The global orthobiologics market size was estimated at USD 109.94 billion in 2023 and is expected to increase from USD 115.28 billion in 2024 to approximately USD 185.29 billion by 2034. It is projected to grow at a CAGR of 5.52% from 2024 to 2034. The North America orthobiologics market size is estimated to be worth USD 3.29 billion in 2024.

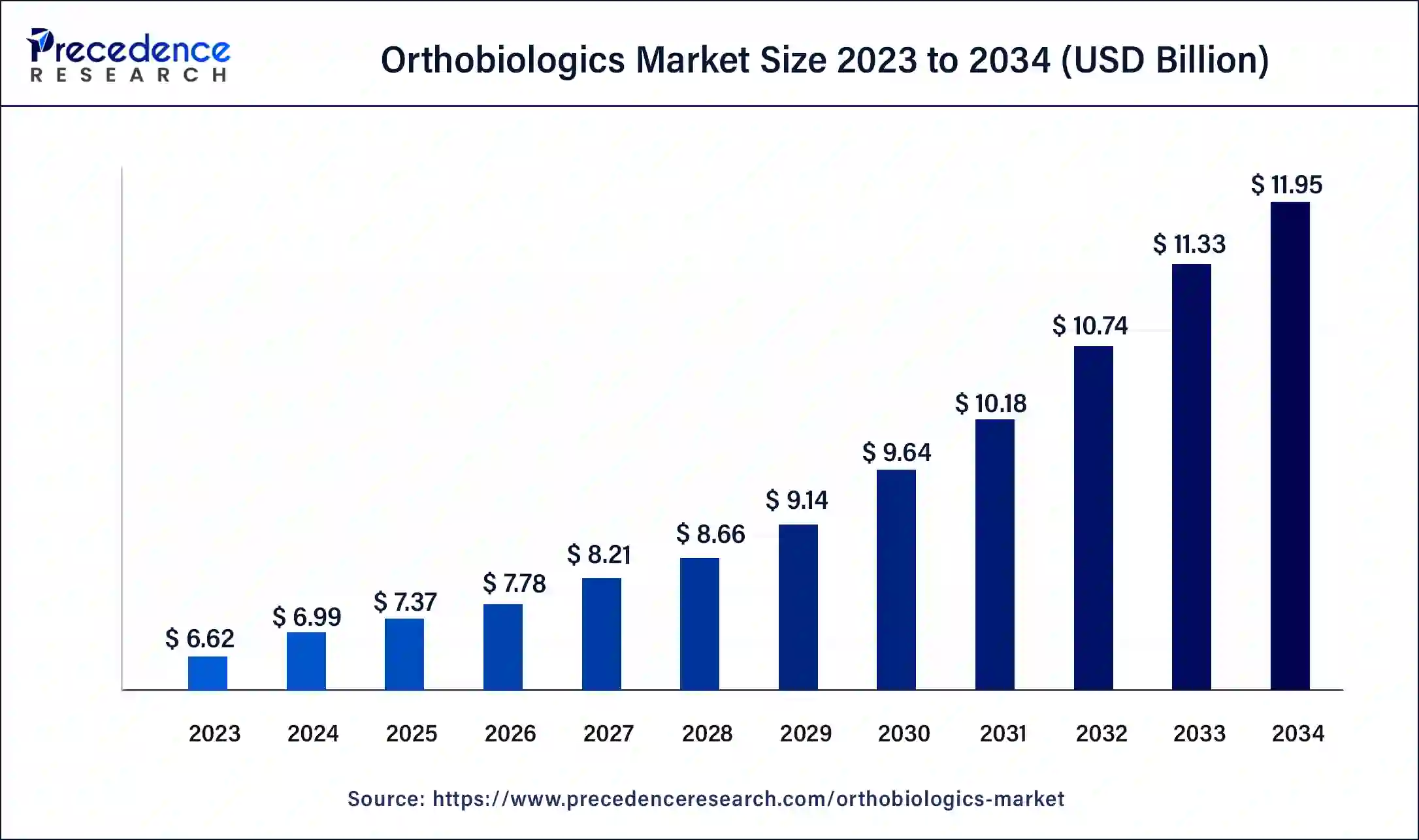

The global orthobiologics market size is calculated at USD 6.99 billion in 2024 and is expected to reach around USD 11.95 billion by 2034, expanding at a solid CAGR of 5.52% over the forecast period 2024 to 2034. The increasing prevalence of orthopedic procedures coupled with the growing geriatric population is the major factor fostering the orthobiologics market growth. Orthobiologics, also known as regenerative cellular therapies, encompass products that contain or secrete growth factors to aid tissue healing, alleviate pain, and restore normal function. Various orthobiologics available in the market operate through different mechanisms. Autologous orthobiologics are derived from the patient's own body, where, under suitable conditions, they divide to form precursor cells. These products are utilized in treating conditions like fracture recovery and spinal fusion and are available for various body parts, including the hip, knee, ankle, spine, and wrist. Orthobiologics primarily facilitates faster injury healing.

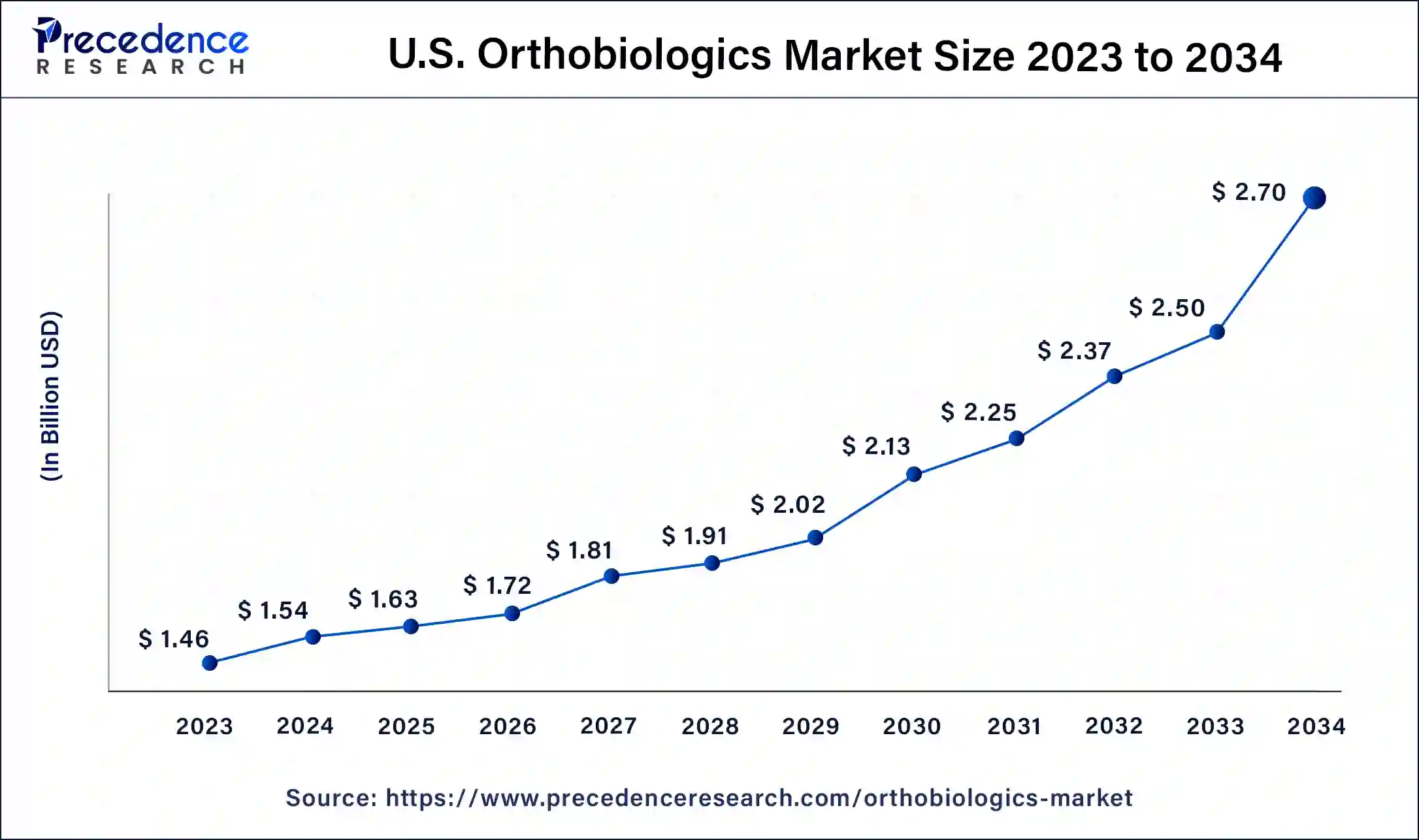

The U.S. orthobiologics market size was exhibited at USD 1.46 billion in 2023 and is projected to be worth around USD 2.70 billion by 2034, poised to grow at a CAGR of 5.74% from 2024 to 2034.

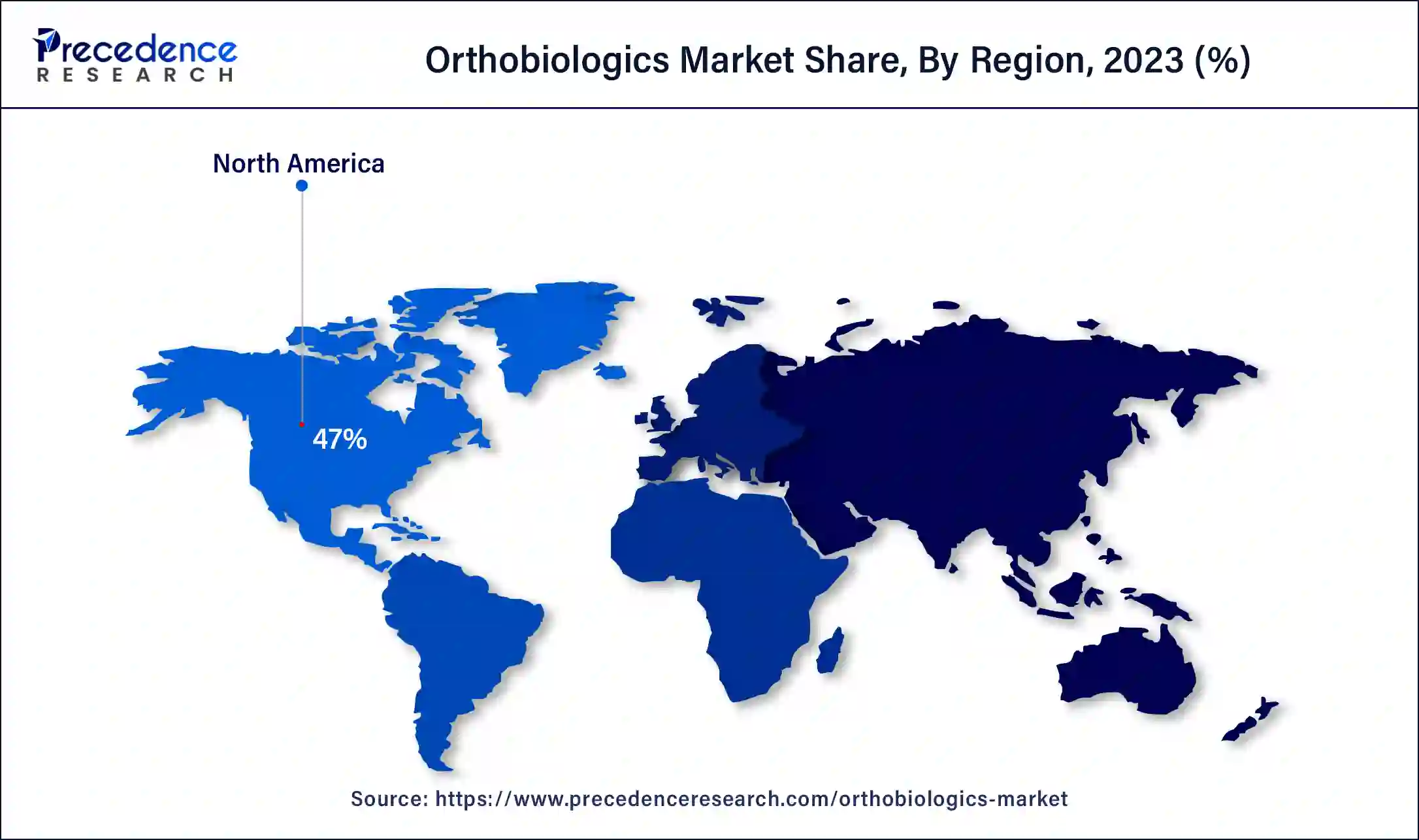

North America dominated the orthobiologics market in 2023. The rise in degenerative bone disease cases and the increasing popularity of outpatient orthopedic procedures are major contributors to market growth. North America leads the market, largely due to the presence of numerous major companies. The market's projected growth is also driven by an aging population.

Europe is expected to grow at the fastest rate in the orthobiologics market over the studied period. European market players' strong emphasis on R&D investments and research initiatives, along with favorable health reimbursement policies for bone grafting procedures and a sharp rise in spinal injuries, are projected to boost the demand for orthobiologics in the coming years.

Within Europe, Germany held the largest share of the orthobiologics market, while the UK was the fastest growing. The UK market is expected to see significant growth during the forecast period. The increasing acceptance of orthobiologics as an effective treatment option is driving this market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.95 Billion |

| Market Size in 2023 | USD 6.62 Billion |

| Market Size in 2024 | USD 6.99 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of orthopedic disorders

Over the past decade, there has been a significant rise in the prevalence of orthopedic disorders. Poor dietary habits and inadequate physical activity can disrupt the body's balance, exacerbating these issues. This susceptibility intensifies with age, particularly affecting individuals aged 60 and above, who are more prone to conditions such as arthritis. Those with osteoarthritis in this demographic often endure joint pain and strain in areas like the lower back, hips, and knees. The population of older adults has expanded due to advancements in healthcare, improved life expectancy, and the availability of more sophisticated treatment options. Hence, the increasing incidence of Orthopedic diseases is expected to drive growth in the orthobiologics market.

Surging prices for orthobiologics-based treatments

The orthobiologics market's growth could be hampered by increasing patient preference for minimally invasive procedures in the coming years. Additionally, challenges may arise from the adverse impacts associated with Bmp-based therapies. The market expansion might face further constraints due to anticipated price increases in orthobiologics treatments. Stringent production regulations, Complex manufacturing processes, and high operational costs also pose significant challenges to market growth.

The Increase in healthcare expenditure

The orthobiologics market is experiencing significant growth in emerging countries like South Africa, India, and China. These nations are compelled to enhance their healthcare sectors due to the smoothly expanding elderly population, rising per capita incomes, large patient numbers, and heightened awareness. Furthermore, there has been an increase in investment in healthcare infrastructure and facilities within these economies. Although sleep apnea machines are highly effective, their success is limited to a small percentage of cases due to their reliance on consistent use and medical supervision.

The viscosupplementation segment led the orthobiologics market in 2023. The growing number of osteoarthritis patients and the frequent introduction of new products are expected to drive market growth. Viscosupplementation with hyaluronic acid injections is a popular treatment for osteoarthritis due to its ease of administration and high tolerance, which supports market expansion. Also, the significant demand for minimally invasive surgical treatments and their high acceptance among patients are also considered key factors contributing to market growth.

The stem cell therapy segment is expected to grow at the fastest rate in the orthobiologics market over the forecast period. The global increase in healthcare spending and the raised focus on personalized medicine have fostered a conducive environment for the growth of the stem cell therapy market. Also, progress in biotechnology and regenerative medicine has paved the way for novel techniques and products within the stem cell therapy sector.

The spinal fusion segment accounted for the largest share of the orthobiologics market in 2023. The benefits of orthobiological products in spinal fusion, such as rapid cell stimulation for bone formation, reduced hospital stays, and fewer follow-up visits, are key factors driving the segment's growth. The increasing number of spinal fusion surgeries globally further boosts the segment's market share. Moreover, leading companies with extensive orthobiologics portfolios for spinal fusion and the growing number of approvals for new products in this area are anticipated to propel market growth in the coming years.

The reconstructive surgery segment is expected to grow at a significant rate in the orthobiologics market over the forecast period. This can be attributed to the rising demand for reconstructive surgery induced by an aging population and a surge in musculoskeletal disorders, which is contributing to the segment's expansion. Moreover, Orthobiologics presents a promising option for improving bone healing, facilitating soft tissue repair, and restoring joint function, thus driving their increased use in reconstructive procedures.

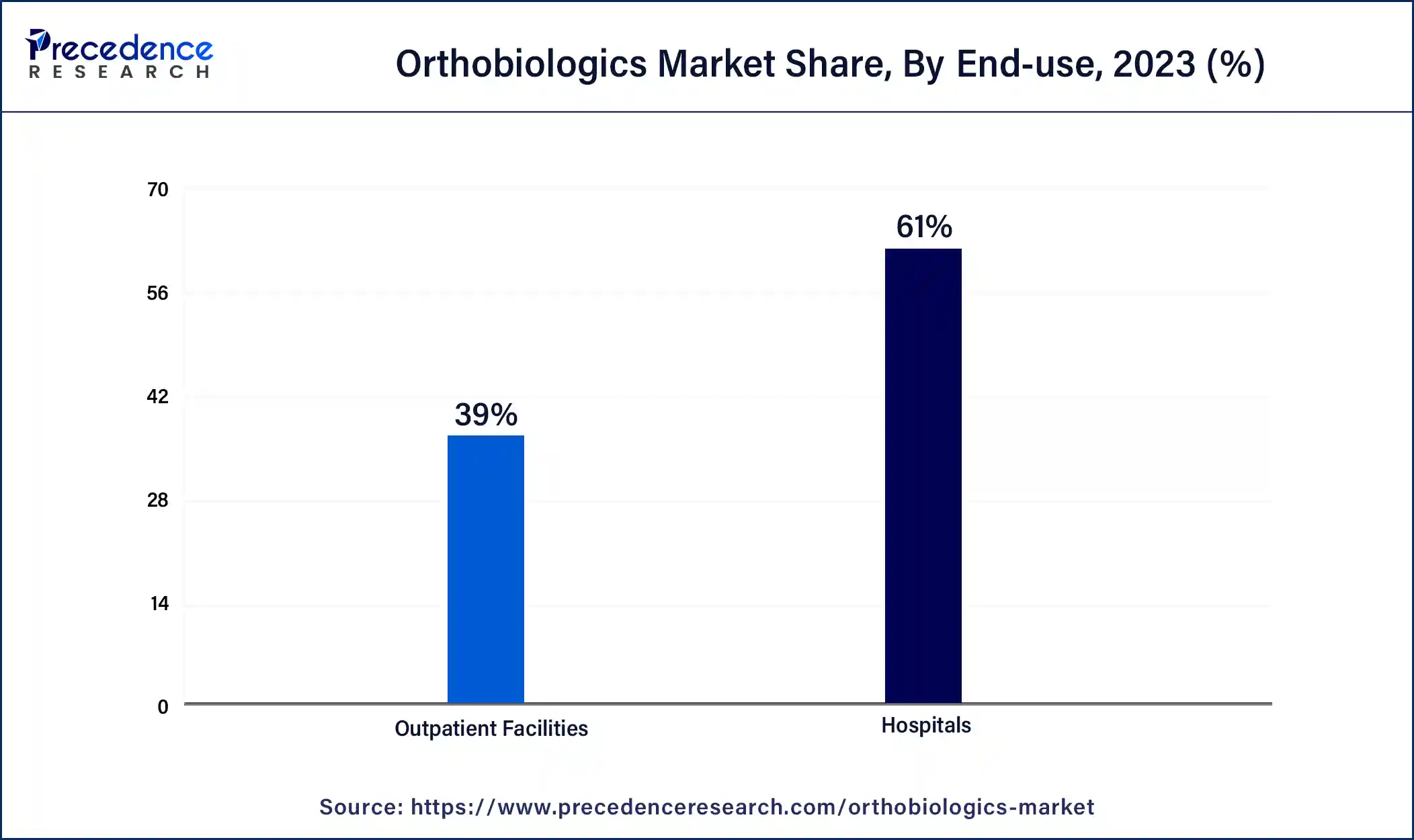

The hospital segment held the largest share of the orthobiologics market in 2023. A key factor behind the market share dominance is the increasing utilization of orthobiological products in diverse spinal and reconstructive surgeries performed in hospitals. Furthermore, the segment's growth is anticipated to be supported by hospitals' easy access to a wide range of orthobiologics and their specialized patient care. The segment's share is bolstered by frequent readmissions, high patient turnover, and substantial procedure volumes.

The outpatient facilities segment is expected to grow rapidly in the orthobiologics market during the forecast period. This trend is fueled by the rising preference for ambulatory care and same-day surgeries. These facilities offer a convenient and cost-effective solution for patients undergoing minor orthopedic procedures or receiving treatments for sports injuries.

Segments Covered in the Report

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client