April 2025

Plastic Additives Market (By Type: Stabilizers, Antioxidants, Plasticizers, Antistatic agents, Anti-scratch additives, Rheology/Thickners, Flame retardants; By Plastic Type: Polystyrene, PVC, Polypropylene, Polyethylene, Engineering plastics, Others; By End-use: Automotive, Construction, Textiles, Electric and electronics, Packaging, Agriculture) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

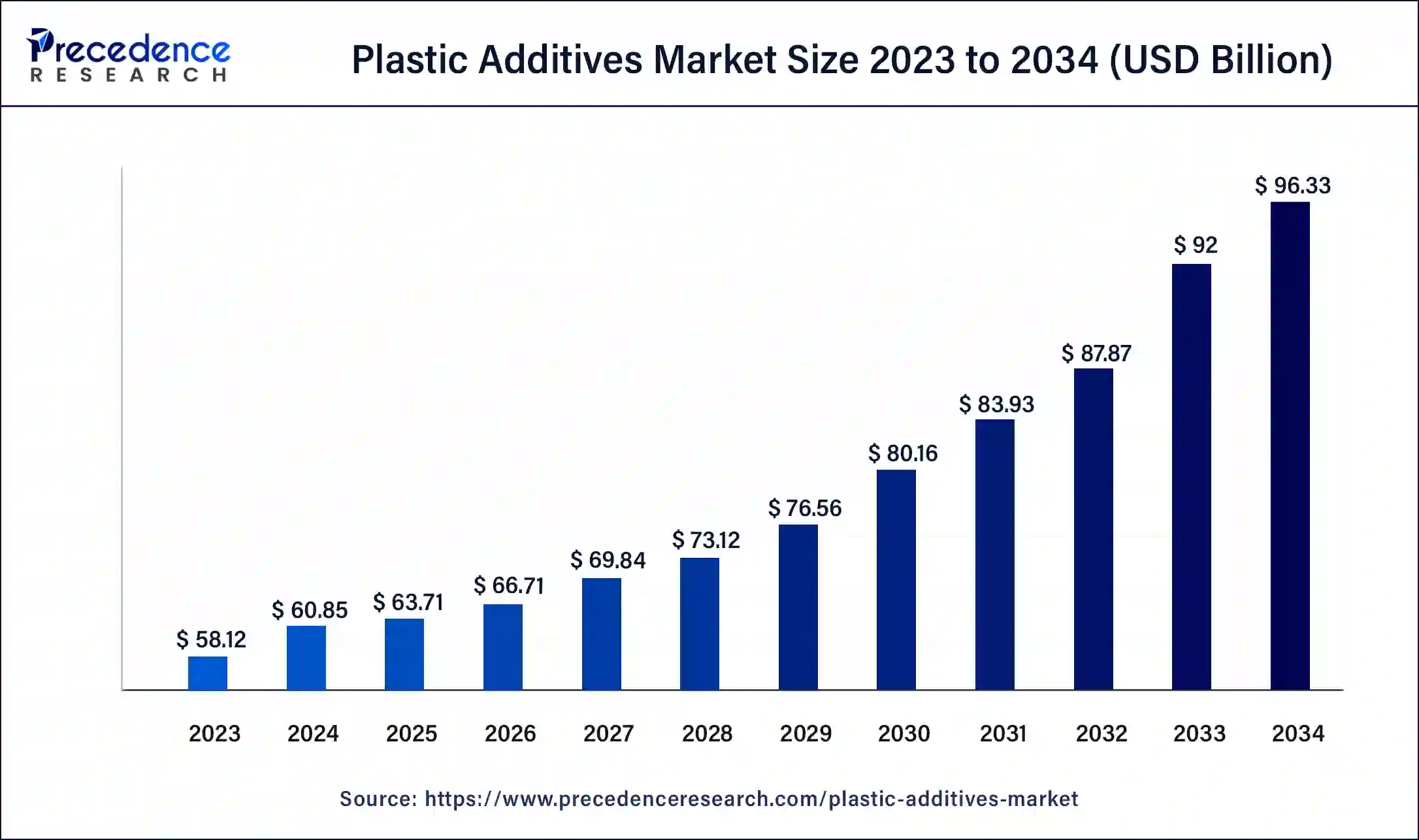

The global plastic additives market size was USD 58.12 billion in 2023, accounted for USD 60.85 billion in 2024, and is expected to reach around USD 96.33 billion by 2034, expanding at a CAGR of 4.7% from 2024 to 2034. The plastic additives market is observed to be driven by the expansion of the automotive sector.

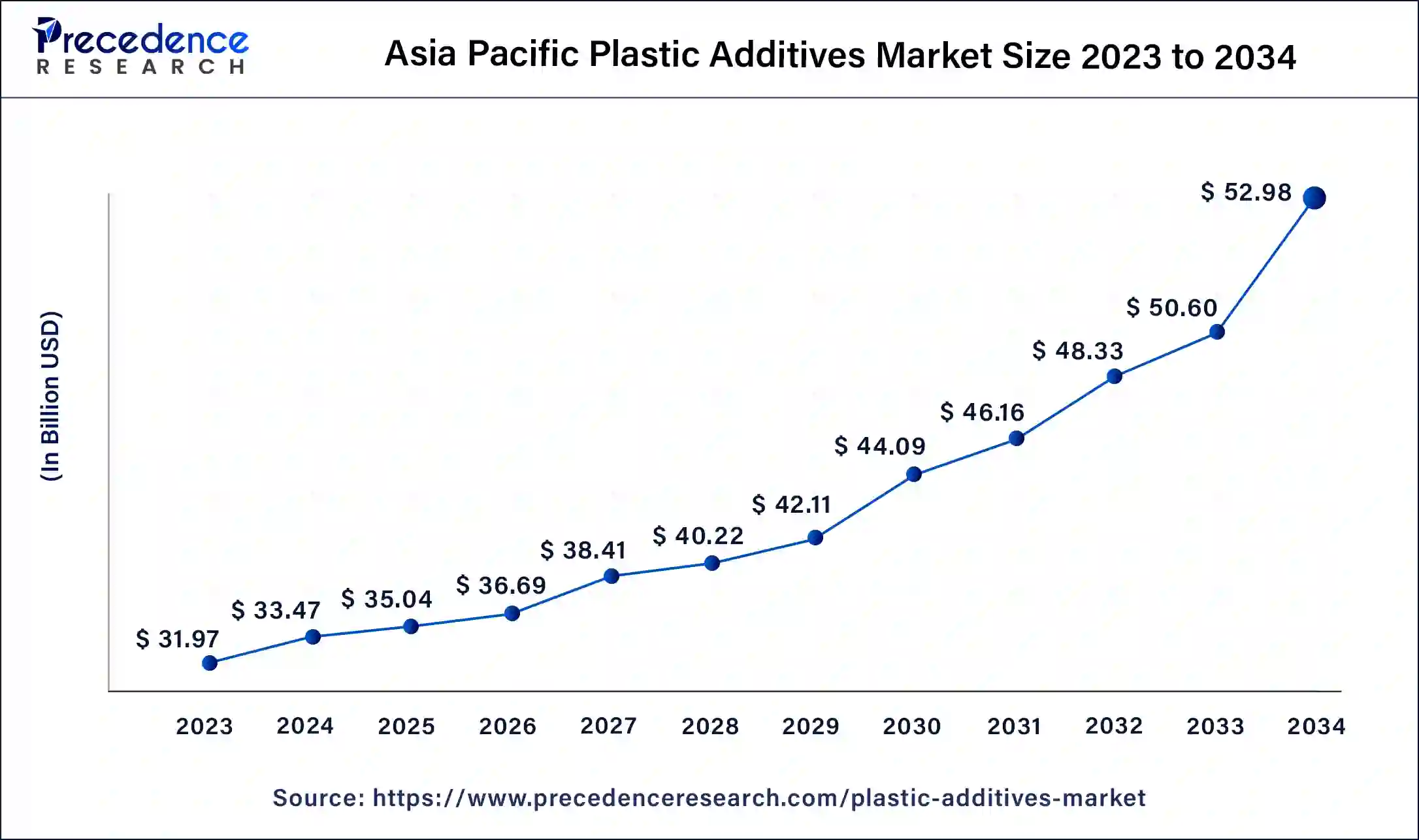

The Asia Pacific plastic additives market size was estimated at USD 31.97 billion in 2023 and is predicted to be worth around USD 52.98 billion by 2034, at a CAGR of 4.9% from 2024 to 2034.

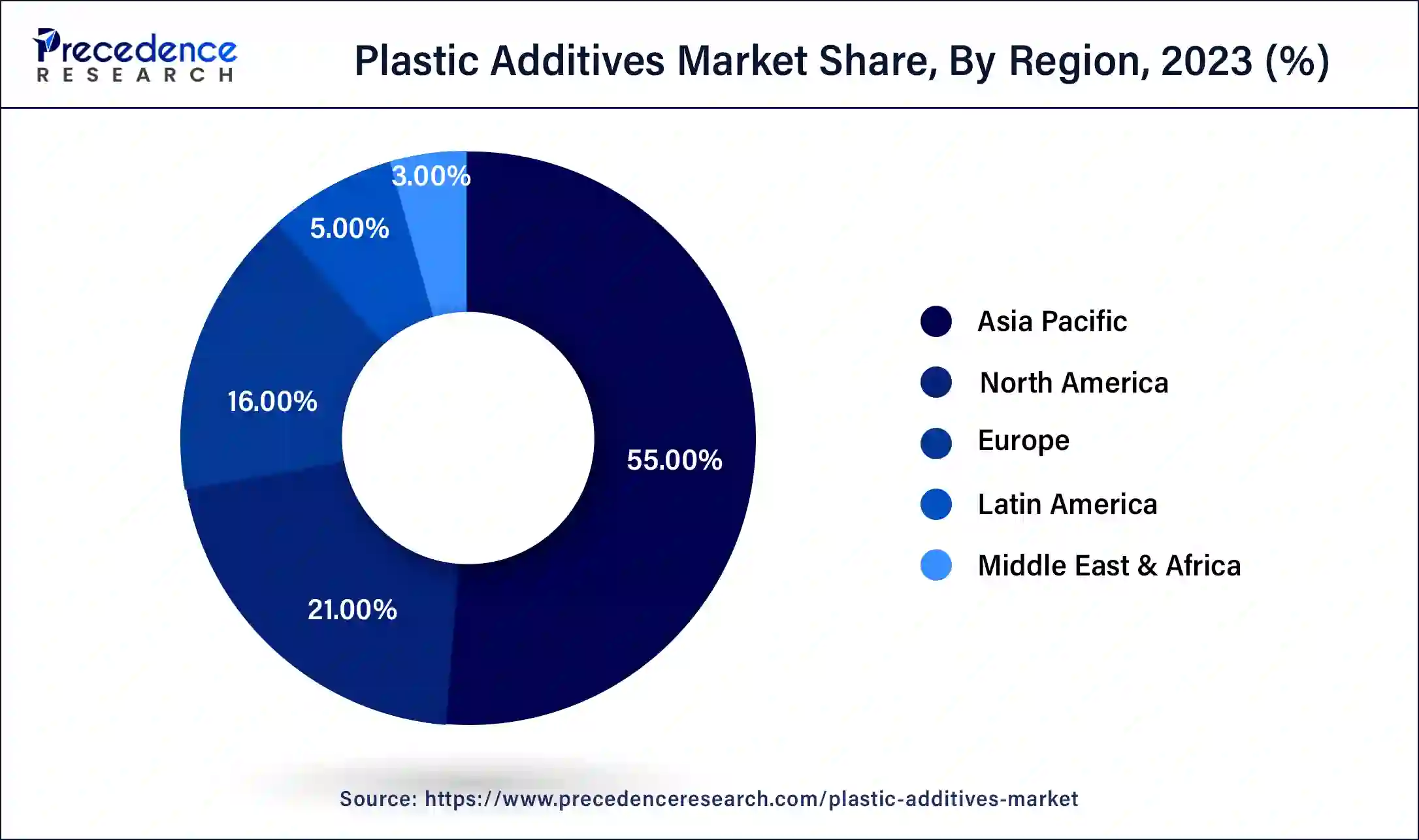

Asia Pacific held the dominating share of the plastic additives market with the largest share of 55% in 2023. Asia Pacific is experiencing rapid industrialization and urbanization, leading to increased demand for plastics in construction, infrastructure development, and consumer products. Plastic additives play a crucial role in enhancing the performance, durability, and aesthetic properties of plastics used in these applications, further driving market growth in the region.

Asia Pacific is witnessing significant investments in research and development (R&D) and technological advancements in the field of plastic additives. Manufacturers in the region are focused on developing innovative additives that offer improved performance, sustainability, and cost-effectiveness, driving market competitiveness and growth.

North America is expected to witness a significant rate of growth during the forecast period in the plastic additives market. North America has a significant manufacturing base for plastics, including industries such as automotive, packaging, construction, and consumer goods. These industries use plastic additives extensively to enhance the performance, durability, and aesthetic properties of plastic materials. The high demand for plastic additives from various manufacturing sectors contributes to North America's dominance in the market.

With increasing awareness of environmental issues and sustainability concerns, there is a growing demand for sustainable plastic additives in North America. Additives that improve the biodegradability, recyclability, and environmental performance of plastics are in high demand. North American manufacturers are at the forefront of developing eco-friendly additives and sustainable plastic solutions to address these demands, further solidifying the region's dominance in the market.

The plastic additives market refers to the industry involved in the manufacturing, distribution, and sale of various chemical additives used in plastics to enhance their properties or performance during processing, fabrication, or end-use applications. Plastic additives are the materials that are added to the plastics at the time of the manufacturing process, they provide the optimal performance of the material at the time of molding and use. Plastic additives are also used for enhancing the properties of polymer to meet specific performance from the plastics. Additives increase the lifecycle of plastics and allow them to be used in many processes. Plastic additives are found in three different variants that are liquid, powder, and pallet.

Plastic additives are used in the plastic compounding process, additives are the chemical that help to modify the plastic combined with raw materials, to meet the required properties, color, and performance. Additives also help to fight against extreme weather conditions like exposure to UV lights or water that help to extend the lifecycle and durability of plastic products. The rising industrialization and the higher demand for the additives are driving the growth of the plastic additives market.

| Report Coverage | Details |

| Global Market Size in 2023 | USD 58.12 Billion |

| Global Market Size in 2024 | USD 60.85 Billion |

| Global Market Size by 2034 | USD 96.33 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.55% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Plastic Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of the automotive industry

The increasing adoption of plastic materials in the automotive industry is driving the growth of the plastic additives market. Automotive plastics are also known as engineering plastics with high performance, which make them compatible for the growing demand from the automotive industry. Automotive plastics play an important role in the manufacturing of various automotive parts. Polypropylene is one of the types of automotive plastics which is widely applicable in the vehicle manufacturing due to its heat resistance, it is used in the manufacturing of automotive parts such as gas cans, bumper fascia, cable insulation, engine covers, and instrument panels.

Polyurethane is another type of high-performance plastic polymer which have higher insulative properties, resilience, strength, and moldability. This type of polymer is used in the manufacturing of headrests, seats, bumpers, soundproof and air filtering systems, and tires. Thus, the higher demand for plastic materials in the automotive sector is boosting the demand for the plastic additives market.

Environmental concerns

Several environmental concerns are observed to act as a major restraint for the plastic additives market. The widespread use and disposal of plastic products have led to environmental issues, including plastic pollution in oceans, rivers, and landfills. Concerns about the environmental impact of plastic waste, such as wildlife entanglement, habitat destruction, and microplastic contamination, have prompted calls for reducing plastic consumption and finding alternatives to conventional plastics.

Many companies across industries are prioritizing environmental sustainability and corporate social responsibility as integral parts of their business strategies. Using plastic additives associated with environmental concerns may tarnish a company's brand reputation and undermine its commitment to sustainability goals. As a result, businesses may seek to avoid or minimize the use of problematic plastic additives and adopt more sustainable practices throughout their supply chains.

Rising utilization of cost-effective materials

The growing utilization of cost-effective materials is driving innovation and collaboration across the plastic value chain. Manufacturers, material suppliers, additive producers, and end-users are collaborating to develop new formulations, technologies, and applications for recycled and bio-based plastics. Plastic additives play a crucial role in these collaborative efforts by enabling the optimization of material properties, processing parameters, and performance characteristics. By working together to overcome technical challenges and scale up production of cost-effective materials, stakeholders can unlock new opportunities for growth and innovation in the plastic additives market.

The plasticizers segment held the largest share of the plastic additives market in 2023. The most commonly utilized additives in plastics are plasticizers. Typically, they come in the form of colorless, non-volatile liquids. Plasticizers work by reducing the viscosity of the polymer melt, which increases the flow and thermoplasticity of the polymer. Plasticizers improve the mechanical properties of plastics, such as tensile strength, elongation at break, impact resistance, and flexibility. They help reduce the glass transition temperature (Tg) of polymers, making them softer and more pliable. This enhancement in mechanical properties makes plasticizers indispensable in applications where flexibility and durability are essential, such as in PVC pipes, flooring, cables, and automotive interiors.

Plasticizers improve the processability of plastics by reducing melt viscosity, improving flow properties, and facilitating easier processing and molding. They enhance the compatibility between polymer chains and fillers or reinforcements, leading to improved dispersion and homogeneity in the final product. This compatibility and processability contribute to the widespread adoption of plasticizers across various manufacturing processes, including extrusion, injection molding, and blow molding.

The stabilizers segment is observed to witness a significant expansion in the plastic additives market during the forecast period. Stabilizers are widely used in enhancing the stability of chemical bonding in order to maintain their physical properties. Stabilizers are additives used to enhance the performance and durability of plastic materials, particularly in challenging environmental conditions. They help prevent degradation caused by exposure to heat, light, oxygen, and other environmental factors, thereby extending the lifespan of plastic products and maintaining their mechanical properties over time.

With increasing consumer demand for high-quality and long-lasting plastic products, manufacturers are under pressure to incorporate effective stabilizers into their formulations. Stabilizers contribute to the overall quality, performance, and reliability of plastic materials, thereby meeting consumer expectations for durable and sustainable products.

The flame retardants segment is observed to witness growth at a notable rate during the forecast period. Flame retardants play a crucial role in enhancing the fire safety properties of plastic materials, making them compliant with stringent safety regulations and standards. Governments and regulatory bodies worldwide impose strict fire safety requirements for various applications, such as building materials, automotive components, electronics, and consumer goods. As a result, there is a high demand for flame retardant additives to meet these regulatory requirements and ensure product safety.

Increasing awareness of fire safety risks among consumers has led to growing demand for flame retardant products in the market. Consumers prioritize safety and reliability when purchasing plastic products for residential, commercial, and industrial use. Manufacturers and brands respond to consumer preferences by incorporating flame retardant additives into their products to enhance fire resistance and meet market expectations for quality and safety.

The polypropylene segment held the largest share of the market in 2023. Polypropylene is a highly versatile polymer used in a wide range of applications, including packaging and automotive parts along with textiles industry. Such widespread applications create a high demand for additives to enhance their properties. Polypropylene-based additives can significantly improve the strength and flexibility of materials. These enhancements make polypropylene more suitable for diverse applications and industries.

The automotive segment held the dominating share of the plastic additives market in 2023. With the increasing regulatory pressure to reduce emissions and improve fuel efficiency, automakers are turning to lightweight materials like plastics to meet these standards. Thereby, the application of plastic additives in the automotive industry is observed to be more significant. Plastic provides greater design flexibility compared to metal, allowing for more intricate shapes and designs, which is important for both aesthetic and functional purposes.

Segments Covered in the Report

By Type

By Plastic Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024