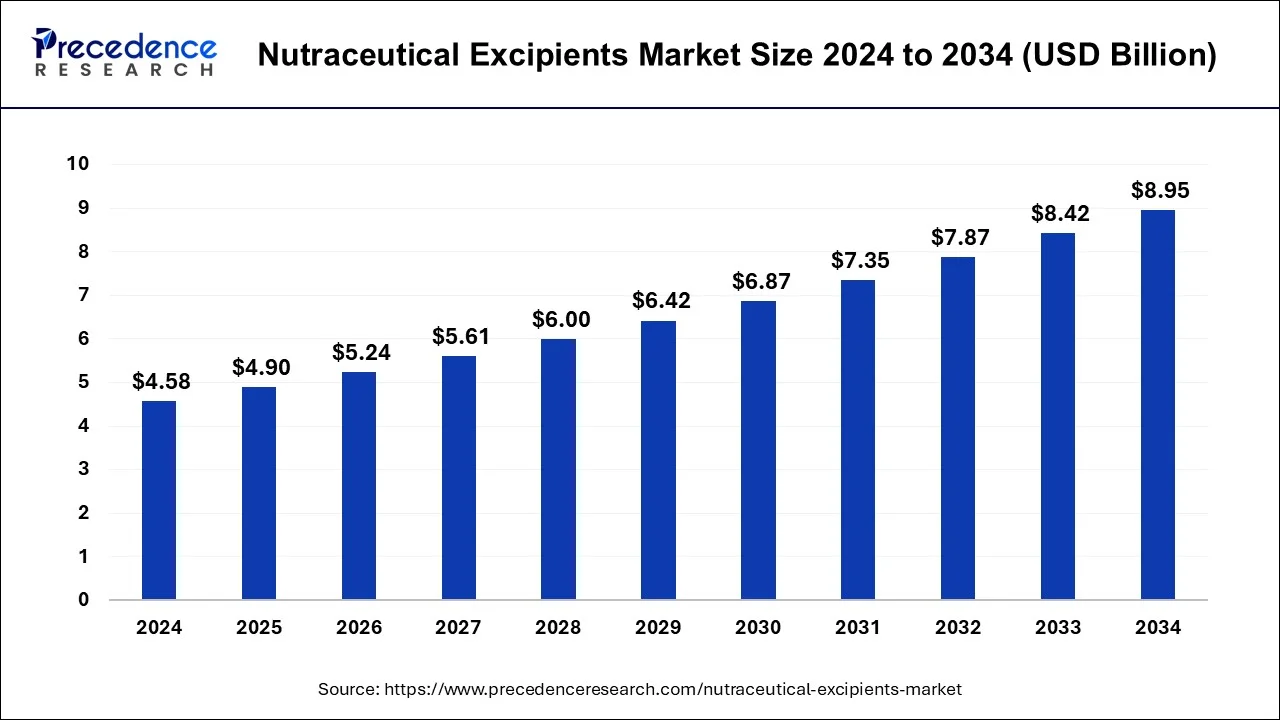

The global nutraceutical excipients market size is estimated at USD 4.90 billion in 2025 and is forecasted to reach around USD 8.95 billion by 2034, accelerating at a CAGR of 6.93% from 2025 to 2034. The North America nutraceutical excipients market size surpassed USD 1.88 billion in 2024 and is expanding at a CAGR of 7.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nutraceutical excipients market size was accounted for USD 4.58 billion in 2024, and is expected to reach around USD 8.95 billion by 2034, expanding at a CAGR of 6.93% from 2025 to 2034.

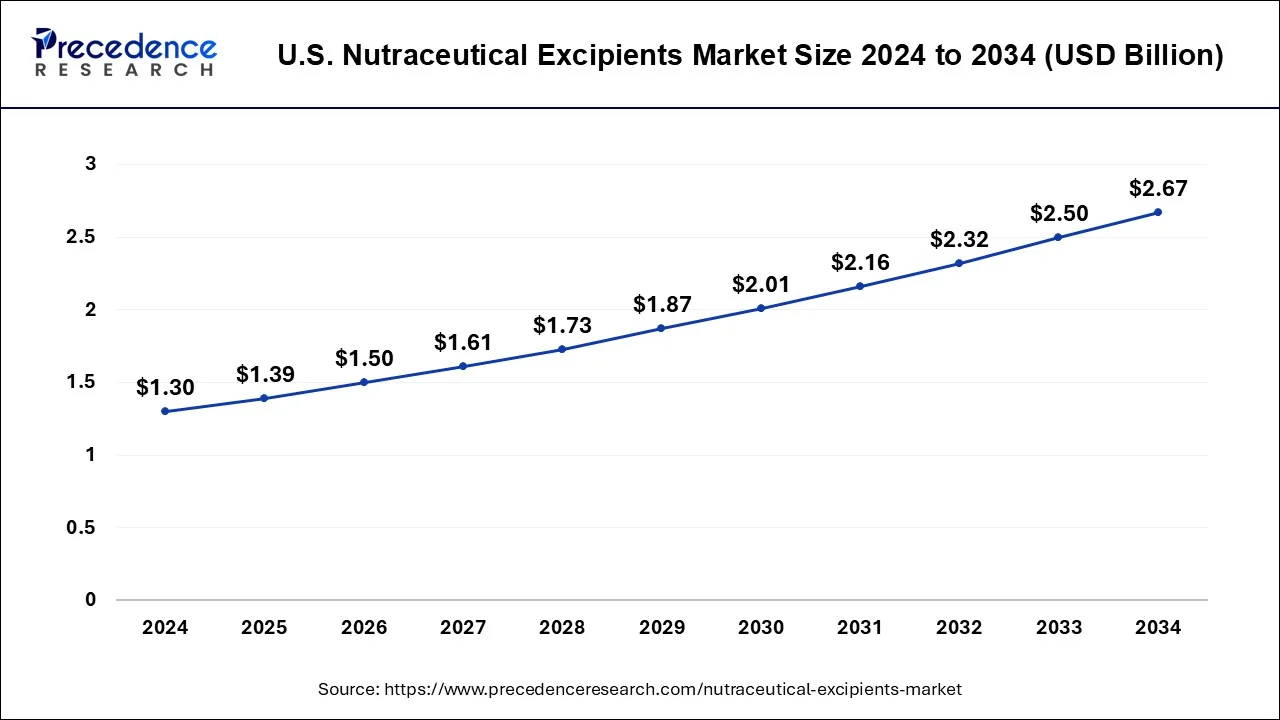

The U.S. nutraceutical excipients market size was estimated at USD 1.30 billion in 2024 and is predicted to be worth around USD 2.67 billion by 2034, at a CAGR of 7.46% from 2025 to 2034.

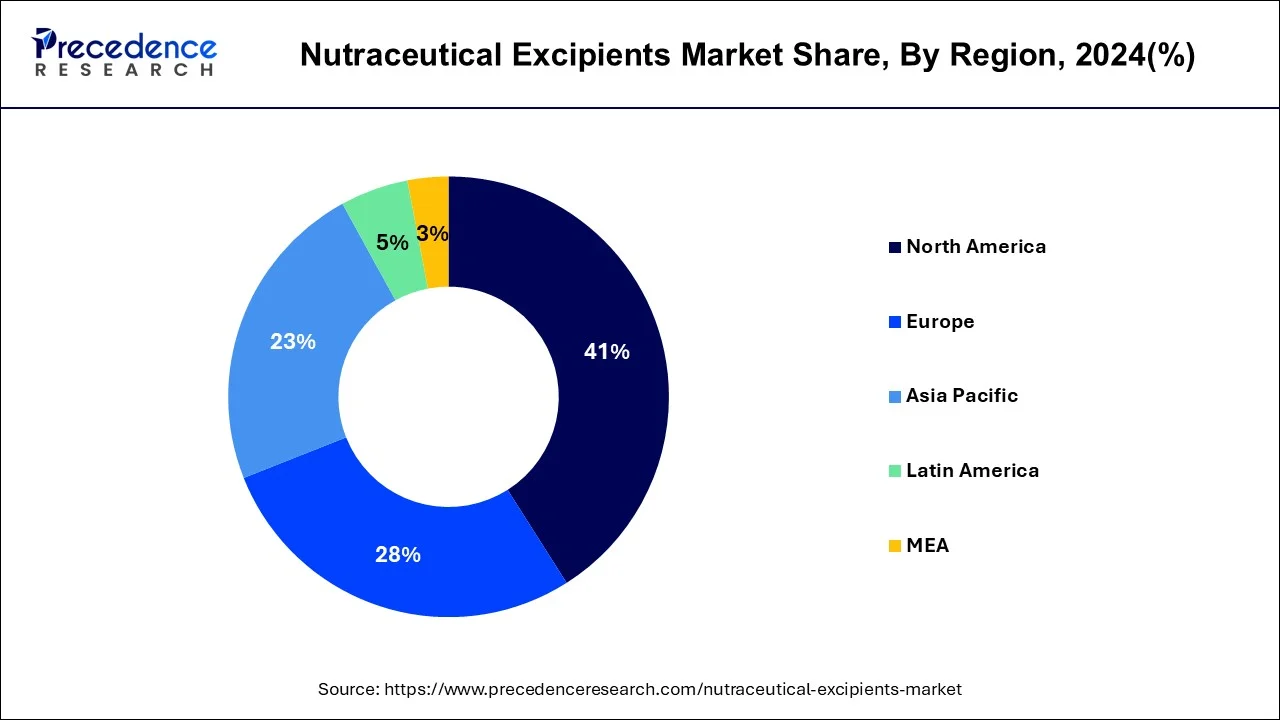

The highest market share and dominant position in the nutraceutical excipients market belongs to North America. The rise of nutraceutical excipients in the North American region has fueled the demand for functional food products. This growth has been attributed to factors such as consumer busy lifestyles, and growing consumer awareness of the health benefits of nutritional foods, including food supplements. In addition, new product launches and the use of technology have made excipients available for use in new and innovative ways.

The market for nutraceutical excipients is anticipated to expand at the quickest rate in the Asia Pacific region. This region majorly includes China, India, and Japan. The region's food sectors, such as nutraceuticals, have promising prospects for growth and diversification as a result of the rise in income and purchasing power, massive expansion of the middle-class population, rise in awareness among consumers of health and fitness, and rise in consumer consumption for nutritional and healthy products. The market players are focusing on the products in this region owning to its population rising factor which boosts the demand for such products in the market. The rising population is leading the market in a significant position as the illness and problems are also rising due to various factors that hence spikes the demand of nutraceutical excipients market.

Excipients for nutraceuticals are inactive substances that are included with active pharmaceutical ingredients to bulk up solutions that contain potent active compounds. Standardized and pharmaceutical-grade supplements use these nutraceutical excipients. Various chemicals found in dietary supplements are unstable in the presence of heat, light, oxygen, and high humidity. They might also have a varied particle size distribution, poor flow, and bulk density. The incorporation of various nutraceutical excipients, including fillers, diluents, disintegrants, binders, coating agents, flavoring agents, colorants, sweeteners, lubricants, and others, during the manufacturing of various forms of supplements helps to manage the unstable character of the compounds. Numerous types of nutraceutical products, including antioxidants, probiotics, prebiotics, nutritional supplements, and others, are sold on the market. When combined with exercise, these items have been shown to help prevent various illnesses.

Nutraceutical excipients market has binders, fillers, coating agents and flavoring agents. The most important food additions are flavorings, which come in a huge variety of natural sources like wine, vegetables, spice blends, seafood, nuts, and fruit. Chemical flavors that imitate natural flavorings include alcohols, which have a medicinal and bitter flavor, pyrazines, and ketones, which give caramel flavor, terpenoids, which have a pine or citrus flavor, phenolics, which have a smokey flavor, and esters, which have a fruity flavor. The main purpose of flavoring substances is to serve as masking agents and improve the taste of the content.

The demand for nutraceuticals is being driven by factors such as rising middle-class consumption and disposable income in countries like China and India, an ageing population, increased urbanization, an increase in the prevalence of lifestyle-related diseases like high blood pressure, diabetes, and cardiac conditions, inadequate nutrition as a result of consumers' busy lifestyles, and the high cost of healthcare. The demand for dietary, food, and supplement supplements is being driven by the increase in diabetes and osteoarthritis cases. Due to growing geriatric and health issues, there is a greater requirement for dietary supplements, which has led manufacturers to adopt nutraceutical excipients.

Additionally, it can be used to increase wellbeing, slow down ageing, prevent the onset of chronic diseases, enhance life expectancy, or maintain the structure of the body.

Due to the region's intense concentration of the nutraceutical excipients market, growth is less rapid. The demand for functional food products has been fueled by the rise in nutraceutical excipients in the North American region, which is a result of consumers' busy lifestyles, the prevalence of chronic diseases brought on by busy lifestyles, and a growing consumer awareness of the health benefits of nutritional foods, including food supplements.

Products known as nutraceuticals can be used as medicine in addition to being nutritional. A substance that has physiological benefits or offers protection against chronic disease may be referred to as a nutraceutical product. Nutraceuticals can be used to boost wellbeing, slow down ageing, stop chronic diseases from occurring, lengthen life expectancy, or support the body's structure or functions. Due to their potential for having nutritional, safe, and therapeutic impacts, nutraceuticals have recently attracted a lot of attention. Although both pharmaceutical and nutraceutical substances may be used to treat or prevent disease, only pharmaceutical substances are approved by the government. Due to their potential for having nutritional, safe, and therapeutic impacts, nutraceuticals have recently attracted a lot of attention.

Nutraceutical such as Probiotics, which contain yeast and beneficial bacteria, are advantageous to consumers because they boost digestion and gut health, immunity, nutrient absorption, and the risk of developing food allergies. Yogurt, beverages, and dietary supplements in the form of tablets and capsules are just a few of the different formats in which probiotic products can be found.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.90 Billion |

| Market Size by 2034 | USD 8.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.93% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Functionality, By Product, By Type, By Form, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Depending upon the functionality, the binder segment is the dominant player and is anticipated to have the biggest impact on nutraceutical excipients market. Binder excipients, such as those used in tablets, hold a formulation's constituents together. Binders make it possible to produce tablets, powders, granules, and other products with the necessary mechanical strength.

Fillers & diluents hold a significant position in nutraceutical excipients market. A diluent is a substance that dilutes. Some liquids are either too dense to flow from one place to another or too viscous to be easily pumped. This can be a concern because it might not be practical to transfer these fluids at this time in terms of cost. Fillers make a product more voluminous and facilitate consumer absorption of tiny active chemicals. The filler is included in the material to enhance its performance or to add to its volume, weight, or both while decreasing the price of the solid material. Combining and stabilizing the supplement is the filler.

During the projected period, the probiotics segment is anticipated to be the largest in the nutraceutical excipients market. The health advantages of probiotic-fortified foods, the versatility of probiotics, and the growing usage of probiotics in food as a result of expanding consumer awareness of the need of a balanced diet are all contributing to an increase in the global demand for probiotics. Due to rising customer interest in high-end products fortified with probiotics and growing knowledge of their advantages, the demand for probiotics in fortified meals is expected to continue strong.

Prebiotics and probiotics are increasingly popular dietary supplements because of the persistently rising prevalence of lifestyle disorders worldwide. In order to meet the growing nutritional demands of consumers, pre- and probiotics are being rapidly adopted.

The detrimental health effects of a sedentary lifestyle are being considered by consumers when making food decisions. The segment is expected to experience rapid growth over the next few years as dietary supplements and heavy pre- and pro-biotic consumption become necessities of the hour.

The dry form of nutraceutical excipients represented a larger market share than the liquid version. Its appeal can be ascribed to dry form's accessibility and usefulness in a variety of applications. Due to growing consumer demand for specialized blends, fortified beverages, and dry beverage mixes with additional nutrients, the market for dry beverage blends is growing.

Azelis Chemical Limited announced the acquisition of CosBond, a major specialty chemical and food ingredient distributor in China, in order to solidify their leadership in the country and capitalize on CosBond's current clientele.

By Functionality

By Product

By Type

By Form

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024