September 2024

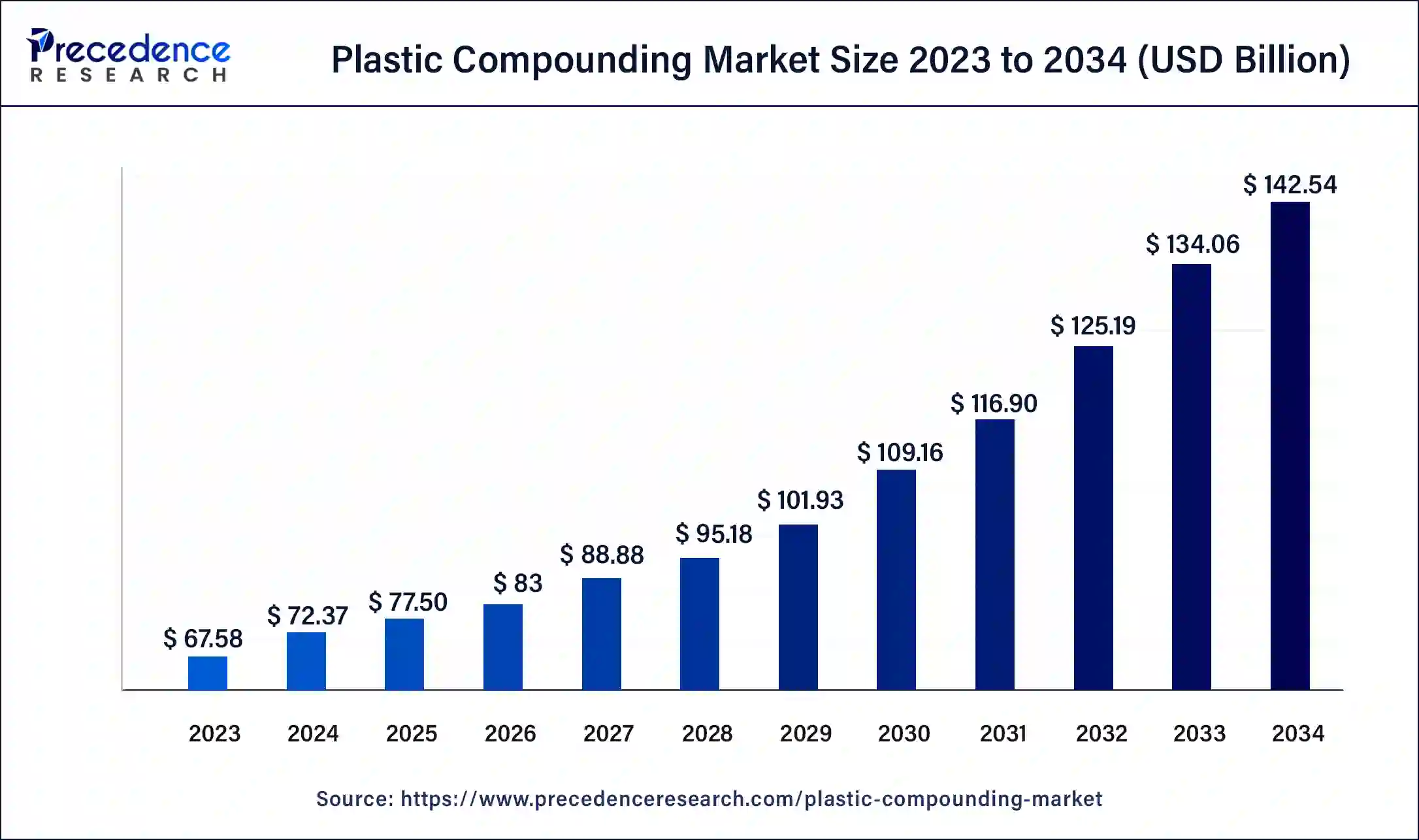

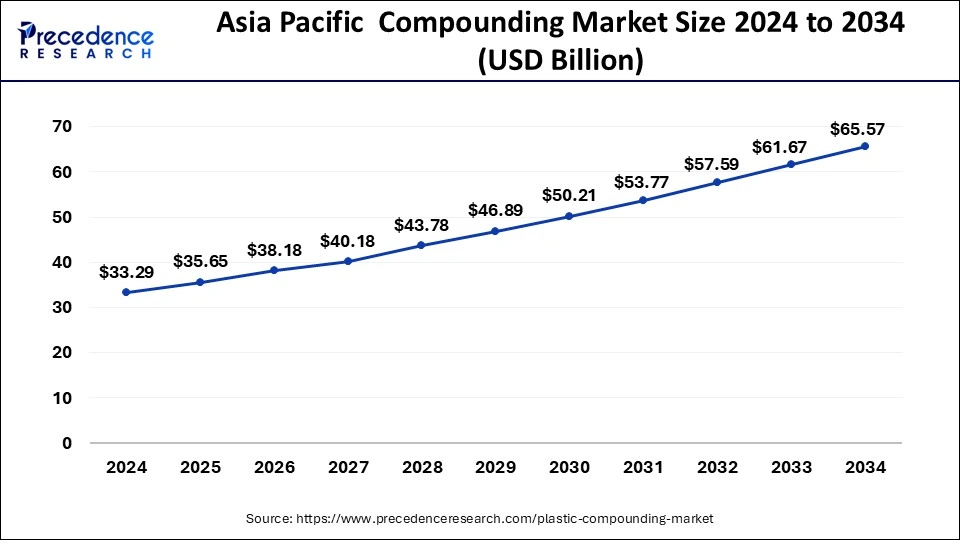

The global plastic compounding market size is calculated at USD 77.50 billion in 2025 and is forecasted to reach around USD 142.54 billion by 2034, accelerating at a CAGR of 7% from 2025 to 2034. The Asia Pacific plastic compounding market size surpassed USD 35.65 billion in 2025 and is expanding at a CAGR of 8% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plastic compounding market size was estimated at USD 72.37 billion in 2024 and is predicted to increase from USD 77.50 billion in 2025 to approximately USD 142.54 billion by 2034, expanding at a CAGR of 7% from 2025 to 2034.

The Asia Pacific plastic compounding market size was estimated at USD 33.29 billion in 2024 and is predicted to be worth around USD 65.57 billion by 2034, at a CAGR of 8% from 2025 to 2034.

The primary cause of the sharp rise is the rising demand for biodegradable polymers in developing nations like China and India. PHA and PLA had sustainable market shares of the 2.11 million tonnes of bioplastics manufactured, respectively. Additionally, businesses are increasing their biodegradable plastic production due to regulatory restrictions on single-use plastic packaging. As a viable alternative to petroleum-based goods, biodegradable polymers from agricultural materials like corn and sugar cane are gaining popularity. For instance, BBCA, a supplier of lactic acids used as food additives, recently established a facility with the capacity to produce 50,000 tonnes of polymers from lactic acid (PLA) each year.

Furthermore, India consumes 9.7 kg of plastic per person annually, compared to China's average of 46 kg. When heated, thermoplastics do not distort plastically. Plastics are widely available, have a high output, a wide range of applications, are inexpensive, and the molding process is simple. Thus, growing economies like China and India employ these kinds of plastics. Also, Firms are turning to bioplastics because consumers in most Asian nations, including China, India, Bangladesh, and others, are worried about the environment. This helps businesses increase their consumer market share.

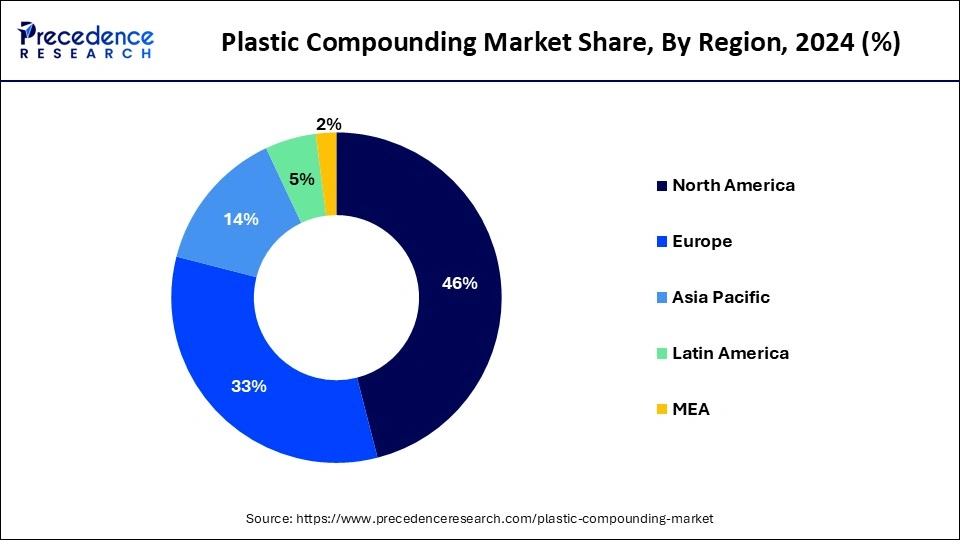

Asia Pacific accounted largest revenue share of 46% in 2024, owing to rise in its demand from arising operation sectors including construction, electrical & electronics, and automotive. In the construction sector, the adding demand for plastic composites is owing to rise in its use in floorings, sequestration accoutrements, storehouse tanks, performance safety windows, doors, pipes, and lines. Growth in domestic and marketable systems in developing economies similar as India and China, is boosting infrastructural development. Expansion of automotive and electronic and electrical element manufacturing shops across Asia-Pacific is anticipated to give economic openings in the market.

Asia Pacific appeared as the prime market for plastic compounding products on account of cost-effective environment and the advent of plastic manufacturers in the region. Asia Pacific is the leading producer of electrical and electronic devices. Since last couple of years, there has been tremendous escalation in demand for electrical and electronic devices in this region on account of technological enhancements and improved R&D in the electronic and electrical sector. Numerous prominent electronic component industrialists have set up facilities in Indonesia,India, South Korea and China. This is indirectly projected to spur the sale of plastic compounding in this region.

Escalating industrialization and augmented in disposable income across the emergent nations like India and China have triggered the need for automobiles. Stimulating production of light weight vehicles and upsurge in demand for electric vehicles are few other influencers of the growth of the market. Europe has also appeared as rapidly growing market for plastic compounding. Germany, France, Russia and UK, are the some of the key revenue generating markets in this region.

Plastic compounding is a process of transubstantiating the characteristics of introductory plastics and thermoplastics using an admixture of plastics and complements. Plastic compounds have higher physical properties such as conductivity, wide range of flame retardancy, are light weight and wear resistance. These properties increase their demand in various buildings, automotive, and construction, packaging and electrical & electronics and therefore boosting the growth of the global plastic compounding market.

Rising consumption from downstream sectors including construction, automotive, electronic, electrical and packaging are flourishing the growth of plastic compounding market. The demand for plastic is constantly growing inseveral industrial applications as it offers many advantages such as easy molding and ability to form preferred shape.Further, spurring use in the infrastructure area is one of the prominent influencing factors for the growth of plastic compounding market globally.

Environmental concerns and diminishing crude oil reserves due to practice of petrochemical polymers have triggered the requirement of bio-based products. Government limitations on consumption of polymers extracted from petrochemicals in many end use industries is anticipated to incentivize production of bio-based polymers. Bioplastic resin suppliers are increasing the raw material supply in anticipation of strong demand. Plastic additive producers are escalating capability to cater the rising demands of global plastic compounding markets.

Future of Plastic Compounding Market

Increase in disposable income of individualities and rapid industrialization across the arising economies similar as China and India, have fueled the demand for vehicles. Growth in increase in demand for electric vehicles and light weight vehicles production are some of the major drivers of this market. Asia-Pacific is the leading manufacturer of electronic and electrical bias. Over the once many times, there has been a surge in demand for electrical and electronic bias across the region due to advancements in technology and R&D in the electrical & electronic market. Numerous leading electronic element manufacturers have set their shops in India, China, Indonesia, and South Korea. This is anticipated to drive the growth of the plastic compounding market.

| Report Highlights | Details |

| Market Size in 2024 | USD 72.37 Billion |

| Market Size in 2025 | USD 77.50 Billion |

| Market Size by 2034 | USD 142.54 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

Increasing Plastic Compounding in Infrastructure Development

As consumer awareness of appealing interiors rises, driving demand for these materials in interior designs, the frequency of residential and commercial projects in developing nations stimulates infrastructural development. The plastic compounding market is projected to benefit from the expanding construction sector. Through various products, including pipes, wires, cables, waterproofing membranes, and wood PVC composites, PVC and CPVC play a significant part in the sustainable management of this industry. The majority of developing nations, including Mexico, India, and others, are anticipated to profit from increased construction spending as well as from customers' propensity to choose sustainable and lightweight building materials over more traditional materials like metals and alloys.

High Substitution Potential from its Bio-based Counterparts

The usage of bio-based polymer manufacture has been encouraged by various limits that governments have placed on the consumption of polymers made from petrochemicals in multiple sectors. Instead of using fossil fuels, these bio-compound polymers are produced from plants or other sustainable resources. Polymers derived from bio-based sources, such as Polyhydroxyalkanoate (PHA), Polylactic Acid (PLA), and Polybutylene Succinate (PBS), have demonstrated outstanding biodegradability, which their corresponding products derived from petrochemicals severely lack. As a result, these products are becoming increasingly popular, particularly for biomedical and agricultural uses.

Continued Advancement in Catalyst Technology to Boost Resin Performance and Yield

Some accelerators can boost resin yield, causing quality problems and poor product performance. The performance, adaptability, and yield of polyethylene and other resins will thus be improved by continuously developing polymerization catalyst technologies, creating a lucrative opportunity for the leading players to boost their output and compete favorably on the market.

Globally, the population is undoubtedly going to need a lot more infrastructure, and this is expected to increase construction activity, increasing demand for building supplies and plastic compounding goods. Automobile OEMs are adopting plastics as alternatives to metals like aluminum and steel in manufacturing automotive components in response to regulatory interference to lower vehicle weight to enhance fuel ability and cut carbon emissions. The global plastic compounding market is driven by an increase in demand for reinforced thermoplastic and thermoset materials used to produce automobile components.

The automotive segment dominated the market with a revenue share of 26% in 2024.

Conventionally, construction sector has been a chief consumer of plastics for multiple applications including insulation, pipe fittings, masonry equipment and materials. Plastic compounds can bereformed as per their necessities. For example, flame retardant additives are mixed to polyvinyl chloride compounds in order to form a very vital facet of building materials. Polyurethane compounding is employed in order to achieve insulation function for buildings. The polystyrene and polypropylene compounding are commonly utilized in the construction sector as it has features such as economical nature, inherent strength and stress-free recyclability. The architects, builders, and service consultants are continuously seeking ways to augment energy efficiency in buildings. Overall, plastic compounding is gaining acceptance due to prerequisite for enhanced energy efficient buildings and rushing energy prices.

Due to its affordability, durability, and resistance to chemical corrosion, polyvinyl chloride (PVC) is expected to continue to be in high demand in the building industry. Over the predicted period, there will be an increase in the usage of unplasticized polyvinyl chloride as an alternative for painted wood in window frames as well as sills. Polyvinyl chloride is used in packaging for medical equipment, device bottle sleeving, packaging, consumer electronics packaging, and other goods. Positive expectations are forecast for the expanding packaging business, particularly the plastic packaging industry. PVC is used in packaging for things like medical equipment and device packaging, bottle sleeving, and packaging for consumer electronics and other goods. Positive expectations are forecast for the expanding packaging business, particularly the plastic packaging sector.

Polypropylene (PP) segment holds the major share of 33% in 2024, as it's extensively used in automotive operations. Plastic composites are light in weight and are replacing metal factors in automotive. To reduce the weight of the vehicles. These results in lower carbon emigrations and increase in energy effectiveness and performance of the vehicles. This factor is anticipated to increase the use of plastic in automotive operations. In addition, properties similar as good fatigue resistance, being light weight, and better temperature & chemical resistance are anticipated to increase the demand for polypropylene and therefore, likely to drive the growth of this market in future.

Polypropylene is an outstanding packaging material as it provides lightweight and economical packaging. Additionally, polypropylene packaging can endure an extensive temperature range from microwave to freezing temperature. Both, polystyrene and polypropylene compounding can be employed for packaging. This fact supports the growth of polypropylene compounding segments growth in the market.

By Application

By Product

By Source

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

August 2024

September 2024