April 2025

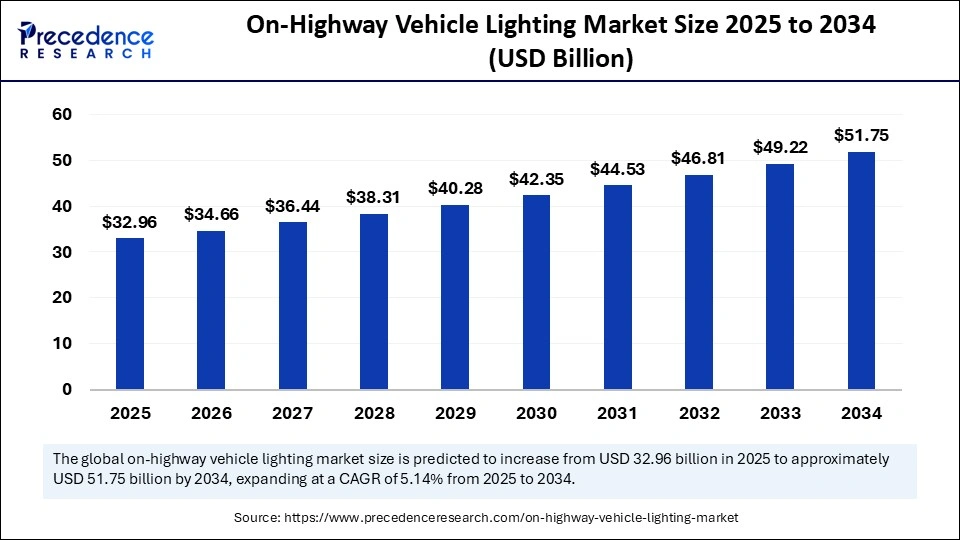

The global on-highway vehicle lighting market size is calculated at USD 32.96 billion in 2025 and is forecasted to reach around USD 51.75 billion by 2034, accelerating at a CAGR of 5.14% from 2025 to 2034. The Asia Pacific market size surpassed USD 16.93 billion in 2024 and is expanding at a CAGR of 5.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global on-highway vehicle lighting market size accounted for USD 31.35 billion in 2024 and is predicted to increase from USD 32.96 billion in 2025 to approximately USD 51.75 billion by 2034, expanding at a CAGR of 5.14% from 2025 to 2034. The demand for vehicle safety features has increased, driving the global market. Stringent regulations mandating advanced on-highway lighting systems are fueling market expansion.

Artificial Intelligence has become a significant tool in enabling smart and adaptive technologies in the on-highway vehicle lighting market. AI-enabled optimization helps to improve energy efficiency, safety, and driver experiences. AI can optimize lighting performance and help reduce energy consumption, making it an ideal tool for energy-efficient features. An AI-powered lighting system can detect and provide a quick response to changing conditions and enhance visibility. Additionally, AI can improve driver experiences with enhanced lighting features. Increased adoption of electric vehicles is surging AI implementation to advance lighting technology. AI is able to offer sophisticated lighting systems for luxury and premium vehicles.

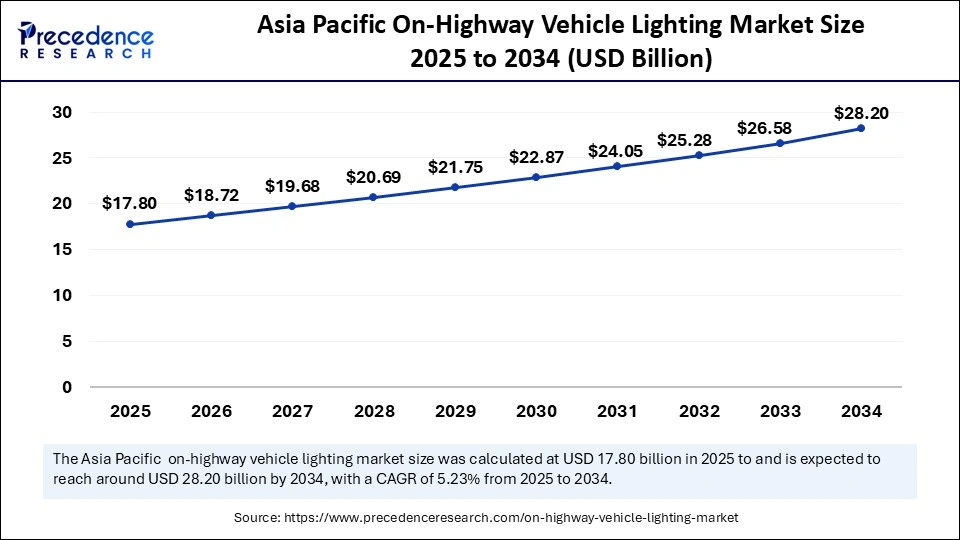

The Asia Pacific on-highway vehicle lighting market size was exhibited at USD 16.93 billion in 2024 and is projected to be worth around USD 28.20 billion by 2034, growing at a CAGR of 5.23% from 2025 to 2034.

Rapid Urbanization to Fuel Asian Innovations and Developments

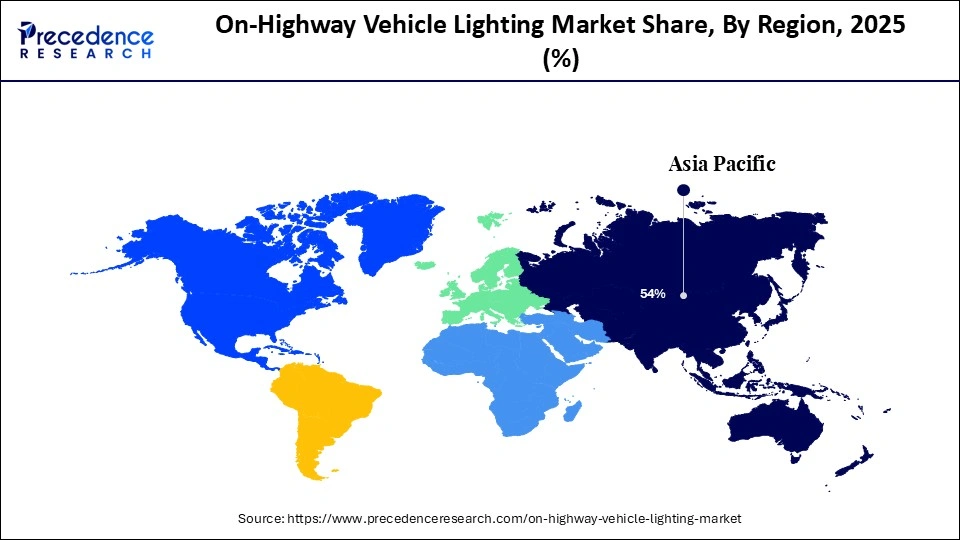

Asia Pacific dominated the on-highway vehicle lighting market with the largest share in 2024 due to various factors like rapid urbanization, demand for energy-efficient lighting systems, and strict government regulatory implementations. Asia Pacific has witnessed growth in demand for ambient light systems. Continuous climate changes and visibility limits are the major factors contributing to accidents. High vehicle production range and high adoption of electric vehicles are contributing to the development of smart lighting.

Government Support Driving China’s Market

China leads the regional market with a well-established automotive industry. Government support and rapid urbanization fueled market expansion in China. Government support and funding for manufacturing industries enable innovation and advancements in lighting technology. The demand for safety and visibility features in vehicles has increased in the country, leading to the adaptive lighting and automatic high beams areas.

European Regulations for Safety Standards Boosting Market

Europe is projected to host the fastest-growing on-highway vehicle lighting market in the coming years, driven by various factors like increased demand for electric vehicles and strong regulations. The European Union has implemented strict regulations and standards of safety and emissions, driving demand for energy-efficient lighting solutions. Additionally, regulations regarding Daytime Running Lights (DRLs) and other safety-related lighting have increased the demand for LED-based solutions and influenced product development. Europe is the hub for major lighting manufacturers, driving innovation and the development of energy efficiency, durability, instant brightness, and high-quality lighting systems.

Strong Automation Industry Contributing to the German Market

Germany leads the regional market due to the existence of leading manufacturing companies and a strong automated industry. Germany is leading in innovation in lighting technology and strict safety standards, which has increased demand for LED, OLED, and adaptive lighting systems.

Stringent Regulations Driving Innovations in the UK’s Lighting Technology

The UK is anticipated to witness significant growth in the forecast period, driven by a high focus on innovations and lighting systems. The UK has a high adoption rate of electric vehicles, driving demand for energy-efficient LED solutions. The UK’s automotive sector is witnessing a shift toward electric vehicles and strict regulations.

North America On-Highway Vehicle Lighting Market Trends

The North American on-highway vehicle lighting market is expected to grow at a notable rate in the foreseeable future. The strong automotive industry, high vehicle sales, and increased adoption of electric vehicles due to government initiatives are contributing to the market growth. Government regulations to promote energy-efficient lighting solutions are improving innovations and developments in the regional lighting sector.

Strong Automotive Industry Leading U.S. Market

U.S. leads the regional market due to factors like the existence of large manufacturing industries and a strong automotive industry. Manufacturers are prioritizing energy efficiency with LED and OLED lighting features. The growing demand for LED lighting is fueling the market expansion.

The on-highway vehicle lighting market has witnessed significant growth due to increasing demand for energy-efficient solutions and government regulations. The increased adoption of passenger and commercial vehicles is driving demand for safety and visibility features. Rapid urbanization has contributed to this adoption. Governments worldwide are implementing stringent safety regulations and standards, pushing for innovations and developments of advanced lighting technologies.

Advancements in LED technology are driving the on-highway vehicle lighting market expansion, driven by the government's push for energy efficiency and highly visible features. Manufacturers are focusing on innovation and advancements in LED lighting systems to advance safety features as well as reduce carbon footprints.

| Report Coverage | Details |

| Market Size by 2034 | USD 51.75 Billion |

| Market Size in 2025 | USD 32.96 Billion |

| Market Size in 2024 | USD 31.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.14% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Vehicle Type , and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Vehicle Safety Regulations

The on-highway vehicle lighting market has witnessed transformative growth due to the government's implementation of stringent vehicle safety regulations and standards. Government initiatives have mandatory manufacturers focus on safety, energy efficiency, and visibility standards. The strong on-highway vehicle lighting safety standards push manufacturing companies to innovations and advancements in lighting technologies.

The government is promoting the implementation of energy-efficient lighting solutions like LEDs and OLEDs. Increased adoption of electric vehicles has driven regulatory implementation for autonomous and connected vehicle lighting systems. The trend of vehicle-to-vehicle communication is expected to boost advancements in vehicle safety.

High LED lighting cost

LED lights are highly energy-efficient and durable. They require cooling equipment to control their heat generation, increasing costs. The high cost of LED lights further increased the production cost of vehicles and limited the adoption rate. This high cost hampers LED utilization in premium and luxurious vehicles. The costs also include the repair costs. Advancements in alternative technologies like HID lights are slowing the utilization of LED lights.

Adoption of electric vehicles

The increased demand for electric vehicles is driving demand for the on-highway vehicle lighting market. Electric vehicles require sophisticated illumination to support adaptive lighting. These vehicles often focus on advanced safety and visibility features. Manufacturers have prioritized advancing visibility features to reduce accidents. Electric vehicles, mainly implemented with LED technology, provide efficiency, flexibility, and cost-effectiveness.

The unique lighting requirements in electric vehicles provide significant space for innovations and advancements in lighting technology. The government is promoting the use of electric vehicles to contribute to net-zero emissions, driving further consumer demands. Government initiatives are creating opportunities for manufacturers in the market.

The LED segment held a dominant presence in the on-highway vehicle lighting market in 2024, driven by increased demand for LED lighting in vehicles. LEDs are energy-efficient, durable, and flexible compared to traditional lighting sources. Energy efficiency reduces the cost burden and carbon emissions. On the other hand, the long life span of a leader further contributes to the need for maintenance and replacement costs. The demand for superior writing quality is the next LED segment, ideal for various on-highway vehicle lighting applications.

The LASER segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. The segment growth is attributed to the rising demand for luxurious vehicles and advanced scene-smart lighting, enabling adaptive lighting and automatic high-beam features. LASER products provide high energy efficiency, durability, and superior lighting quality. Rising safety concerns are driving innovations and developments of advanced LASER-based lighting systems.

The passenger car segment led the global on-highway vehicle lighting market in 2024. The increased demand for passenger cars is driving demand for lighting systems. Consumer preference for smart lighting, such as ambient lighting, LED headlights, adaptive lighting, and mood lighting for passenger cars has grown rapidly.

On the other hand, the heavy trucks segment is projected to expand rapidly in the market in the coming years, driven by rising demand for logistics and transportation. The government is improving safety regulations and standards to ensure the safety and performance features of lighting. Manufacturers are focusing on safety and visibility with features like adaptive lighting and automatic high beams in heavy trucks. Additionally, the increased adoption of electric commercial vehicles like electric trucks and buses is fueling innovation and advancements in lighting systems.

The headlight segment dominated the global on-highway vehicle lighting market in 2024, driven by increased vehicle production and safety and visibility requirements. Headlights provide safety and visible features, especially at night and in low-light conditions. Strict regulatory requirements for safety standards contribute to advancements and implementations of headlights. Technological advancements such as LED products and laser headlights are enabling high performance, efficiency, and flexibility of lighting systems. The increased adoption of LED headlights is a trending segment expansion.

The interior lights segment is projected to grow at the fastest rate in the future years. The demand for ambient lighting, customizable color schemes, and premium lighting has increased, making manufacturers focus on areas of sophisticated and personalized interior lighting experiences. Interior lights are comfortable and convenient for drivers, especially at night. The increased electric vehicle adoption and advancements in smart lighting are expected to drive significant advancements in interior lights. Additionally, the trend of aesthetic designs and the appearance-boosting segment is growing.

By Product

By Application

By Vehicle Type

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

August 2024