January 2025

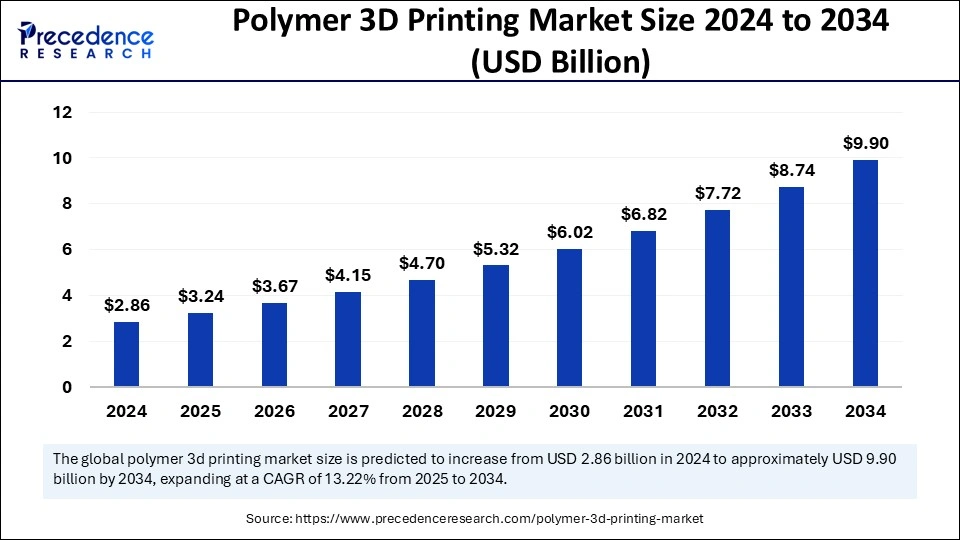

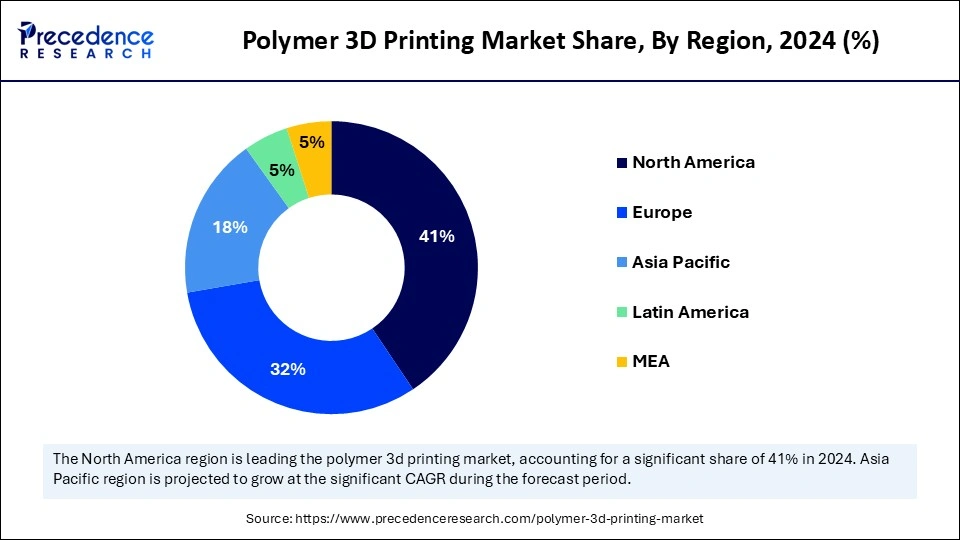

The global polymer 3d printing market size is calculated at USD 3.24 billion in 2025 and is forecasted to reach around USD 9.90 billion by 2034, accelerating at a CAGR of 13.22% from 2025 to 2034. The North America market size surpassed USD 1.17 billion in 2024 and is expanding at a CAGR of 13.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polymer 3d printing market size accounted for USD 2.86 billion in 2024 and is predicted to increase from USD 3.24 billion in 2025 to approximately USD 9.90 billion by 2034, expanding at a CAGR of 13.22% from 2025 to 2034. The polymer 3D printing market is experiencing rapid growth due to increasing adoption of 3D printing in various industries.

The integration of artificial intelligence in polymer 3D printing technology is set to revolutionize the global market. The advent of Industry 4.0 is boosting the adoption of AI to achieve precise results in various industries. AI is helpful in creating advanced 3D printing technology and environmentally friendly manufacturing methods. Integrating AI in 3D printing technology can optimize printing by identifying patterns and adjusting temperature and layer thickness. This further helps to improve print quality.

AI predicts potential failures in printing machines, enabling proactive maintenance and reducing downtime. Moreover, generative design has emerged as an innovative approach, which is possible using AI-powered printing solutions. This method is applied in various sectors like aerospace, consumer goods, and automotive to address complex engineering challenges, reduce component weight, and minimize manufacturing costs.

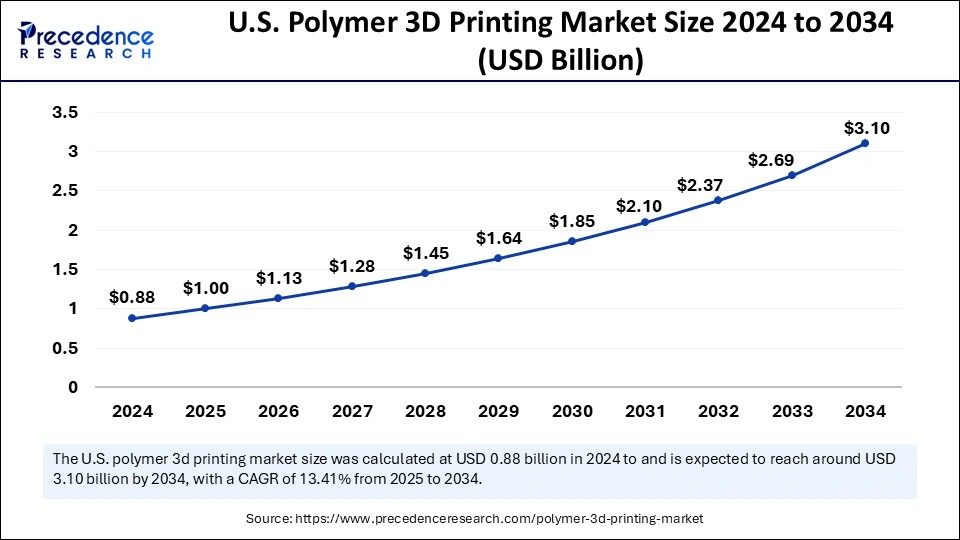

The U.S. polymer 3d printing market size was exhibited at USD 0.88 Billion in 2024 and is projected to be worth around USD 3.10 billion by 2034, growing at a CAGR of 13.41% from 2025 to 2034.

North America’s Sustain Dominance in the Market

North America registered dominance in the polymer 3D printing market by capturing the largest share in 2024. This is mainly due to the presence of a well-established 3D printing sector. The region is an early adopter of 3D printing technology. Moreover, government initiatives to promote additive manufacturing bolstered the market in the region. For instance, in May 2022, the U.S. government launched the Additive Manufacturing Forward Program to help smaller U.S.-based suppliers increase their use of additive manufacturing, also known as 3D printing.

Asia Pacific Polymer 3D Printing Market Trends

Asia Pacific is expected to witness rapid growth in the foreseeable period. The rising adoption of 3D printing technology in manufacturing is a major factor supporting market expansion. The rapid industrialization and the rising government initiatives to promote advanced manufacturing technologies further contribute to market expansion.

Trends in China

China's polymer 3D printing market is set to expand at a significant rate due to the rising adoption of advanced manufacturing technologies and increasing demand for customized solutions. The country's high investment in R&D and a robust manufacturing ecosystem make it a frontrunner in the market. Moreover, the increasing trend of integrating cutting-edge technologies like AI, internet of things, and big data with manufacturing technologies represents new possibilities for creating sophisticated 3D printing technologies. One of the significant milestones for China is that TCT Asia 2025, a major 3D printing and additive manufacturing event, took place at the NECC in Shanghai from March 17-19. This highlighted China's growing influence in the industry.

Polymers are basically long chain molecules made up of repetitive units on a primary level. Polymer 3D printing refers to the process where a three-dimensional object can be made from polymer material deposition with multiple layers, creating an object as an exact replica of the desired system, either biological or material. It finds applications in many end-use industries, highlighting its assertion in the global market.

Polymer 3D printing technology refers to additive manufacturing that can generate three-dimensional objects by depositing polymer materials with layers instead of using ceramics or metals. The polymer 3D printing market is expected to expand at a significant growth rate due to the increasing shift toward additive manufacturing to develop intricate product designs. Market players are expanding their product portfolio by integrating cutting-edge technologies. This product diversification is useful for businesses seeking advanced 3D printing solutions. Moreover, the rising focus on sustainable practices contributes to market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.90 Billion |

| Market Size in 2025 | USD 3.24 Billion |

| Market Size in 2024 | USD 2.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Material Type, Technology, End-use and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Need for Rapid Prototyping & Shift Toward Sustainable Practices

The rising need for rapid prototyping is a major factor driving the growth of the polymer 3D printing market. 3D printing technology allows for rapid prototyping, which further accelerates product development cycles. This technology enables the production of complex and intricate geometrical products that are hard to achieve by traditional manufacturing methods. Therefore, this technology is gaining immense traction in the aerospace and automotive industries.

3D printing allows automobile and aircraft manufacturers to easily iterate and test component designs before mass production, which helps reduce errors in the final design. Moreover, growing environmental awareness among businesses is driving the demand for sustainable printing solutions. 3D printing allows on-demand printing, reducing waste generation and thus contributing to sustainability goals.

Limitations in Materials

The major restraining factor of the polymer 3D printing market is material limitation. Some of the polymers do not hold the potential to create the desired product due to the lack of mechanical properties. Characteristics like temperature resistance and durability are required to manufacture certain products. This creates a barrier to market expansion as several 3D printed parts need extensive processing after manufacturing them, like sanding and painting, to meet quality measures. Due to such processes, time and cost is again escalates, affecting market growth. Moreover, 3D printing equipment is costlier, creating barriers, especially for SMEs, hampering the growth of the market.

Material Advancements

Advancements in material science create immense opportunities in the polymer 3D printing market. Advancements in material science led to the development of new polymers that unlock new potential for 3D printing. Rising research and development activities to develop new polymers further unlock new possibilities. These new polymers can enhance the quality of products. In addition, the integration of technologies like robotics and AI in 3D printing can accelerate printing processes and reduce time, which is expected to create lucrative growth opportunities in the market.

The healthcare segment dominated the polymer 3D printing market with the largest share in 2024. This is mainly due to the extensive applications of 3D printing to manufacture medical devices and prosthetics, which helps improve patients' health and overall outcomes of the treatment. The rise in demand for customized prosthetics further bolstered the segment.

The automotive segment is likely to grow at the fastest rate during the forecast period. The segment growth is attributed to ongoing research and development activities in the automotive field to improve product adoption rate. Due to the minimum production time, polymer 3D printing is highly preferred for rapid prototyping and production of vehicles and related components. Versatile materials with high-performance features are in demand in the automotive industry to manufacture various components, driving the segment’s growth.

The thermoplastics segment dominated the polymer 3D printing market in 2024 and is expected to experience significant growth over the studied period. Thermoplastics are widely preferred in 3D printing for their versatility and ability to be processed. Moreover, thermoplastics exhibit excellent flexibility, durability, and strength and are heat and chemical resistance, making them suitable for various applications.

The resins segment is projected to grow at the fastest rate in the coming years. The segment growth is attributed to the increasing adoption of resins to make intricate designs. Resins are widely preferred for their properties like superior finish and detail making.

The fuse deposition modeling segment dominated the polymer 3D printing market by holding a significant share in 2024. Fuse deposition modeling printers create quick prototypes of designs, making them a preferred choice in industries requiring rapid prototyping. The increasing demand from the automotive, aerospace, and defense sectors further supports the segment’s growth.

The stereolithography segment is anticipated to grow at a significant rate during the forecast period. This is mainly due to its ease of use. This technology is preferred for its ability to produce intricate designs with high accuracy and fine details. Moreover, rising research and development activities to enhance the capabilities of 3D printing technologies contribute to segmental growth.

The prototyping segment accounted for the largest market share in 2024. This is mainly due to the increase in demand for rapid prototyping. It enables manufacturers to achieve higher precision and rapidly create models before final production. Functional parts like smaller joints and metallic hardware for connecting components need to be created precisely to develop complex systems and machinery, requiring prototyping.

The production segment is expected to register a notable growth rate in the foreseeable period. The segmental growth is attributed to the increasing demand for personalized products and highly efficient manufacturing processes. Rapid production enables businesses to respond to evolving market demands.

Bioprinting and Medical Applications

As per market trends, the medical sector is the most lucrative option to expand a business. By investing in biotech firms, hospitals and research institutes can yield greater returns owing to the surge in 3D-printed implants, biocompatible materials, and prosthetics.

Automation and Software

By integrating automation and evolving technologies like AI, ML, and convolutional neural networks (CNNs) with 3D printing, workflows can be streamlined with less human intervention. Moreover, by incorporating software that suggests precise solutions for optimizing material use, printing failures can be reduced.

High-performance Composites and Polymers

By investing in high-quality and advanced materials like polyetherimide (PEI), polyetheretherketone (PEEK), and reinforced composites, businesses in the aerospace, automotive, and medical sectors can gain a competitive edge. Using these materials in 3D printing enables the development of intricate components with fine details. These materials offer high tensile strength and thermal resistance, making them suitable for 3D printing.

Eco-friendly and Sustainable Filaments

Investing in eco-friendly filaments and bio-degradable polymers, like polylactic acid (PLA) and polyhydroxyalkanoates (PHA), that can be recycled easily offers a great opportunity to expand the business, which attracts environmentally conscious consumers.

By Application

By Material Type

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

November 2024