July 2024

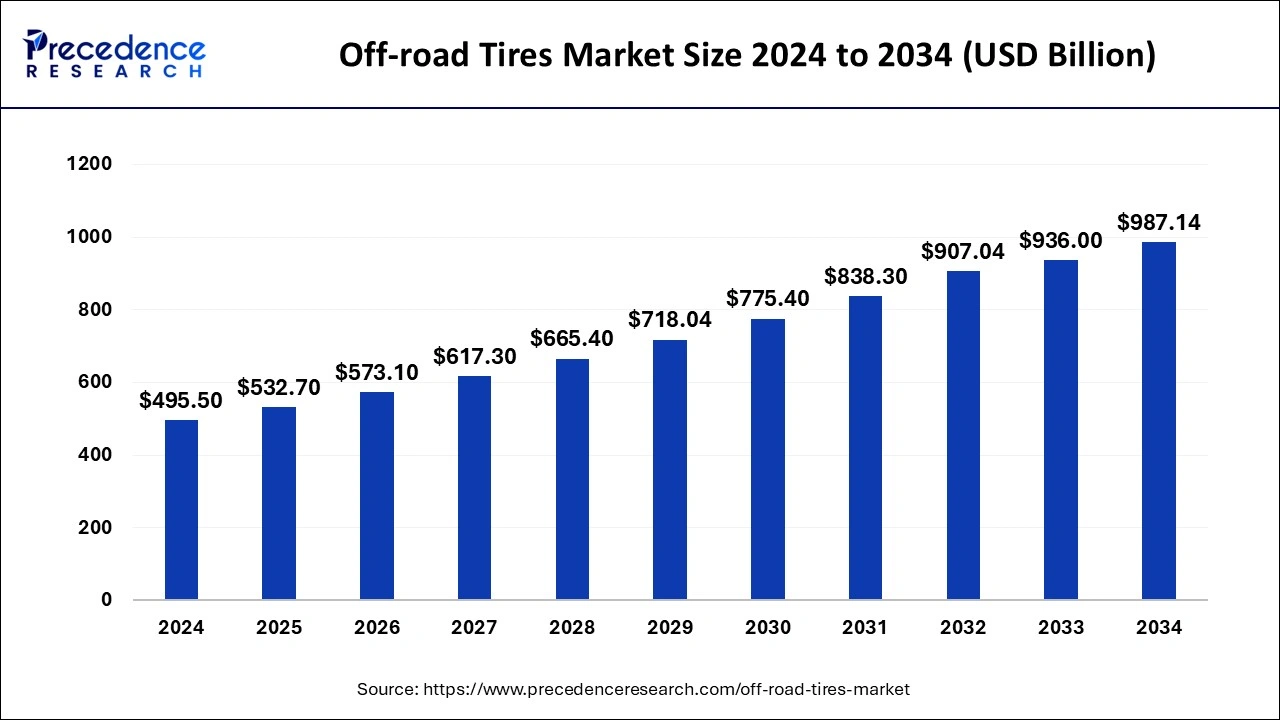

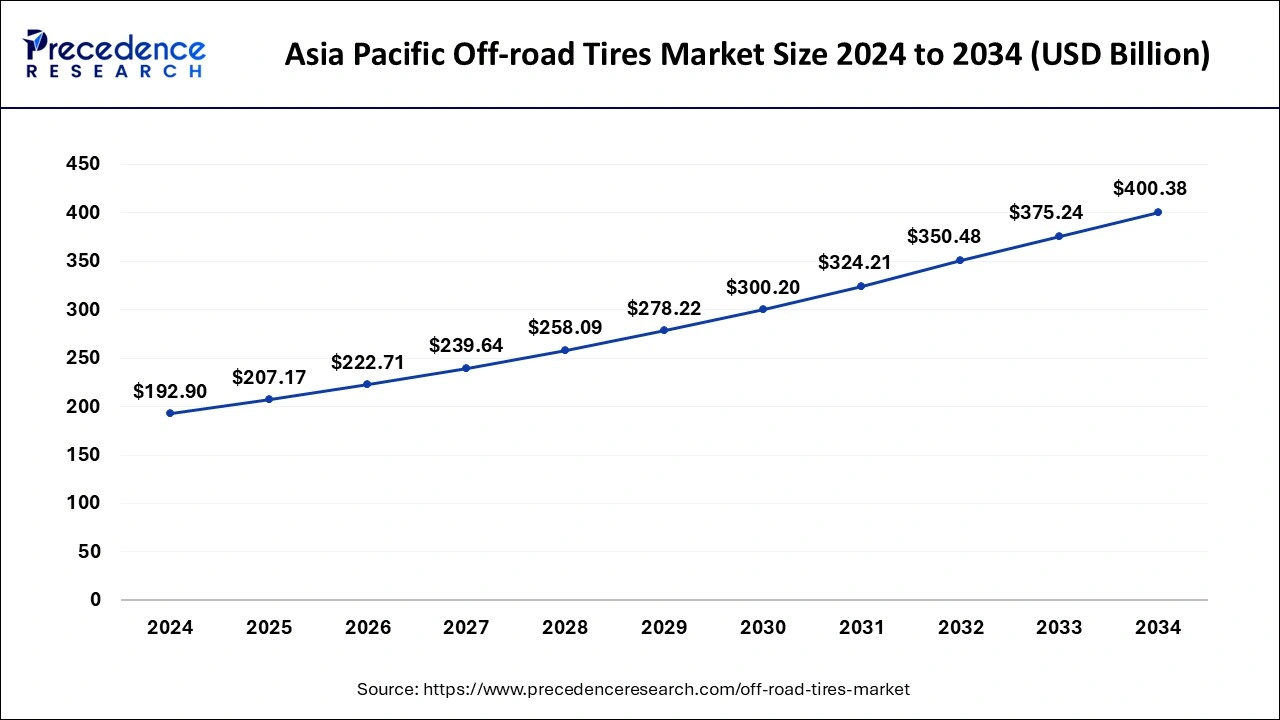

The global off-road tires market size is calculated at USD 532.7 billion in 2025 and is forecasted to reach around USD 987.14 billion by 2034, accelerating at a CAGR of 7.13% from 2025 to 2034. -based (USD Million/Billion), with 2024 as the base year. The Asia Pacific off-road tires market size surpassed USD 207.17 billion in 2025 and is expanding at a CAGR of 7.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global off-road tires market size was estimated at USD 495.5 billion in 2024 and is anticipated to reach around USD 987.14 billion by 2034, expanding at a CAGR of 7.13% from 2025 to 2034.

Artificial intelligence algorithms can be integrated into terra mechanics engineering for the modeling and predicting target parameters. AI can be involved in modeling and predicting traction, soil stress, soil sinkage, etc. based on the movement of the traction device on the soil. AI-based methodologies can address the challenges associated with soil-machine interaction. Machine learning can process large data sets and enhances the efficiency of off-road vehicles. Machine learning and other optimization methods enhance vehicle mobility, improve traction, optimize energy efficiency, and minimize environmental impacts. Machine learning, evolutionary algorithms, and neural networks help to understand and model soil-wheel dynamics.

The Asia Pacific off-road tires market size was evaluated at USD 192.9 billion in 2024 and is predicted to be worth around USD 400.38 billion by 2034, rising at a CAGR of 7.57% from 2025 to 2034.

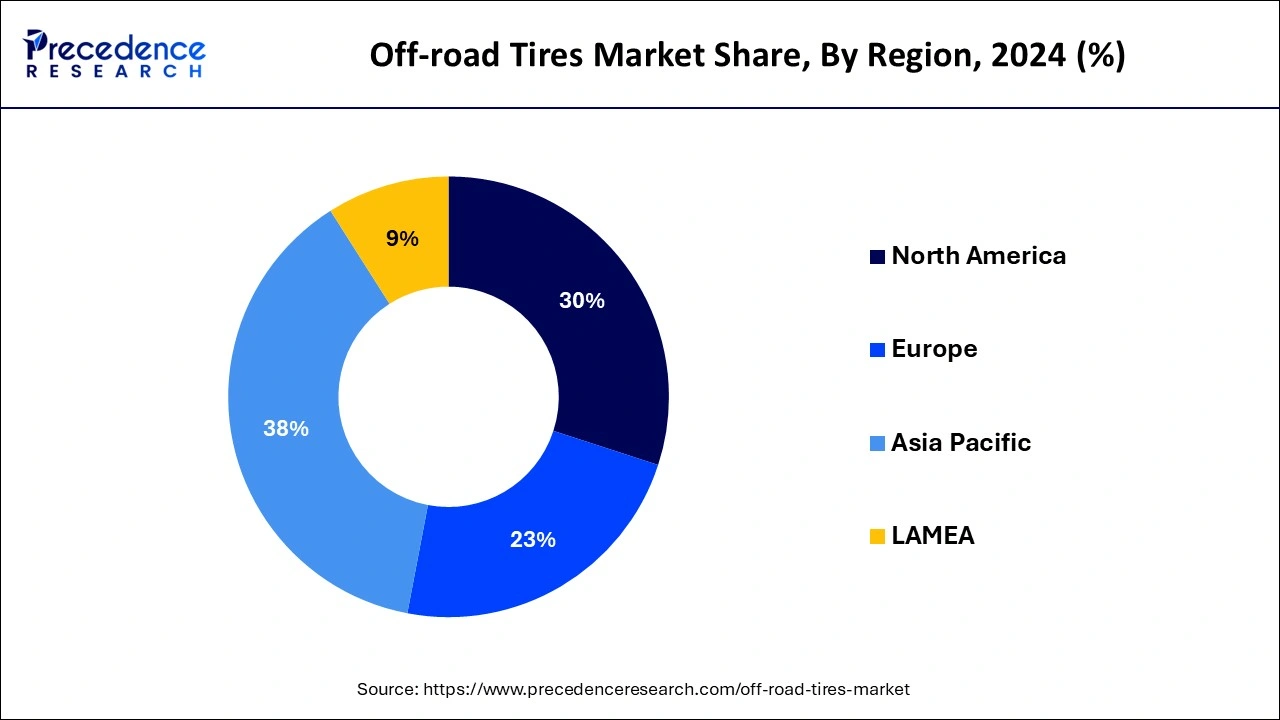

Asia Pacific dominated the global off-road tires market with the largest market share of 38% in 2024. The China and India are leading countries of the Asia-Pacific off-road tires market. China and India’s economic expansion, combined with China’s significant investments in road and other infrastructure development, will fuel the Asia-Pacific regional market demand. However, rising demand from developing nations and strategic measures from key market players are expected to boost the off-road tires market’s growth.

Off-road Tires Industry in China and Japan Trends

The off-road tires are commonly used in heavy duty vehicles for off-road applications in the agriculture, mining, and logistics industries, as well as in the housing industry. The development of the housing industry in emerging nations has increased demand for construction and material handling equipment, which is likely to drive the significant growth in the off-road tires market. The increased use of off-road vehicles such as wheel loaders, cranes, telescopic handlers, special purpose vehicles, and tractors is further driving the off-road tires market expansion.

The increased sales of off-highway vehicles and increased farm mechanization are driving the global off-road tires market growth during the forecast period. Furthermore, the global off-road tires market’s growth is hampered by adverse weather conditions and low-cost tires from an unorganized sector. However, the development of environmentally friendly off-road tires is expected to present a lucrative growth opportunity for the industry.

The key market players are diversifying their portfolios in the off-road tires market, as agriculture is expected to generate the highest revenue among all industrial types. The harvester and floater tires, among others, were introduced by Michelin to help maximize harvests.

The off-road tires manufacturers are increasing production capacity for high performance radial tires with long service life and excellent year-round traction. They’re ramping up research and development to include strong and flexible sidewalls as well as self-cleaning connectors for maximum pulling force. In addition, harvester tires are being developed that deliver less pressure, resulting in reduced soil compaction.

The increased in medium-sized farms around the world is driving up demand for agricultural equipment, which in turn is driving up demand for agriculture tires. The transportation activities have increased as a result of increased industrialization around the world. Intercity transportation operations, such as business to business (B2B) and business to consumer (B2C) trade, are increasing, resulting in a demand for compact and rapid transport vehicles to get around the cities efficiently. The global off-road tires market is propelled by aforementioned factors.

The growing global population and increased consumer affluence are expected to push the agriculture sector toward mechanization, boosting the off-road tires market. Increasing technological advancements in tires, such as connected tires and the TeadStat rim management system, which provides information prior to a vehicle breakdown. The off-road tires market is expected to grow as a result of this.

The costing of bias tire is heavily influenced by rawmaterial price volatility. The natural rubber and synthetic rubber prices fluctuate due to a lack of natural rubber cultivation or a surge in the price of crude oil.

| Report Coverage | Details |

| Market Size in 2025 | USD 532.7 Billion |

| Market Size by 2034 | USD 987.14 Billion |

| Growth Rate from 2025 to 2034 | 7.13% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Tires Height, Vehicle, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Synthetic rubber is the most extensively utilized material in off-road manufacturing, thus it’s a major source of revenue. The synthetic rubber segment accounted for huge revenue share in 2024, and it is expected to expand at a significant rate until 2034. The widespread of butadiene rubber and styrene-butadiene rubber in mining and agricultural vehicles is a major element is the high market capturing ability. The material’s high strength and abrasion resistance, as well as its low cost, are driving its adoption.

The above 45 inches segment is growing at a notable CAGR during the forecast period. The growing demand for off-road tires and agricultural vehicles is the main driver of the market growth. Various trends, such as farming mechanization and automation, increasing adoption of heavy machinery, and growing mining activities, are expected to drive the segment penetration. This can also be seen in the steps taken by product manufacturers to meet the rising demand.

The off-road tires market’s UTV segment has a huge amount of potential and is expected to produce greater demand by 2034. UTV’s functional adaptability when compared to heavier machinery like trucks and tractors is promoting their popularity for a variety of farm operations. The off-road tires market revenue will be driven by a movement in preference toward UTV vehicles because to their simplicity and mobility for completing different chores. Furthermore, the off-road tires market’s growth will be aided by the increasing use of drones in adventure events and racing championships.

The market revenue, market shares, business strategies, recent developments, and growth rates of major businesses holding substantial market shares in the worldwide off-road tires market are all examined. Recent events for these firms, such as new solution, product launches, acquisitions, research activities, geographic expansions, and technological advancements, are taken into account when determining their position in the off-road tires market. All important stakeholders in the off-road tires value chain and technological ecosystem are expected to benefit the growth of the off-road tires market.

The key market players concentrate on developing new technologies that can be used to improve the off-road tires market’s product portfolio. The market players are adopting various marketing strategies for the growth and development of the market during the forecast period.

By Material

By Tire Height

By Vehicle

By Distribution Channel

By Application

By Construction Type

By Process

By Industrial Equipment

By Agriculture Tractors

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

January 2025

September 2024