April 2025

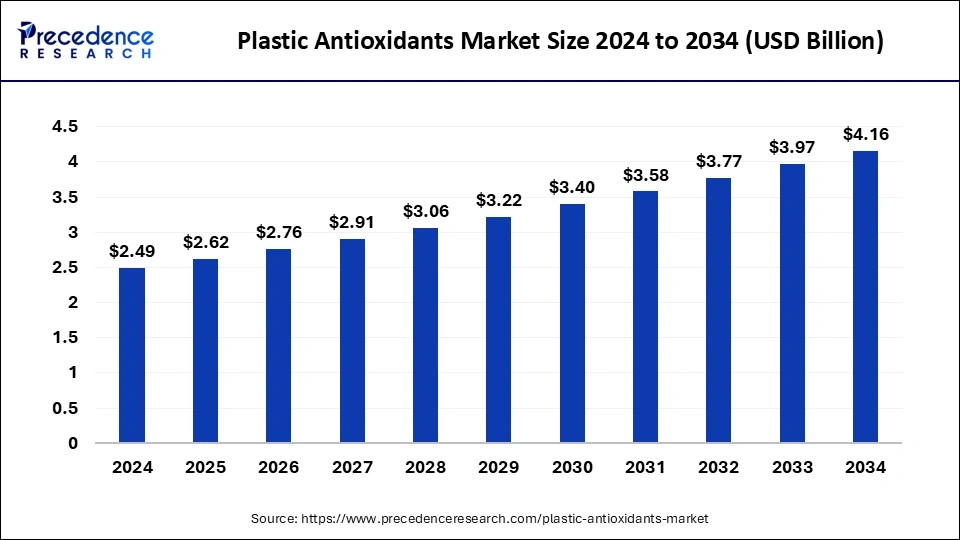

The global plastic antioxidants market size is calculated at USD 2.62 billion in 2025 and is forecasted to reach around USD 4.16 billion by 2034, accelerating at a CAGR of 5.27% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plastic antioxidants market size was estimated at USD 2.49 billion in 2024 and is predicted to increase from USD 2.62 billion in 2025 to approximately USD 4.16 billion by 2034, expanding at a CAGR of 5.27% from 2025 to 2034. The growing application of plastic antioxidant for production of protective clothing in healthcare sector is driving the growth of the plastic antioxidants market.

The plastic antioxidants market has gained the utmost importance due to the rising demand for plastic products across the world. This industry has also developed due to continuous research activities in the field of chemical sciences. Plastic antioxidants are plastic-neutralizing molecules that neutralize free radicals and harmful chemicals that destroy plastic products.

There are two main types of plastic antioxidants: primary plastic antioxidants and secondary plastic antioxidants. These antioxidants may be derived naturally or manufactured by humans to extend the shelf-life of plastic products. It inhibits the oxidation process by decomposing and reacting with the harmful reactants. Plastic antioxidants provide several advantages when added to plastics, including high durability, enhanced flexibility, temperature stability, inflammation reduction, aesthetic improvements, and more. This antioxidant finds its application in several end-user industries, including plastic toys, packaging, automotive, construction, electronics, aerospace, and some others.

This industry is fragmented due to the presence of global market players along with new entrants. Some prominent market players in the plastic antioxidants market include BASF SE, 3V Sigma S.p.A., Dover Chemical Corporation (ICC Industries Inc., Everspring Chemical Co. Ltd., Evonik Industries AG, and others. These market players are constantly engaged in research and development of high-grade plastic antioxidants and have adopted several strategies such as product launches, business expansions, partnerships, and some others to maintain their dominance in the industry.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.62 Billion |

| Market Size by 2034 | USD 4.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.27% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Polymer Resin, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for plastic antioxidants from the automotive sector

The automobile industry is one of the fastest-growing industries in the world. This industry has grown rapidly due to the rising demand for cars among people for several activities ranging from commutes to towing. Also, automotive manufacturers are constantly engaged in manufacturing cars that provide superior performance, high safety features and are environmentally friendly. Thus, with the rising demand for cars, the demand for plastic antioxidants has increased rapidly in the automotive industry as these additives are used for several factors such as increasing fuel efficiency, ignition control, radio, computers, telematics engine management, in-car entertainment systems, doors, fenders, headlights, windows, and others. Also, players in the plastic antioxidants market, such as BASF SE, Songwon, Solvay SA, and others, are developing high-grade antioxidant additives for the automotive industry.

Rise in raw materials prices along with strict government regulations.

The prices of raw materials for manufacturing plastic antioxidants have increased rapidly in recent times. In order to gain maximum profits, companies started to increase the prices of plastic antioxidants, which, in turn, decreased sales, thereby restraining market growth. Also, the governments of several countries, such as India, Canada, the U.S., and some others, have adopted strategies to ban plastic packaging and plastic products. Thus, with the decreased use of plastic products, the demand for plastic antioxidants is likely to fall gradually, restraining the growth of the plastic antioxidants market.

High-performance additives

The plastic antioxidants market is developing gradually due to its rising application in several end-user industries such as medicine, electronics, transportation, electronics, packaging, and others. Currently, the concept of high-performance plastic additives has gained the utmost importance as these additives come with several benefits, such as weight-saving capabilities, rigidity, high stiffness, supreme sliding friction, and durability of the materials. Thus, ongoing research and development activities related to high-performance plastic additives are expected to create ample growth opportunities for the market players in the future.

The phenolic segment led the plastic antioxidants market in 2024. The growth of this segment is driven by the rising developments in the chemical industries across the world. Also, rising investments from private and public sector entities for the production of high-grade phenolic antioxidants have also boosted the market growth. Moreover, the growing use of polyethylene and polypropylene in the food packaging industry has increased the demand for plastic additives, thereby driving the growth of the market. Additionally, plastic antioxidant companies such as BASF SE, Solvay SA, Songwon, SI GROUP, and some others have adopted strategies such as product launches, partnerships, and business expansions to maintain the demand-supply chain across the world, thereby driving the market growth.

The phosphite & phosphonite segment will show the fastest growth in the global plastic antioxidants market during the forecast period. The growth of this segment can be attributed to the growing applications of secondary plastic antioxidants in the plastic and automotive industries. Also, phosphite & phosphonite are used for stabilizing plastics during the production process of plastic products, driving the growth of the market. Moreover, phosphite & phosphonite-based antioxidants combine with primary antioxidants to prevent the proliferation of hydroxyl radicals and alkoxyl radicals in plastics, thereby driving the market growth. Furthermore, plastic antioxidant manufacturing companies such as SI Group, BASF SE, and some others are constantly engaged in manufacturing phosphite & phosphonite-based plastic antioxidants to maintain their dominance in the industry.

The PP segment dominated the plastic antioxidants market in 2024. This segment is generally driven by the rising use of propylene (PP) resin in several industries, such as automotive, packaging, medicine, toys, and others. Moreover, the growing use of these resins in injection molding for faster production of plastic products has also driven the growth of the market. Also, the increase in demand for PP resin from the construction and automotive industries has increased the demand for plastic antioxidants, thereby driving the growth of the plastic antioxidants industry.

In the plastic antioxidants market, the PE segment is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is generally driven by the rising scientific developments in the packaging industry. Also, the growing use of PE resins such as LDPE, LLDPE, and HDPE for the production of surface protection films for laptops, smartphones, and tablets has also increased the demand for plastic antioxidants, thereby driving market growth. Moreover, the rising demand for HDPE from the food and beverages industry has also driven the growth of the market.

Asia Pacific led the plastic antioxidants market in 2024. The growth of this region is mainly driven by the rising technological developments in the chemical industry. Moreover, the rising application of plastic antioxidants from the automotive sector has also boosted market growth. Also, governments of countries such as India, China, South Korea, and Japan are launching initiatives to strengthen the chemical sector, which in turn boosts market growth. Additionally, the presence of market players such as Songwon, Sumimoto Chemicals, Adeka Corporation, Ampacet Corporation, and some others also boost the market growth.

Europe is projected to experience the fastest rate of growth in the plastic antioxidants market during the forecast period. The growth of this region is mainly driven by the scientific advancements in the healthcare sector in countries such as the UK, France, Italy, and Germany. Also, the increasing interest from the public and private sectors in development & research related to plastic antioxidants has also boosted the market growth. Moreover, the rise in government initiatives aimed at developing the chemical industry has fostered market growth.

Additionally, the presence of a well-established automotive industry in countries such as Germany, France, the UK, and others has increased the demand for plastic antioxidants, thereby driving the market growth. Furthermore, the presence of plastic antioxidant companies such as BASF SE, Lanxess, Oxiris Chemicals, Evonik Industries, and others boost the growth of the plastic antioxidants market.

By Type

By Polymer Resin

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024