January 2025

Plant-based Packaging Market (By Material: Bagasse, Starch-based, Bioplastics, Cellulose, Seaweed, Coconut Husk, Shrimp Shells, Mycelium; By Application: Flexible Packaging, Rigid Packaging; By End use: Food And Beverage, Cosmetics, Pharmaceutical, Industrial) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

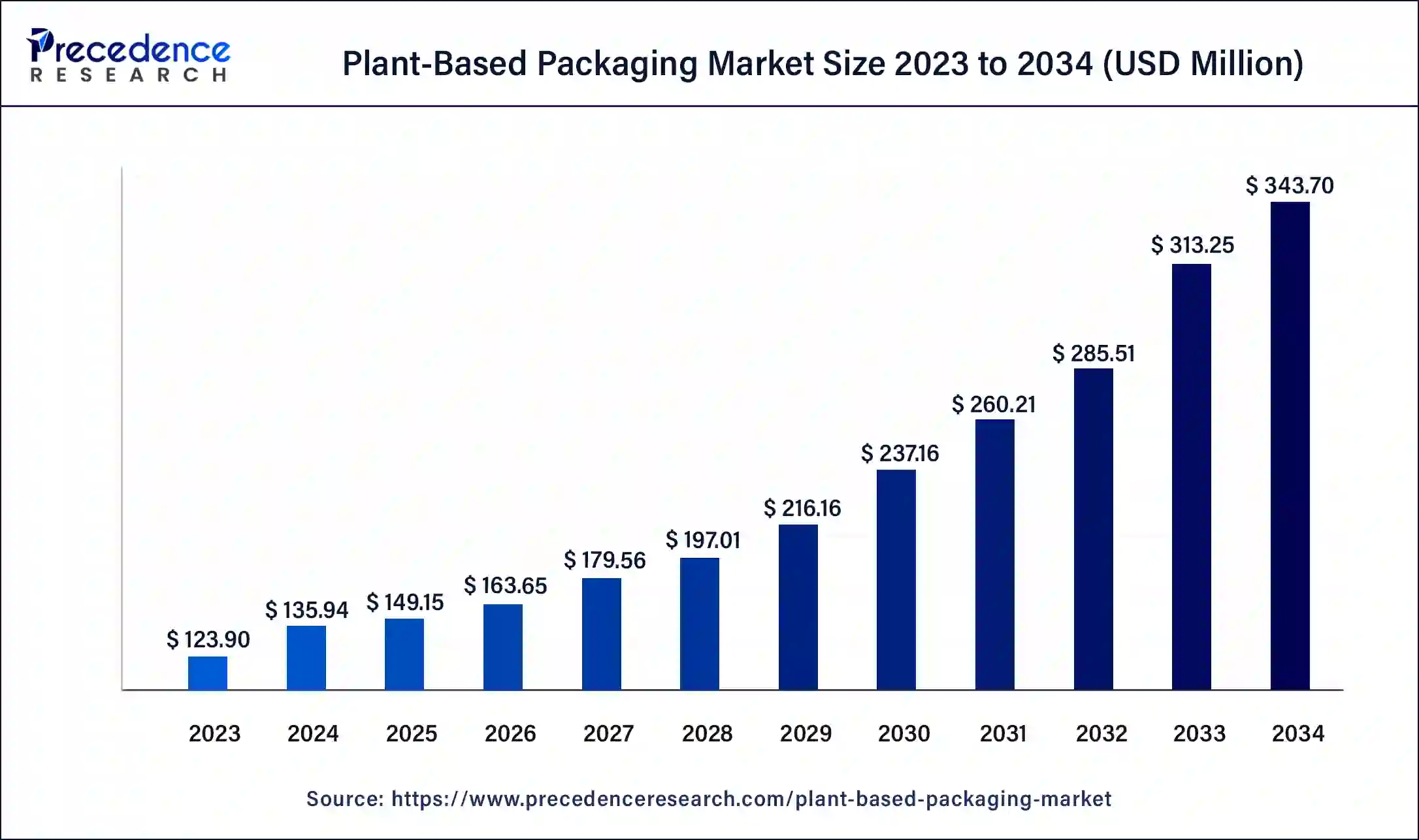

The global plant-based packaging market size was USD 123.90 million in 2023, calculated at USD 135.94 million in 2024 and is expected to reach around USD 343.70 million by 2034 with a CAGR of 9.71% over the forecast period 2024 to 2034.

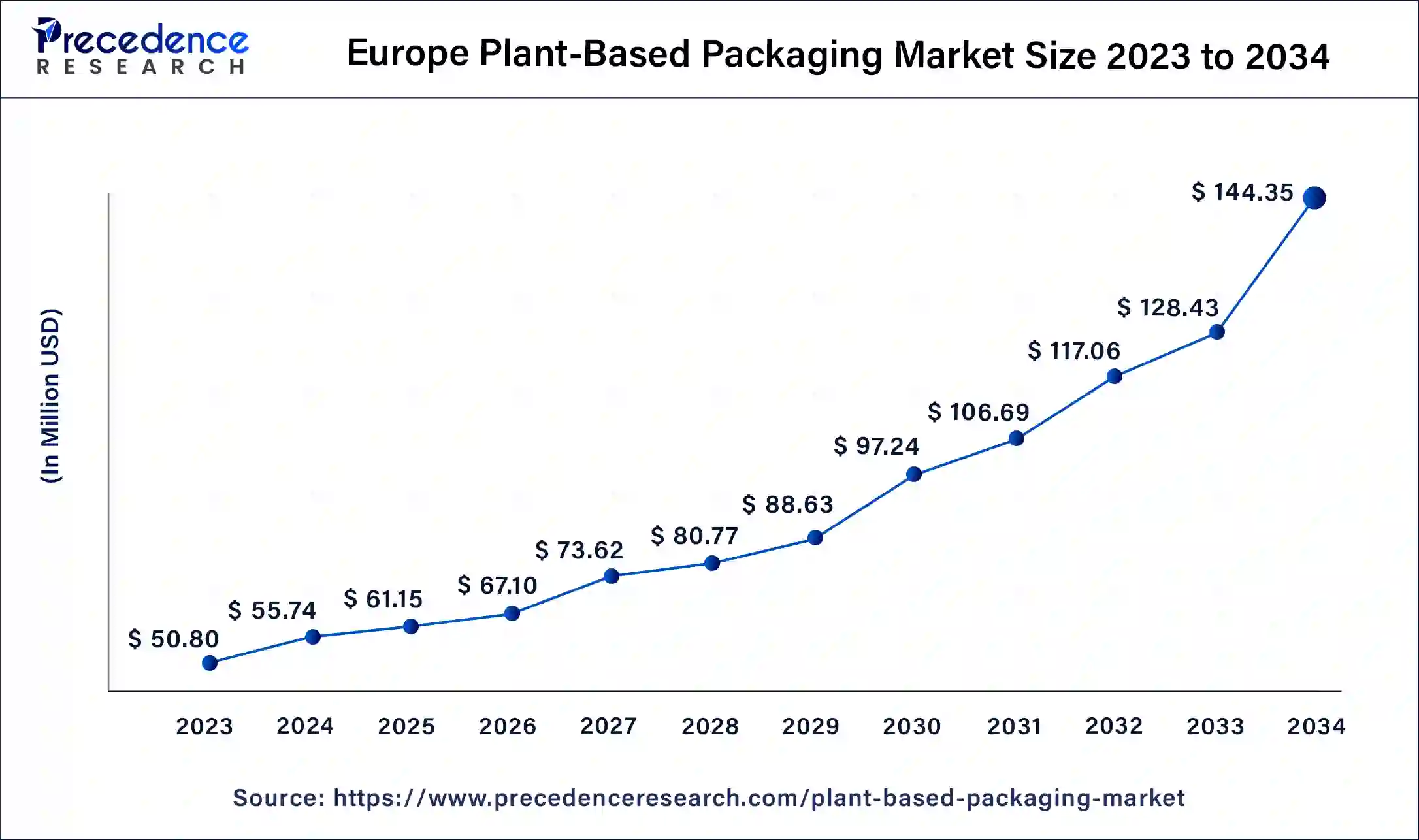

Europe Plant-based Packaging Market Size and Growth 2024 to 2034

The Europe plant-based packaging market size was exhibited at USD 50.80 million in 2023 and is projected to be worth around USD 144.35 million by 2034, poised to grow at a CAGR of 9.95% from 2024 to 2034.

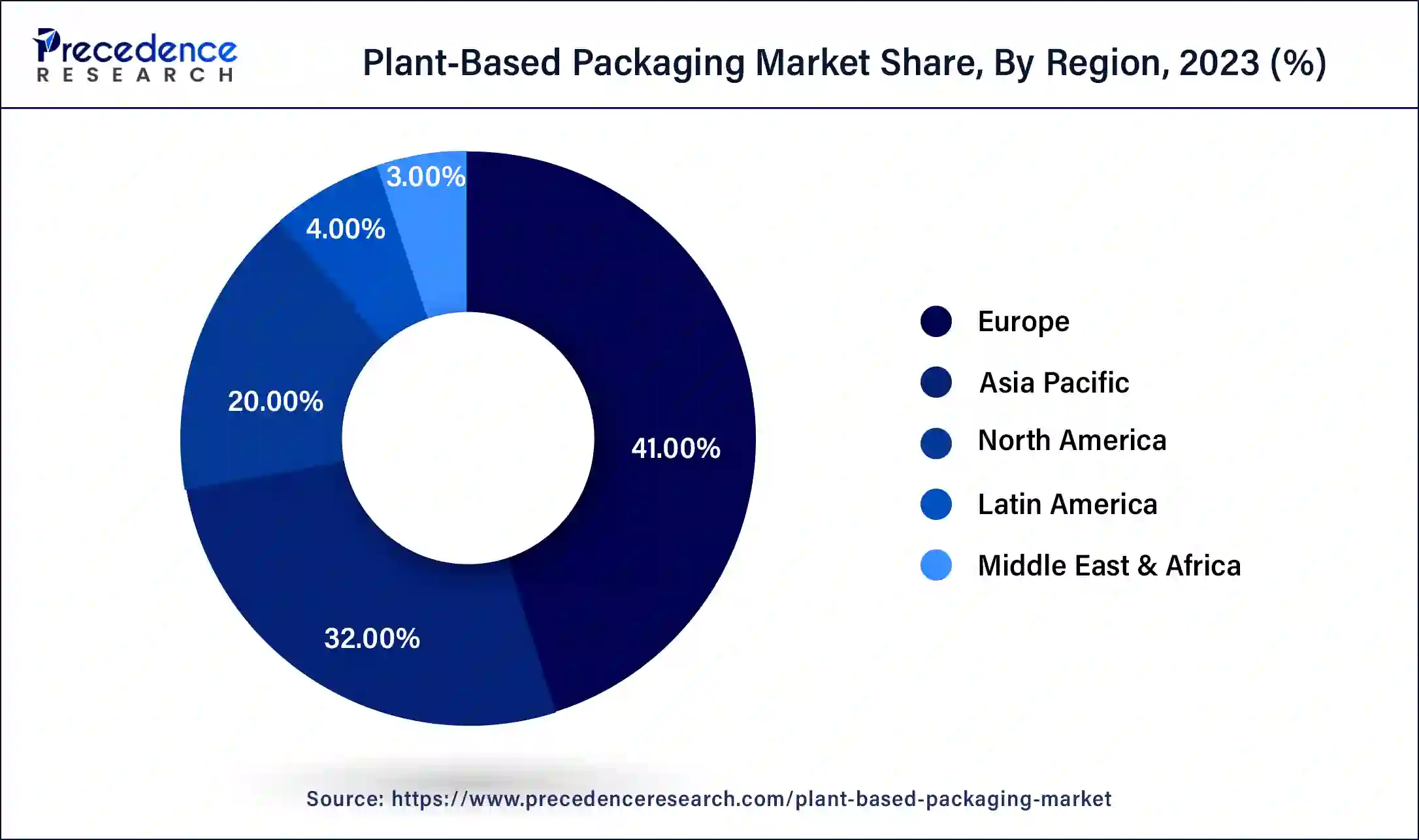

Europe held the dominant share of the plant-based packaging market in 2023 and is observed to witness prolific growth during the forecast period. The growing consumer preference for sustainable packaging solutions compels companies to opt for plant-based packaging. This shift increases the rapid adoption of plant-based materials, offering a greener future for packaging solutions in the European region. Companies in the packaging industry are highly investing in R&D activities to develop innovative, sustainable packaging solutions to meet the ongoing demand of several industries.

The rising awareness of environmental issues, coupled with government regulations on single-use plastics, contributes to the market’s revenue in the region. Several European nations are implementing legislation and initiatives to curb plastic waste and promote the adoption of sustainable packaging solutions. Furthermore, European countries such as Spain, the UK, France, Germany, and Russia witnessed a large customer base that prefers the plant-based packaging of consumer products, drinks, and meals. Such factors are propelling the growth of the plant-based packaging market.

North America is observed to expand at a rapid pace in the plant-based packaging market during the forecast period. The growth of the region is attributed to the presence of an established packaging industry, stringent regulatory policies of the government on plastic packaging, increasing adoption of sustainable packaging, rising demand for plant-based packaging solutions across various industries, and rising environmental concern regarding plastic use.

The United States and Canada are anticipated to be leading countries witnessing strong demand for packed food & beverages due to changing lifestyles. Major companies in the region are committed to the sustainability goals for their packaging. They are offering plant-based packaging as eco-friendly alternatives to meet the consumer demand for more eco-friendly products. Moreover, various technological innovations have resulted in the manufacturing of new and improved plant-based packaging materials.

At the United Nations Environmental Assembly (UNEA) in March 2022, the United States joined other countries in adopting a resolution on plastic pollution. The resolution launched a process to develop a new international agreement on plastic pollution, with the aim of concluding negotiations by the end of 2024.

Plant-based packaging is made from renewable materials derived from plants. As the world moves toward a more sustainable future, plant-based packaging plays a crucial role in eco-friendly alternatives. The availability of raw materials in abundance to manufacture plant-based packaging puts less strain on the earth and its resource supply. Plant-based packaging supports the environment as it requires less carbon to produce, lowers the amount of waste sent to landfills, and produces no toxins. This collection of packaging can be composted safely. Plant-based packaging is purely organic, as opposed to many forms of conventional packaging, such as plastics, and can take many forms.

| Report Coverage | Details |

| Market Size by 2034 | USD 343.70 Million |

| Market Size in 2023 | USD 123.90 Million |

| Market Size in 2024 | USD 135.94 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.71% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising consumer demand for sustainable packaging materials

The rising demand for sustainable packaging materials is expected to boost the growth of the plant-based packaging market during the forecast period. Plant-based packaging breaks down quickly under the right conditions. In contrast to plastic packaging, which takes centuries to degrade and ends up as microplastics, plant-based packaging breaks down quickly under the right conditions. The introduction of sustainable and eco-friendly packaging materials assists in catering to the ongoing consumer demand for eco-friendly products.

The plant-based packaging market is gaining immense popularity globally as it is offering an eco-friendly and sustainable alternative to plastic packaging. Plant-based packaging is made from renewable resources such as sugarcane, corn, potatoes, mushroom mycelium, seaweed, and other plant-based sources. Manufacturers have significantly increased their product offerings to include a more excellent range of plant-based packaging choices for a wide range of industries. Therefore, plant-based packaging aligns with the principles of sustainability and circular economy and is anticipated to propel the market’s growth in the coming years.

High cost

The high cost associated with plant-based packaging materials is anticipated to hamper the plant-based packaging market growth. Plant-based packaging materials may be more expensive than plastics, which increases overall manufacturing costs. In addition, depending on the geographic location and climate, the availability of plant-based resources can be limited, which can impact the production of plant-based packaging materials and restrict the expansion of the global plant-based packaging market.

Rising environmental concern

The rising environmental concern about plastic waste and environmental degradation increases the demand for sustainable packaging alternatives during the forecast period. Plant-based packaging emerges as a game-changer in the fight against plastic pollution and resource depletion. Plastic pollution is a major environmental issue. Most plastics do not biodegrade; instead, they break down into microplastics. In addition, plant-based packaging is often biodegradable or compostable, which results in a reduction in the amount of waste in landfills and oceans. Therefore, the plant-based packaging market can mitigate the environmental impacts by tackling waste accumulation and pollution during the forecast period.

Gradually, consumers are becoming more conscious of their environmental footprint. Plant-based materials produce fewer greenhouse gases during the production process compared to fossil fuels used to make plastics, which substantially increases the demand for eco-friendly and recyclable packaging solutions in several industries, such as food and beverage, pharmaceutical, personal care, and others. Plant-based packaging is made from renewable resources and offers sustainable solutions to the environmental challenges associated with the use of conventional plastics. The plant-based packaging market reduces GHG emissions and pollution.

An estimated 11 million metric tons of plastic enter the ocean every year. Plastic pollution is damaging ecosystems and reducing their ability to adapt to climate change, contaminating drinking water, devastating tourist industries, and causing harm to wildlife and marine life.

The world produces about 400 million tons of plastic waste annually. Every minute, one million plastic bottles are purchased around the world, while five trillion plastic bags are used worldwide every year. In total, half of all plastic produced is designed for single-use purposes only, and it is used just once and then thrown away.

A Switzerland-based non-profit EA Earth Action study predicts that a massive 220 million tonnes of plastic waste will be generated in 2024. It has steadily increased by nearly 10% (7.11%) since 2021. Only 12 countries are responsible for 60% of the world’s mismanaged plastic waste, with China, the U.S., India, Brazil, and Mexico leading the list.

The bioplastics segment accounted for the dominating share of the plant-based packaging market in the year 2023 and is projected to continue this dominance over the forecast period. Bioplastics are revolutionizing the packaging industry by offering several benefits over petroleum-based plastics. Bioplastics are generally derived from natural sources such as corn starch, sugarcane, and seaweed. They are biodegradable and compostable, which helps reduce dependency on fossil fuels. They are extensively used for a variety of applications, from food packaging to disposable cutlery. The most common bioplastics are polylactic acid (PLA) and polyhydroxyalkanoate (PHA). PHA and PLA can be used as plastic packaging alternatives. PLA is commonly used for plastic films, food containers, bottles, salad boxes, compostable cutlery, coffee cups, and others. PHA is often used for single-use packaging for foods, beverages, consumer products, agricultural foils and films, and medical equipment.

The cellulose segment is expected to witness considerable growth in the plant-based packaging market over the forecast period. Cellulose packaging is an eco-friendly form of packaging. The common sources include cotton, wood pulp, and other plant fibers. Cellulose-based materials are widely used in packaging due to their biodegradability, renewable nature, and reduced carbon footprint. Thereby driving the segment’s growth.

The flexible packaging segment held the largest segment of the plant-based packaging market in 2023 and is expected to sustain its position throughout the forecast period. Flexible packaging includes pouches, sachets, stretch film, and seal bands. This form of packaging is generally cheaper to produce and easier to use. Plant-based flexible packaging is widely used in the food and beverages industry to preserve and increase the shelf-life of perishable products, including baked goods, meats, coffee, fish, and others. Thus accelerating the segment’s growth.

The rigid packaging segment is expected to grow significantly in the plant-based packaging market during the forecast period. Rigid packaging is generally made of heavier and stronger materials, which may consist of cardboard boxes or containers. Rigid packaging is a more expensive form of packaging than flexible packaging, but it offers robust quality and is more resilient.

The food & beverage segment dominated the global plant-based packaging market in 2023. Plant-based food packaging is gaining significant popularity in the food and beverage sector due to the rising global demand for packed food & beverages. Food packaging is pivotal for preservation, protection, preventing food contamination, and showing food hygienically and attractively. Plant-based packaging options include mushroom mycelium, coconut husk, sugarcane bagasse, shrimp shells, seaweed, and others that are sustainable and environmentally friendly. Such packaging solutions have numerous applications in food and beverage products. Therefore, this highlights a growing preference for eco-friendly packaging options in both businesses and consumers.

The cosmetics segment is expected to grow at a robust rate in the plant-based packaging market during the forecast period, owing to the increasing demand for cosmetics products to enhance aesthetic appearance and gain social value. Biodegradable packaging is widely used as an alternative to the plastics used in cosmetic products. Natural ingredients such as bamboo packaging and paper are becoming increasingly popular in the cosmetic packaging industry as they are made of environmentally friendly material and are easily renewable and biodegradable. Thus bolstering the market’s growth.

Segments Covered in the Report

By Material

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025