February 2025

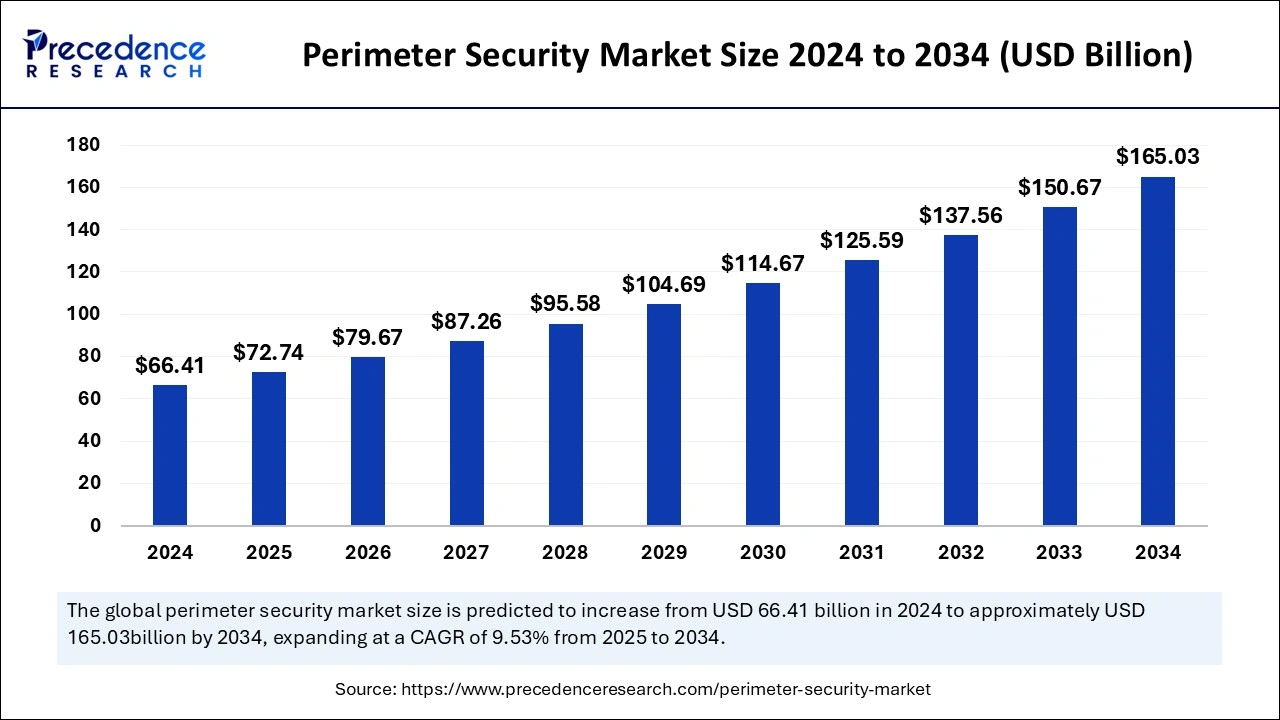

The global perimeter security market size is accounted at USD 72.74 billion in 2025 and is forecasted to hit around USD 165.03 billion by 2034, representing a CAGR of 9.53% from 2025 to 2034. The North America market size was estimated at USD 23.91 billion in 2024 and is expanding at a CAGR of 9.68% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global perimeter security market size was calculated at USD 66.41 billion in 2024 and is predicted to reach around USD 165.03 billion by 2034, expanding at a CAGR of 9.53% from 2025 to 2034. The rising concerns of cross-border intrusions and terrorism are the key factors driving market growth. Also, a surge in the development of smart cities and infrastructure coupled with technological advancement in the defense sector can fuel market growth soon.

Artificial Intelligence has the ability to transform the perimeter security market. It enhances surveillance, detects threats, and decreases false alarms in real time. AI-driven video surveillance ensures more accurate and efficient hazard protection by making independent decisions. Furthermore, AI can also be utilized to optimize real-time analysis of objects and people, informing security authorities and related facilities.

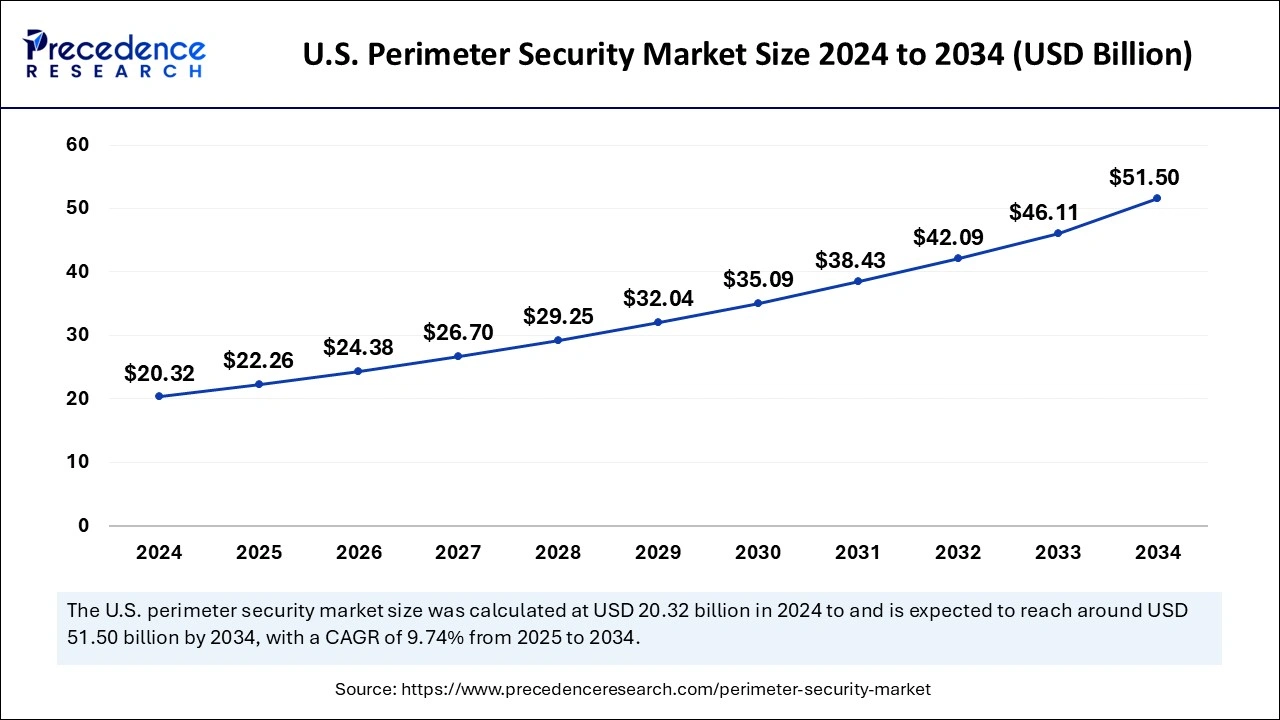

The U.S. perimeter security market size was exhibited at USD 20.32 billion in 2024 and is projected to be worth around USD 51.50 billion by 2034, growing at a CAGR of 9.74% from 2025 to 2034.

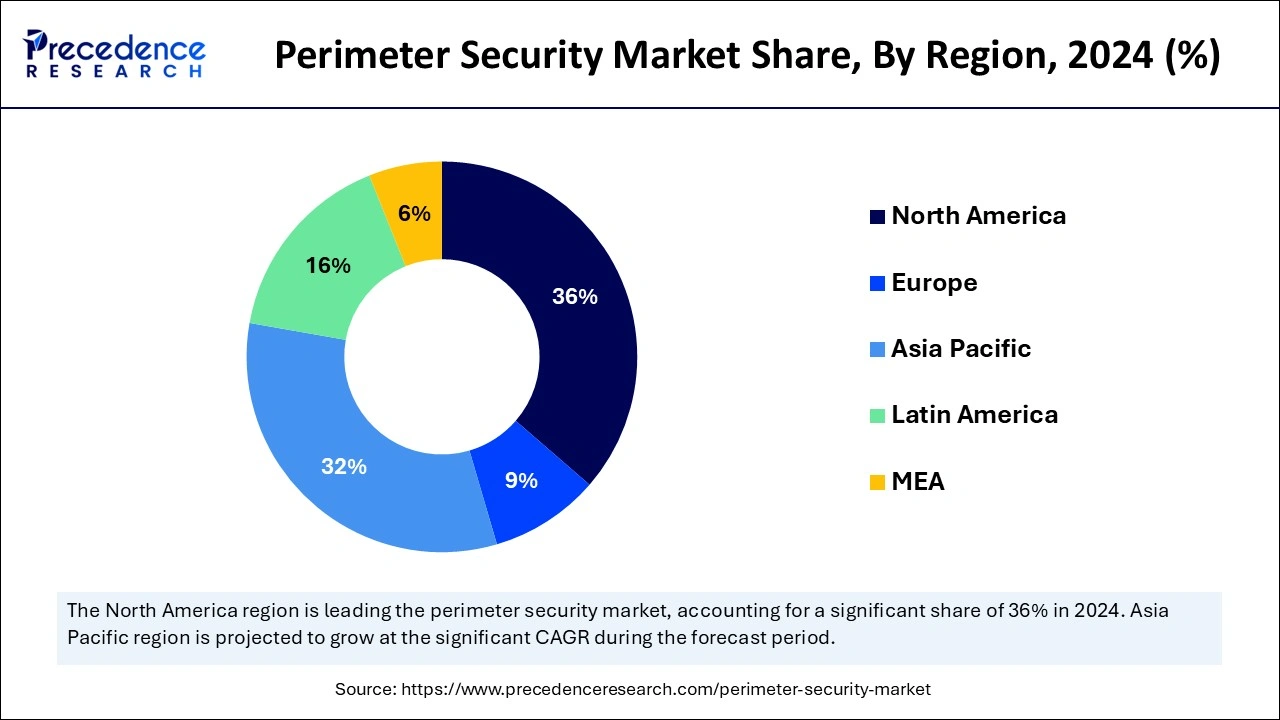

North America dominated the global perimeter security market in 2024. The dominance of the region can be attributed to the ongoing research and development initiatives conducted by government and private organizations in the field. The growing use of the Internet of Things (IoT) in the region can impact regional growth positively. In the region, the U.S. led the market owing to the stringent government regulations towards the security of the country.

Asia Pacific is expected to grow at the fastest rate in the perimeter security market over the studied period. The growth of the region is credited to the strict government measures and developing infrastructure in emerging economies such as China and India. Moreover, nuclear facilities, transportation, chemical industries, and military and defense are key contributors to the market expansion. The rising incidences of crime like data theft and personal crime can increase the need for perimeter security in the region.

Perimeter security is an integrated system that offers physical security to the facility. It also helps to protect from illegal physical intrusions. The perimeter security market includes technologies like access control systems, video surveillance systems, notifications, and communication systems. The ongoing developments in technology have facilitated the launches of microwave, radar, infrared, and seismic sensors. These technologies are completely dedicated to the protection of intellectual assets in the perimeter.

| Report Coverage | Details |

| Market Size by 2024 | USD 66.41 Billion |

| Market Size in 2025 | USD 72.74 Billion |

| Market Size in 2034 | USD 165.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System, Service, End-Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising of technical cooperation among key players

Automated processes decrease the number of checkpoints. Industries like petrochemical, oil, and electrical industries will see a surge in demand for the perimeter security market in the upcoming years. It is general for security solutions to include remote control, semiconductors, and computer programming. In addition, the high operational and production complexity level in the industry encourages market players to cooperate on a technical level.

Limited technical knowledge

Limited technical knowledge regarding security threats and frequent potential losses is the major factor hampering the perimeter security market growth. Many companies hire security professionals who are unable to analyze the complexities of the system. Moreover, to tackle this, employees have to train properly about the use of the currently installed solution.

High demand from a financial institution

To this day, the perimeter security market plays an important role, especially in financial and bank facilities, to protect important assets from illegal access and cross-border intrusions. Innovative security technologies, like data analytics, access control, and automated solutions, play a significant role in safeguarding the perimeter of these institutions. Furthermore, financial institutions focus on around-the-clock perimeter security to tackle threats associated with robbery, theft, and kidnapping.

The video surveillance systems segment held the largest perimeter security market share in 2024 and is expected to grow at the fastest rate over the forecast period. The dominance and growth of the segment can be attributed to the rising emphasis on the complete safety and continuous capturing of images. The segment generally consists of video analytics, CCTV cameras, video cameras, and smart video devices that can be connected to many devices at once. Additionally, Video surveillance solutions can daunt financial loss from vandalism, stolen merchandise, and destruction of valuable data.

The system integration and consulting services segment dominated the perimeter security market in 2024. The dominance of the segment can be credited to the increasing adoption of innovative technologies like motion sensors, IP-based security cameras, and wireless technology. This segment helps businesses with an efficient functional workflow, effective performance, and access to real-time data. Moreover, the integration of different security systems gives the controller with more precise information.

The risk assessment and analysis services segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the increasing demand for this system services from large enterprises because they find it simpler to outsource the whole security system, hence detecting bugs in the security of sensitive information and safeguarding the company premises from potential intruders.

In 2024, the military and defense segment led the global perimeter security market. The dominance of the segment can be driven by rising outings and shopping trends along with the growing population. Also, the presence of big entertainment hubs at many locations has necessitated the large application for perimeter security systems. In addition, it is important to maintain sophisticated military base perimeter security to keep the security of operations and troops, leading to segment growth further.

The transportation segment is anticipated to show the fastest growth over the projected period. The growth of the segment is due to the wide applications of perimeter security in freight cars, railways, and cargo vehicles to safeguard the valuable assets on board. Furthermore, surveillance cameras, access control points, and vehicle barriers are generally used to secure the transportation hubs.

Latest Announcement by Market Leaders

By System

By Service

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025