April 2025

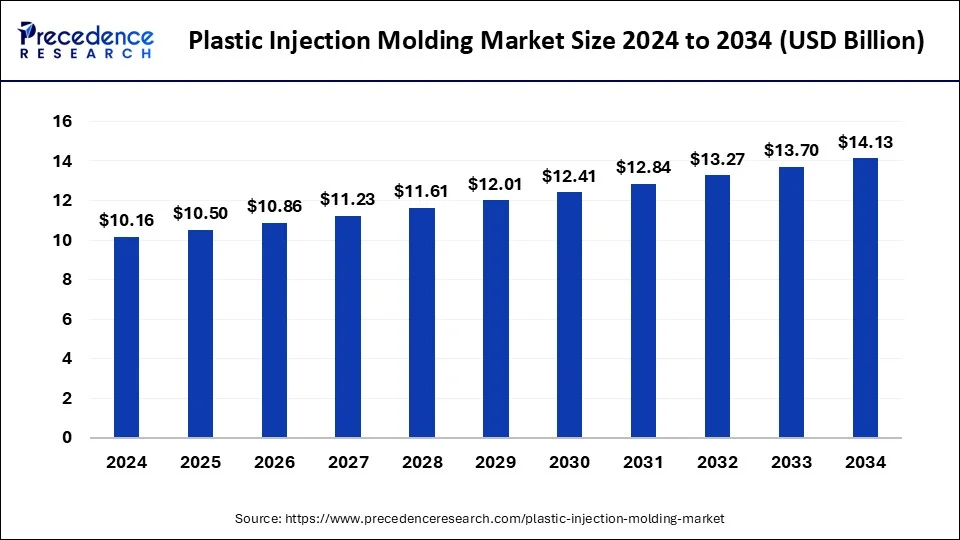

The global plastic injection molding market size is calculated at USD 10.5 billion in 2025 and is forecasted to reach around USD 14.13 billion by 2034, accelerating at a CAGR of 3.35% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plastic injection molding market size accounted for USD 10.16 billion in 2024, estimated at USD 10.5 billion in 2025, and is anticipated to reach around USD 14.13 billion by 2034, expanding at a CAGR of 3.35% from 2025 to 2034.

The injection molding is a plastic product manufacturing technique that involves injecting molten material into a mold, where it is cooled, melted, and solidified as the final part or product. Injection molded plastics, both thermosetting and thermoplastic, are used in a variety of sectors to create diverse parts and components. Polypropylene, high-density polyethylene, polycarbonate, polyvinyl chloride, low density polyethylene, and polysulfide are some of the most common thermoplastic polymers used in injection molding. Some of the thermosetting polymers used for injection molding include melamine formaldehyde and polyester.

Consumer preferences for high performance materials, as well as the adoption of new manufacturing technologies and government rules promoting energy efficient structures and smart building technologies, will all contribute to the construction industry’s growth.

The increased construction expenditure, particularly in developing countries, should help the plastic injection molding market by boosting public infrastructure and housing construction. In addition, rising industrialization, as well as stringent government requirements on energy efficient buildings and smart building technology, will drive industrial growth in Asia-Pacific region.

The injected molded plastics are used to replace a range of alloys and metals in the construction sector to improve weight, ultraviolet protection, insulation, cost-effectiveness, and waterproofness. The flooring, plumbing, walls, roofs, and insulation are the most common applications for plastics in the construction and building industry. The injection molded plastics’ broad use in diverse sectors is expected to stimulate demand.

The use of injection molded plastics in conjunction with an automated process lowers manufacturing costs. In the manufacturing or production process, it also decreases waste creation. The injection molded plastics market expansion will be aided by lower production waste and a speedier manufacturing process. Furthermore, the technique may create plastic components using multiple types of plastics at the same time. Moreover, the technical advancements in the plastic injection molding process, where robots are employed to execute various activities, such as assembling and finishing injection molded parts, as well as loading components into the injection molding would help the plastic injection molding market to develop. The plastic injection molding market’s expansion, however, may be hampered by high initial tooling costs and variable oil and gas prices.

For precision and little waste, injection molded plastics are utilized in the manufacturing of complicated and intricately shaped parts. The injection molded plastics are employed in the production of vehicle components, interior covering, and other miscellaneous assembly parts because of these benefits. It’s also utilized in packaging to make packaging objects and components that improve the packaging’s appearance and consumer appeal. Due to the durability, strength, and look of the injection molded plastics are frequently used in building and construction. The plastic components and parts are commonly used in insulation, piping systems, and roofing systems in the construction and building industry.

During the projected period, the plastic injection molding sector’s fastest growing application segment will be the healthcare industry. Due to the lightweight, ease of serializability, and cost effectiveness of injection molded plastic, blood sample analysis pipettes, needle housings, pregnancy test devices, and pieces of medical devices are only a few of the chosen segments.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.16 Billion |

| Market Size in 2025 | USD 10.5 Billion |

| Market Size by 2034 | USD 14.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.35% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Due to its expanding use in automotive components, packaging applications, and household products, the polypropylene segment dominated the plastic injection molding market, accounting for the highest market share during the forecast period. Over the projected period, increasing polypropylene finished product penetration in protective caps in electrical connections, food packaging, and battery housings is expected to boost the demand.

On the other hand, Acrylonitrile Butadiene Styrene is expected to be the opportunistic raw material for plastic injection molding in 2023. Over the projection period, the rising demand for Acrylonitrile Butadiene Styrene components in medical devices, automotive components, electronic housings, and consumer appliances manufacturing is likely to fuel demand.

Based on the application, the packaging segment dominated the global plastic injection molding market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. To comply with regulatory rules and end user needs, final packaging items go through several development stages. Increased life of food products and improved durability are just a few of the requirements that plastics must achieve for packaging applications.

On the other hand, the healthcare is estimated to be the most opportunistic segment during the forecast period. The injection molded plastics are projected to be in high demand in the healthcare business due to their optical clarity, cost-effective, and biocompatibility manufacturing methods.

The Asia-Pacific segment dominated the global plastic injection molding market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The rapid industrialization and the expansion of various plastics end user sectors are the primary drivers of market growth. Furthermore, the factors such as easy access to raw materials and inexpensive labor costs are enticing other plastic manufacturers to set up a base in this region. Moreover, improved living standards and disposable income are expected to promote the market expansion over the projection period.

On the other hand, the Europe is estimated to be the most opportunistic segment during the forecast period. The Europe region’s main economic driver is increased demand for automobile and consumer goods industries. People in this region have a lot of discretionary wealth, thus there’s a lot of demand for high-end luxury products made of plastics.

Segments Covered in the Report

By Raw Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024