February 2025

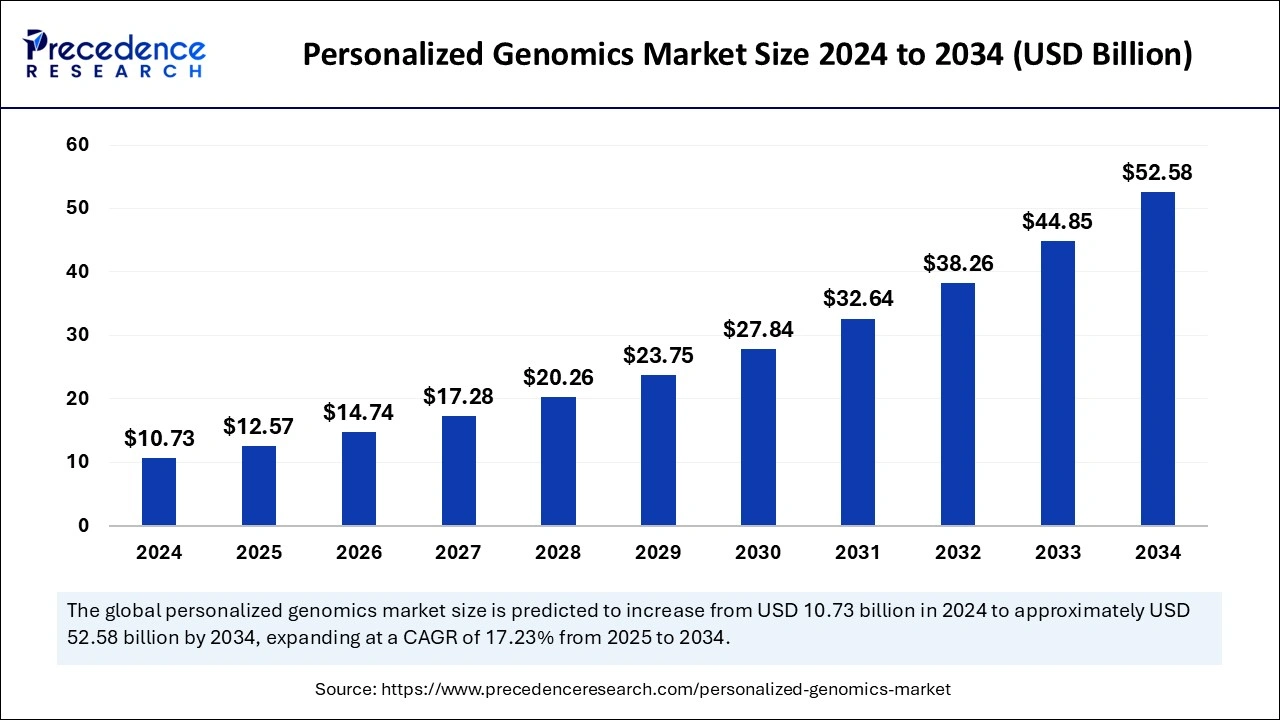

The global personalized genomics market size is calculated at USD 12.57 billion in 2025 and is forecasted to hit around USD 52.58 billion by 2034, representing a CAGR of 17.73 from 2025 to 2034. The North America market size was estimated at USD 12.57 billion in 2024 and is expanding at a CAGR of 17.73 during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global personalized genomics market size accounted for USD 10.73 billion in 2024 and is predicted to increase from USD 12.57 billion in 2025 to approximately USD 12.57 billion by 2034, expanding at a CAGR of 17.73 from 2025 to 2034. The market growth is attributed to the increasing demand for personalized healthcare solutions, driven by advancements in genomic technologies and the rising prevalence of chronic diseases.

The use of artificial intelligence algorithms in genome sequencing operations enables scientists to conduct disease-related genetic variation detection at both faster and improved levels of precision. Machine learning technologies offer better biomarker discovery abilities, which leads to early disease detection capabilities and allows the creation of targeted treatment strategies. The use of AI-driven data analytical systems streamlines big genomic research by improving data processing of complex datasets with fewer mistakes and better efficiency. Through genetic profile analysis, AI enables the production of patient-specific medical treatments.

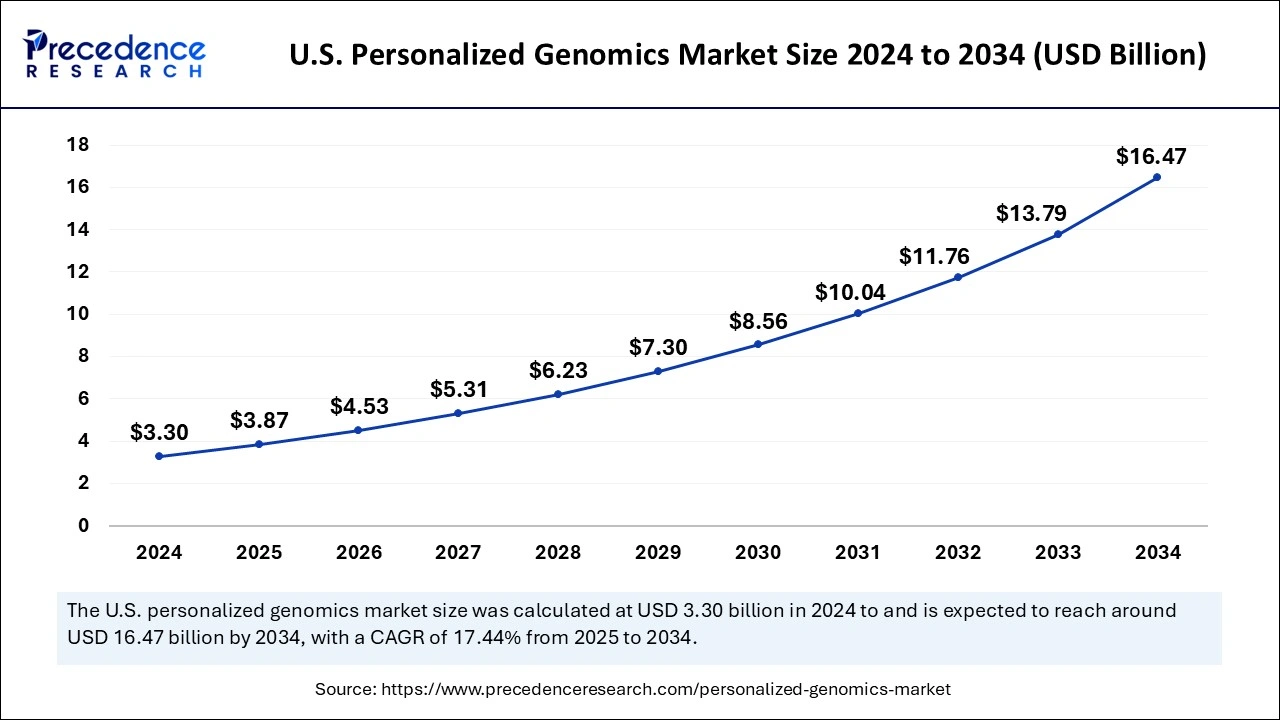

The U.S. personalized genomics market size was exhibited at USD 3.30 billion in 2024 and is projected to be worth around USD 16.47 billion by 2034, growing at a CAGR of 17.44% from 2025 to 2034.

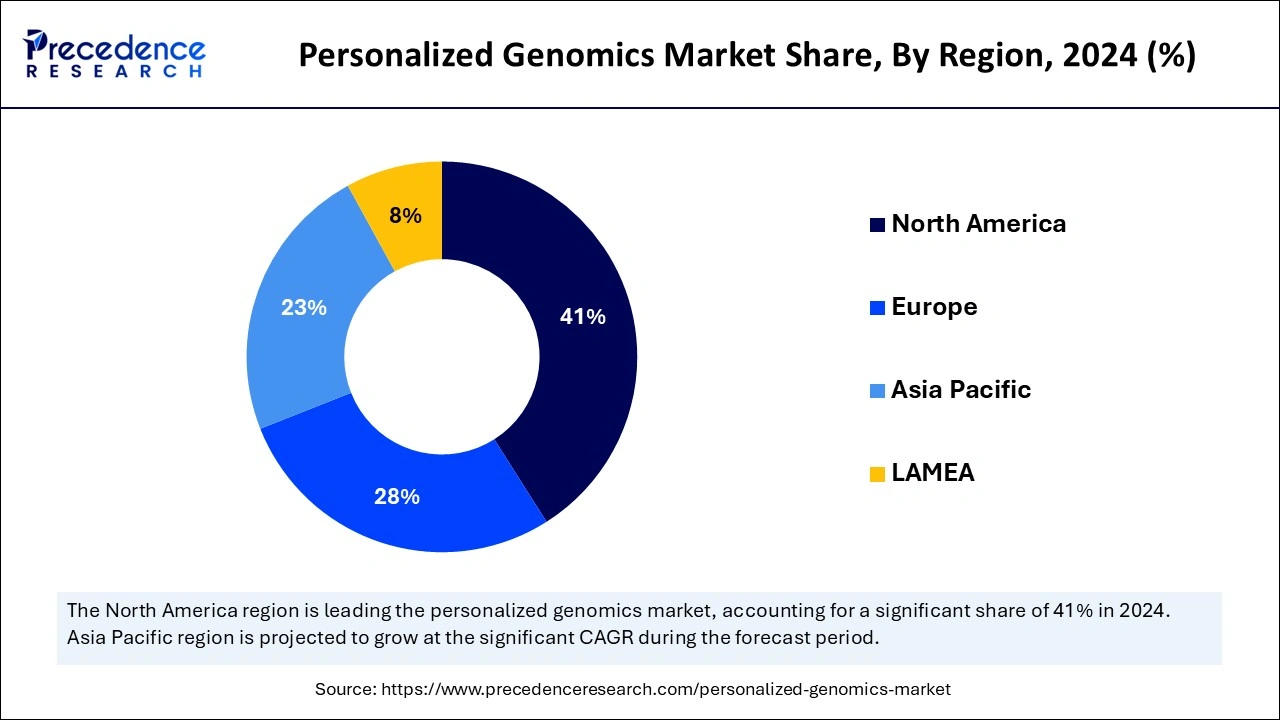

North America held the dominant share of the personalized genomics market in 2024 due to the robust adoption across healthcare facilities and research and clinical domains. The United States leads worldwide genomic research and personalized medicine through institutional support from the National Institutes of Health (NIH) and Centers for Disease Control and Prevention (CDC). The clinical-sector implementation of genetic testing at hospitals and clinics and growing government genomics funding.

Asia Pacific is projected to host the fastest-growing personalized genomics market in the coming years, owing to the healthcare industry's rapid growth and governance bodies increasing their genomics-related priorities. The governments of China, together with India and Japan, invest heavily in accelerating genomic research through their funding and public-private institution partnership programs. China's government views genomic research as vital for healthcare evolution; thus, it devotes substantial funds to genomic infrastructure development and next-generation sequencing technology implementations.

The personalized genomics market expansion is propelled by the rising need for personalized medicine, as precision treatments that apply to specific genetic profiles are becoming more popular. Healthcare providers continue to use genomic data to develop personalized therapies that help treat cancer, cardiovascular conditions, and rare inherited disorders. Genomic sequencing advances have enabled doctors to detect diseases at early stages, thus enabling targeted clinical interventions.

Drug development efforts from pharmaceutical businesses leverage genetic science to produce medication based on biomarkers, which results in better treatment outcomes. The adoption of genetic testing receives support from regulatory agencies, which leads to programs that promote genetic testing adoption. The growth of the personalized genomics market is further facilitated by healthcare providers transitioning from standardized treatments to personalized medical solutions.

| Report Coverage | Details |

| Market Size in 2034 | USD 52.58 Billion |

| Market Size in 2025 | USD 12.57 Billion |

| Market Size by 2024 | USD 10.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.23% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Technology, Applications, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for personalized medicine

Growing demand for personalized medicine is anticipated to drive the personalized genomics market as precision treatments tailored to individual genetic profiles gain traction. Medical professionals nowadays are using genomic information to create individualized treatment approaches for cancer patients alongside cardiovascular disease patients and those with unusual genetic disorders.

Genomic sequencing improvements enable medical experts to make fast disease diagnoses, which allows them to deliver precise intervention treatments. Furthermore, the global rise of genomic medicine services demonstrates the utilization of individualized healthcare solutions, which will further fuel the market in the coming years.

High cost of genomic sequencing

The personalized genomics market growth is hampered due to the high cost of genomic sequencing, limiting accessibility for individuals and healthcare providers in low- and middle-income regions. The high price of genomic sequencing acts as an obstacle to market expansion, as it prevents individuals and healthcare providers in low- and middle-income areas from accessing these services. Hong Kong's diagnostic laboratories face greater financial pressures from investing in advanced sequencing technologies along with bioinformatics tools.

The adoption of genetic testing remains limited because of patient reluctance to spend out-of-pocket costs when insurance does not cover expenses. Biotech firms, together with research organizations, experience difficulty balancing the reduction of operational expenses with precise genomic analysis outcomes. The cost expenses for genomic data storage infrastructure, together with processing requirements, arise as obstacles to widespread acceptance.

High adoption of direct-to-consumer (DTC) genetic testing

High adoption of direct-to-consumer genetic testing is expected to create significant opportunities for the personalized genomics market, as individuals seek deeper insights into their ancestry, health risks, and wellness traits. DNA testing solutions provided by companies have seen increased demand as people know more about their genetic disease risk factors, which include cancer, cardiovascular diseases, and metabolic conditions. The combination of declining sequencing expenses and better accessibility drives increased market entry, which motivates people to adopt proactive health practices. Better regulations have recognized features that ensure the safe, ethical performance of DTC testing methods, which builds consumer confidence in these testing services.

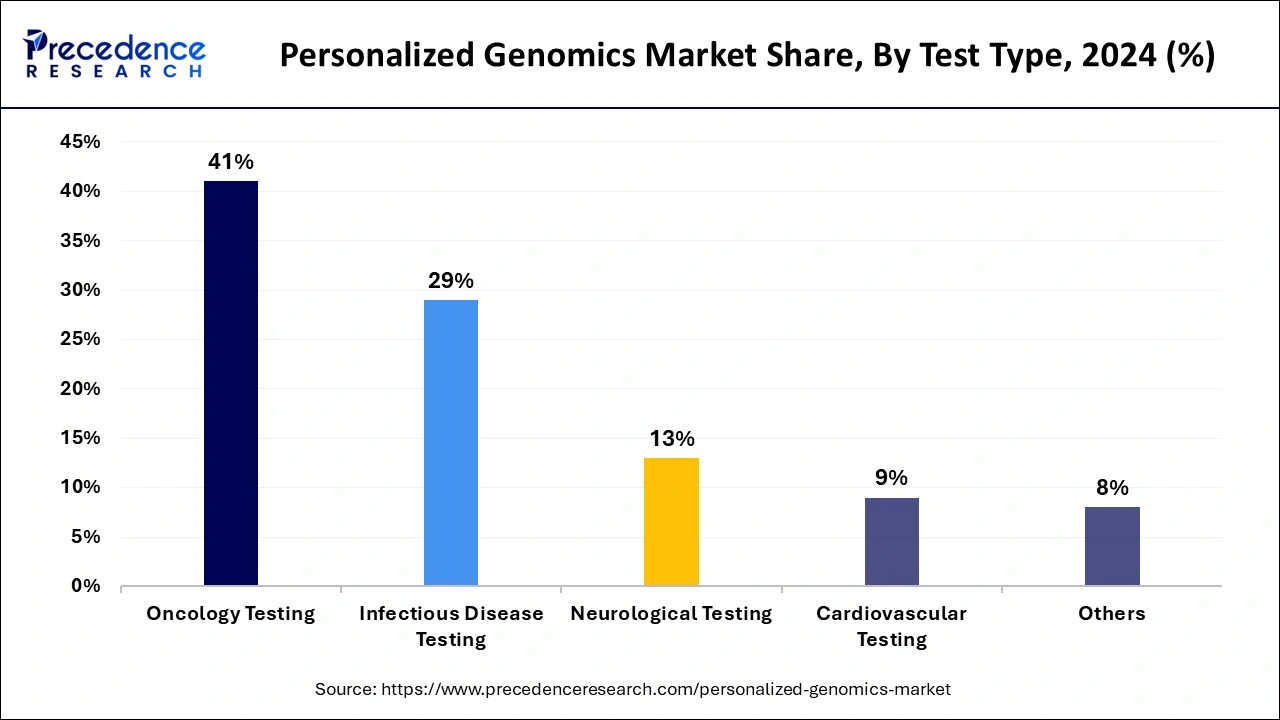

The oncology testing segment held a dominant presence in the personalized genomics market in 2024 due to the increasing prevalence of cancer and the demand for precision medicine. Medical professionals now use genomic information to create individualized treatment approaches for cancer patients alongside cardiovascular disease patients and those with unusual genetic disorders.

The cardiovascular testing segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to the growing number of heart diseases. According to the CDC report, in 2022, 702,880 people died from heart disease. Research in coronary artery disease genomic risk prediction accelerates early detection services coupled with prevention methods.

The sequencing-based tests segment accounted for a considerable share of the personalized genomics market in 2024, which was largely driven by advancements in next-generation sequencing (NGS). Genomic testing chooses NGS because the technology provides strong accuracy and fast results while analyzing the complete genome system. Scientific advancements in whole genome sequencing and exome sequencing permit customized disease therapy approaches while helping detect diseases earlier through biological assessments. Moreover, their decreasing technology cost resulted in major price drops in the past few years.

The PCR-based tests segment is anticipated to grow with the highest CAGR over the studied years, owing to their precise identification of genetic mutations, which aid in infectious disease and inherited disorder diagnosis. PCR (Polymerase Chain Reaction) technology accomplishes specific DNA sequence amplification and remains exceptionally sensitive when quantifying minimal genetic substance levels. This technology holds critical importance in viral infection testing, which includes COVID-19, and operates as a vital component of molecular diagnostic procedures. The increasing demand for genetic-based infectious disease testing of HIV and Hepatitis viruses.

In 2024, the precision medicine segment led the global personalized genomics market. The healthcare industry demands custom-made medical solutions at an increasing rate. Precise treatment decisions in oncology and rare genetic disorders, along with cardiovascular diseases, became prominent due to the quick genomic application expansion in the clinical care marketplace. The dominance of precision medicine remains strong, as various pharmaceutical corporations and healthcare entities choose to utilize genomic information while developing individualized patient therapeutics that generate better results.

The wellness segment is projected to expand rapidly in the coming years, as customers are shifting to know about the genetic makeup that affects their wellness and health traits. More individuals are using genomic tests to determine their likelihood of developing obesity, diabetes, heart disease, and other lifestyle-linked disorders. The growth of consumer demand combined with improved genomic testing tools designed for public use will probably accelerate opportunities for genomics in personal wellness applications.

The hospitals and clinics segment dominated the global personalized genomics market in 2024 due to its expanded presence in medical facilities for diagnosis and treatment determination. The field of healthcare utilizes genomic testing more extensively in both oncology and cardiology departments, along with facilities that handle rare diseases to deliver individualized treatment options. The adoption of NGS and PCR-based testing in hospital sites has created a greater need for personalized genomic services in medical facilities.

The pharmaceuticals and biotechnology segment is projected to grow at the fastest rate in the future years, as they support drug development and meet growing requirements for specific treatments. Pharmaceutical and biotech industries expect increasing demand for genomic testing as the expanding use of genomic data is used to discover new biomarkers for diseases, including cancer, along with various neurological and autoimmune conditions.

By Test Type

By Technology

By Application

By End User

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

October 2024

February 2025