January 2025

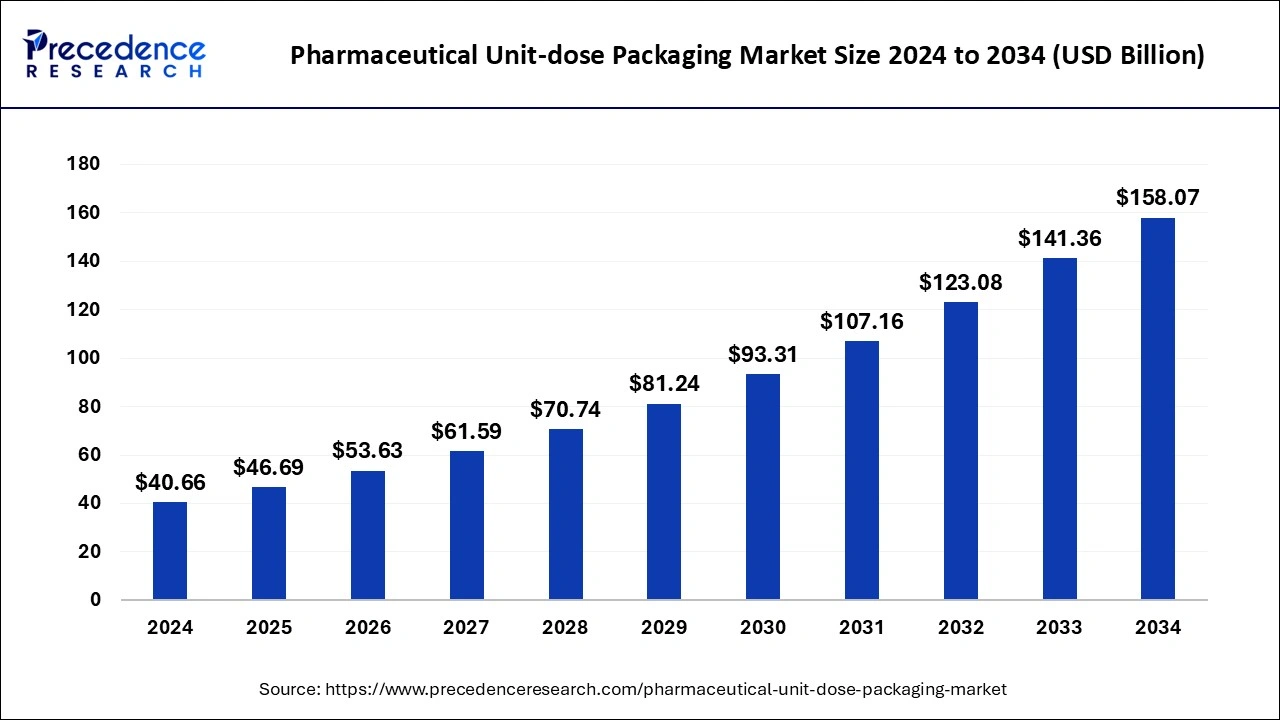

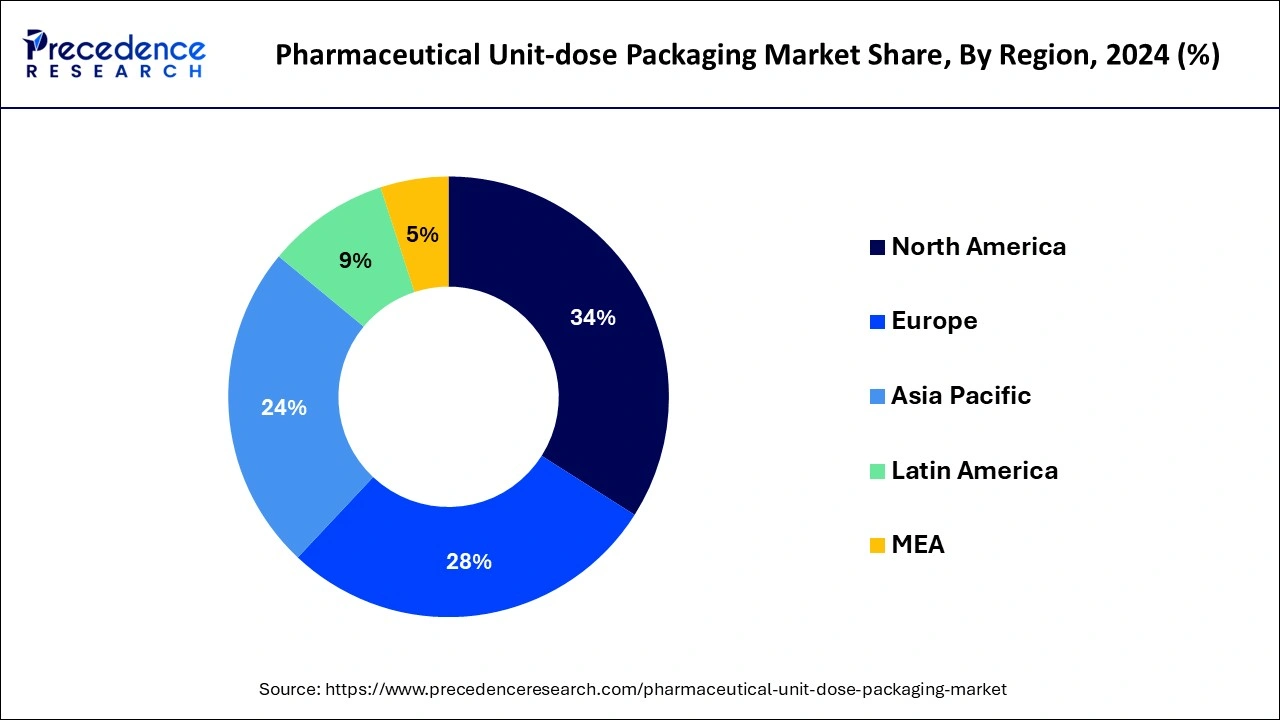

The global pharmaceutical unit-dose packaging market size is calculated at USD 46.69 billion in 2025 and is forecasted to reach around USD 158.07 billion by 2034, accelerating at a CAGR of 14.54% from 2025 to 2034. The North America pharmaceutical unit-dose packaging market size surpassed USD 13.82 billion in 2024 and is expanding at a CAGR of 14.71% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical unit-dose packaging market size was estimated at USD 40.66 billion in 2024 and is predicted to increase from USD 46.69 billion in 2025 to approximately USD 158.07 billion by 2034, expanding at a CAGR of 14.54% from 2025 to 2034. The rise in the global population and the surge in chronic diseases are driving the growth of the market.

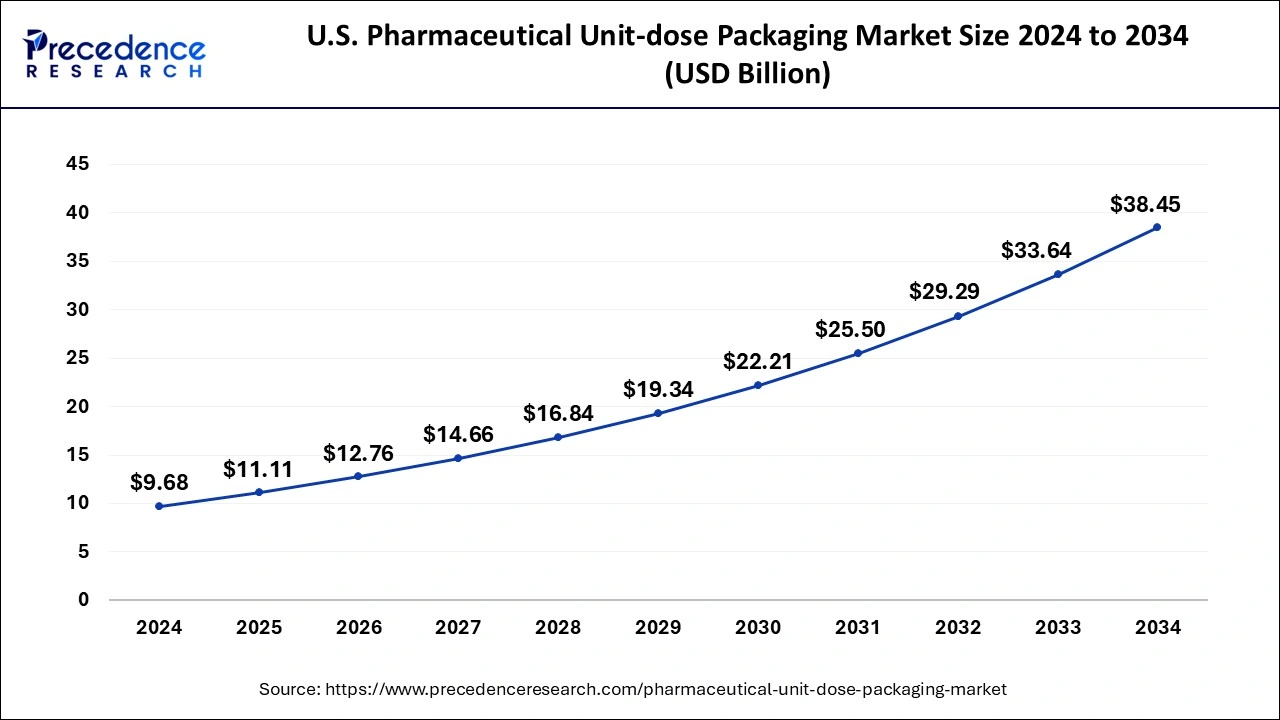

The U.S. pharmaceutical unit-dose packaging market size was valued at USD 9.68 billion in 2024 and is anticipated to reach around USD 38.45 billion by 2034, poised to grow at a CAGR of 14.79% from 2025 to 2034.

North America held the largest share of the pharmaceutical unit-dose packaging market in 2024. The region is observed to sustain the position with a significant expansion during the forecast period. North America, particularly the United States, has well-established healthcare industry standards that prioritize patient safety, medication adherence, and infection control. Unit-dose packaging, which provides individual doses of medications in pre-packaged, single-use containers, aligns with these standards by reducing the risk of medication errors, cross-contamination, and dosage inaccuracies.

North America has a large aging population and a high prevalence of chronic diseases, leading to increased demand for pharmaceuticals and healthcare services. Unit-dose packaging is widely used in healthcare settings such as hospitals, long-term care facilities, and home healthcare settings to facilitate medication administration, improve medication compliance, and minimize medication waste, particularly among elderly and chronically ill patients.

There is a growing emphasis on patient-centered care and personalized medicine in North America, with healthcare providers seeking innovative packaging solutions that enhance patient convenience, safety, and treatment outcomes. Unit-dose packaging supports patient-centered care by simplifying medication management, reducing the risk of medication errors, and empowering patients to take control of their health through self-administration of medications.

Asia Pacific is expected to witness significant growth in the pharmaceutical unit-dose packaging market during the forecast period. Asia Pacific is home to a significant portion of the world's population, including densely populated countries such as China and India. The region's large and growing population drives demand for pharmaceuticals, personal care products, and consumer goods, which often utilize unit-dose packaging for convenience, hygiene, and precise dosing.

The healthcare industry in Asia Pacific is experiencing robust growth due to factors such as rising healthcare expenditure, aging populations, and increasing prevalence of chronic diseases. Unit-dose packaging is widely used in pharmaceuticals and healthcare products to ensure accurate dosing, reduce medication errors, and improve patient compliance. As the healthcare sector expands, so does the demand for unit-dose packaging solutions.

Asia Pacific is a major manufacturing hub for packaging materials and pharmaceuticals, with established infrastructure and capabilities in plastics, flexible packaging, and pharmaceutical manufacturing. The region's advanced manufacturing facilities and expertise enable efficient production of unit-dose packaging formats, including blister packs, sachets, ampoules, and vials, to meet the diverse needs of local and export markets.

The pharmaceutical unit-dose packaging market offers a packaging format where a single dose of a product is contained within an individual package. As accurate dosing is essential to patient safety and regulatory compliance, this kind of packaging is frequently employed in the medical and pharmaceutical industries. Medication is delivered using a unit dose packing technique. Hospitals use these systems, which are made by companies that package and prepare pre-measured medications. The rising cases of chronic diseases including the cases of diabetes contribute to the growth of the overall market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.54% |

| Market Size in 2025 | USD 46.69 Billion |

| Market Size by 2034 | USD 158.07 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Product, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising research and development activities

Increased R&D investments enable manufacturers to develop innovative unit-dose packaging solutions that offer unique features, functionalities, and benefits. By leveraging advanced materials, technologies, and design concepts, companies can differentiate their products in the market and meet evolving consumer preferences and industry trends.

Innovative unit-dose packaging designs may include features such as tamper-evident seals, child-resistant closures, dose-tracking mechanisms, and enhanced usability, enhancing product safety, convenience, and user experience. R&D efforts in unit-dose packaging focus on meeting stringent regulatory requirements and quality standards imposed by government agencies and industry associations. Thereby, the rising research and development activities act as a major driver for the pharmaceutical unit-dose packaging market.

Regulatory hurdles

Unit-dose packaging must comply with stringent regulatory standards imposed by government agencies such as the Food and Drug Administration (FDA) in the United States, the European Medicines Agency (EMA) in Europe, and similar regulatory bodies worldwide. These regulations govern various aspects of unit-dose packaging, including safety, efficacy, labeling, child-resistant packaging, tamper-evident features, and dosage accuracy. Ensuring compliance with these requirements can be complex and time-consuming, requiring extensive testing, documentation, and regulatory approvals. Thereby, such regulatory hurdles create a significant restraint for the pharmaceutical unit-dose packaging market.

Advanced packaging solutions

As technology develops, smart package features like QR codes or RFID tags may be utilized to make tracking medications easier and lower the possibility of fake goods. Furthermore, developments in three-dimensional printing may enable the production of unit dose packaging that is personalized to meet the unique requirements of each patient. People who need specific dose schedules or have complicated medical problems may benefit the most from this. Thereby, such advanced packaging solutions create a significant opportunity for the pharmaceutical unit-dose packaging market.

The plastic segment held the dominating share of the pharmaceutical unit-dose packaging market in 2024. The growth of the segment is attributed to the increasing use of plastic material for the unit-dose packaging of drugs because it provides safety limits the breakage and is easy to manufacture and design. Plastic material provides exceptional precaution from atmospheric conditions and its non-chemical reactive properties are enhancing the growth of the segment. There are some types of plastic packaging in the pharmaceutical industry including bottles, bags, vials, metered-dose inhalers, cartridges, prefilled syringes, pouches, and closures for tablets and capsules. Polypropylene, polyethylene, polyvinyl chloride, and polyolefins are some of the types of plastic materials used in the pharmaceutical unit-dose packaging market.

The glass segment holds a significant share of the pharmaceutical unit-dose packaging market. Glass offers superior protection against moisture, oxygen, light, and other environmental factors that can degrade the quality and efficacy of pharmaceutical and healthcare products. Glass unit-dose packaging helps maintain the integrity and stability of the contents, ensuring product safety and efficacy throughout its shelf life. This is particularly important for sensitive medications, vaccines, and biologics that require strict storage and handling conditions.

The vials segment dominated the pharmaceutical unit-dose packaging market in 2024. Vials are highly versatile and adaptable containers that can accommodate a wide range of liquid, semi-solid, and solid pharmaceutical formulations. They come in various sizes, shapes, and materials, making them suitable for packaging diverse unit-dose medications, including injectables, oral solutions, suspensions, powders, and lyophilized drugs. Vials offer precise dosing capabilities, allowing pharmaceutical manufacturers to accurately measure and dispense unit doses of medications. This precision dosing is essential for ensuring patient safety and medication efficacy, particularly for critical or high-potency drugs that require precise dosage administration.

Vials offer excellent protection and stability for unit-dose medications, shielding them from light, moisture, oxygen, and other environmental factors that can degrade pharmaceutical formulations. The airtight seals and opaque materials used in vial construction help preserve the potency and shelf life of the medication, ensuring its efficacy and safety throughout storage and transportation.

The blisters segment is observed to witness the fastest rate of expansion in the pharmaceutical unit-dose packaging market during the forecast period. Blisters provide excellent protection for unit-dose medications, ensuring their integrity and stability during storage, transportation, and handling. The individual compartments in blister packs help prevent contamination, moisture ingress, and exposure to light, oxygen, and other external factors that can degrade the medication's efficacy and shelf life.

Blisters are lightweight, compact, and portable, making them convenient for patients to carry and use on the go. The individual unit-dose compartments are easy to open, allowing patients to access their medication quickly and conveniently without the need for additional measuring devices or packaging materials. This convenience enhances patient compliance and medication adherence, especially for individuals with busy lifestyles or mobility limitations.

The oral segment dominated the pharmaceutical unit-dose packaging market in 2024. The growth of the segment is attributed to the increasing number of diabetes patients globally resulting in the increasing number of medications driving the growth of the market. Unit-dose packaging for oral medication provides pre-measured doses of medications, making it easier for patients to adhere to their prescribed treatment plans. By eliminating the need for manual dose measurement or pill counting, unit-dose packaging reduces the risk of dosing errors and enhances medication compliance among diabetes patients.

The rising cases of diabetes and other chronic diseases that require continuous medication and therapeutics has created a significant value for the oral segment to grow in the market. Unit-dose packaging offers convenience and portability, allowing diabetes patients to carry their medications with them wherever they go. Individual doses are packaged in compact, lightweight containers that are easy to handle and transport, making it convenient for patients to take their medications on-the-go, whether at home, work, or while traveling. This convenience factor contributes to improved medication adherence and better disease management outcomes for diabetes patients.

By Material

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

September 2024