April 2025

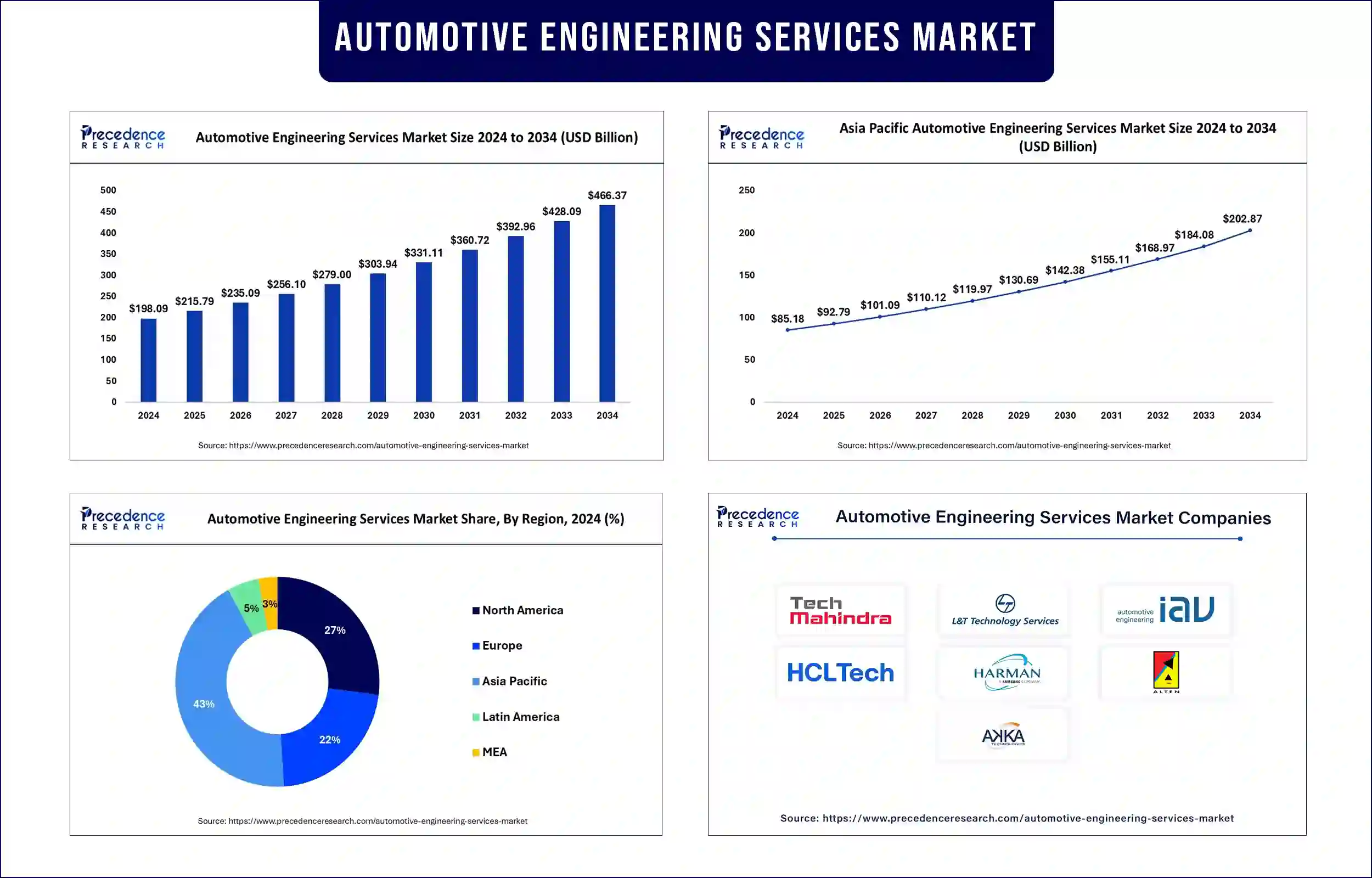

The global automotive engineering services market revenue surpassed USD 215.79 billion in 2025 and is predicted to attain around USD 428.09 billion by 2033, growing at a CAGR of 8.94%. The market is driven by rapid growth due to advances in electric vehicles, autonomous driving cars, and the ongoing demand for new and innovative connected and sustainable mobility solutions.

Automotive engineering services are solutions focused on improving vehicle design, manufacture, and performance of vehicles. It plays a fundamental role in the manufacture and processing of vehicle components that require the highest levels of quality for mechanical, electrical, and software systems. Automotive engineering services also cover upgrades to engines, transmissions, chassis, and components that will enhance vehicle performance and functionality.

The increase in consumer demand for vehicle customization and personalization is prompting automakers to invest more in engineering services. The automotive engineering services market is also growing due to the demand for advanced ways of connectivity, such as navigation systems, connected vehicle systems, and advanced safety features. In addition, government initiatives supporting green vehicle technologies, such as electric vehicles and sustainable manufacturing, are driving the market.

R&D Investment in the Automotive Industry

Research and development (R&D) investments in the automotive industry are driving market growth through increased product innovation. Investment is also made to reduce development costs while addressing extreme government regulations, which expand the automotive engineering services market.

Developments in Autonomous Vehicles

Advanced automotive engineering services are necessary to strengthen autonomous vehicles' sensing capabilities to manage and interpret their environment. As automated driving occurs more widely, it is anticipated that the confluence of driverless vehicles will reduce accidents and street congestion due to human error.

Increased Digitization and Electrification

The automobile industry is also turning to automotive engineering services for the digitization and electrification of vehicles. Additionally, features such as advanced driving assistance systems (ADAS) and enhanced safety systems integrate ESPs are developing vehicles.

Asia Pacific holds a significant market share, as the sector generated the largest revenue in 2024. The region benefits from a highly developed automotive manufacturing base driven by increasing consumer demand for electric vehicles (EVs) and many technological advancements. Countries in the region, such as China, Japan, and India, are investing heavily in research and development.

China is the largest automotive manufacturer globally; it is also a leader in EV manufacturing. More funding and investments in electric vehicles and sustainable transportation have been witnessed across China. Moreover, regular support of the R&D process to fuel innovation with a focus on smart manufacturing has positioned China as the leading destination for automotive engineering service providers both at the multinational and domestic levels.

North America is expected to register the highest growth in the world automotive engineering services market. The region has a high weighting of innovation, with significant levels of investment in electric and autonomous vehicle technologies. The advanced R&D infrastructure and the emerging trend of connected cars and intelligent mobility solutions complement the overall growth of the market.

The U.S. projects significant growth in the automotive engineering services market. This growth will primarily be fuelled by new automotive technologies and growing pressure from automotive companies to innovate. U.S. automotive companies are increasingly developing partnerships and collaborations with ESO providers to accelerate product development timelines, commercialize advanced technologies, and remain competitive in a rapidly growing global market.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 215.79 Billion |

| Market Revenue by 2033 | USD 428.09 Billion |

| CAGR | 8.94% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Markets | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Location

By Service

By Application

By Vehicle Type

By Nature

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1584

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

April 2025

January 2025

April 2025

January 2025