January 2025

Pharmacovigilance Outsourcing Market (By Service: Pre-marketing Pharmacovigilance Services, Post-marketing Pharmacovigilance Services, Others; By Service Providers: Contract Research Organizations (CROs), Business Processing Outsourcing (BPO)) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

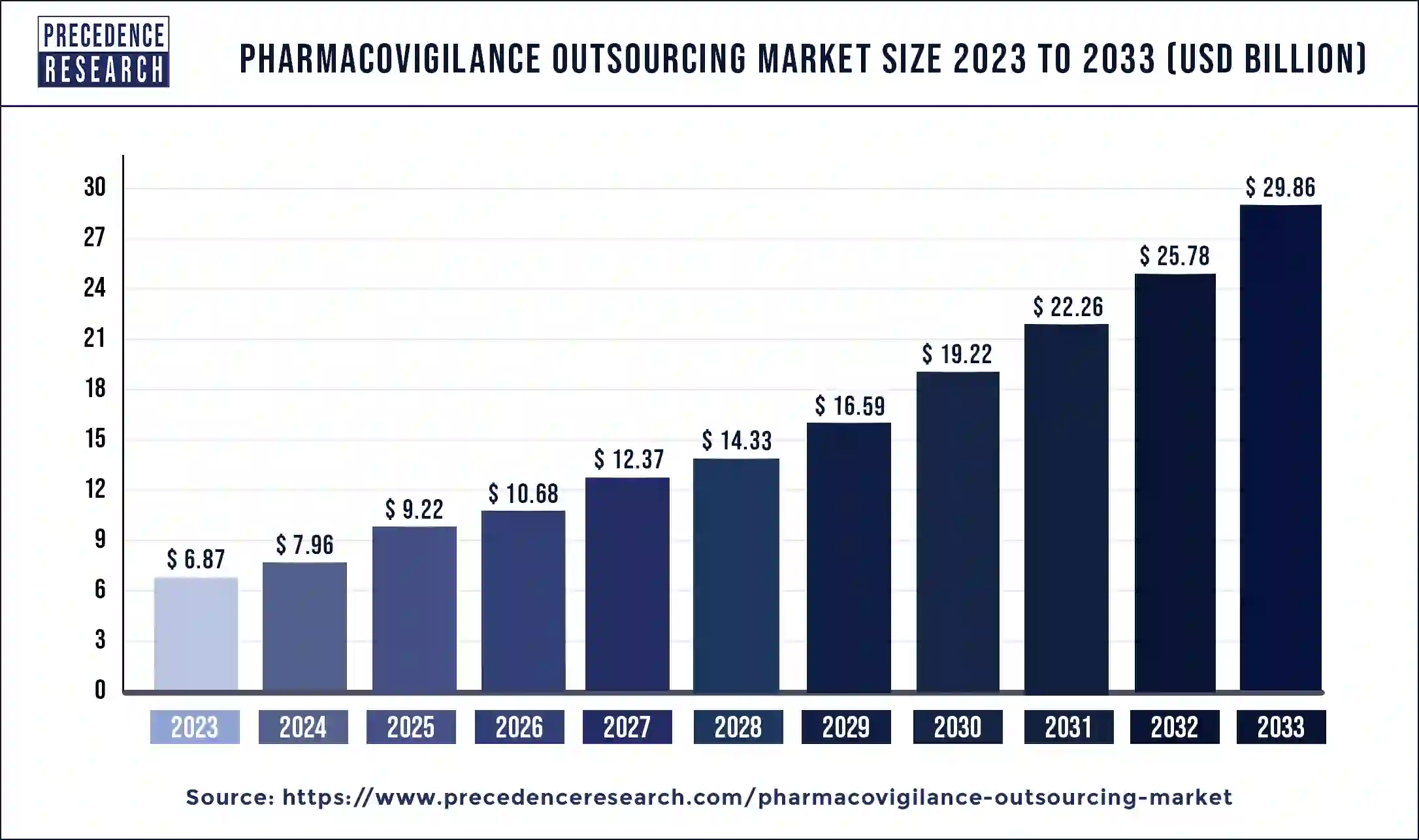

The global pharmacovigilance outsourcing market size was USD 6.87 billion in 2023, calculated at USD 7.96 billion in 2024 and is expected to reach around USD 29.86 billion by 2033. The market is expanding at a solid CAGR of 15.82% over the forecast period 2024 to 2033. Pharmacovigilance outsourcing allows pharmaceutical companies to be able to access the latest technology in the pharmacovigilance process, which can help grow the pharmacovigilance outsourcing market.

Market Overview

The pharmacovigilance outsourcing market refers to the process of managing drug safety and monitoring related tasks through the employment of outside service providers. This usually covers side effect detection, evaluation, comprehension, and prevention, as well as any other issues relating to drugs. To maintain compliance with regulatory requirements, manage risks, and concentrate on their core competencies, pharmaceutical companies and other organizations involved in the development, production, and marketing of drugs often outsource these activities to specialized firms.

There are different types of pharmacovigilance outsourcing activities, including adverse event reporting and management, regulatory compliance, signal detection and risk management, case processing, periodic safety update reports, and clinical trial safety monitoring. The pharmacovigilance outsourcing market is driven by the rising popularity and adverse drug reaction reports, the rising number of clinical trials and new drug approvals, and the rising number of pharmaceutical companies.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.87 Billion |

| Market Size in 2024 | USD 7.96 Billion |

| Market Size by 2033 | USD 29.86 Billion |

| Pharmacovigilance Outsourcing Market Growth Rate | CAGR of 15.82% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service, Service Providers, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising popularity and ADR reporting

The rising popularity and adverse drug reaction reporting can boost the pharmacovigilance outsourcing market. The patients and healthcare professionals, including doctors, nurses, etc, report more adverse drug reactions as the awareness increases. Strong systems and procedures are required to effectively manage, evaluate, and report these responses in light of the data explosion. To manage this increased workload, pharmaceutical companies often turn to pharmacovigilance outsourcing.

High cost of outsourcing services

The high cost of outsourcing services slows down the pharmacovigilance outsourcing market. Pharmaceutical companies' budgets can be limited, particularly for startups or smaller businesses. Because pharmacovigilance services can be too costly to outsource, these businesses either handle these tasks internally or look for less expensive alternatives.

Technical advancement in pharmacovigilance outsourcing

The technical advancements in pharmacovigilance outsourcing are the opportunity to boost the pharmacovigilance outsourcing market. The technical advancements in pharmacovigilance outsourcing include artificial intelligence and machine learning, automation tools, natural language processing, big data analytics, blockchain technology, cloud computing, integrated pharmacovigilance systems, mobile technology, advanced data visualization, and regulatory technology. The efficiency, accuracy, and quality of pharmacovigilance operators are increased by this technology, which can be the opportunity to grow the pharmacovigilance outsourcing market.

Global market expansion

Pharmaceutical companies looking to expand into new markets can benefit from the global presence and local expertise of pharmacovigilance outsourcing providers. This is crucial for navigating diverse regulatory environments and ensuring compliance across different regions. Outsourcing providers often offer multilingual capabilities, which are essential for managing adverse event reports and regulatory submissions in multiple countries.

The pre-marketing segment dominated the pharmacovigilance outsourcing market in 2023. A lot of safety data is needed before regulatory bodies like the FDA, EMA, and others will approve a new medication. The companies may acquire, examine, and submit this information in order to comply with regulations with the aid of pre-marketing pharmacovigilance. It is necessary to recognize and address possible risks prior to a product’s release in the pharmacovigilance outsourcing market. The pre-marketing pharmacovigilance services facilitate safer product launches by assisting in the early detection of adverse events.

The post-marketing pharmacovigilance services segment is expected to grow at the highest CAGR in the pharmacovigilance outsourcing market by service during the forecast period. Global regulatory organizations, including the FDA in the U.S., the EMA in Europe, and other national organizations, have strict guidelines for monitoring the safety of drugs after they are approved.

Strong post-marketing surveillance is required to comply with these regulations, which is driving the demand for outsourced pharmacovigilance outsourcing services. The post-marketing safety monitoring is becoming more necessary as a result of the growing number of new drug approvals. Pharmaceutical companies are outsourcing these services in order to efficiently handle the increasing amount of data and reporting needs.

The contract research organizations (CRO) segment dominated the pharmacovigilance outsourcing market by service provider in 2023. Contract research organizations (CROs) have specialized knowledge and committed teams with a wealth of pharmacovigilance experience. This enables them to provide dependable, high-quality services that adhere to legal requirements.

Pharmaceutical companies may find that outsourcing pharmacovigilance to contract research organizations (CROs) is more economical than keeping teams on staff. By utilizing economies of scale, contract research organizations (CROs) can lower the expenses of their clients. The scalable solutions are offered by The contract research organizations (CRO) and are crucial for managing fluctuating workloads, particularly in various stages of clinical trials or post-marketing surveillance. The all sizes of pharmaceutical companies benefit from this flexibility.

The business processing outsourcing (BPO) segment is expected to grow at the highest CAGR in the pharmacovigilance outsourcing market by the service provider during the forecast period. Pharmaceutical companies are capable of saving a lot of money by contracting with specialized business processing outsourcing (BPO) providers to handle their pharmacovigilance needs. These suppliers can attain economies of scale and operate in areas with cheaper labor costs, which lowers the overall cost of the process. Business processing outsourcing (BPO) companies usually possess a high level of pharmacovigilance knowledge, with specialized teams knowledgeable about risk management, adverse event reporting, and regulatory requirements. This knowledge guarantees excellent compliance and effective operations.

North America dominated the pharmacovigilance outsourcing market by region in 2023. Numerous biotech and pharmaceutical companies are based in North America, especially in the U.S. These businesses require substantial pharmaceutical services due to the volume of clinical trials and post-market surveillance activities they conduct. The US Food and Drug Administration (FDA) and Health Canada, two organizations that enforce strict pharmaceutical requirements, have established regulatory environments in the region. Specialized outsourcing services are required to guarantee compliance with these regulations.

Asia Pacific is expected to grow at the highest CAGR in the pharmacovigilance outsourcing market by region during the forecast period. The Asia Pacific is home to an increasing number of highly qualified individuals with backgrounds in clinical research, pharmacovigilance, and related disciplines. To develop this expertise, several Asia Pacific nations have made investments in training and educational initiatives. The pharmaceutical companies in Asia Pacific are quickly due to rising income levels, the growing need for healthcare, and growing public awareness of health issues. The need for pharmacovigilance services is increased by this growth.

Governments in the Asia Pacific region are strengthening pharmacovigilance regulations to align with global standards. This regulatory support encourages pharmaceutical companies to establish or expand their pharmacovigilance operations in the region. The region is witnessing a surge in clinical trials due to a large and diverse patient population, which enhances the ability to conduct various phases of drug testing efficiently. This increase in clinical trials necessitates comprehensive pharmacovigilance services to monitor and report adverse events.

Recent Developments

Segment Covered in the Report

By Service

By Service Providers

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

January 2025

February 2025