July 2024

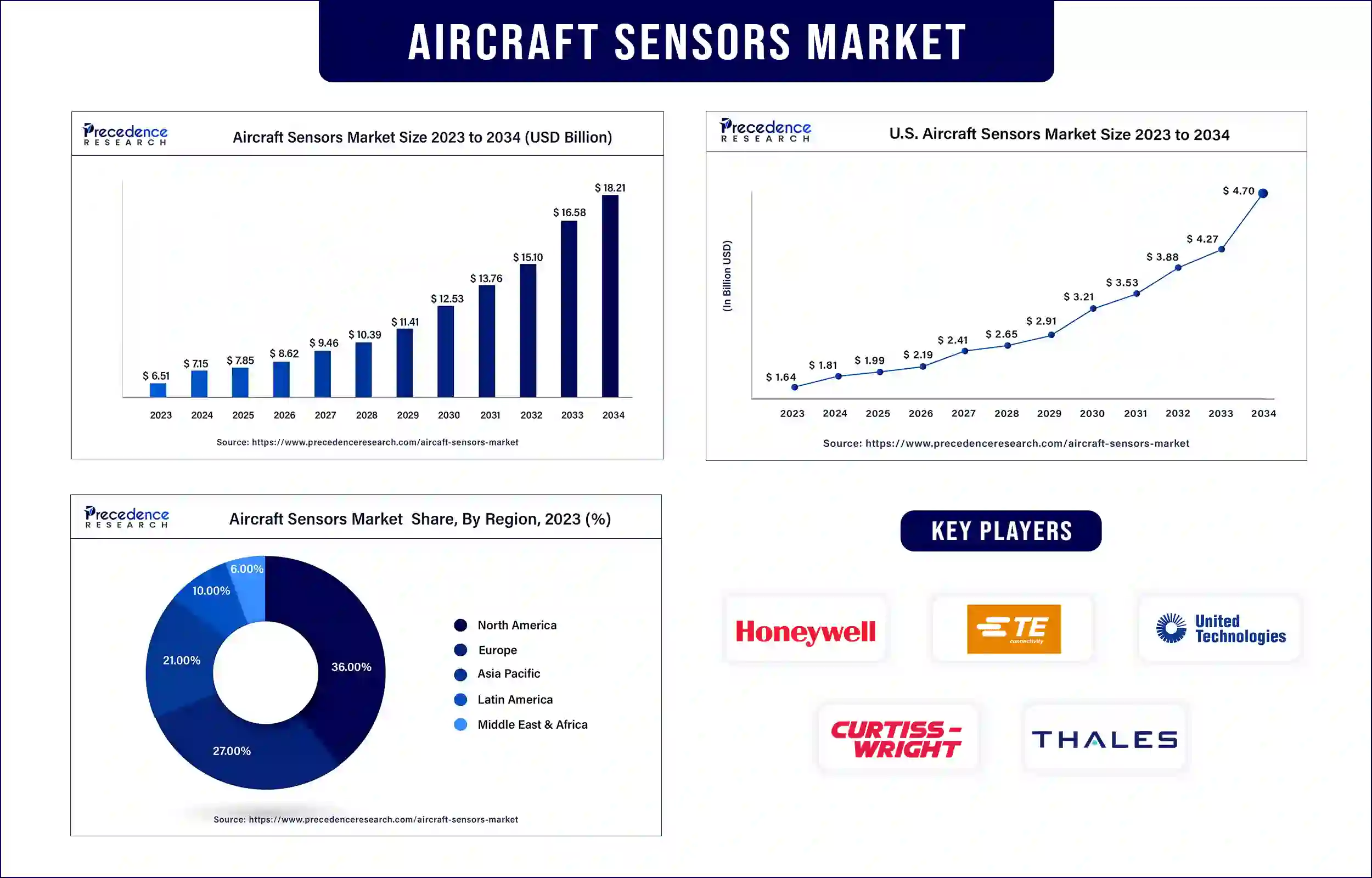

The global aircraft sensors market revenue was valued at USD 6.51 billion in 2023 and is poised to grow from USD 7.15 billion in 2024 to USD 18.21 billion by 2034, at a CAGR of 9.8% during the forecast period 2024 – 2034. The increasing need for adopting advanced sensing services to ensure the safety of the aircraft and efficient operations of aircraft systems has contributed to propelling market growth.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3044

The aircraft sensors market deals with structural, flight control systems, engine, navigation, and environmental sensors. Aircraft sensors are devices installed in aircraft to collect data about the environment, internal systems, and surroundings of an aircraft. The increasing demand for more electrical aircraft systems, increasing air traffic, increasing cases of aircraft accidents, and increasing need for electrical systems to replace traditional systems on aircraft are expected to drive the growth of the aircraft sensors market.

In addition, the growing demand for UAV sensors, the growing investment of aircraft OEMs in connected aircraft, the increasing demand for new aircraft globally, the rising demand for technologically advanced aircraft to replace aging fleets, and the increasing adoption of wireless sensors for commercial and military purposes are further anticipated to accelerate the market growth during the forecast period.

Enhance safety and many other advantages drive the market growth

Aircraft sensors enhance safety by offering real-time system health, environmental conditions, and flight parameters. Aircraft sensors such as IMUs and GPS enable reliable and more accurate flight positioning and navigation. Aircraft sensors play an important role in optimizing and monitoring the performance of aircraft systems in areas such as aerodynamics, fuel consumption, and engines. By monitoring the performance of aircraft systems and compounds, aircraft sensors can detect initial signs of anomalies.

In addition, aircraft sensors offer important data for situational awareness, such as identifying potential threats, detection of terrain or obstacles and weather conditions, etc., which assist and guide decision-making. Aerospace sensors are available from several manufacturers at affordable prices for various applications in the aviation industry. Aerospace sensors are necessary to collect reliable and accurate data, which is essential for efficient and safe flight operations. These factors are expected to drive the growth of the aircraft sensors market.

However, regulations by aviation safety agencies may restraint the market growth

The aviation industry follows stringent regulations and rules related to the use of electronic compounds in the utilization of the aviation industry. Manufacturers are required to follow certain rules related to design and safety concerns. In addition, integrating old data systems with modern technology takes effort and time and may divert a company from its main business operations due to the lack of adequate analytical capabilities.

It is challenging to adopt contemporary and traditional aircraft equipment, and it takes significant technical and financial effort. New devices can have several protocols that make them challenging to adopt. Thus, these driving factors are expected to restrain the growth of the aircraft sensors market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 7.15 Billion |

| Market Revenue by 2034 | USD 18.21 Billion |

| Market CAGR | 9.8% from 2024 to 2034 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Innovation in the Aircraft Sensors Market by Honeywell

Recent Innovation in the Aircraft Sensors Market by Quantum Space

North America is expected to grow at the fastest rate in the coming period. The increasing number of sensor manufacturers, the presence of important aircraft, and the rise in air travel are expected to drive the growth of the market in the region. North America also manufactures and designs a rapid number of various aircraft platforms. These factors contribute to the highest growth in North America. The U.S. and Canada are the leading countries in the region. The U.S. is a rapidly growing country and has a major hub for aircraft manufacturing, with various industries producing military, commercial, and general aviation aircraft. In the U.S., there are various major aircraft sensor manufacturers such as TE Connectivity, General Electric, Honeywell, and many others.

Furthermore, the increasing continuous advancements in sensor technology are expected to lead to the development of more efficient, reliable, and accurate sensors. Enhanced data processing capabilities, improved sensor materials, and miniaturization contribute to the integration of sensors in several aircraft systems. Thus, these factors are anticipated to drive the growth of the aircraft sensors market in North America.

Asia Pacific held a considerable share of the market in 2023. The region's rapid economic development has led to retrofitting existing aircraft with advanced sensor technologies, increasing the demand for new aircraft and increasing air levels. In addition, a growing defense budget in various countries is contributing to the required cutting-edge sensors for enhanced safety and performance and the growth of military aviation.

China, India, Japan, and South Korea are the major leading countries in the region. China holds the most significant share in the aircraft industry, contributes to technological advancements, and enhances air travel in flight services across the region. Also, the increasing demand for aircraft deliveries drives the demand for aircraft sensors in China. These are the major factors expected to drive the growth of the aircraft sensors market in the Asia Pacific region.

Internet of Things (IoT) in the aircraft sensors

Internet of Things (IoT) technology has revolutionized the aircraft industry by enabling airlines to optimize and monitor various systems, such as in-flight entertainment systems, fuel tanks, navigation systems, and aircraft engines. IoT sensors can detect significant problems with aircraft systems before they reduce downtime, become severe, and enhance safety. In addition, Internet of Things (IoT) aircraft sensors collect data on passenger preferences and behavior, elevate customer satisfaction, and enable airlines to personalize the in-flight experience. Thus, these factors are expected to enhance the growth and demand for the aircraft sensors market in the coming future.

Market Segmentation

By Aircraft Type

By Sensor Type

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3044

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

July 2024

January 2024

April 2024

July 2024