May 2024

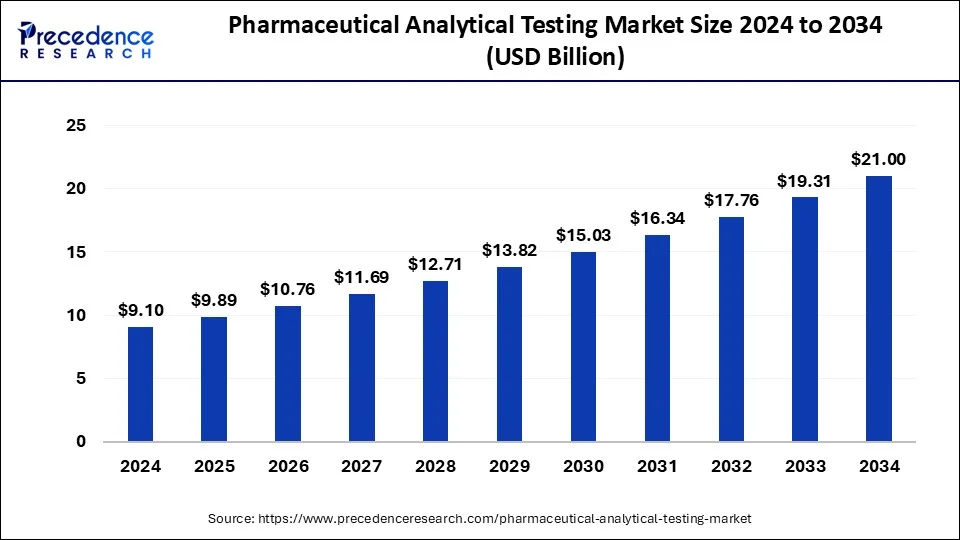

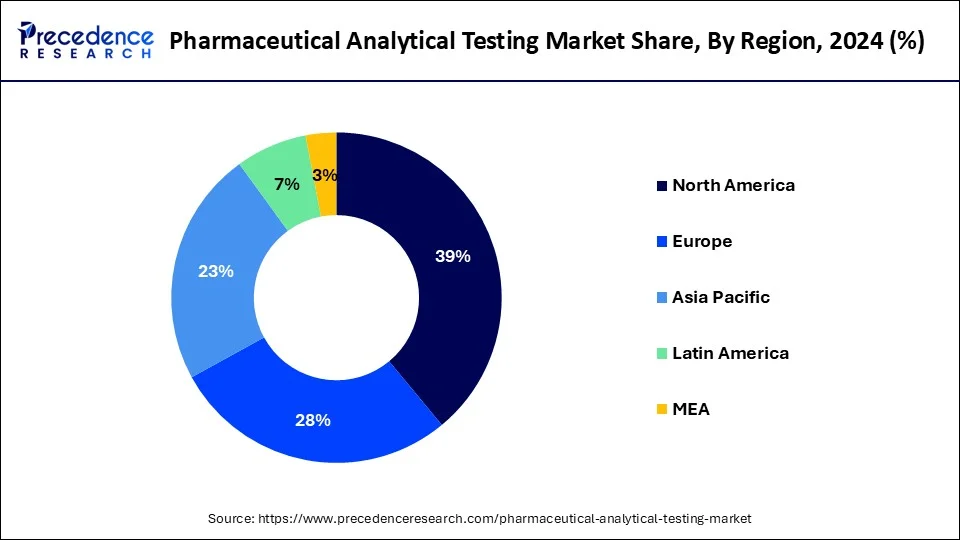

The global pharmaceutical analytical testing market size is calculated at USD 9.89 billion in 2025 and is predicted to reach around USD 21 billion by 2034, accelerating at a CAGR of 8.72% from 2025 to 2034. The North America pharmaceutical analytical testing market size surpassed USD 3.55 billion in 2024 and is expanding at a CAGR of 8.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical analytical testing market size was estimated at USD 9.10 billion in 2024 and is predicted to increase from USD 9.89 billion in 2025 to approximately USD 21 billion by 2034, expanding at a CAGR of 8.72% from 2025 to 2034. The pharmaceutical analytical testing market is driven by the major factors such as rising investments in the pharmaceutical industry and booming government support for the same. Alongside, major players are involved in creating sophisticated and advanced testing materials, these factors along with technological innovations will support the market’s growth.

Testing is expedited by AI, which analyzes hundreds of data points more quickly than the human eye can. As many data analysis jobs in laboratory testing involve repetition and take time, assigning simpler tasks to artificial intelligence (AI) expedites and simplifies processing. This enables lab personnel to concentrate on more delicate testing issues, like assessing anomalous or critical samples of great concern to clients. As a result, they can provide more insightful analysis and recommendations.

Furthermore, AI can learn as it goes along, which is vital for testing services because it allows it to recognize sample patterns more rapidly and accurately over time. Machine learning maintains its interpretive flexibility since it is not rule-based but instead considers correlations and permutations.

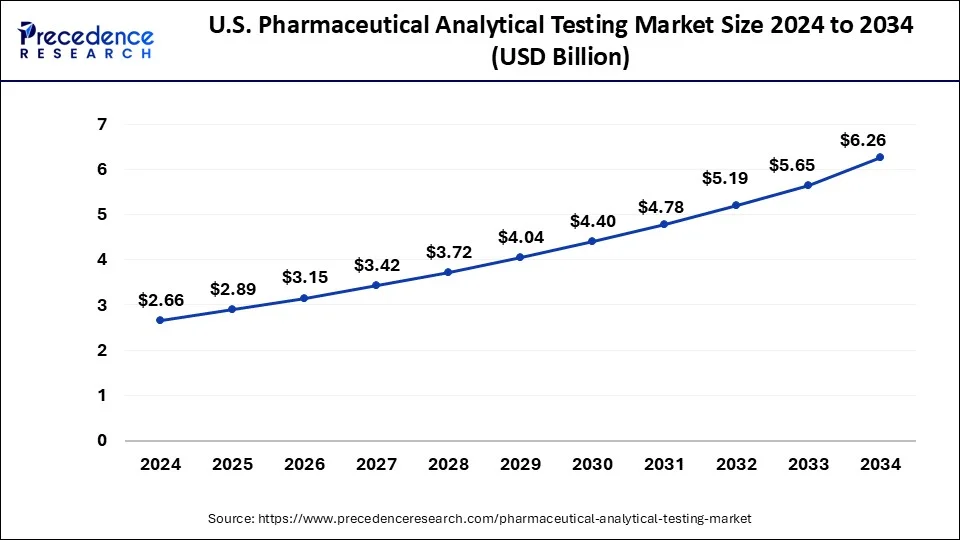

The U.S. pharmaceutical analytical testing market size was valued at USD 2.66 billion in 2024 and is projected to surpass USD 6.26 billion by 2034 with a CAGR of 8.94% from 2025 to 2034.

North America dominated in the pharmaceutical analytical testing market in 2024. North America, particularly the United States, has some of the world's strictest and most well-defined regulatory environments. Health Canada and the U.S. Food and medication Administration (FDA) set high criteria for medication development, production, and testing. These organizations demand thorough analytical testing at every phase of the pharmaceutical development process, from preclinical research to post-market surveillance. The strict guidelines established by these regulatory agencies fuel the need for superior analytical testing services, hence reinforcing North America's dominant position in this industry.

Asia-Pacific is observed to be the fastest growing in the pharmaceutical analytical testing market during the forecast period. Global pharmaceutical regulations, such as Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP), are being adopted throughout the Asia-Pacific region at an increasing rate. The need for these services is driven by thorough analytical testing that conforms with international regulations. The market for analytical testing has also been helped by tightening pharmaceutical quality rules in some countries, which call for more thorough testing and compliance.

In the pharmaceutical industry, ensuring that medications are safe and effective for their intended purpose is the primary goal of analytical testing. Extensive testing aids in locating possible pollutants, impurities, or variances that can jeopardize the safety of pharmaceuticals. Pharmaceutical product quality must be maintained through analytical testing. It aids in ensuring that every batch satisfies the requirements by helping to check the consistency and purity of the products. Advanced analytical testing techniques are crucial to validate novel approaches and assure the viability of newly created medications and therapies, especially in biologics and personalized medicine.

| Report Coverage | Details |

| Market Size by 2034 | USD 21 Billion |

| Market Size in 2025 | USD 9.89 Billion |

| Market Size in 2024 | USD 9.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.72% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of chronic diseases

Adequate medication is in high demand because of the rise of chronic diseases such as diabetes, cancer, cardiovascular disease, and respiratory problems worldwide. The pharmaceutical sector is under pressure to create novel medications and treatments to deal with these illnesses. Medication for chronic diseases is usually needed for the rest of one's life. This calls for ongoing pharmacovigilance programs to monitor drug efficacy and safety. Analytical testing is essential to identify any possible side effects and guarantee the long-term safety of these drugs.

The Drug Supply Chain Security Act (DSCSA) was not followed by Connecticut-based contract testing lab Valisure, according to a recent untitled letter from the US Food and Drug Administration (FDA). The letter also revealed that the company's analytical testing laboratory had "methodological deficiencies."

Limited availability of skilled professionals

The need for analytical testing services rises with the expansion of the pharmaceutical industry. However, the scarcity of qualified personnel can lead to bottlenecks, making it difficult for labs to expand to accommodate growing demand. In some areas, a large percentage of the highly qualified staff in pharmaceutical analytical testing is getting close to retirement. If there isn't enough fresh talent entering the market, the skilled professional deficit will probably get worse over time, raising questions about the industry's long-term viability.

Limited access to advanced testing facilities

This equipment demands continuous expenditure for calibration and maintenance after initial setup. High-tech lab running expenses, such as utilities, consumables, and recurring improvements, can be unaffordable. Analytical testing for pharmaceuticals is strictly regulated. Facilities must be accredited by regulatory agencies such as the FDA or EMA and adhere to Good Laboratory Practices (GLP). Companies may find it challenging to achieve these strict requirements if they have limited access to cutting-edge testing facilities, which could cause delays in the licensing of new drugs. This limits the growth of the pharmaceutical analytical testing market.

Growth in generic drug manufacturing

In contrast to small-molecule generics, biosimilars, generic equivalents of biologic drugs, require more intricate and thorough analytical testing. Thus, the expansion in biosimilar manufacturing has increased the demand for specialized analytical testing services.

Analytical testing organizations invest in cutting-edge testing apparatus and methodologies to remain competitive. The growing complexity of generic medications, particularly considering the emergence of biosimilars, calls for the creation of novel testing procedures. This ongoing innovation gives analytical testing companies a competitive edge and creates new growth opportunities. This opens an opportunity for the growth of the pharmaceutical analytical testing market.

The bioanalytical testing segment dominated the pharmaceutical analytical testing market in 2024. Biologics, which includes gene therapies, vaccines, and monoclonal antibodies, has experienced rapid growth. Bioanalytical testing has become crucial since these complex compounds need highly sophisticated analytical techniques to guarantee their safety, efficacy, and quality. More robust and standardized bioanalytical testing procedures are required when clinical trials are carried out worldwide to ensure uniform and trustworthy results in all areas.

The method development and validation segment show a significant growth in the pharmaceutical analytical testing market during the forecast period. The Quality by Design (QbD) approach highlights the importance of thorough method development in pharmaceutical production. To guarantee consistent product quality throughout the lifespan, well-defined and validated analytical procedures are necessary for QbD, which focuses on integrating quality into the product from the outset. The need for method development and validation services is anticipated to increase as QbD concepts are applied more frequently in drug development and production.

The stability testing segment shows a notable growth in the pharmaceutical analytical testing market during the forecast period. Stability testing has gotten more challenging with the introduction of increasingly complex medication formulations, such as biologics, biosimilars, and combination medicines. Specific stability studies are needed to assess the chemical, physical, and microbiological stability of these sophisticated formulations under varied circumstances. The demand for complicated stability testing services has grown due to this complexity, which has fueled the market expansion.

The biopharmaceutical companies segment dominated the pharmaceutical analytical testing market in 2024. Massive, complicated molecules like biopharmaceuticals often need thorough characterization, which includes stability tests, potency testing, and structural analysis. Due to their intricacy, high-performance liquid chromatography (HPLC), nuclear magnetic resonance (NMR), and mass spectrometry are among the sophisticated analytical methods that must be used. Many biopharmaceutical businesses would rather hire specialized service providers to handle their analytical testing needs. By outsourcing, companies can cut down on the overhead of running internal testing facilities while concentrating on their core skills.

By Service Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

February 2025

September 2024

December 2024