December 2024

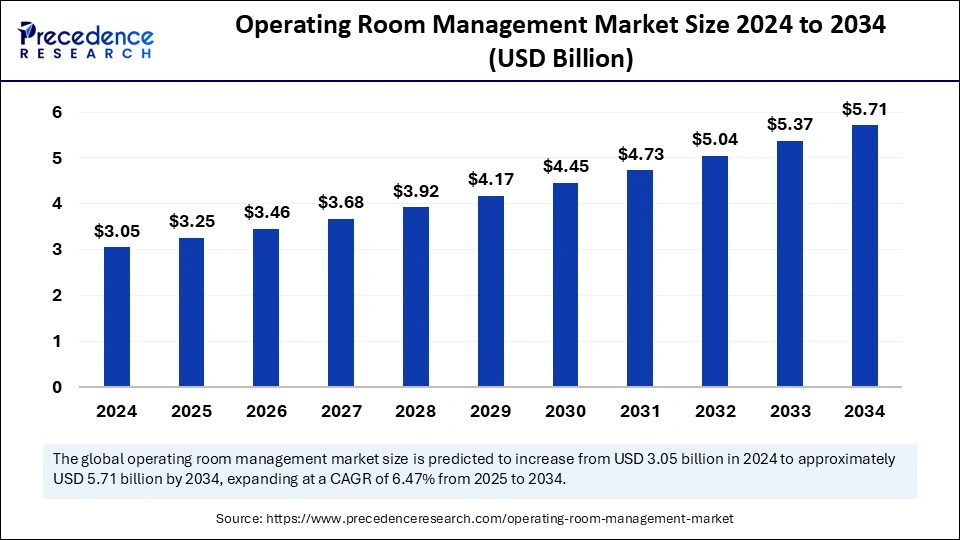

The global operating room management market size is calculated at USD 3.25 billion in 2025 and is forecasted to reach around USD 5.71 billion by 2034, accelerating at a CAGR of 6.47 % from 2025 to 2034. The North America market size surpassed USD 1.34 billion in 2024 and is expanding at a CAGR of 6.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global operating room management market size was estimated at USD 3.05 billion in 2024 and is predicted to increase from USD 3.25 billion in 2025 to approximately USD 5.71 billion by 2034, expanding at a CAGR of 6.47% from 2025 to 2034. The demand for efficient resource utilization is the major driver of the global market. The expanding operating room capabilities and rising need for improved communication and collaborative solutions have increased demand for operating room management solutions. Additionally, the growing emphasis on advanced technology implementation with operating room management solutions is generating growth opportunities for the market.

Operating room management solutions have improved communication and coordination between healthcare professionals and patients. However, the need for more efficient surgical precision, identifying potential complications, and optimizing workflow have taken over the operating theaters. The increased need for operating room management market solutions has driven manufacturers and healthcare professionals to surge toward the implementation of cutting-edge technologies like Artificial Intelligence with existing operating room management solutions.

AI algorithms can analyze a broad amount of data, optimize procedure optimization, and provide data-driven, real-time decision-making. The expanded operating theater capacity and demand for surgical procedures have influenced the need for automated solutions for data entry, surgical instrument tracking, and post-operative reporting. AI generating life saver position in operating room management infrastructure.

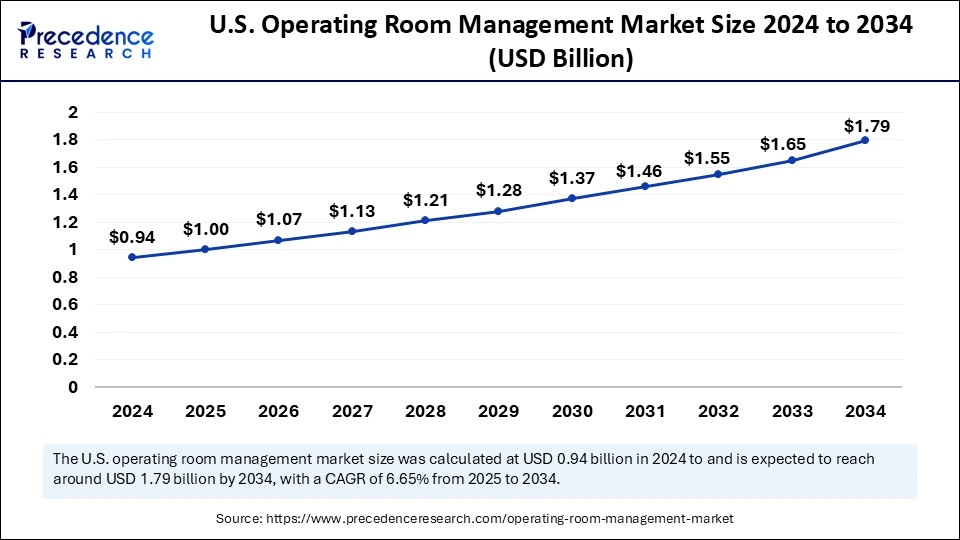

The U.S. operating room management market size was exhibited at USD 3.05 billion in 2024 and is projected to be worth around USD 1.79 billion by 2034, growing at a CAGR of 6.65% from 2025 to 2034.

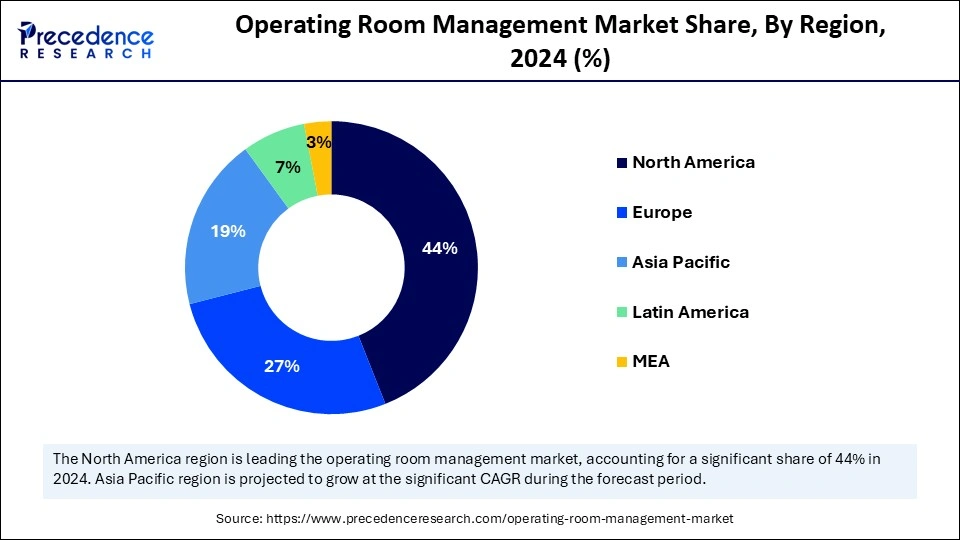

North America dominated the global operating room management market in 2024 with the largest share, majorly due to the region's well-established healthcare infrastructure and government investment in healthcare organizations. North America is home to key manufacturers of healthcare software and services. The option of cutting-edge technologies and the emphasis on the utilization of digital solutions are the major factors driving the adoption of operation room management solutions in hospitals and ambulatory surgical centers.

The United States is leading the regional market for various reasons, including technology advances, high healthcare investments, increased prevalence of chronic disease, and high demand for minimally invasive surgeries. The increased need for well-trained solutions, connectivity, flexibility, and efficient staff communications to improve overall procedures and patient outcomes is driving demand for efficient operating room management solutions in the country.

Asia Pacific is anticipated to grow at the fastest rate in the operating room management market during the forecast period due to expanding healthcare infrastructure, an aging population, and government initiatives. The increased government emphasis on investing in the development of advanced healthcare infrastructure plays a favorable role in market expansion in Asia. Countries like China, Japan, and India are contributing a significant share of the regional market.

The demand for advanced management solutions for operating hospitals and ambulatory surgical centers has taken place. Operating rooms are at the peak of healthcare sectors. The rising demand for efficient operating room management solutions to enhance operation efficiency, reduce errors, and improve patient outcomes is essential in healthcare. Advances in technologies like the implementation of cloud-based solutions, data management and communication, anesthesia information management, operating room scheduling management, operating room supply management, and performance management are advancing operating management as well as improving productivity.

The demand for operating room management market solutions is prominent among surgeons, anesthesiologists, and other medical experts. Government and regulatory funding and companies' investments in healthcare infrastructure are allowing the adoption of advanced techniques like operating management. Additionally, an emphasis on the integration of artificial intelligence (AI), ML, and IoT operating room management solutions is emerging in the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.71 Billion |

| Market Size in 2025 | USD 3.25 Billion |

| Market Size in 2024 | USD 3.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Solution, Deployment, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The demand for surgical procedures

The increased prevalence of chronic diseases, including diabetes, obesity, cancer, and cardiovascular diseases, the aging population, and increased age-related issues in the world have increased the demand for the operating room management market in the past few years. The increased demand for minimally invasive surgeries is driving advanced surgical procedures. Additionally, the adoption of advanced surgical technologies like 3D printing and imaging, virtual reality, and integration of AI are enabling high-performing surgical procedures.

The rapidly growing demand for surgical procedures has driven the need for efficient operating room management solutions to advance communication between surgeon teams and patients. The need for improved data analytics and real-time decision-making systems has driven healthcare professionals' preference toward operating room management software and services. Additionally, advancements in operating room capabilities in hospitals and ambulatory surgical centers are further contributing to the need for operating room management solutions.

High cost

The high-cost related software, advanced technology implementations, and installations are the major restraints of the global operating room management market. The maintenance of operating room management solutions can be expensive. Additionally, the cost of software and hardware required for operating room management solutions is pretty high, which hampers healthcare organizations'' investments in manufacturing, adoption, and implementation of operating room management solutions with an ongoing surge for integration of cloud-based solutions, it can help to overcome the high-cost challenge of the market.

Cost control and efficiency

The emphasis on cost control is the major opportunity for the adoption of operating room management market solutions in hospitals and ambulatory surgical centers. Operating room management solutions help optimize resources and resources, which helps to reduce waste and enhance efficiency. Optimizing Scheduling and specialized surgical procedures can help reduce labor costs. The growing prevalence of chronic disease and increasing demand for surgical procedures are driving cost-effective modules with high productivity. The implementation of advanced technologies like cloud-based solutions, AI, and ML integrations is providing cost-effective, scalable, flexible, and more efficient operating room management solutions to improve patient care. Furthermore, the integration of IoT and robotics in operating rooms is emerging further advancements in operating room management solutions.

The software segment accounted for the largest operating room management market share in 2024 due to the increased adoption of operating room management software in hospitals and ambulatory surgery centers. The software provides streamlined operations by optimizing, using communication tools, and making quick data-driven decisions. The growing need for efficient operating room management workflow and the emphasis on healthcare pre-production for the adoption of digitalization is driving the adoption of advanced software. The ongoing surge of competitive landscapes has developed novel, innovative software solutions to enhance surgery experiences and patient outcomes, leveraging segment expansion.

The services segment is projected to witness significant growth in the forecast period due to the rising demand for advanced and efficient services in operating management nets. Services of patient communications, efficient scheduling, and streamlining processes help to enhance overall operation efficiency and patient outcomes. The growing adoption of managed services, support services, and consulting services is all over operation systems.

In 2024, the data management and communication segment held the largest share of the operating room management market because of the rising need for efficient data sharing, communication, and coordination between surgical team solutions. The data management and communication solution provides seamless communications and data exchange between various systems, making it easier for the surgical team to understand real-time patient health conditions and updates. The increased adoption of electronic health records (EHR) is driving further demand for these solutions to generate accurate and timely patient data. Furthermore, companies' surge in developing AAI-integrated and cloud-based data management and communication solutions to improve scalability, flexibility, predictive analytics, and patient outcomes is drawing a major influence on segment growth.

However, the anesthesia information management segment is expected to grow at a steady pace during the forecast period with increased emphasis on anesthesia dose recordings, making essential demands for precise and efficient anesthesia management. Anesthesia information management systems help to improve data accuracy and accessibility, as well as real-time monitoring and pre-alerts, and streamline procedures. This solution improves patient safety and overall operational efficiency.

The cloud-based solution segment dominated the operating room management market in 2024 due to the rapidly increased need for efficient data management analytical solutions. Cloud- and web-based solutions provide high scalability and flexibility, which makes them ideal for healthcare infrastructure. Cloud- and web-based solutions provide access from anywhere, which is essential for remote operations, reduce the reliability of hardware and software, and provide cost-effective services.

The on-premises solution segment is expected to gain a significant market share during the forecast period. Well-established on-promises infrastructure and investments are developing innovative emphasis on on-premises solutions in the operating room management market. On-premises solutions provide improved data security, reliability, customizability, integration, and complete control over data and existing systems. The need for more reliable and suitable solutions in operating room management systems is driving preference for on-premises applications.

The hospital segment dominated the global operating room management market in 2024. The segment growth is attributed to a well-established healthcare infrastructure and the expansion of digitalization in hospitals. The rising prevalence of chronic disease is increasing the number of hospitalizations. The adoption of operating room management solutions has increased in hospitals due to the growing need for improved overall efficiency of operations.

The ambulatory surgical centers segment is also expected to show a notable presence during the forecast years. The demand for outpatient surgical procedures has increased in ambulatory surgical centers, making it essential to adopt efficient operating room management solutions. The increased adoption of advanced technologies enables shorter, more efficient, and more accurate procedures, which drives the consumer preference for ambulatory surgical centers.

By Component

By Solution

By Deployment

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

April 2025

April 2025

January 2025