April 2025

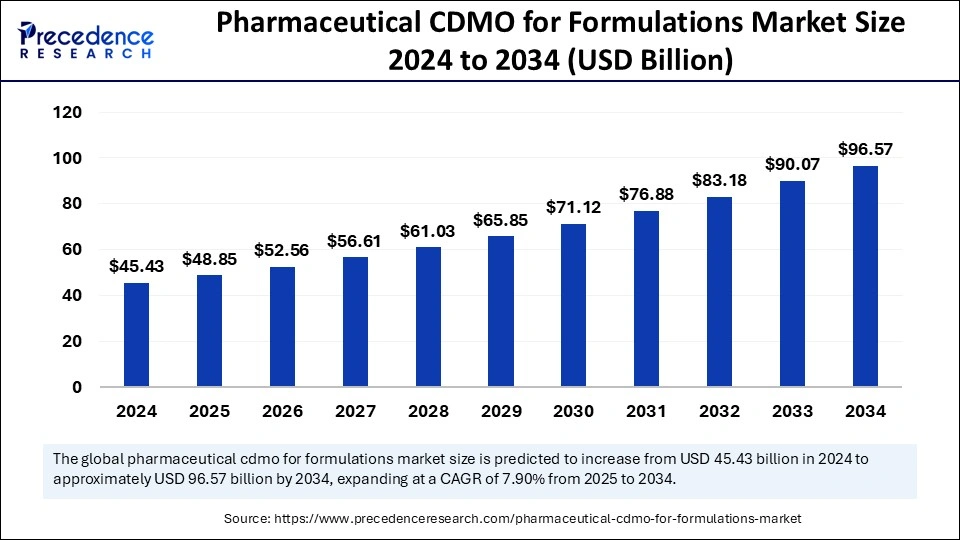

The global pharmaceutical CDMO for formulations market size is calculated at USD 48.85 billion in 2025 and is forecasted to reach around USD 96.57 billion by 2034, accelerating at a CAGR of 7.90% from 2025 to 2034. The North America market size surpassed USD 19.28 billion in 2024 and is expanding at a CAGR of 7.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical CDMO for formulations market size was estimated at USD 45.43 billion in 2024 and is predicted to increase from USD 48.85 billion in 2025 to approximately USD 96.57 billion by 2034, expanding at a CAGR of 7.90% from 2025 to 2034. The pharmaceutical CDMO formulation market expands because companies allocate more research and development funding to tackle rising drug complexity and pursue external partnerships to meet rising personal medication needs.

Disease analysis becomes faster with Artificial Intelligence systems, which helps researchers identify drug targets to discover new therapeutic molecules more efficiently. Artificial intelligence enhances the optimization of manufacturing parameters, leading to reduced waste and improved consistency in medicine formulations, resulting in lower production costs and higher-quality medications. AI-enabled supply chain management systems enhance future demand forecasting while also streamlining inventory processes and logistics operations to ensure ongoing manufacturing efficiency.

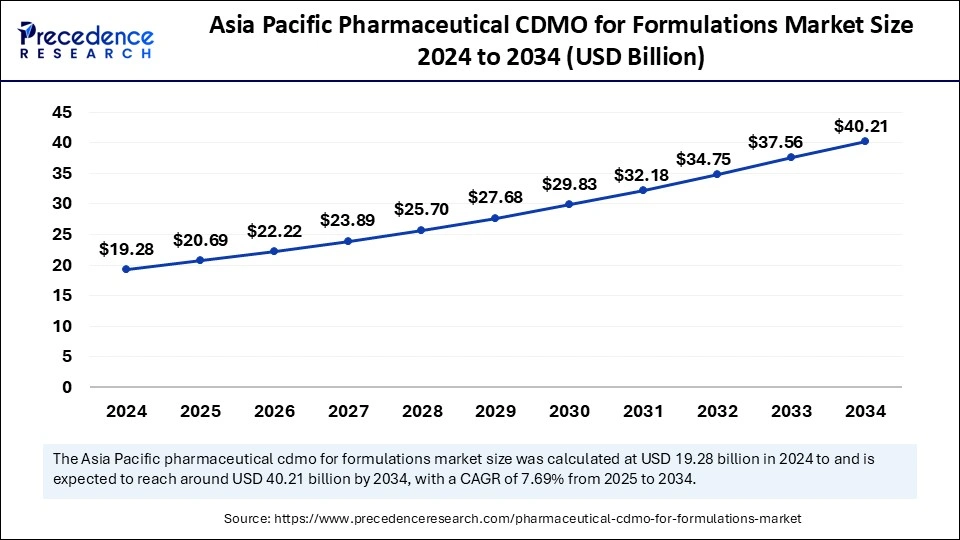

The Asia Pacific pharmaceutical CDMO for formulations market size was exhibited at USD 19.28 billion in 2024 and is projected to be worth around USD 40.21 billion by 2034, growing at a CAGR of 7.69% from 2025 to 2034.

Asia Pacific Market Trends

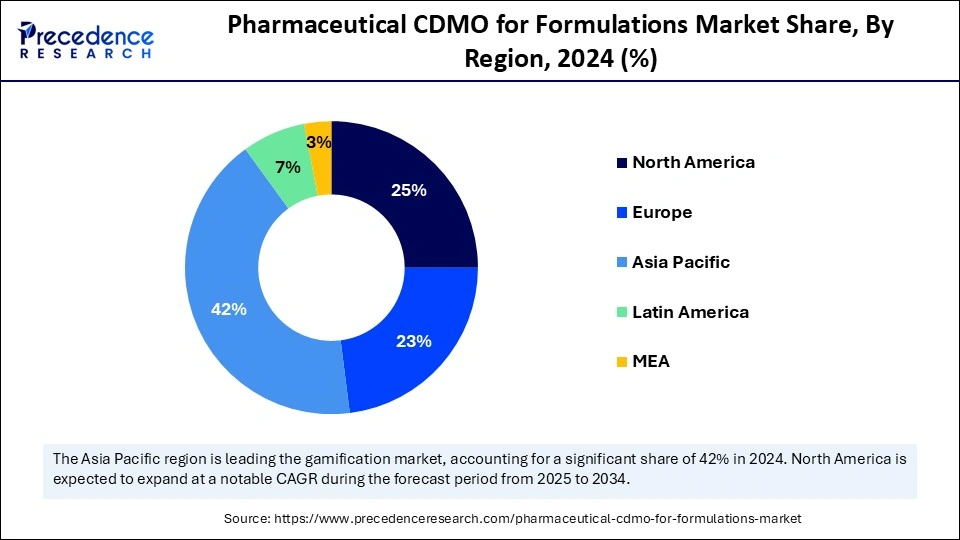

Asia Pacific accounted for the largest share of the pharmaceutical CDMO for formulations market in 2024. The rising pharmaceutical sector, advanced healthcare facilities, and expanding pharmaceutical outsourcing operations drive the market expansion. Improving pharmaceutical services and better healthcare availability because of improved insurance systems and growing economic conditions that allow patients to purchase pharmaceutical treatments.

China has become one of the leading providers of pharmaceutical CDMO formulations in the Asia Pacific. Drug development and manufacturing activities find strong appeal in China because of its extensive industrial capacity and low production costs. The well-developed healthcare system and its commitment to pharmaceutical industry expansion contribute significantly to its primary force in worldwide CDMO markets.

North American Market Trends

North America is anticipated to witness the fastest growth in the pharmaceutical CDMO for formulations market during the forecasted years, driven by its prosperous pharmaceutical industry, large investments in research and development, and well-developed healthcare facilities. The major pharmaceutical organizations operating in the U.S. and Canada create a marketplace. Regional pharmaceutical entities boost R&D investments to develop advanced therapeutic drugs such as biologics, biosimilars, and personalized medicines. With the increasing investment in drug research and development, pharmaceutical companies demand specialized formulation services from CDMOs in addition to manufacturing and regulatory support services.

European Market Trends

The European pharmaceutical CDMO for formulations market shows substantial growth because companies offer investment in biopharmaceutical research and development. The market advances because of government support and research activities, and the substantial presence of leading industry players. The market receives major drive from countries like Germany, the United Kingdom, and France. Academic institutions partner with research institutions in European pharmaceuticals to develop innovation that fuels the market demand for formulation CDMO services. The pharmaceutical industry in Germany employs a significant number of qualified researchers and scientists responsible for delivering sophisticated drugs and complex manufacturing methods.

A pharmaceutical contract development and manufacturing organization (CDMO) for formulations associates with companies that assist pharmaceutical and biotechnology industries in developing drug formulations and performing production tasks. CDMOs utilize specialized techniques to make drug development more efficient as they produce pharmaceutical products of high quality at reduced costs. Pharmaceutical companies find essential drug development support through CDMOs to optimize production processes.

The pharmaceutical and biotechnology firms increase their research and development activities, which drives up their need for specialized formulation services. The pharmaceutical CDMO for formulations market gains strength because pharmaceutical companies require specialized formulation services to develop advanced treatments and biologics. Pharmaceutical firms are expected to continue leveraging CDMOs since these entities help them minimize costs and reduce risks while enhancing overall operational excellence in their drug development process.

| Report Coverage | Details |

| Market Size by 2034 | USD 96.57 Billion |

| Market Size in 2025 | USD 48.85 Billion |

| Market Size in 2024 | USD 45.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.90% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form, Therapeutic Area, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Outsourcing for cost efficiency

The Pharmaceutical CDMO for Formulations market is expanding due to the rising practice of pharmaceutical companies outsourcing development and manufacturing processes. The pharmaceutical industry employs CDMOs to help small and medium-sized pharmaceutical businesses decrease costs and optimize their operations. CDMOs offer essential support for companies by processing complex drug formulations, including biologics and personalized medicines, that pharmaceutical markets demand at an increasing rate. The escalating pharmaceutical industry demand for specialized formulations makes pharmaceutical companies choose CDMO partners for rapid and cost-efficient manufacturing methods.

Regulatory complexities and compliance challenges

Regulatory complexity and drug manufacturing compliance challenges represent a major market obstacle for the pharmaceutical CDMO for formulations market operations. The drug development phase, production processes, and quality control activities require CDMOs to follow strict universal regulations. The regulatory systems extend across different regions, such as the U.S. FDA or the European Medicines Agency.

CDMOs face substantial operational risks with manufacturing disruptions due to this regulatory situation. The compliance process requires investments that often prove difficult and expensive for small contract development and manufacturing organizations because of costs related to quality control measures, documentation management, and employee training.

Growing demand for personalized medicine

Increasing medical demands for personalized therapies present an opportunity within the pharmaceutical CDMO for the formulations market. The practice of personalized medicine delivers customized medical treatments by using a combination of assessments of genetic makeup and personal characteristics. CDMOs gain strategic advantages from pharmaceutical industry changes that highlight targeted therapies because of their advanced formulation development competencies. The rising number of personalized medicines creates a substantial business potential for CDMOs that enables them to increase their market reach as well as develop innovative services with pharmaceutical entities dedicated to producing individualized therapeutic solutions.

The oral solids segment donated the largest pharmaceutical CDMO for formulations market share in 2024. With the common use and favoring of oral dosage forms such as tablets, capsules, and liquids, the market for these products thrives. Oral solid drug products offer advantages like longer shelf life and ease of handling, making them ideal for the treatment of various diseases and chronic conditions.

The oral solid dosage forms continue to expand as healthcare providers require them for the management of diabetes and cardiovascular issues. Modern pharmaceutical outsourcing includes this segment as its main target because the world invests more in economical delivery systems, and patients choose oral medications for sustained therapy.

The injectables segment is anticipated to show considerable growth over the forecast period. The rising market need for biologics, biosimilars, and targeted therapies creates an opportunity for injectable formulations. Injectable medications have several beneficial properties, including immediate effectiveness, high drug availability, and accurate dosage measurement, which makes them useful in diverse treatment areas to treat cancer patients and manage diabetes.

The increasing frequency of chronic diseases among aging people drives substantial demand for injectable drugs because these treatments need swift and powerful responses. The segment observes growth because biologics and biosimilars, which require complex injectable formulations, have become more popular among patients. CDMOs take a primary position in developing injectable dosage forms because they follow strict protocols to preserve stability and sterility as well as safety.

Pharmaceutical CDMO for Formulations Market Revenue, By Dosage Form 2022-2024 (USD Million)

| Dosage Form | 2022 | 2023 | 2024 |

| Oral Solids | 15,775.64 | 16,927.71 | 18,180.37 |

| Oral Liquids | 5,869.00 | 6,291.01 | 6,749.47 |

| Injectables | 9,332.27 | 10,053.68 | 10,840.54 |

| Topicals | 3,845.87 | 4,112.86 | 4,402.30 |

| Inhalation Products | 2,142.64 | 2,301.50 | 2,474.37 |

| Transdermal and Patches | 1,384.02 | 1,482.97 | 1,590.43 |

| Others | 1,066.05 | 1,129.45 | 1,197.50 |

The oncology segment contributed the largest pharmaceutical CDMO for formulations market share in 2024. The global cancer incidence rate increases while pharmaceutical companies simultaneously expand their demand for complex treatments, including biologics and targeted drugs, as well as personalized medicines. Pharmaceutical companies consider CDMOs crucial because oncology drugs need sophisticated manufacturing capabilities, which include exact formulation techniques.

This market segment expands because innovative cancer treatments like monoclonal antibodies and antibody-drug conjugates (ADCs), and other biopharmaceuticals create high demand. The adoption of targeted therapies has become possible because personalized medicine advances have enabled higher treatment efficiency with reduced side effects, leading to growing market demand.

The infectious diseases segment is anticipated to show considerable growth in the forecast period. Hepatitis, cholera, measles, and typhoid infections have become more widespread globally, leading to market expansion. The rising requirement for vaccination treatments and immunization therapies stands as the main growth driver in this market.

This segment grows because of rising global efforts to stop emerging infectious threats and increased funding support for vaccine and antiviral drug programs. CDMOs help pharmaceutical firms execute the intricate procedures required for vaccine and therapy manufacturing through their services that confirm quality standards while maintaining sterility and expanding production capabilities.

Pharmaceutical CDMO for Formulations Market Revenue, By Therapeutic Area 2022-2024 (USD Million)

| Therapeutic Area | 2022 | 2023 | 2024 |

| Oncology | 8,878.99 | 9,547.62 | 10,275.88 |

| Cardiology | 5,973.51 | 6,405.73 | 6,875.44 |

| Central Nervous System (CNS) | 4,666.23 | 5,005.74 | 5,374.81 |

| Gastroenterology | 3,997.29 | 4,291.62 | 4,611.80 |

| Infectious Diseases | 7,155.97 | 7,687.88 | 8,266.80 |

| Endocrinology (Diabetes, Hormonal Therapy) | 3,440.22 | 3,690.87 | 3,963.36 |

| Others | 5,303.27 | 5,669.72 | 6,066.88 |

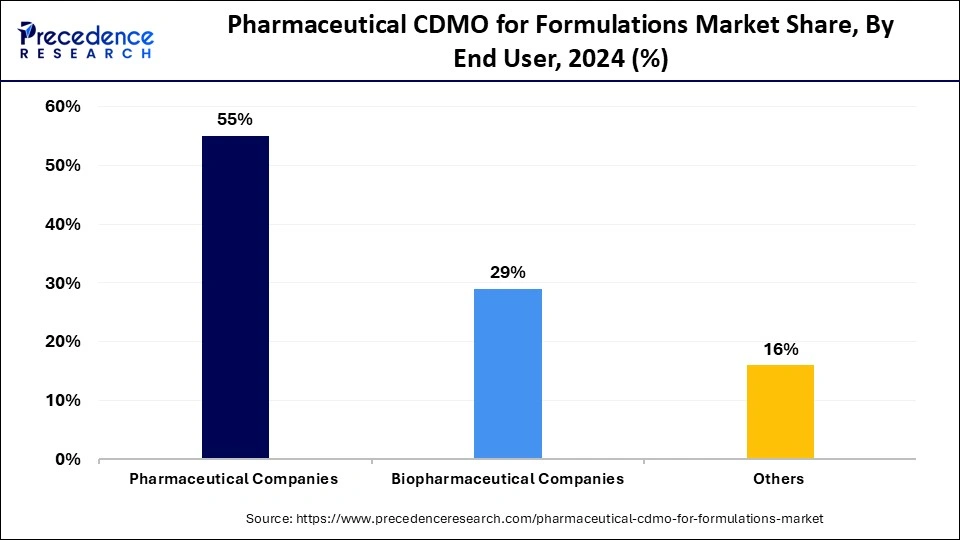

The pharmaceutical companies segment held the largest pharmaceutical CDMO for formulations market share in 2024. Pharmaceutical businesses depend on CDMOs for optimizing their drug progression, cost management, and market delivery efficiency enhancement. CDMOs help drug developers reach optimal formulations through their formulation development services to maintain the highest possible quality standards with safety assurance. Drugs have become more challenging to develop, so pharmaceutical firms partner with CDMOs to execute specialized functions, including pre-formulation testing, stability measurements, and volume manufacturing operations. CDMOs support pharmaceutical companies through their ability to scale operations and provide regulatory assistance and technological advantages to enable companies to concentrate on their main research activities.

The biopharmaceutical companies segment is anticipated to show considerable growth over the forecast period. CDMOs operate at an accelerated pace due to rising market needs for complex biologics, biosimilars, and advanced therapeutic solutions. The stability, effectiveness, and safety of biological products are supported by CDMOs as they deliver essential services to these companies.

Biopharmaceutical firms depend on contract development and manufacturing organizations for stability assays, scale-up operations, and regulatory requirements for biologics and biosimilars. Increased demand for specialized CDMO services will drive the CDMO for formulations market expansion because of growing gene therapy and monoclonal antibody and cell-based treatment markets.

Pharmaceutical CDMO for Formulations Market Revenue, By End-User 2022-2024 (USD Million)

| End-user | 2022 | 2023 | 2024 |

| Pharmaceutical Companies | 21,860.12 | 23,430.35 | 25,136.09 |

| Biopharmaceutical Companies | 11,339.18 | 12,199.27 | 13,136.42 |

| Others | 6,216.19 | 6,669.56 | 7,162.47 |

By Dosage Form

By Therapeutic Area

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

February 2025

September 2024