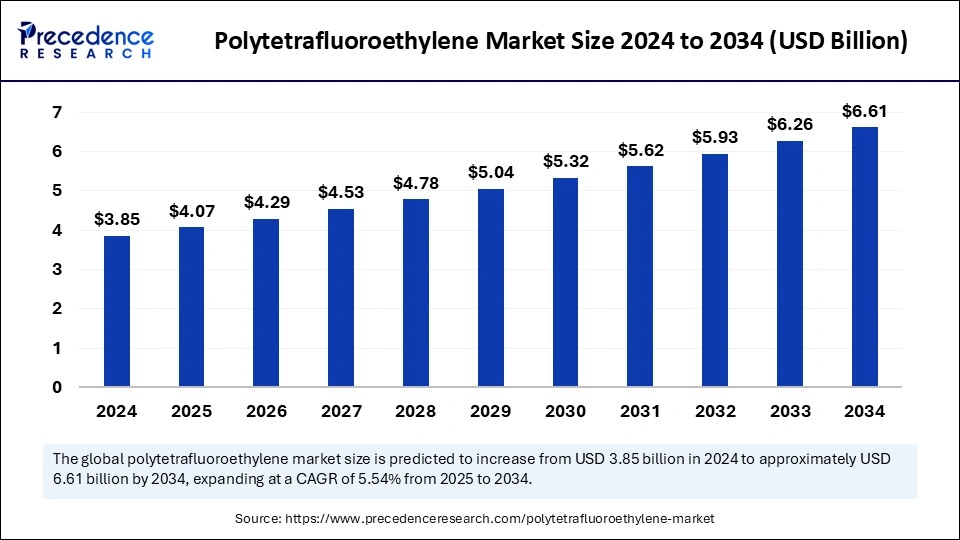

The global polytetrafluoroethylene market size is calculated at USD 4.07 billion in 2025 and is forecasted to reach around USD 6.61 billion by 2034, accelerating at a CAGR of 5.54% from 2025 to 2034. The Asia Pacific market size surpassed USD 1.73 billion in 2024 and is expanding at a CAGR of 5.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polytetrafluoroethylene market size was estimated at USD 3.85 billion in 2024 and is predicted to increase from USD 4.07 billion in 2025 to approximately USD 6.61 billion by 2034, expanding at a CAGR of 5.54% from 2025 to 2034. The growth of the PTFE market stems from its exceptional properties that serve several applications within the automotive industries, aerospace, electronics, and healthcare markets that need resistant materials.

Artificial intelligence solutions transform aspects of production methods, as well as product development and analytics assessment. The integration of AI technologies provides beneficial enhancements for PTFE manufacturing through improved quality control, optimized processes, and defect reduction. Material science data analysis through AI algorithms enables fast performance predictions of new PTFE formulations that speed up product development for specific industries, including automotive, aerospace, and electronics applications. Through AI integration, PTFE achieves improved manufacturing power and enhanced strategic operations, which secure long-term business growth.

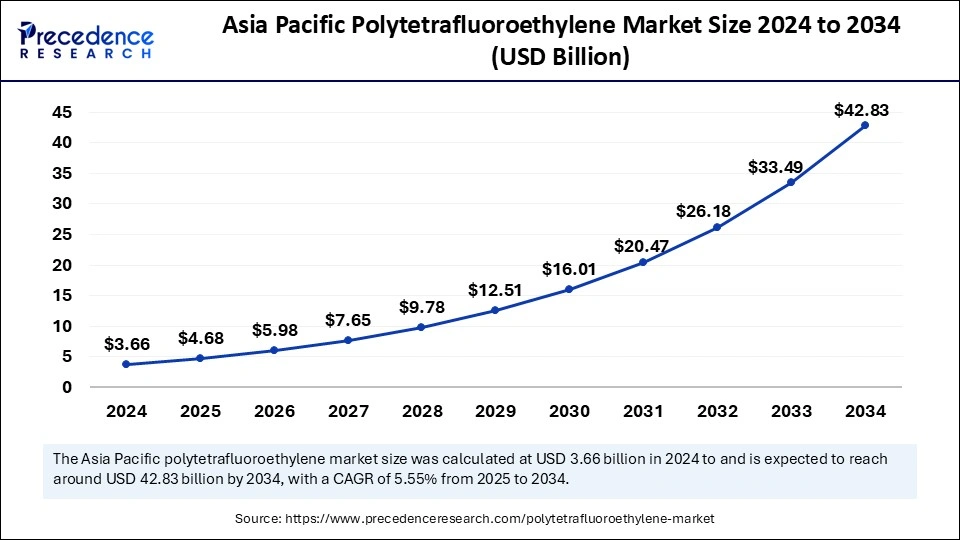

The Asia Pacific polytetrafluoroethylene market size was exhibited at USD 1.73 billion in 2024 and is projected to be worth around USD 2.97 billion by 2034, growing at a CAGR of 5.55% from 2025 to 2034.

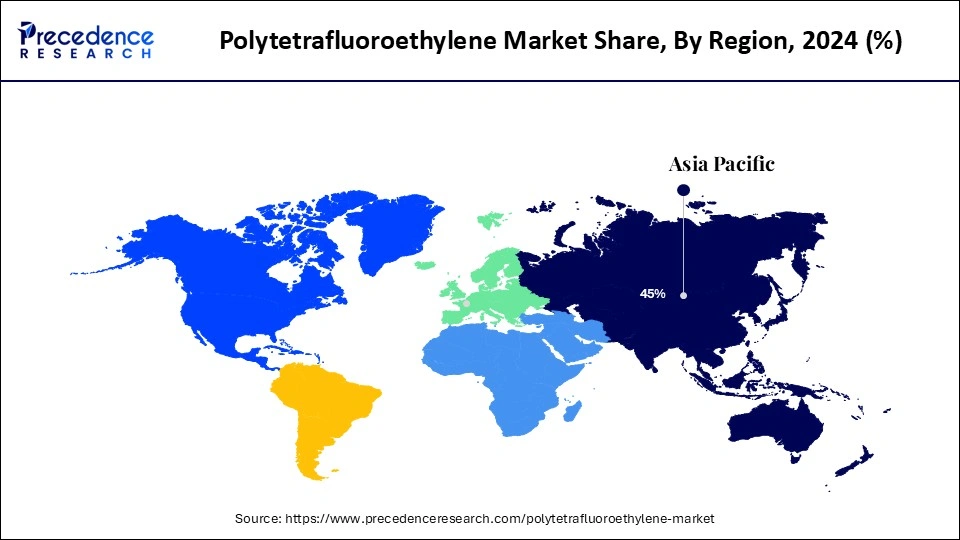

Asia Pacific dominated the polytetrafluoroethylene market because of its rapid industrialization, rising middle class, and expanding manufacturing sector. PTFE has experienced significant market growth across automotive and chemical, electronic, and consumer product applications. The PTFE market expansion in Asia depends on countries like China, India, and Japan to meet their growing demands because of their robust industrial capacity.

China demonstrates exceptional performance as a PTFE producer and consumer because its government supports domestically produced essential materials and technology through policy initiatives. The PTFE market will retain Asia Pacific's superiority because increasing manufacturing industries and developing infrastructure in emerging markets will drive continuous PTFE consumption growth.

North America is anticipated to witness the fastest growth in the polytetrafluoroethylene market during the forecasted years. The PTFE demand in the region flourishes because of its industrial base consisting of automotive, electronics, and chemical processing sectors. This material provides critical protection because of its outstanding thermal stability and chemical resistance when used within these industry sectors.

PTFE adoption receives support from North American regulatory standards that apply to healthcare and food processing sectors because it fulfills strict regulatory requirements. The PTFE market benefits from increased manufacturing capacity and research investment activities, which boost its growth prospects.

PFTE represents an artificial polymer consisting of carbon atoms bound to fluorine atoms through a precise molecular arrangement. PTFE's unique molecule structure confers permanent chemical resistance and thermal stability with minimal friction properties and exceptional non-adhesive traits. PTFE’s extensive suitability enables its use in producing multiple products that include industrial applications like bearings, seals, and household items such as non-stick cookware.

The PTFE market establishes remarkable expansion because of industry developments and technological breakthroughs. The automotive industry reflects one of the primary growth factors because PTFE utilizes its superior properties, including high-temperature resistance capabilities, chemical inertness, and low friction characteristics, to produce automotive components such as gaskets and seals as well as bearings and fuel lines. The polytetrafluoroethylene market growth receives substantial support from the electronics industry because its outstanding insulation characteristics enable cable insulation and semiconductor components as well as printed circuit board applications. The consumer interest in non-stick cookware fuels market growth because PTFE coatings deliver better maintenance and superior cooking abilities.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.61 Billion |

| Market Size in 2025 | USD 4.07 Billion |

| Market Size in 2024 | USD 3.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Growing automotive industry demand

The automotive industry selects PTFE as its vital material because this material demonstrates outstanding characteristics, including temperature resistance, chemical stability, and reduced friction levels. Manufacturers in the automotive field need PTFE because it extends material life spans while enhancing fuel performance and reducing system friction through its effective use in bearings, seals, and gaskets. PTFE reaches its critical success by producing minimal friction to safeguard vehicle parts from damage, thus decreasing repair costs and enhancing system dependability.

PTFE finds steady market demand across automotive applications, aerospace applications, electronics, and industrial uses because it provides essential performance reliability under intense operating conditions. PTFE usage will expand across different sectors since industries require this material to enhance operational efficiency and safety measures while being drawn to its versatile properties.

Environmental concerns

Environmental and health concerns related to PTFE production create the most significant barrier in the market because they result in perfluorooctanoic acid (PFOA) emissions. Because PFOA persists in the environment, it creates problematic conditions for ecosystem health and human health besides raising environmental regulatory challenges. PTFE encounters fierce competition from lower-priced polyethylene and polypropylene alternatives, which compete in similar applications.

PTFE adoption is limited by both its production price levels and challenging manufacturing protocols, which present manufacturing difficulties for profitability and competitive pricing maintenance. Various cost-related factors, along with competitive alternative materials.

Bio-based PTFE alternatives and sustainable solutions

The rising polytetrafluoroethylene market interest in sustainable materials creates a substantial business possibility for bio-based PTFE replacement technology. Manufacturers seek environmentally friendly production methods because of rising supply costs, increased regulatory pressure, and customer demands for environmentally friendly products. The adoption of sustainable solutions in military and firefighting operations, with textile production and pharmaceutical manufacturing, because PTFE membranes bring essential properties such as water resistance, oil-blocking abilities, and strong chemical tolerance.

Sustainability-oriented innovations in bio-based PTFE alternatives need to be developed because emerging manufacturing standards demand low-environmental-impact production methods, which should deliver top performance to diverse industries.

The granular polytetrafluoroethylene segment contributed the largest share of the polytetrafluoroethylene market in 2024. The use of granular PTFE goes into making seals, gaskets, and valves for harsh service requirements. The excellent chemical resistance, thermal stability, and low friction properties of this PTFE form make it ideal for chemical processing applications and the automotive industry, as well as aerospace operations and electrical industries. These industrial sectors find this material attractive because of its flame resistance, low-temperature toughness, and excellent electrical characteristics. The market demand for granular PTFE remains high because industrial sectors require this material to deliver exceptional performance in harsh conditions.

The fine-powder polytetrafluoroethylene segment is expected to grow considerably in the polytetrafluoroethylene market over the forecast period. The production method of controlled emulsion polymerization yields small white particles that exhibit characteristics such as outstanding thermal stability, stress crack resistance, and superior dielectric properties. PTFE fine powder serves multiple industries as a valuable component for producing parts that must maintain precise operation and reliability under harsh environments. This fine material improves other materials wear resistance and friction properties, while the powder functions well as an additive for this purpose. The market anticipates growth because the material demonstrates superb performance qualities in challenging environments, which drives demand from multiple mechanical, electrical, and chemical applications.

The industrial and chemicals segment accounted for the largest share of the polytetrafluoroethylene market. PTFE serves as an ideal material for durable applications since it demonstrates non-stick characteristics, high-temperature resistance, along resistance to most acids and caustics. The industrial and chemical sector chooses PTFE to build gaskets, seals, washers, pump interiors, and vessel linings because their components experience severe chemicals and demanding environmental scenarios. PTFE-based protective coatings enhance the service period and operational efficiency of heat exchangers alongside compressors and reaction vessels. PFTE serves as an essential material for critical processes because it possesses outstanding properties. The chemical and industrial processing sector expansions keep the PTFE market position strong because it serves their growth requirements.

The electrical and electronics application segment is anticipated to witness significant growth in the polytetrafluoroethylene market over the studied period. PTFE serves as an excellent electrical insulator that finds essential applications in cable insulation and circuit boards, as well as several electronic components. Engineers in the electrical sector utilize PTFE for multiple applications, which include electric switch gears, capacitors, as well as traction motors. PTFE demonstrates outstanding dielectric strength properties, which allow it to transmit high electrical voltages, thus becoming an essential material for dependable, safe electronic equipment. The rising need for advanced electronic and electrical equipment will escalate PTFE applications in insulation along with protective components, which will boost its overall market expansion. The PTFE stands as a vital choice in the electronics industry due to its durability and high-temperature resistance with outstanding insulating properties.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client