January 2025

Nutraceutical Packaging Market (By Packaging Type: Bottles and Jars, Bags and Pouches, Cartons, Stick Packs, Blister Packs, Other; By Product: Dietary Supplements, Functional Foods, Herbal Products, Isolated Nutrient Supplements, Other; By Material: Plastic, Glass, Metal, Paper and paperboard, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

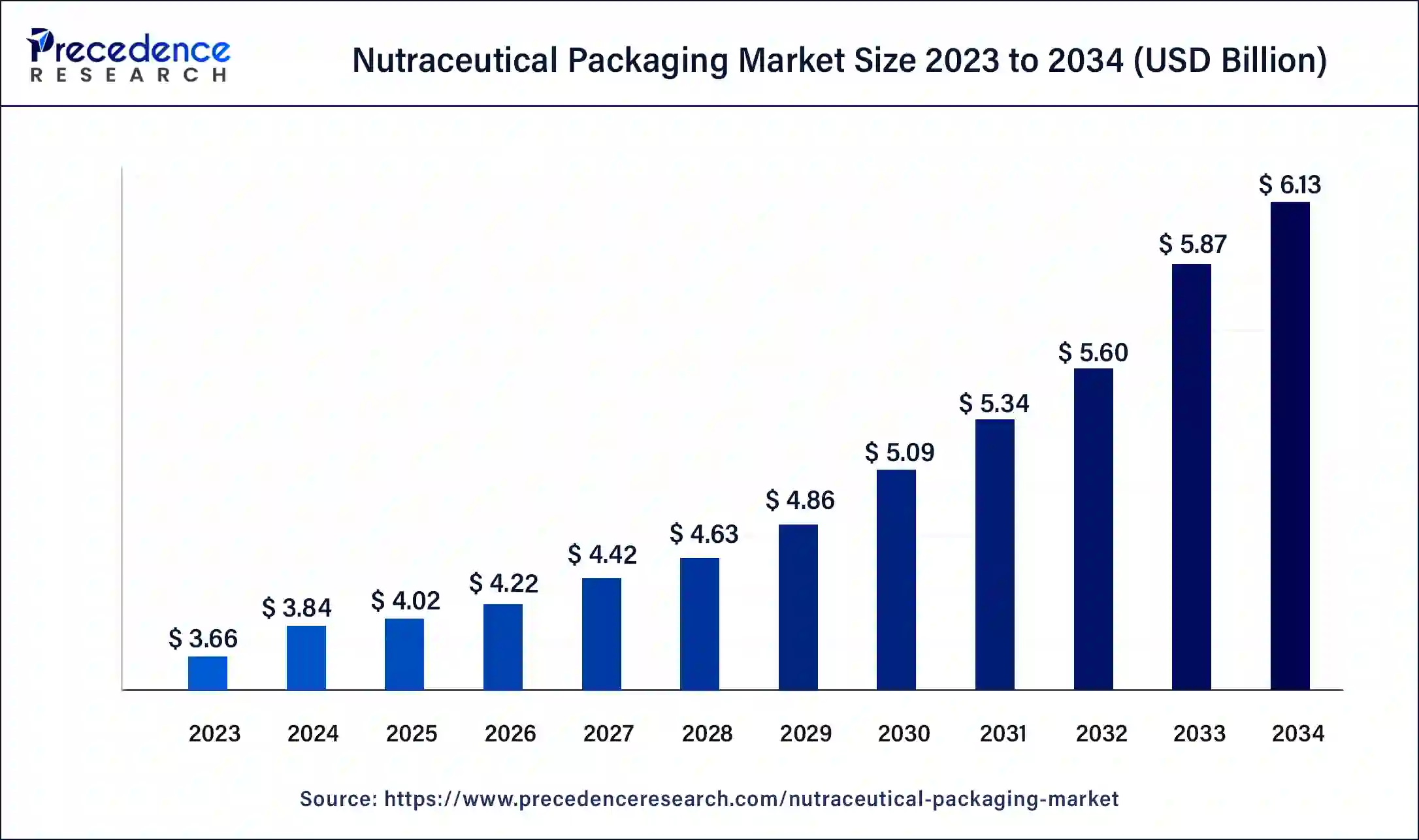

The global nutraceutical packaging market size was USD 3.66 billion in 2023, calculated at USD 3.84 billion in 2024 and is expected to reach around USD 6.13 billion by 2034, expanding at a CAGR of 4.8% from 2024 to 2034. The nutraceutical packaging market size reached USD 1.94 billion in 2023.

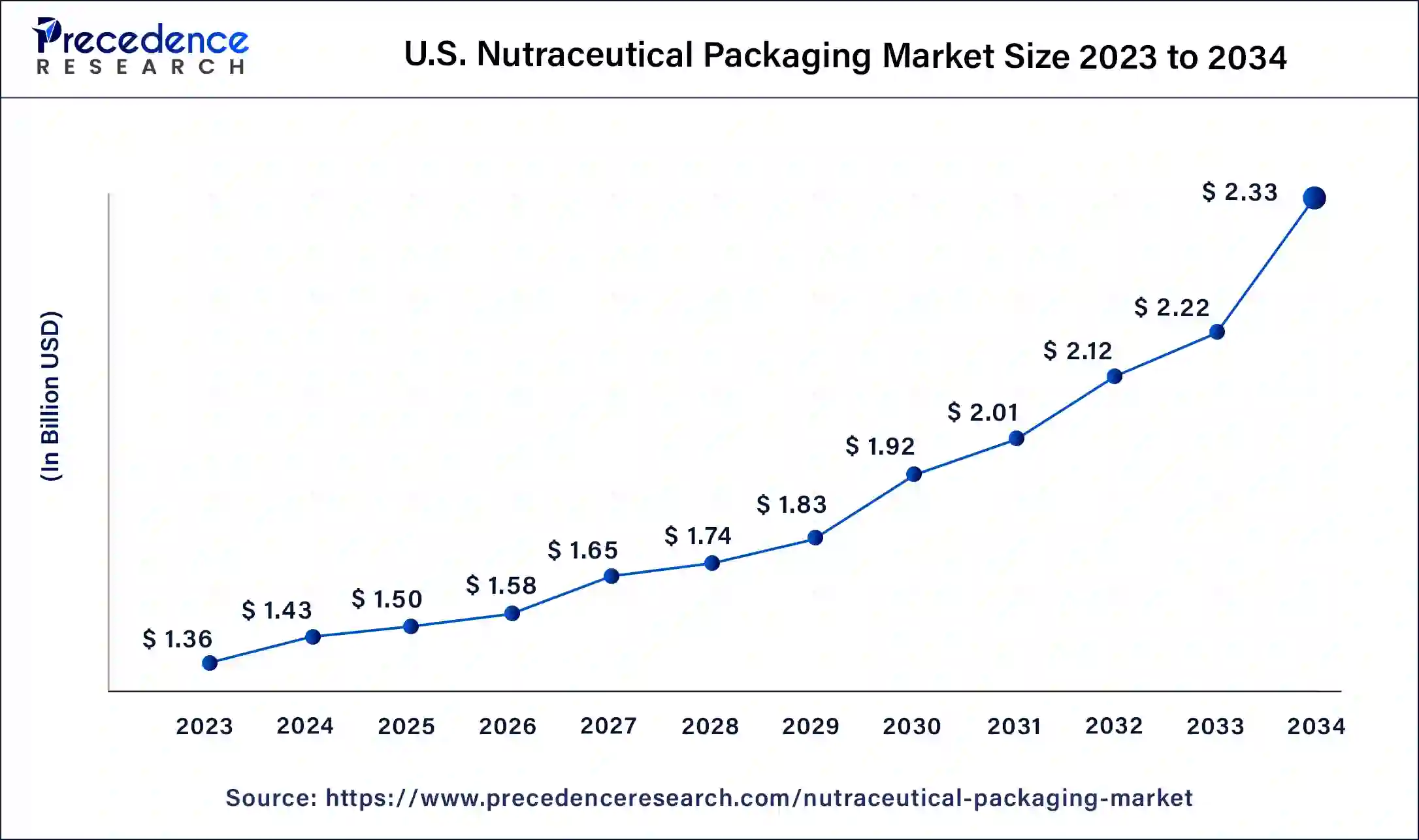

The U.S. nutraceutical packaging market size reached USD 1.36 billion in 2023 and is projected to surpass around USD 2.33 billion by 2034 at a CAGR of 5% from 2024 to 2034.

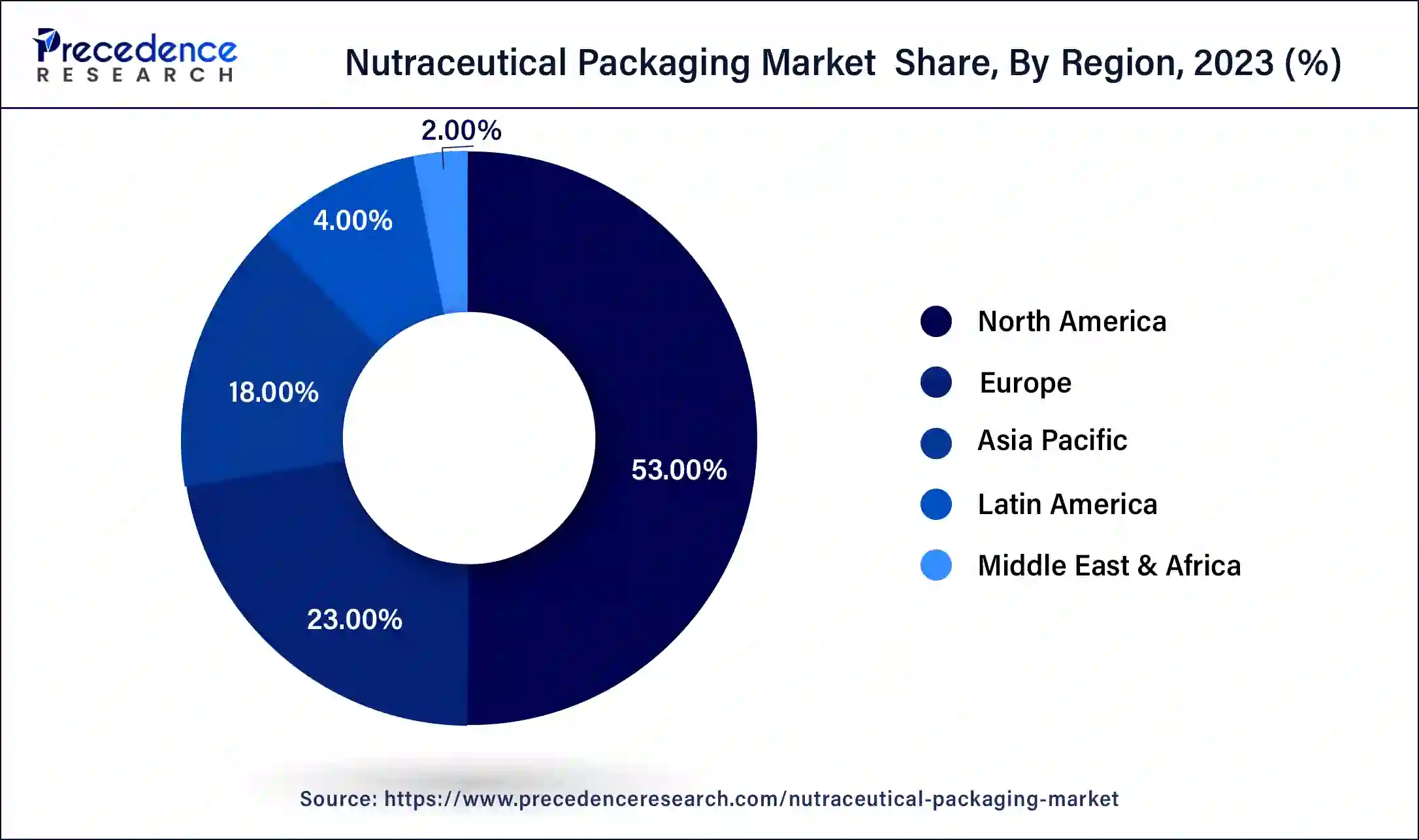

North America dominated the nutraceutical packaging market in 2023. Nutraceutical products are derived from food sources with more health benefits in addition to their basic nutritional value. These health benefits are food products sold in the form of pills, powders, liquids, or also marketed as health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods.

Nutraceutical products help to reduce the risk of chronic diseases, including cardiovascular diseases, diabetes, certain cancers, and age-related macular degeneration. The rising prevalence of such chronic diseases in North America countries promotes the market’s expansion. Awareness of nutraceutical products, including information about nutraceuticals, the benefits and uses of nutraceutical products, etc., can boost the market for nutraceutical products in North America.

Europe is expected to grow to the highest CAGR in the nutraceutical packaging market by region during the forecast period. Europe has a growing population that is becoming more health-conscious, which increases the demand for nutraceutical products and has a positive impact on the nutraceutical packaging market. Additionally, the integration of robotic packaging can be an opportunity for the nutraceutical packaging market.

The nutraceutical packaging market refers to the dedicated industry that offers packaging design specially for the products in the nutraceutical industry. Nutraceutical packaging may include features like temper evident seals, moisture barriers, UV protection, and child resistance closures depending on the specific need of the products and their intended use.

Nutraceutical products are derived from food sources with more health benefits in addition to their basic nutritional value. These health benefits are food products sold in the form of pills, powders, and liquids or also marketed as health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods. Nutraceutical packaging helps maintain product freshness, reduce transportation costs and overall carbon footprint, enhance shelf appeal, create convenient packaging, and boost the sustainability of nutraceutical products.

The nutraceutical packaging market is fragmented with multiple small-scale and large-scale players, such as Alpha Packaging, Amcor Limited, Gerresheimer AG, Mondi Plc., RPC Group, Graham Packaging Company, Sonoco Products Company, Constantia Flexible Group GmbH, ALPLA Werke Alwin Lehner GmbH & Co KG, Flex-pack, Innovia Film, Law Print & Packaging Management Ltd., American Nutritional Corporation, Wasdell Packaging Group, PontEurope, Arizona Nutritional Supplements LLC, Comar, Medifilm AG, Origin Pharma Packaging, CSB Nutrition Corporation, Nutra Solutions, etc.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 6.13 Billion |

| Global Market Size in 2023 | USD 3.66 Billion |

| Global Market Size in 2024 | USD 3.84 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Packaging Type, Product, Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising popularity of nutraceutical products

The rising popularity of nutraceutical products can boost the nutraceutical packaging market. Nutraceutical products are derived from food sources with health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods.

Nutraceutical products help to reduce the risk of chronic diseases, including cardiovascular diseases, diabetes, certain cancers, and age-related macular degeneration. Awareness of nutraceutical products, including information about nutraceuticals, the benefits and uses of nutraceutical products, etc., can boost the market for nutraceutical products.

Benefits of nutraceutical packaging

The benefits like temper evident seals, moisture barriers, UV protection, and child resistance closures of nutraceutical packaging can grow the demand for nutraceutical packaging, which may lead to the growth of the nutraceutical packaging market. Nutraceutical packaging may include benefits like temper evident seals, moisture barriers, UV protection, and child resistance closures depending on the specific need of the products and their intended use.

Nutraceutical products are derived from food sources with more health benefits in addition to their basic nutritional value, and if the benefits of packaging nutraceuticals are good, then there is a rise in demand for the nutraceutical packaging market.

Negative impact on the environment

The negative impact of nutraceutical packaging on the environment may slow down the progress of the nutraceutical packaging industry. The packaging materials include plastic, glasses, metals, and paper. These materials are non-biodegradable materials, which means these materials do not decompose naturally.

Materials like plastics, glass, and metals take hundreds of years to degrade, are responsible for the cause of pollution, and are also harmful to animals. The packaging materials contain chemicals like bisphenol A (BPA) and phthalates. These compounds can come into the food and pose health risks.

Integration of robotic packaging

The integration of robotic packaging can be an opportunity for the nutraceutical packaging market. A packing robot can complete the operations such as filling, transporting, sealing, palletizing, opening, labeling, and code products. Robots can pack and load cartons and also fulfill secondary packaging applications, like printing a cartoon on the back of a cereal box. Robotic packaging helps to streamline the entire packaging line, boost system accuracy, and increase productivity, which may derive the nutraceutical packaging market.

The bottles and jars segment dominated the nutraceutical packaging market by packaging type in 2023. Bottles and jars are the most common packaging type of nutraceutical products. The bottles and jars are useful for capsules, soft gels, liquids, tablets, and gummies. Their rigid shape protects the contents from moisture, oxygen, pests, and physical damage. The bottles and jars prevent the nutraceutical products from physical oxygen, damage, moisture, and pests. The transparent bottles and jars are best for showcasing nutraceutical products and their quality. Nutraceutical products are health benefits food products sold in the form of pills, powders, and liquids or also marketed as health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods.

The bags and pouches segment is expected to grow to the highest CAGR in the nutraceutical packaging market by packaging type during the forecast period. Bag-and-pouch packaging provides eco-conscious solutions that help keep nutraceuticals safe and fresh from fill through end-use. Nutraceutical packaging may include features like temper-evidence seals, moisture barriers, UV protection, and child-resistant closures depending on the specific needs of the products and their intended use.

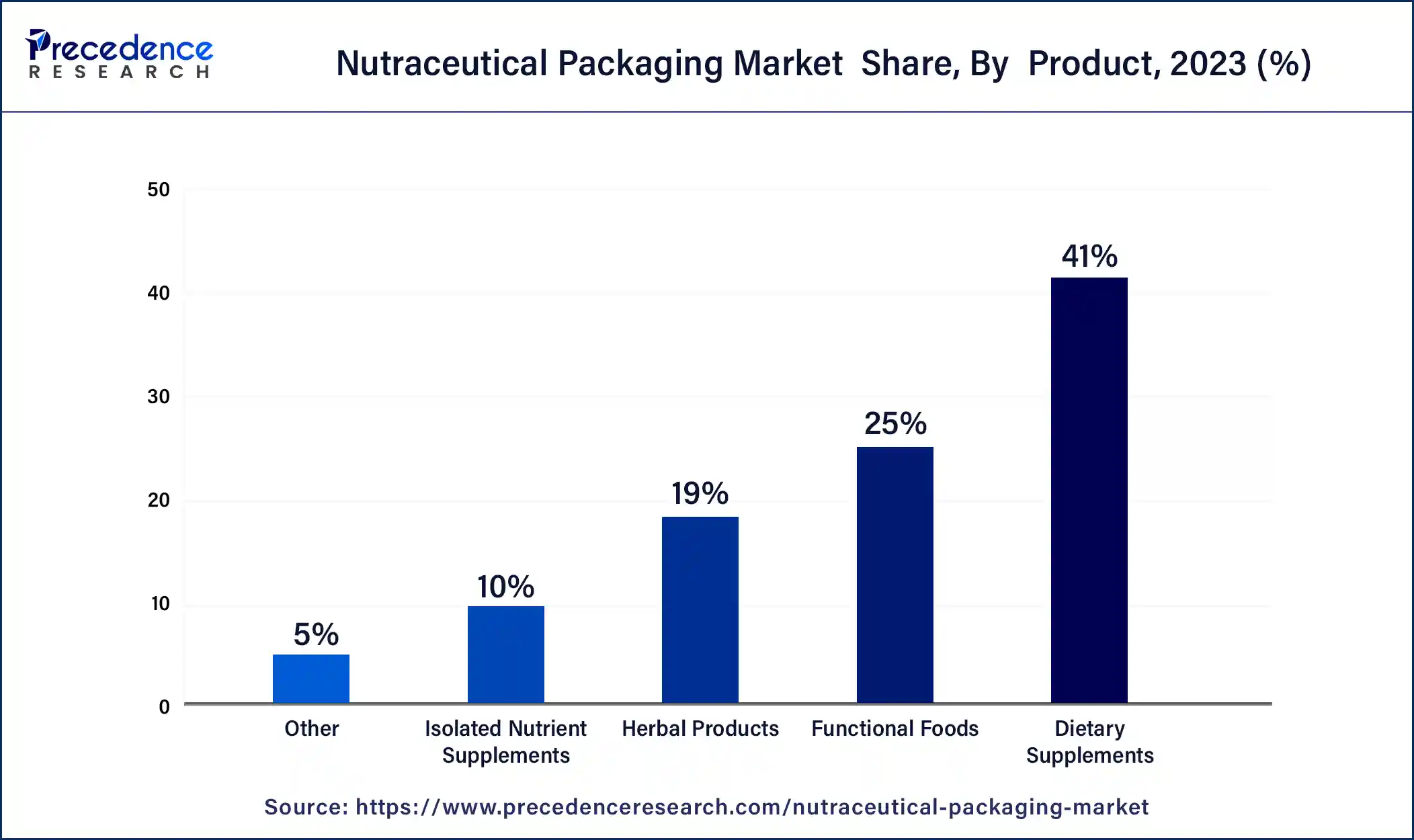

The dietary supplement segment dominated the nutraceutical packaging market by product type in 2023. The dietary supplement is manufactured to improve and maintain the overall health of individuals. Dietary supplements are also useful in fulfilling the daily requirement for essential nutrients. The dietary supplements include vitamins, minerals, proteins, amino acids, bodybuilding supplements, essentially fatty acids, natural products (like extracts from plants, animals, algae, fungi, or lichens), fertility, prenatal, and pharmacotherapy.

The functional foods segment is expected to grow to the highest CAGR in the nutraceutical packaging market by product type during the forecast period. Functional foods are used for health promotion or disease prevention by adding ingredients that are essential for the individual or according to the disease. Functional foods include food, beverage, and supplement sectors, which are essential for individuals to prevent disease and promote health. Functional foods are further divided into four types. These include modified foods, medical foods, conventional foods, and foods for special dietary use.

The plastic segment dominated the nutraceutical packaging market by material type in 2023. The packing of plastic allows nutraceutical industries to protect, preserve, store, and transport products in a variety of ways. Plastics are used because of the combination of benefits like durability, safety, hygiene, security, lightweight, and design freedom. Examples of plastic packaging include bottles, jars, bulk containers, trays, and blister packing.

The glass segment is expected to grow to the highest CAGR in the nutraceutical packaging market by material type during the forecast period. The glass is made by cooling a heated, fused mixture of silicates, lime, and soda to the point of fusion. After cooling, the glass comes in the condition of substance which is continuous with, and similar to, the liquid state but which, as a result of a reversible change in viscosity, has attained so high a degree of viscosity as to be for all practical purposes solid. There are two types of glass packaging used for nutraceutical products, bottles with a narrow neck, jars, and pots with wide openings.

Segments Covered in the Reports

By Packaging Type

By Product

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025