May 2024

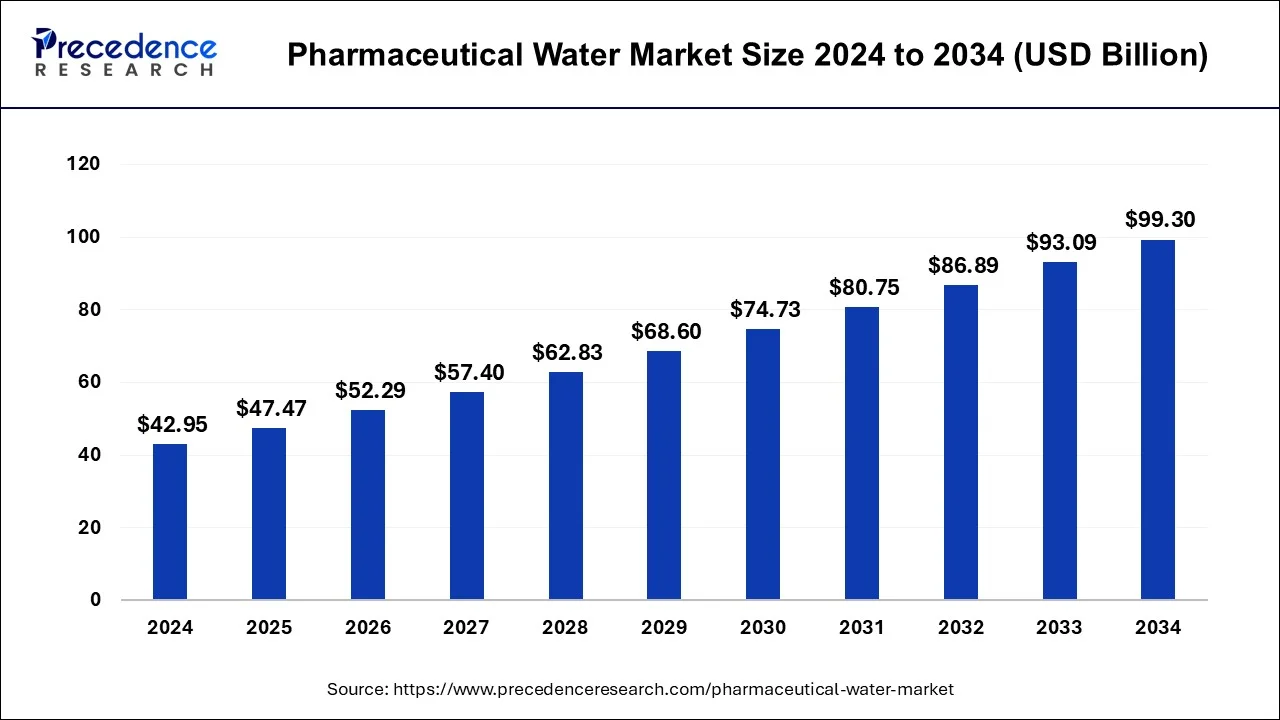

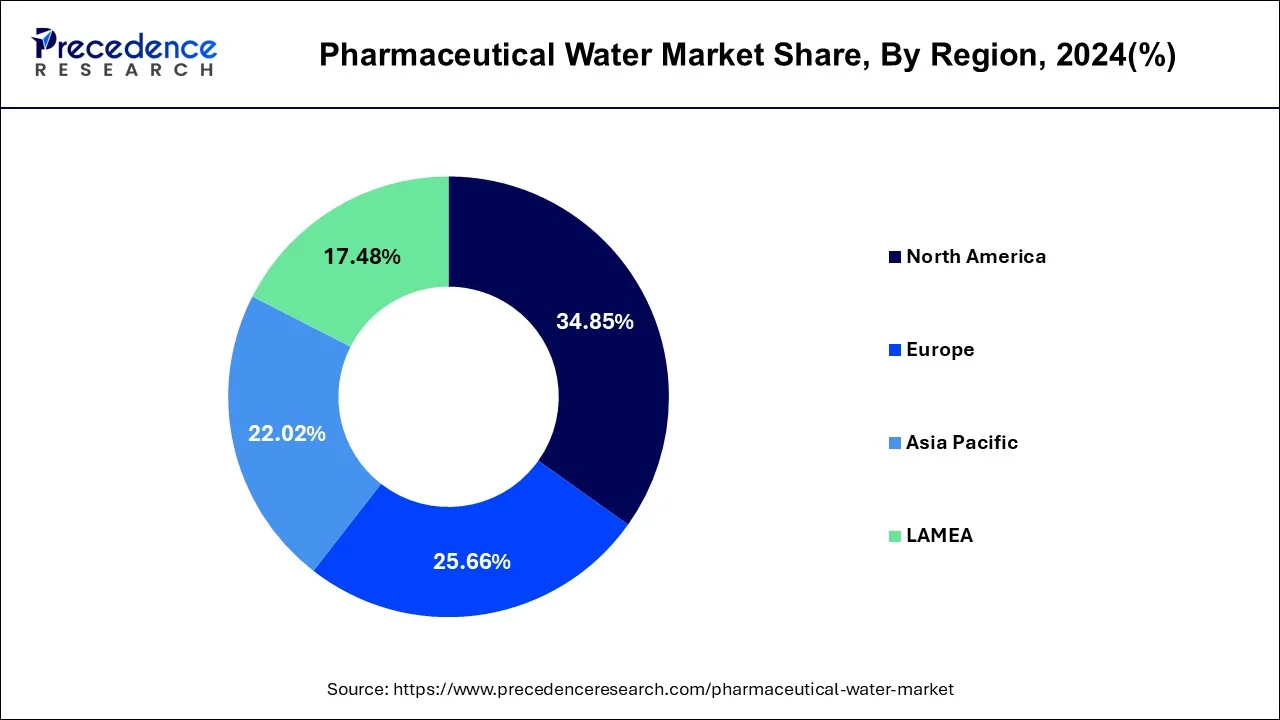

The global pharmaceutical water market size is calculated at USD 47.47 billion in 2025 and is forecasted to reach around USD 99.30 billion by 2034, accelerating at a CAGR of 8.55% from 2025 to 2034. The North America pharmaceutical water market size surpassed USD 14.97 billion in 2024 and is expanding at a CAGR of 8.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical water market size accounted for USD 42.95 billion in 2024, grew to USD 47.47 billion in 2025 and is projected to surpass around USD 99.30 billion by 2034, representing a healthy CAGR of 8.55% between 2025 and 2034.

Artificial intelligence (AI) is revolutionizing the market. Integrating AI technologies in pharmaceutical water production will produce high-quality water. AI can optimize the quality control process by analyzing data from water purification systems. Several pharmaceutical companies are increasingly leveraging the power of AI to manufacture pharmaceutical products. AI assists pharmaceutical companies in streamlining operations, ensuring quality, minimizing downtime, optimizing supply chain management, and driving innovations. AI also detects flaws in water purification systems, thus reducing errors and ensuring water meets stringent regulatory standards.

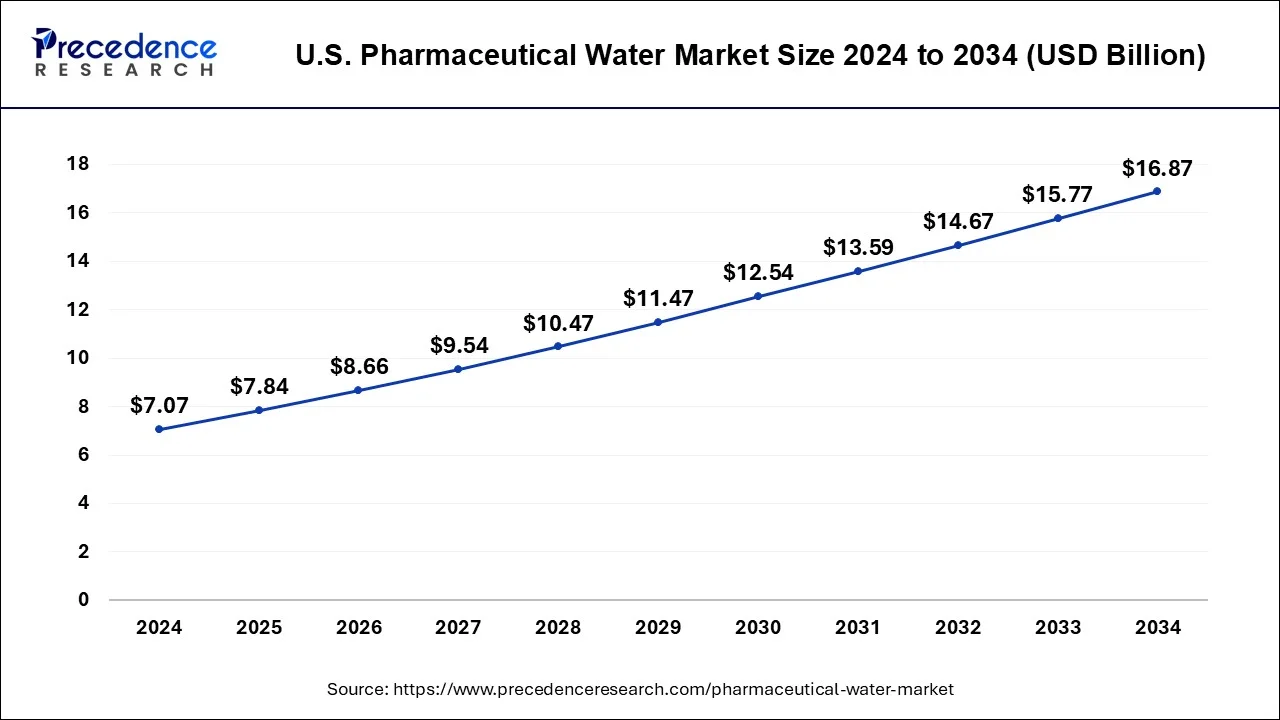

The U.S. pharmaceutical water market size reached USD 7.07 billion in 2024 and is predicted to be worth around USD 16.87 billion by 2034, growing at a CAGR of 8.90% from 2025 to 2034.

North America dominated the pharmaceutical water market with the largest share in 2024. This is mainly due to the rapid expansion of the pharmaceutical and biotechnology industries, heightened demand for generic injectables, growing innovations in genetic engineering, increasing R&D activities, stringent regulatory policies, increasing demand for outsourcing of pharmaceutical manufacturing, the surge in biologics and biosimilar production, and rapid adoption of advanced purification technologies. The U.S. is a major contributor to the market in the region due to the presence of a large number of pharmaceutical companies, the rise in collaboration or partnership among prominent market players, and the increase in investment by pharmaceutical companies in novel drugs.

The increased burden of chronic diseases led to the increased production of biopharmaceuticals, such as proteins, vaccines, monoclonal antibodies, and plasma, that are extensively used to manufacture life-saving drugs. Several prominent market players operating in the region shifted their focus toward developing innovative water purification systems to enhance the quality of water.

Asia Pacific is anticipated to witness rapid growth in the pharmaceutical water market during the forecast period. This is primarily due to the increasing investments in establishing advanced healthcare infrastructure and expansion of the biopharmaceutical sector. With the increasing prevalence of infectious diseases in the region, there is a significant rise in investments in injectable drugs. Rising number of clinical trials, increasing production of generic medicines, and increasing adoption of multi-parameter water quality testing further contribute to regional market growth.

Pharmaceutical water, also known as sterile water, is a vital component used as a raw material or ingredient in manufacturing pharmaceutical products, such as active pharmaceutical ingredients (APIs) and intermediates. This highly purified water is free from microorganisms and other contaminants. Thus, it is used in various medical applications such as injectable medications, IV fluids, and other sterile solutions. The market is experiencing significant growth due to the rising demand for high-quality water for various applications. It is used in drug formulation and cell culture production. In addition, it is used to clean and purify pharmaceutical products. The rising production of pharmaceutical products and increasing focus on drug discovery and development can have a positive impact on the market.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.55% |

| Market Size in 2025 | USD 47.47 Billion |

| Market Size by 2034 | USD 99.30 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Application of WFI

With the growing prevalence of chronic diseases, the demand for pharmaceutical products is increasing, leading to a higher need for high-quality pharmaceutical water. Water for injection (WFI) is high-quality, sterile water used to manufacture drugs and vaccines. This water is also used to manufacture parenteral and ophthalmic products. Moreover, WFI is used as a cleansing solution to clean implantable medical devices and laboratory equipment that come in direct contact with fluids and other bacteria. Moreover, the rising production of biopharmaceuticals, such as recombinant proteins, monoclonal antibodies, and cell & gene therapies, fuel the growth of the market. WFI ensures that these biopharmaceuticals meet stringent purity standards.

High Investments

The purchase of pharmaceutical water purification systems requires a high investment, which often discourages small and medium-sized pharmaceutical and biotechnology companies from adopting these technologies, particularly in low and middle-income countries. In addition, water purification systems require regular maintenance to reduce errors and control water quality, which further increases operational costs, thereby hindering the growth of the market.

Rising Need for Advanced Purification Technologies

The rising need for advanced purification technologies across pharmaceutical and biopharmaceutical companies is projected to create lucrative opportunities in the pharmaceutical water market. Technological advancements in water purification systems, such as reverse osmosis, ultrafiltration, UV oxidation, and distillation, can enhance the effectiveness of water treatment processes. Additionally, the rising demand for ultrapure water for the production of biologics propels market growth.

The water for injection segment dominated the market with the largest share in 2023. This is mainly due to the rise in the production of vaccines and rising chronic illnesses worldwide. Water for injection (WFI) is a high-purity, sterile water that is widely used in the formulation of pharmaceutical products such as injectables, infusions, and sterile solutions. In addition, regulatory agencies such as the United States Pharmacopeia (USP), European Pharmacopoeia (EP), Japanese Pharmacopoeia (JP), and most other worldwide pharmacopeias mandate strict quality standards for water for injection (WFI) to ensure product safety, efficacy, and compliance with good manufacturing practices (GMP), contributing to segmental growth.

The HPLC grade water segment is expected to expand at a rapid pace during the forecast period. High-performance liquid chromatography (HPLC) grade water is ultrapure with low ultraviolet absorbance and has a conductivity of 16 to 18 megaohms. HPLC-grade water is suitable for the HPLC mobile phase and sample preparation. Factors such as the stringent regulations regarding water quality control and the rising demand for high-quality water to develop complex drug formulations are expected to boost segmental growth.

Pharmaceutical Water Market Revenue, By Type, 2022-2024 (USD Bn)

| By Type | 2022 | 2023 | 2024 |

| HPLC Grade Water | 7.29 | 8.10 | 8.95 |

| Water for Injection | 27.41 | 30.60 | 33.99 |

The pharmaceutical & biotechnology companies segment accounted for the largest share of the pharmaceutical water market in 2023. This is mainly due to the rise in the production of vaccines and biologics. Pharmaceutical water is a critical component in manufacturing pharmaceutical products, as it is used in various stages of production, including drug formulation, cleaning equipment, and quality control. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent requirements for the quality and purity of water used in pharmaceutical manufacturing. Pharmaceutical and biotechnology companies have the expertise, resources, and infrastructure to meet these regulatory standards and ensure the production of high-quality pharmaceutical water. Furthermore, the rise in drug discovery and development investments by pharmaceutical companies augmented the segment.

The academics and research laboratories segment is projected to expand rapidly in the coming years. The segmental growth is attributed to the increasing demand for high-purity water from research laboratories. These laboratories heavily invest in developing innovative drugs and therapeutics for rare and chronic diseases. Research and clinical trials require high-purity pharmaceutical water to develop new drugs and therapeutics. Moreover, rising R&D activities contribute to segmental growth.

Pharmaceutical Water Market Revenue, By Application, 2021-2023 (USD Bn)

| By Application | 2022 | 2023 | 2024 |

| Pharmaceutical & Biotechnology Companies | 19.97 | 22.30 | 24.78 |

| Academics & Research Laboratories | 14.72 | 16.39 | 18.16 |

With the industry assuming regulatory fluctuations across the globe on micropollutants, pharmaceutical corporations are seeking to get forward of the micropollutants issues. Water technology suppliers have prospect to profit from the necessity for leading-edge systems that can deal micropollutants, and want to recognize the suitable technology combinations to attain the most well-organized and cost-effective outcomes. Chief competitors contending in global Pharmaceutical Water market are as follows:

In order to better recognize the current scenarios of pharmaceutical water sector, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the Pharmaceutical Water market. This research report embraces complete valuation of the market with the help of wide-ranging qualitative and quantitative perceptions, and forecasts concerning the market. This report bids classifications of market into potential and niche segments. Further, this research study examines market size and its growth trend at global, regional, and country from 2024 to 2034.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

April 2025

September 2024

December 2024