November 2024

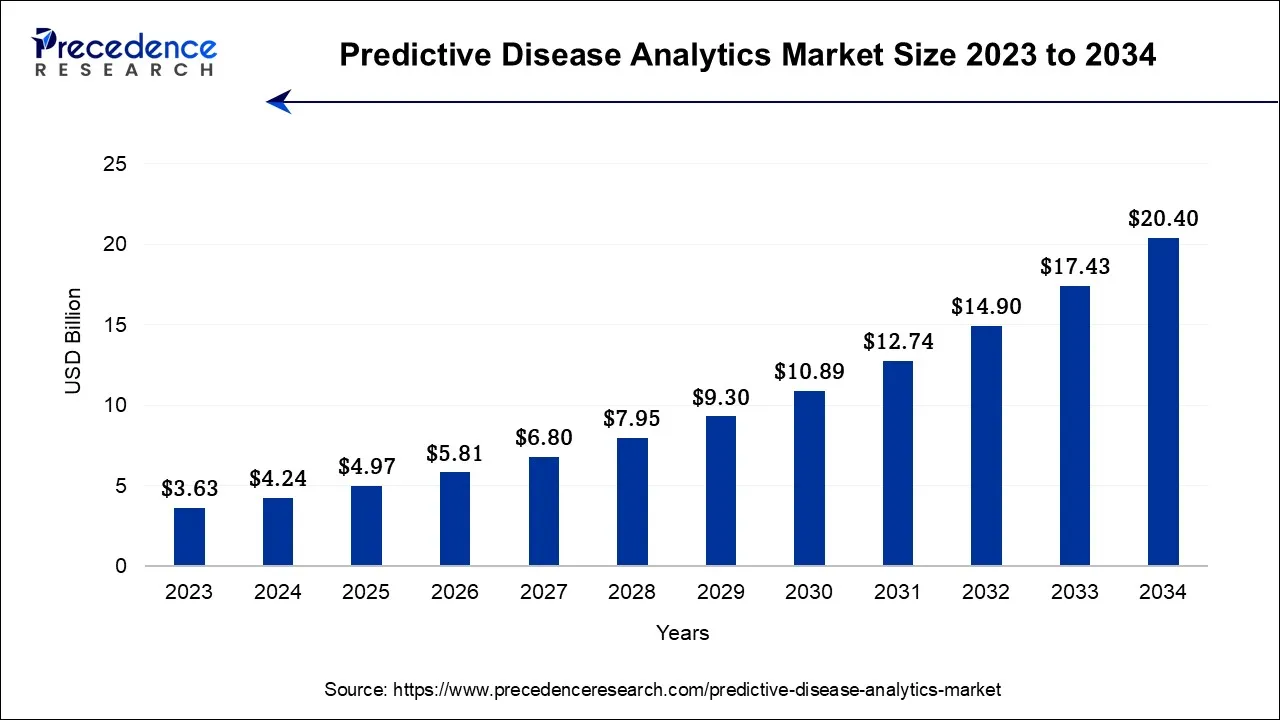

The global predictive disease analytics market size is calculated at USD 4.24 billion in 2024, grew to USD 4.97 billion in 2025, and is predicted to hit around USD 20.40 billion by 2034, poised to grow at a CAGR of 17.01% between 2024 and 2034. The North America predictive disease analytics market size accounted for USD 1.95 billion in 2024 and is anticipated to grow at the fastest CAGR of 17.14% during the forecast year.

The global predictive disease analytics market size is expected to be valued at USD 4.24 billion in 2024 and is anticipated to reach around USD 20.40 billion by 2034, expanding at a CAGR of 17.01% over the forecast period from 2024 to 2034.

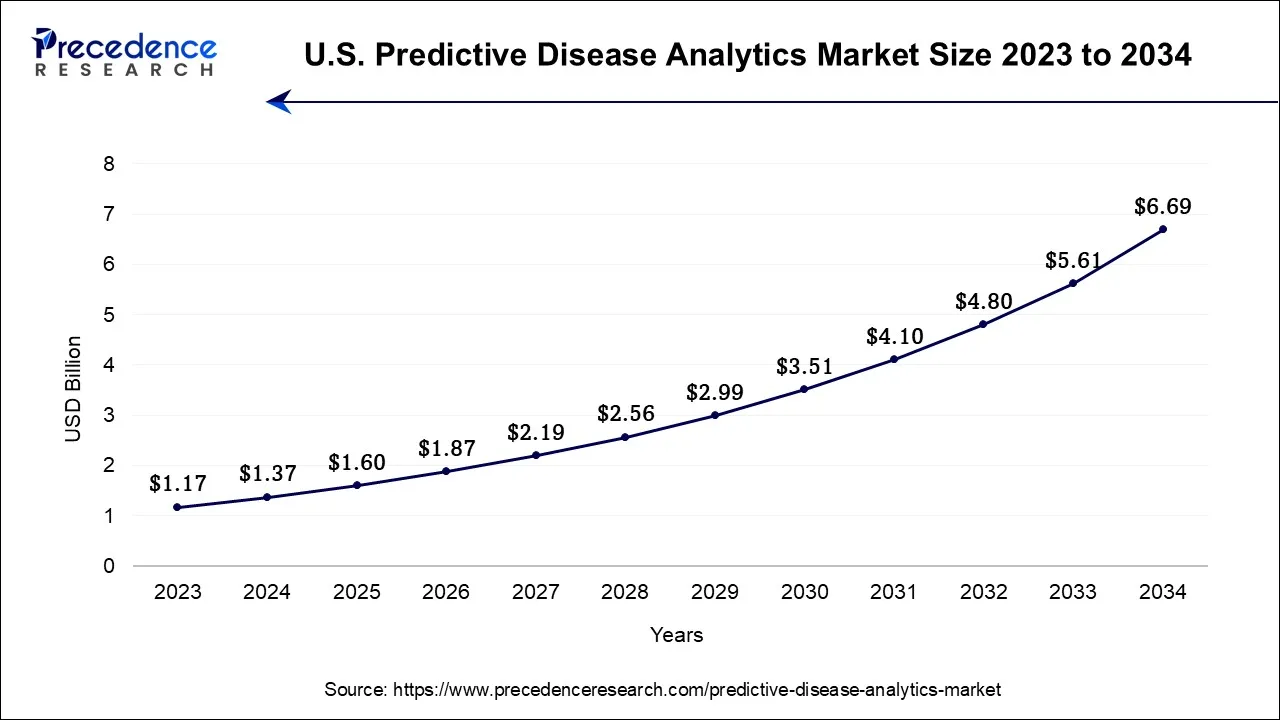

The U.S. predictive disease analytics market size is accounted for USD 1.37 billion in 2024 and is projected to be worth around USD 6.69 billion by 2034, poised to grow at a CAGR of 17.22% from 2024 to 2034.

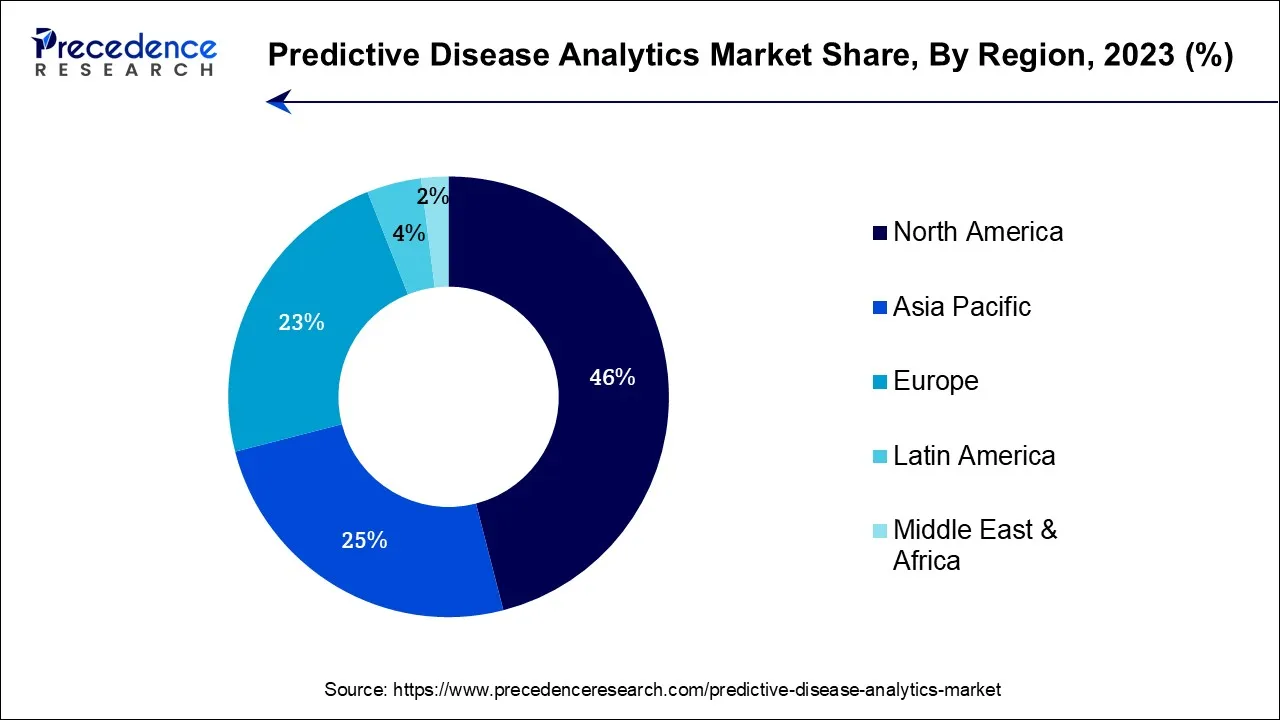

North America has held the largest revenue share 46% in 2023. In North America, the predictive disease analytics market is marked by several prominent trends. The region has witnessed a growing emphasis on personalized medicine, with predictive analytics playing a pivotal role in tailoring treatment plans based on individual patient data. Additionally, the COVID-19 pandemic accelerated the adoption of telemedicine and remote patient monitoring, further boosting the relevance of predictive analytics in continuous patient care. The robust healthcare infrastructure and a strong focus on data-driven healthcare decision-making have positioned North America as a significant driver of innovation and adoption in the predictive disease analytics sector.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the predictive disease analytics industry is experiencing noteworthy trends. The increasing adoption of digital healthcare solutions and data analytics is driving the demand for predictive disease analytics. Governments and healthcare providers are leveraging these tools to address the region's diverse healthcare challenges. Moreover, the growing prevalence of chronic diseases, coupled with an aging population, has spurred interest in predictive analytics for early disease detection and personalized treatment plans. As healthcare infrastructure continues to evolve in countries like India and China, the Asia-Pacific region represents a promising frontier for the expansion of predictive disease analytics applications and services.

The predictive disease analytics market is characterized by the application of advanced data analytics and predictive modeling techniques in healthcare. It involves the analysis of vast healthcare datasets to forecast and prevent the onset of diseases, optimize treatment strategies, and enhance patient outcomes.

By leveraging data from electronic health records, medical imaging, genomics, and patient histories, predictive disease analytics aims to provide healthcare providers and organizations with valuable insights for early disease detection, personalized treatment plans, and efficient resource allocation, ultimately improving the overall quality of patient care while reducing healthcare costs.

The predictive disease analytics market is at the forefront of healthcare innovation, leveraging advanced data analytics and predictive modeling techniques to revolutionize disease management. It involves the systematic analysis of extensive healthcare data sources, including electronic health records, genomics, and medical imaging, to anticipate disease onset, optimize treatment strategies, and improve patient outcomes. This market's dynamic landscape is shaped by various trends, drivers, challenges, and opportunities, reflecting its critical role in enhancing healthcare delivery.

Healthcare providers increasingly rely on predictive analytics to optimize clinical workflows, allocate resources efficiently, and enhance patient care. The shift towards personalized medicine is another prominent trend, with predictive disease analytics enabling the tailoring of treatment plans to individual patient profiles based on genetics and medical history. Early disease detection is a key driver, allowing timely interventions and preventive measures. Additionally, the rise of telemedicine and remote patient monitoring, accelerated by the COVID-19 pandemic, has boosted the adoption of predictive disease analytics, enabling continuous patient monitoring and timely interventions.

Despite its promise, the Predictive Disease Analytics Market faces challenges. Data privacy and security concerns arise from handling sensitive healthcare data, necessitating a balance between data access for predictive analytics and patient data protection. Interoperability issues hinder the seamless flow of information required for effective predictive analytics. Meeting stringent regulatory requirements, such as HIPAA in the United States, can be complex and resource-intensive, affecting the implementation of predictive analytics solutions.

There are several promising business opportunities within this market. Developing predictive disease analytics tools for healthcare providers and insurers to create preventive healthcare programs can lead to improved patient outcomes and reduced healthcare costs. Collaborative research efforts between healthcare institutions, research organizations, and tech companies can drive innovation in predictive analytics, resulting in more accurate and effective disease prediction models. Investing in remote monitoring platforms that incorporate predictive analytics can enable healthcare providers to offer continuous care to patients outside traditional clinical settings.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 17.01% |

| Market Size in 2024 | USD 4.24 Billion |

| Market Size by 2034 | USD 20.40 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Year | 2024 to 2034 |

| Forecast Period | North America |

| Segments Covered | By Component, By Deployment, and By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancements in AI and machine learning are instrumental in surging market demand for predictive disease analytics. These technologies enhance the accuracy and efficiency of predictive models, enabling healthcare providers to harness vast datasets for early disease detection, treatment optimization, and resource allocation. AI and machine learning empower predictive analytics to deliver more precise insights, driving better patient outcomes and cost savings. As healthcare increasingly embraces data-driven strategies, the demand for these advanced technologies continues to grow, making them vital drivers of market expansion in the predictive disease analytics sector.

Moreover, Early disease detection significantly drives market demand for predictive disease analytics. By identifying high-risk individuals and enabling timely interventions, predictive analytics enhances healthcare providers' ability to prevent, manage, and treat diseases effectively. This proactive approach not only improves patient outcomes but also reduces treatment costs and resource utilization. Consequently, there is a growing emphasis on predictive analytics solutions that can aid in early diagnosis, attracting substantial demand from healthcare providers and organizations aiming to enhance patient care and reduce healthcare expenditures.

Interoperability issues pose a significant restraint on the predictive disease analytics market. The fragmentation of healthcare data across various systems and formats hinders the seamless exchange of information required for effective predictive analytics. This lack of data interoperability results in incomplete or inaccurate patient profiles, reducing the accuracy and reliability of predictive models. Healthcare providers and organizations struggle to integrate diverse data sources, impeding the adoption of predictive analytics solutions. Addressing interoperability challenges is crucial to unlock the full potential of predictive disease analytics and meet the growing demand for data-driven healthcare solutions.

Moreover, Regulatory compliance, while essential, can also pose restraints on the predictive disease analytics market. Adhering to strict healthcare regulations, such as HIPAA and GDPR, requires substantial investments in data security, privacy measures, and legal compliance. These efforts can lead to increased operational costs for businesses. Additionally, navigating complex regulatory frameworks can slow down product development and market entry. The need to meet rigorous compliance standards can be a barrier for some smaller players, limiting market competitiveness and potentially hindering the broader adoption of predictive disease analytics solutions.

Enhanced patient outcomes play a pivotal role in surging the market demand for predictive disease analytics. By accurately identifying at-risk individuals and enabling timely interventions, predictive analytics contributes to improved patient health and well-being. Patients experience better treatment outcomes, reduced disease progression, and enhanced overall quality of life. This positive impact fosters trust in predictive analytics solutions, driving their adoption among healthcare providers and organizations seeking to prioritize patient-centric care and ultimately fueling market demand for these transformative technologies.

Moreover, Data-driven decision-making is a powerful driver of market demand in the predictive disease analytics sector. Healthcare providers increasingly rely on data-driven insights to optimize clinical workflows, allocate resources efficiently, and enhance patient care. Predictive disease analytics empowers these providers to make informed decisions based on comprehensive patient data, enabling early disease detection, personalized treatment plans, and improved patient outcomes. As the healthcare industry continues to prioritize data-driven approaches, the demand for predictive disease analytics solutions that facilitate such decision-making grows, driving market expansion and adoption.

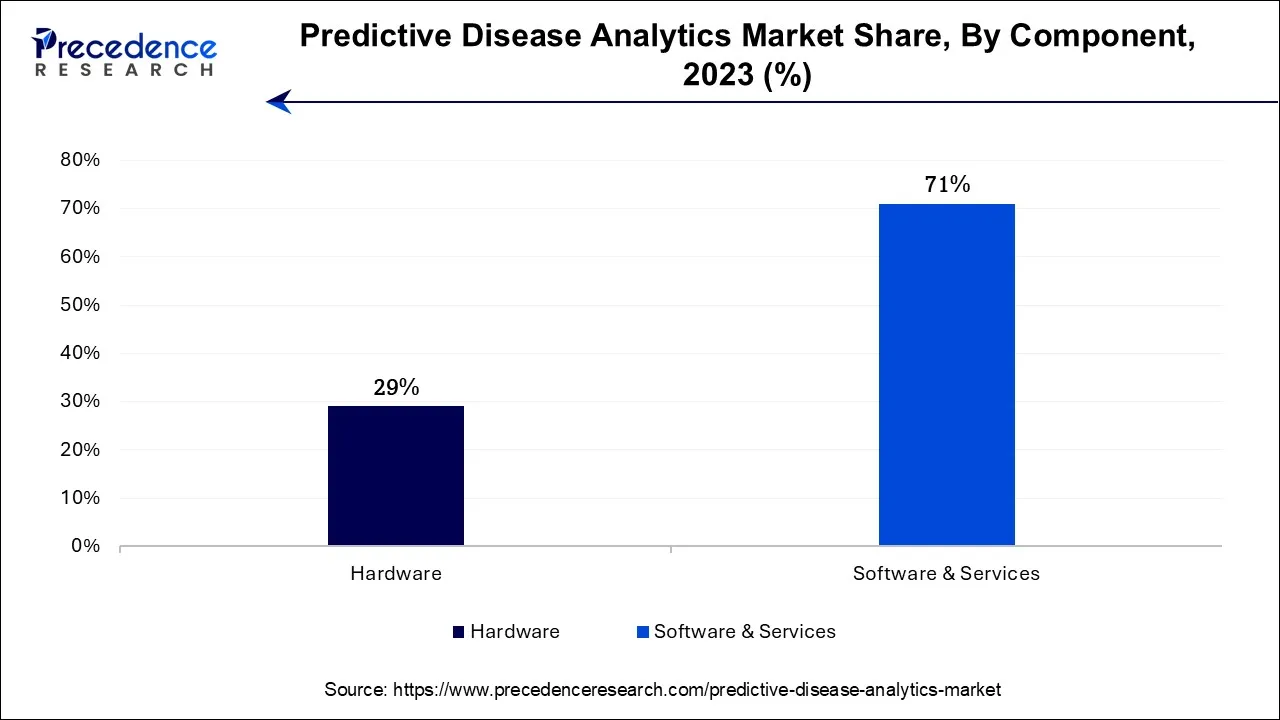

According to the component, the software and services segment has held 71% revenue share in 2023 and also expected to grow with a highest CAGR during the forecast period. In the predictive disease analytics market, software encompasses the technological platforms and applications used for data analysis, machine learning, and predictive modeling. These software solutions enable healthcare professionals to process extensive datasets and generate predictive insights, aiding in early disease detection and personalized treatment strategies. Complementing software, services encompass consulting, implementation, maintenance, and support provided by vendors and third-party providers.

These services assist healthcare organizations in effectively deploying predictive analytics tools, optimizing their use, and ensuring compliance with healthcare regulations. Recent trends include the growing adoption of cloud-based predictive analytics solutions for scalability, the integration of artificial intelligence and machine learning algorithms within software platforms for enhanced accuracy, and a rising demand for consulting and ongoing support services to create customized predictive models and ensure long-term sustainability.

Based on the deployment, On-premise segment is anticipated to hold the largest market share of 68.1% in 2023. On-premise deployment in the predictive disease analytics market refers to the installation and operation of predictive analytics solutions within an organization's own infrastructure, typically within its data centers or servers. This approach offers greater control over data security and customization but requires significant upfront investment and ongoing maintenance. Despite the growing popularity of cloud-based solutions, on-premises deployment still holds relevance in the predictive disease analytics market.

Organizations with stringent data privacy regulations, such as healthcare providers and government agencies, prefer on-premises solutions to maintain control over sensitive patient data. Additionally, hybrid deployment models, combining on-premises and cloud-based capabilities, are emerging as a strategic choice to balance control, scalability, and cost-effectiveness in predictive disease analytics implementations.

On the other hand, the Cloud-Based Segment is projected to grow at the fastest rate over the projected period. Cloud-based predictive disease analytics refers to the deployment of predictive analytics solutions on cloud computing platforms. These platforms provide scalable, cost-effective, and accessible infrastructure for processing vast healthcare datasets and running complex predictive models.

Trends in the cloud-based predictive disease analytics market include a growing preference for cloud deployment due to its flexibility and scalability. It enables real-time data analysis, facilitates collaborative research, and supports remote access, making it increasingly vital for healthcare organizations seeking agile and efficient predictive analytics solutions. The cloud also empowers machine learning and AI-driven models, enhancing predictive accuracy and healthcare decision-making.

In 2023, the payer segment had the highest market share of 42.8% on the basis of the end user. Healthcare payers refer to insurance companies or organizations responsible for covering the cost of medical services for their beneficiaries. In the predictive disease analytics market, healthcare payers utilize predictive analytics to assess and manage risks among their insured populations. This includes identifying high-risk individuals for proactive interventions, optimizing claims processing, and enhancing fraud detection. Recent trends in healthcare payers' use of predictive disease analytics include the implementation of personalized preventive care programs for policyholders, which can lead to reduced claims costs. Additionally, payers are investing in advanced data analytics to improve the accuracy of risk assessment models and enhance their overall decision-making processes. These trends aim to improve patient outcomes while controlling healthcare expenditures.

The provider is anticipated to expand at the fastest rate over the projected period. Healthcare payers refer to insurance companies or organizations responsible for covering the cost of medical services for their beneficiaries. In the predictive disease analytics market, healthcare payers utilize predictive analytics to assess and manage risks among their insured populations. This includes identifying high-risk individuals for proactive interventions, optimizing claims processing, and enhancing fraud detection. Recent trends in healthcare payers' use of predictive disease analytics include the implementation of personalized preventive care programs for policyholders, which can lead to reduced claims costs. Additionally, payers are investing in advanced data analytics to improve the accuracy of risk assessment models and enhance their overall decision-making processes. These trends aim to improve patient outcomes while controlling healthcare expenditures.

Segments Covered in the Report

By Component

By Deployment

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2024

January 2025

July 2024