November 2024

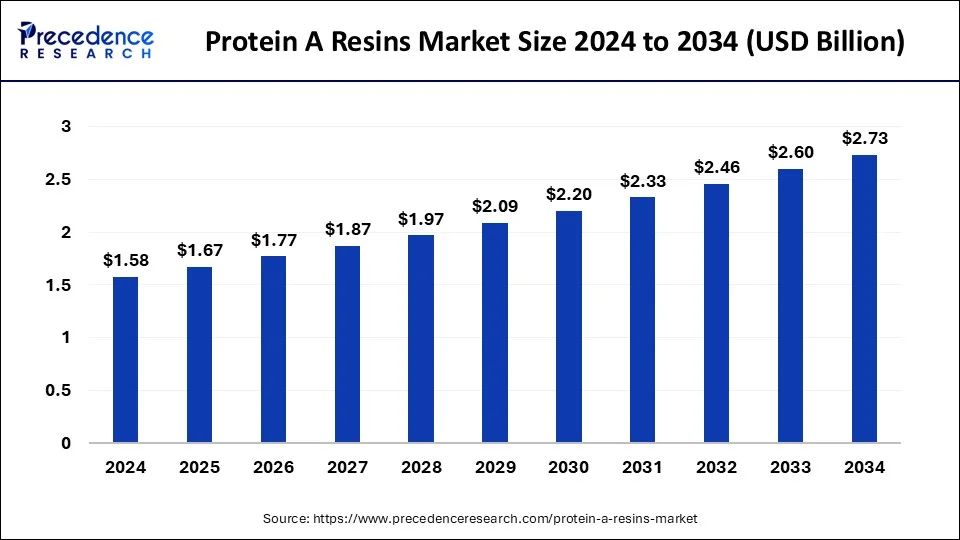

The global market size is calculated at USD 1.67 billion in 2025 and is forecasted to reach around USD 2.73 billion by 2034, accelerating at a CAGR of 5.62% from 2025 to 2034. The North America market size surpassed USD 660 million in 2024 and is expanding at a CAGR of 5.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global protein A resins market size was estimated at USD 1.58 billion in 2024 and is predicted to increase from USD 1.67 billion in 2025 to approximately USD 2.73 billion by 2034, expanding at a CAGR of 5.62% from 2025 to 2034. The increasing demand for protein A resins for drug development in the pharmaceutical industry is driving the growth of the protein a resins market.

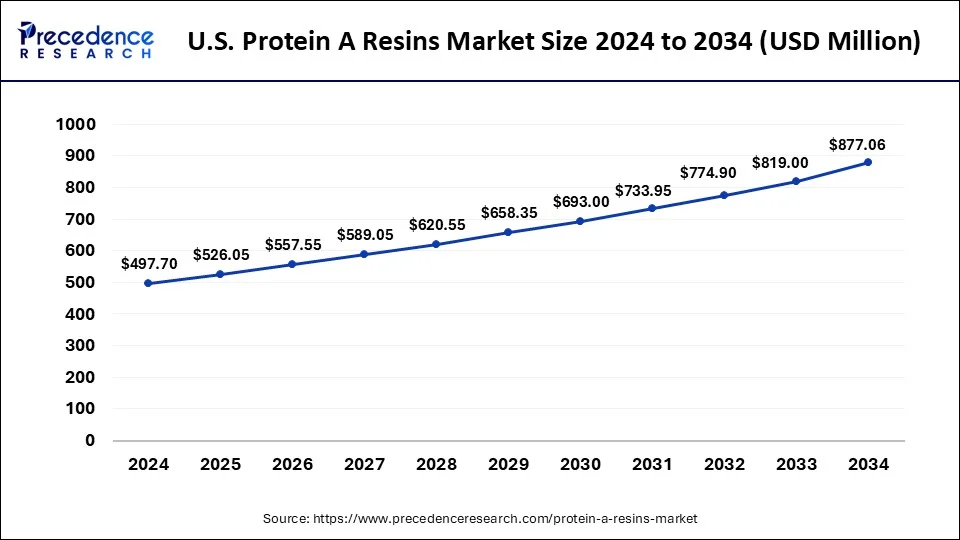

The U.S. protein A resins market was estimated at USD 497.70 million in 2024 and is predicted to be worth around USD 877.06 million by 2034, at a CAGR of 5.83% from 2025 to 2034.

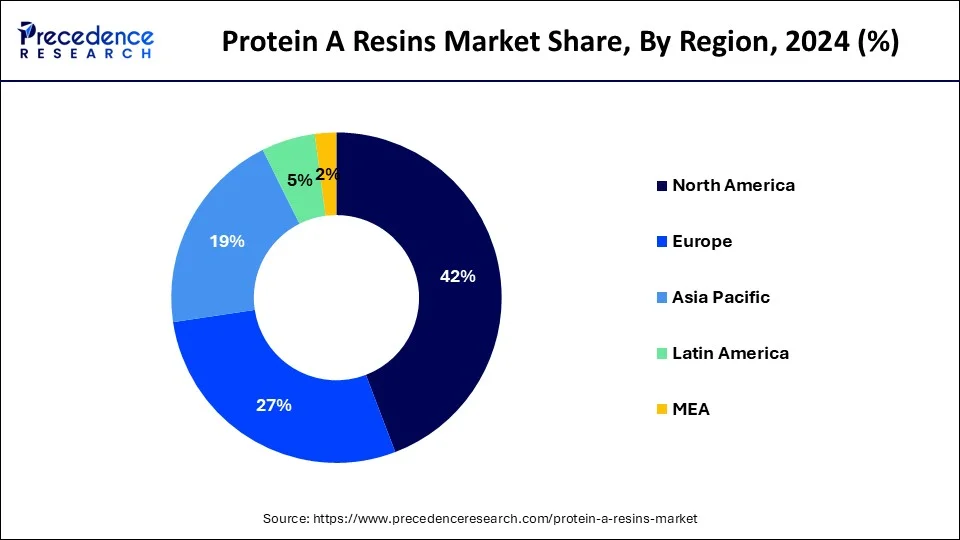

North America led the protein A resins market with the largest market share in 2024. The growth of the market is attributed to the rising adoption of protein A resins in drug development and the treatment of the various types of diseases that drive the growth of the market. The rising presence of the major biopharmaceuticals and life science research centers is contributing to the expansion of the market. The rising cases of diseases such as autoimmune diseases are driving the expansion of the demand for effective treatment and will boost the growth of the protein A resins market across the region. The rising government interventions in the development of drug discovery and the pharmaceutical industry and the R&D in the developed economies for the development of life science and healthcare are contributing to the expansion of the market.

Asia Pacific is expected to witness the fastest growth in the protein A resins market during the forecast period. The growth of the market in the region is attributed to the expansion of the healthcare infrastructure and rapidly growing population that drives the demand for efficient healthcare infrastructure which contributes to the growth of the market. The rising investments in the development of biopharmaceuticals and life science research centers are driving the demand for the protein A resins market in the region.

The protein A resins market offers services associated with resins that are highly efficient chromatographic medium, used to purify monoclonal antibody products (mAbs) and immunoglobulin from a cell culture medium in a single process. Protein A chromatographic resin is essential to the purification process. It enables high purity levels while purifying therapeutic antibodies. Protein A resin is used in a variety of applications, including affinity chromatography, immunoprecipitation, biomanufacturing and bioprocessing. Because of its selectivity, resin is used as a common approach for capturing antibodies during purifying processes. Protein A resins have a high capacity and affinity. As a result, they are employed in the biopharmaceutical and life sciences industries to produce antibody products. Thus the rising demand for the protein A resin in the pharmaceutical industries is driving the growth of the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.58 Billion |

| Market Size in 2025 | USD 1.67 Billion |

| Market Size by 2034 | USD 2.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Product, Matrix Type, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding pharmaceutical industry

The expansion of the overall global pharmaceutical industry along with the rising prevalence of chronic diseases and the demand for effective treatment and drug discovery that driving the demand for the protein A resins market. The rising investments in synthetic biology and innovations in drug discovery in the biopharmaceutical industries are contributing to the growth of the market. The increasing use of chromatography in the discovery and development of drugs is further driving the expansion of the protein A resins market.

Higher cost

Protein A resins are much costlier than the other types of resins and no other resin can match the purification level of the protein A resins that makes it higher in cost. Protein A resins are often expensive due to the complex manufacturing processes involved and the high purity required. This cost can be a significant barrier, especially for small biotech companies or academic research labs with limited budgets. Thus, the higher cost limits the adoption of the protein A resin and restraining the growth of the protein A resins market. The production capacity for protein A resins may not be able to keep up with the growing demand, leading to shortages and increased prices. Manufacturers may struggle to scale up production due to technical challenges or regulatory constraints.

Opportunity

Rising chronic diseases

The increasing prevalence of chronic diseases such as cancer is driving the demand for monoclonal antibodies for treatment and diagnostics. Monoclonal antibodies are widely accepted in the treatment of various types of cancer that require a unique treatment type. The increasing use of monoclonal antibodies in the various types of therapeutics due to their specificity and flexibility and the demand for the protein A resin. Thus, the rising rate of cancer and other chronic diseases worldwide is driving the demand for protein A resins and opening lucrative opportunities for the expansion of the protein A resins market.

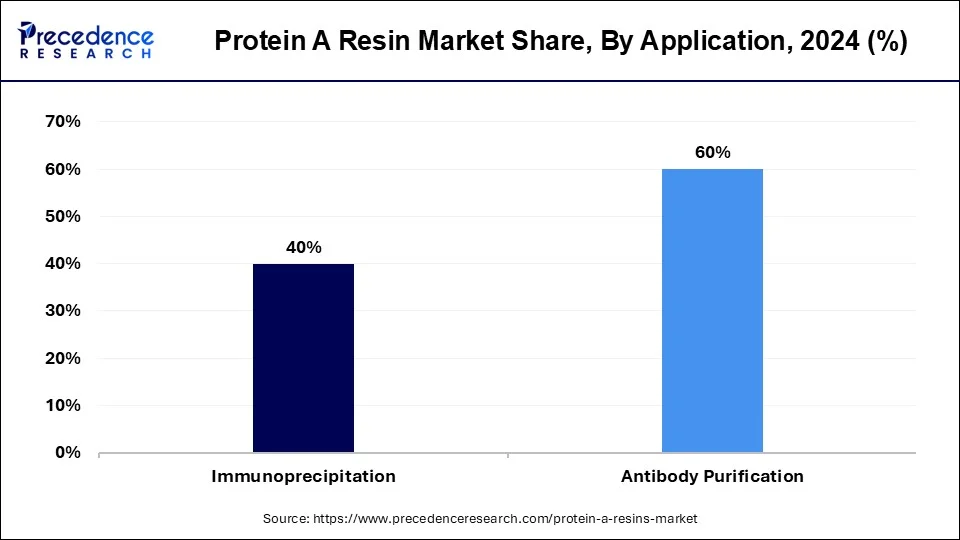

The antibody purification segment dominated the protein A resins market in 2024. The segment's growth is attributed to the rising demand for drug discovery and development, which is influencing the growth of the segment. Antibodies purification entails the selective enrichment or isolation of antibodies from ascites fluid, serum (polyclonal antibodies), or the cell culture supernatant of a hybridoma cell line (monoclonal antibodies).

The only method available for the purification of biomolecules according to their unique chemical structure or biological function is affinity chromatography. It is dependent upon the reversible interaction of a certain ligand with a protein. The basis for this is the high specificity and affinity of Protein A and Protein G for the Fc-region of lgC across various animals. An antibody can be eluted by decreasing pH, and its binding to the ligand is reversible.

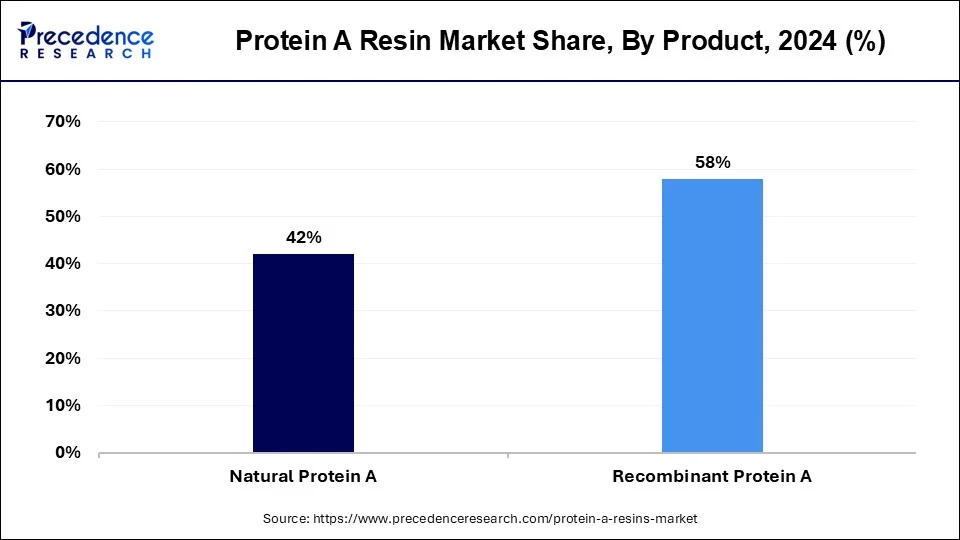

The recombinant protein A segment projected the highest market share in 2024. Recombinant protein purification technologies are significant in modern biotechnology because they allow unique proteins to be used in a variety of applications such as research, diagnostics, and therapies. Scientists may now generate proteins of interest in heterologous host systems such as bacteria, yeast, or mammalian cells thanks to advances in genetic engineering technology. Recombinant protein purification is the process of isolating and purifying synthesized proteins utilizing recombinant DNA technology.

It entails extracting the target protein of interest from a complicated combination of other cellular components and contaminants, such as host cell proteins, nucleic acids, and culture medium components. Recombinant protein purification aims to provide a highly pure, bioactive, and homogeneous protein sample suitable for further characterization, structural investigations, therapeutic uses, or other downstream processes.

The agarose-based matrix segment dominated the protein A resins market in 2024. Agarose resins, often known as agarose beads, are agarose-based matrix materials used in column chromatography. There are two varieties of agarose resins, plain agarose beads, using gravity techniques, they should not be used for high-pressure separation. Cross-linked beads have greater physical and chemical stability than normal agarose beads. Cross-linked beads are high-intensity agarose beads that have been reacted with a specific reagent to form more cross-linked polysaccharide chains, increasing the strength and stability of the matrix.

On the other hand, the organic polymer-based matrix segment is observed to grow at a notable rate during the forecast period. Organic polymer-based matrices are well-established in the biopharmaceutical industry and have a proven track record of regulatory compliance. Manufacturers can leverage the extensive documentation and regulatory support available for these materials to streamline the regulatory approval process for protein purification applications.

The biopharmaceutical companies segment dominated the market with significant growth in the market in 2024. The rising adoption of the protein A resins in the biopharmaceutical industry for the development of mAbs, drug discovery, vaccines, and therapeutics production process. The rising investments in biopharmaceutical and life science development drive the demand for protein A resins for drug discovery. Additionally, technological advancements in the pharmaceutical and biopharmaceutical industry are also expanding the growth of the market.

Regulatory bodies such as the FDA and EMA require biopharmaceutical companies to meet stringent quality and purity standards for their products. Protein A resins offer high specificity and purity in antibody purification processes, making them indispensable in complying with these regulations.

By Application

By Product

By Matrix Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

November 2024

August 2024