April 2025

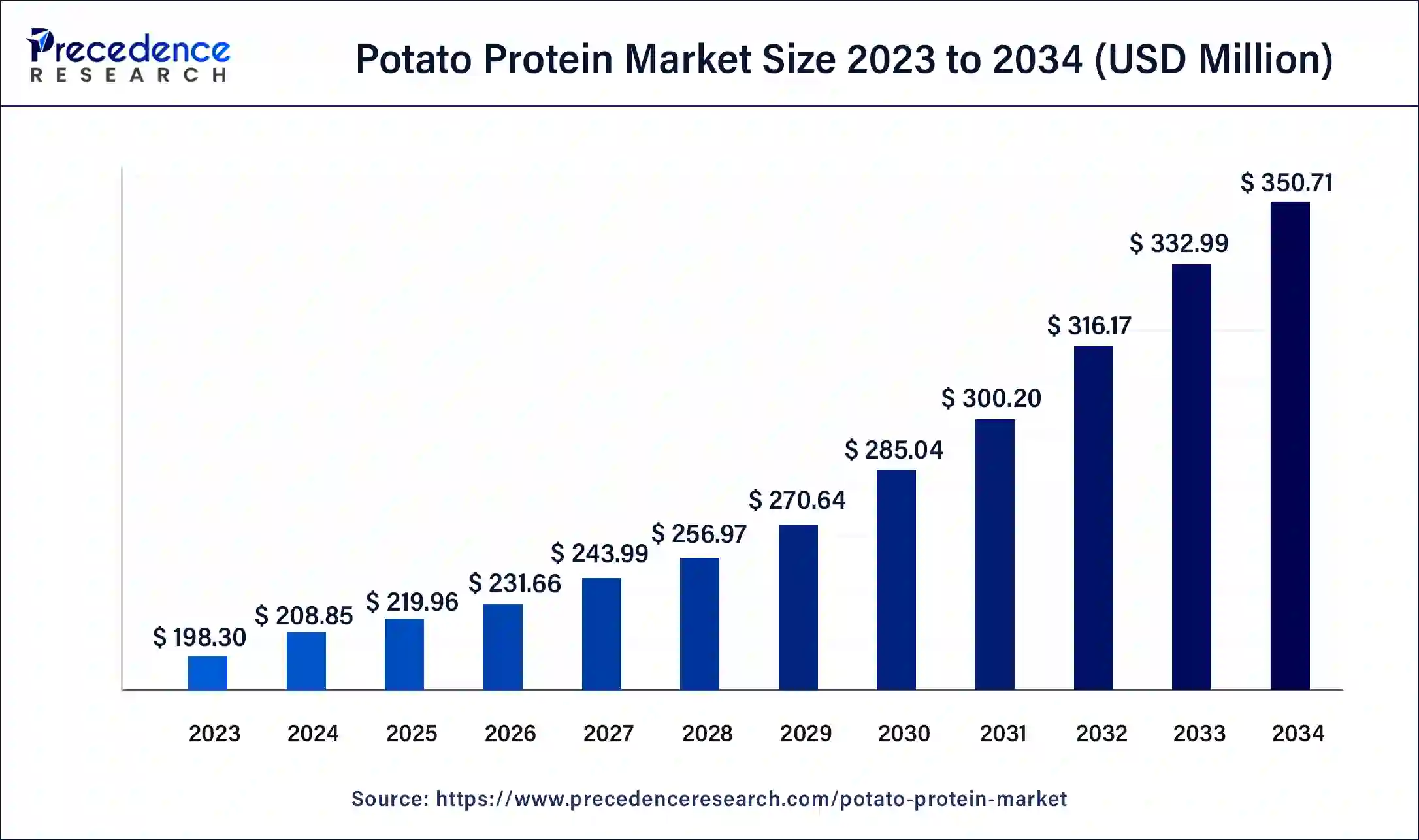

The global potato protein market size was USD 198.30 million in 2023, calculated at USD 208.85 million in 2024 and is expected to be worth around USD 350.71 million by 2034. The market is slated to expand at 5.32% CAGR from 2024 to 2034.

The global potato protein market size is expected to be worth USD 208.85 million in 2024 and is anticipated to reach around USD 350.71 million by 2034, growing at a CAGR of 5.32% over the forecast period 2024 to 2034.

Potato protein refers to protein extracted from the tuber and industrial potato waste products. There are several extraction techniques such as ion exchange and expanded bed absorption that help easily isolate and modify potato protein. In addition, hydrolyzing proteins into smaller peptide chains has been proven beneficial to enhance the proteins' functional abilities. Potatoes have high starch content, and several nutritionally beneficial proteins, fiber, vitamins and organic acids. Potato proteins are shown to be equally nutritious as soy and egg proteins.

Potatoes are a staple of many cultures and one of the most consumed food crops in the world after rice, wheat, and maize. Biotechnological innovations in potato proteins present a good opportunity for new businesses to create more soluble and stable formulations. Due to the widespread availability of protein, sophisticated extraction techniques will lead to widespread adoption. Potatoes are also the second largest protein-supplying crop per hectare. New research on potato proteins has helped develop new technologies to produce food-grade potato protein.

The potato protein market has seen growth in the past few years due to the rising popularity of plant-based and vegan protein alternatives. The number of people switching to a vegan diet has grown substantially in the last decade. Research into potato protein is still nascent, with potato protein still seeing limited integration into broad food product formulations. There is also limited knowledge about potato storage proteins in the food industry. These factors serve as a challenge for growth in the market.

How Artificial Intelligence is Transforming the Potato Protein Market?

Artificial intelligence is transforming the potato protein market with innovations in protein structure prediction and de novo protein design. AI tools, such as AlphaFold2, RoseTTAFold, and ESMFold, help with accurate protein modeling. There have also been several breakthroughs in protein-aggregation mechanisms, the pathogenesis of protein misfolding, and disease. In the study of the synthesis of potato proteins, deep learning-based protein design tools are helping characterize the chemical and biological properties of patterns, the major potato storage proteins. Artificial intelligence is also being used to undertake more efficient potato production, leading to the early identification of diseases in the potato leaf.

| Report Coverage | Details |

| Market Size by 2034 | USD 350.71 Million |

| Market Size in 2023 | USD 198.30 Million |

| Market Size in 2024 | USD 208.85 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising number of people identifying as vegan and switching to plant-based protein diets

A shift towards more environmentally and health-conscious food consumption among the world’s population is driving demand for plant-based proteins and diets. Consumer awareness around the negative influence of livestock rearing on global greenhouse gas emissions and meat on human health is spurring individuals to look for vegan and plant-based protein options. Thus, a rising demand for plant-based protein alternatives is spurring growth in the potato protein market.

Limited awareness of potato proteins and few stable extraction techniques

Demand for potato protein is restricted by limited knowledge about potato storage proteins, hindering their widespread adoption in the food industry. Potatoes have a low protein concentration compared to other plant-based sources. Potatoes contain a mere 1.5% protein concentration, requiring a large quantity for protein ingredient production. Processing methods to remove certain compounds without affecting protein functionality and stability also significantly increase the cost of production. With current extraction processes, the acid and thermal treatments cause protein denaturation. Thus limiting the growth of the potato protein market.

Developments in the production process

Potatoes are one of the most widely produced primary crops in the world. Developing scalable protein extraction will lead to widespread adoption in baking, confectionery, and processed meat and dairy products. Further research and development investments will lead to the development of effective methods of protein isolation and, eventually, commercial production of the potato protein market products. New research has shown that using processes such as precipitation with (NH4)2SO4, FeCl3, or ethanol instead of acid and thermal treatments results in higher yields and purity and reduced sensitivity to pH and temperature changes. Biotechnology research into improving protein content in potatoes can further improve the efficiency of extraction processes.

The isolates segment dominated the global potato protein market in 2023. Protein isolates are a refined form of protein containing a greater amount of protein with high digestibility. Protein isolates are widely produced from deoiled cakes of legumes such as peanuts, soybeans, potatoes, etc. Isolates can be incorporated into various food products as food ingredients. Some techniques of potato protein isolate production, such as FeCl3 precipitation, result in the highest purification factor and isolates with the lowest relative proportion of high MW proteins (<4.6%).

The concentrates segment is expected to see notable growth in the potato protein market during the forecast period between 2024 and 2033. Potato protein concentrates are made by precipitating the proteins with a combined acidic heat treatment (thermal coagulation) of the potato fruit juice. Potato protein concentrates have low levels of cholesterol and lactose but high amounts of proteins. Concentrates are widely used in functional foods, such as cereals and yogurt. The unique nutritional properties of potato protein concentrates are set to drive demand in the market segment.

The food & beverages segment made up the largest share of the potato protein market in 2023. Potato protein derivatives are increasingly seen as a replacement for high-quality animal proteins such as whey protein isolate, egg white and egg yolk in meat and meat substitutes, dairy-free cheese, confectionery products, ice cream, and dressings. Certain potato proteins have foaming properties that make them a potential replacement for egg whites.

The feed segment is expected to see notable growth in the potato protein market during the forecast period between 2024 and 2033. For instance, in horses’ potato protein concentrate is seen as beneficial for muscle growth and future exertion. Diets containing potato protein were reported to sustain the performance of weanling animals. Potato protein reportedly benefits young horses during early training and athletic horses during training and competition periods. It also benefitted convalescent horses with a loss of muscle or older horses with difficulties eating and digesting proteins. Potato protein is also suitable for high-grade animal feed applications in piglets and calves, poultry, and pets.

Asia Pacific held the largest share of the potato protein market in 2023, the region is seen to sustain the position during the forecast period. Increasing awareness about protein supplements and the presence of a growing vegan population in the region are likely to boost demand. The abundant supply of raw material with availability of suitable environment for all relative process of forming potato protein create a significant potential for Asia Pacific to sustain its dominance in the upcoming years. Along with this, strong consumer base and presence of major manufacturers promote the growth of the market in several Asian countries.

According to data from the Food and Agriculture Organization of the United Nations, China was the largest producer, accounting for 25.5% of world production, followed by India at 15.0%.

Europe is observed to grow at a notable rate in the potato protein market during the forecast period. Potatoes are a staple of many European cuisines. Increasing awareness around plant-based protein substitutes and the presence of prominent firms in the space are all factors of growth. The presence of notable potato protein production businesses, such as Royal Avebe (based in the Netherlands) in the region and the growing research and development spending are reasons for Europe’s dominance in the market. In 2020, Germany was the largest producer of potatoes in the EU at 11.7 million tons, making up 21.2 % of the European production.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

December 2024

February 2025