July 2024

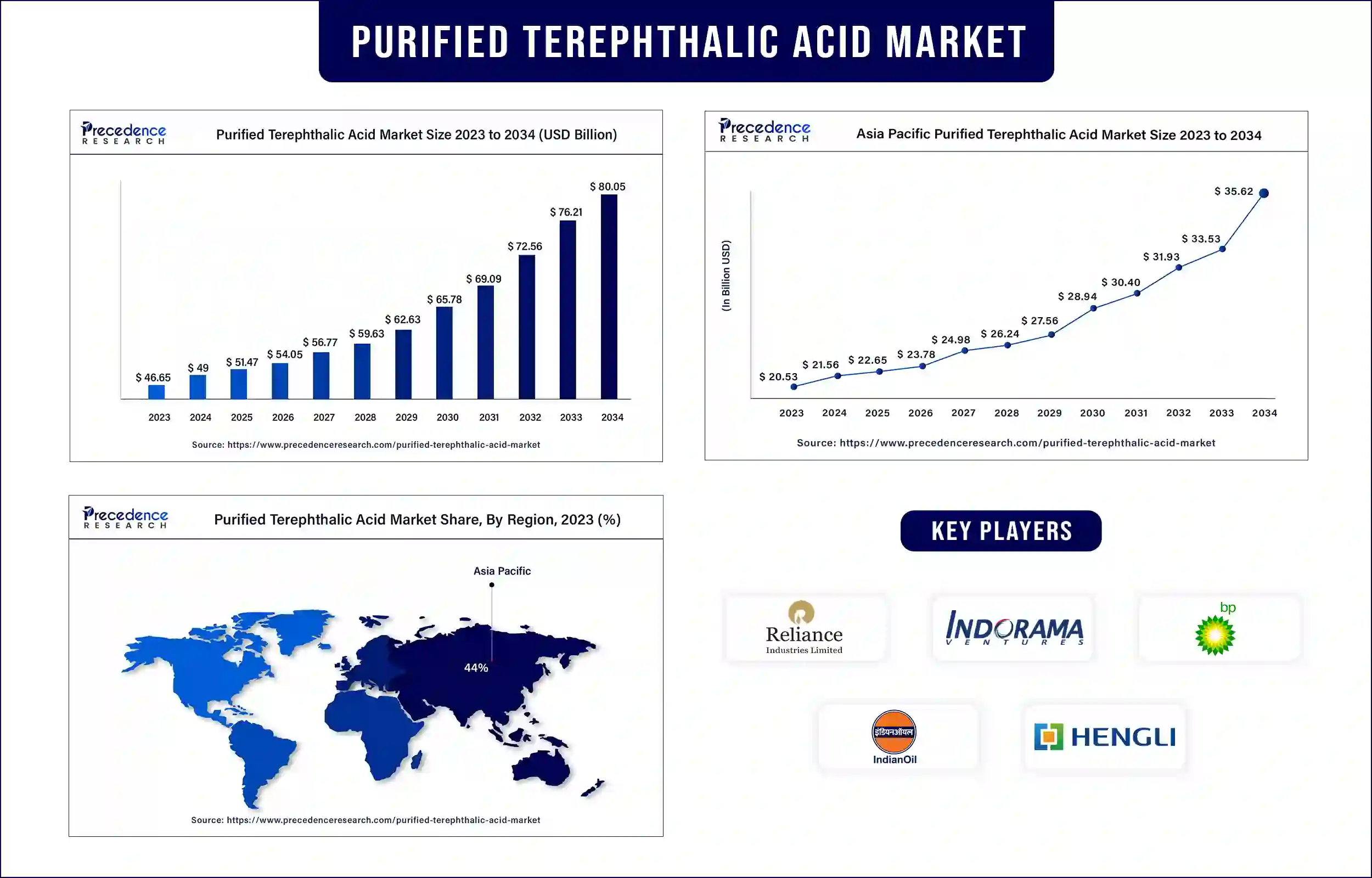

The global purified terephthalic acid market was exhibited at USD 46.65 billion in 2023 and is anticipated to touch around USD 76.21 billion by 2033, poised to grow at a CAGR of 5.03% during the forecast period. The increasing demand for recyclable and sustainable products and the rising demand for polyester fibers are increasing the demand for the purified terephthalic acid market.

Purified terephthalic acid (PTA) is an organic compound formed as a result of a chemical reaction between paraxylene and acetic acid. It appears as a highly inflammable and innoxious white crystalline powder with the chemical formula C6H4(CO2H)2, which is used to produce polyethylene terephthalate. It plays a crucial role in the textiles industry, packaging industry, and film industry with its wide range of applications. With the increasing demand of polyester fibers and PET bottles, textile and packaging industry have witnessed a rapid expansion. In addition, the purified terephthalic acid industry seems to have a bright future due to the ongoing developments in sustainability and recycling. Companies such as Reliance Industries, Indorama Ventures, and BP have been continuously contributing to the growth and expansion of this industry.

Increasing demand for polyester fibers: Polyester fibers have witnessed a significant growth in demand in industrial applications, automotive textiles, home furnishing, and upholstery fabrics due to their attributes such as durability, resilience, and high strength. The growing application of polyester fibers in these industries is expected to surge its consumption, thereby increasing the demand for purified terephthalic acid.

Rise in demand for recyclable and sustainable products: The growing concern for carbon footprint reduction has shifted the focus towards sustainability, resulting in a growing interest in bio-based purified terephthalic acid development. In addition, to reduce the dependency on raw materials, companies have begun focusing on breaking down PET into raw components for reuse. All these growing interests are driving the purified terephthalic acid market to a new level.

Stringent regulations: The growing environmental concerns across the globe have compelled the government to impose strict regulations. As a result, the majority of producers of purified terephthalic acid are adopting cleaner technologies to reduce emissions and achieve green certifications for PTA products.

Increasing demand from the bottling and packaging industry

Polyethylene terephthalate (PET) is widely used in the packaging industry, specifically for PET bottles and containers. In addition, polyethylene terephthalate has also found its application for the packaging of pharmaceuticals, skin care products, food, and beverages at a larger level, driving the purified terephthalate acid market.

However, paraxylene, obtained from crude oil, plays a crucial role in the production of purified terephthalic acid. A slight oscillation in the crude oil price due to any factor, such as natural hazards and geopolitical tension, may lead to a drastic increase in the paraxylene price. These factors sometimes lead to uncertainties, restraining the overall purified terephthalic acid market. For instance, In July 2024, ChemAnalyst, one of the world’s largest chemical and petrochemical market information provider companies, reported notable volatility in paraxylene prices in July 2024, indicating the complex dependency of prices on the global supply chain dynamics and economic uncertainties.

Recent Development by Hengli Petrochemical

| Company Name | Hengli Petrochemical |

| Headquarters | Suzhou, China, Asia Pacific |

| Recent Developments | In November 2023, Hengli Petrochemical, a leading factory and export base of rubber and plastics machinery in China, resumed the production of terephthalic acid at its facility located at Dalian in Liaoning Province. It aligns with the ongoing demand for PET and associated products. |

Recent Development by Indian Oil

| Company Name | Indian Oil |

| Headquarters | New Delhi, India, Asia Pacific |

| Recent Developments | In April 2023, Indian Oil, an Indian multinational petroleum refinery company, approved preliminary development work to proceed on a long-planned grassroots petrochemical complex to support the rising demand for plastics and textiles in India. |

North America is expected to expand fastest during the projected timeframe. The rising demand for PTA in the textile and packaging industry, as well as the rapid urbanization and industrialization, are considered to be the primary drivers of the purified terephthalic acid market in the North American region. The need for PTA to carry out various tasks has grown because of the automobile industry's growing development and the presence of multiple businesses, including Ford, Rivian, Cadillac, Tesla, and Chevrolet. This has fueled market expansion. Because of the highly expanded food and beverage industries in the U.S. and Canada, there is a greater need for PET-based packaging, which in turn propels market expansion. The market for purified terephthalic acid is anticipated to increase as a result of the growing demand for the product from the coatings and construction industries.

Asia-Pacific dominated the purified terephthalic acid market in 2023, with China being the largest producer and consumer of PTA. The market is expanding due to the expanding development of the chemical industry in nations like South Korea, Japan, China, India, and others. Additionally, the apparel industry has benefited from the increased need for polyester resins, which has positively changed the sector. The need for PTA has further risen because of the growing expansion of the electronics and electrical industries, particularly in China, Japan, and South Korea. Industrial growth is also being fueled by the increasing investments made by the governments of numerous nations in the development of the textile sector in this region. China’s extensive polyester manufacturing industry has made it a top global market leader, driving the demand for PTA. In addition, the increasing demand for the textile and packaging industry and the rapid expansion of production facilities for PTA are expected to keep India and China at the top of the purified terephthalic acid market.

Rising demand for recycling PET

Growing environmental concerns have shifted the consumer and regulator focus toward sustainability, surging the demand for recycled PET. As a result, producers have started experimenting with new ideas to develop and promote technologies that will improve the recycling process, which will further help in the production of high-quality recycled PET for textiles and other applications.

Growing Textile Industry

Notably, the textile industry's growing need for PTA is fueling the market's expansion. PET fibers are widely used in textile production because of their washability, durability, and rapid drying times. They may be used for a variety of purposes since they are resistant to moisture and strain. The quality of synthetic fabrics and textiles is ensured, and these qualities are enhanced by the use of textile chemicals and production procedures. PET is utilized in several items, including conveyor belts, car tire yarns, seat belts, and disposable medical clothing. The textile industry has grown quickly as a result of rising disposable income and consumer spending.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 49 Billion |

| Market Revenue by 2033 | USD 76.21 Billion |

| CAGR | 5.03% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Application

By End-User Industry

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4828

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

July 2024

January 2024

April 2024

July 2024