February 2025

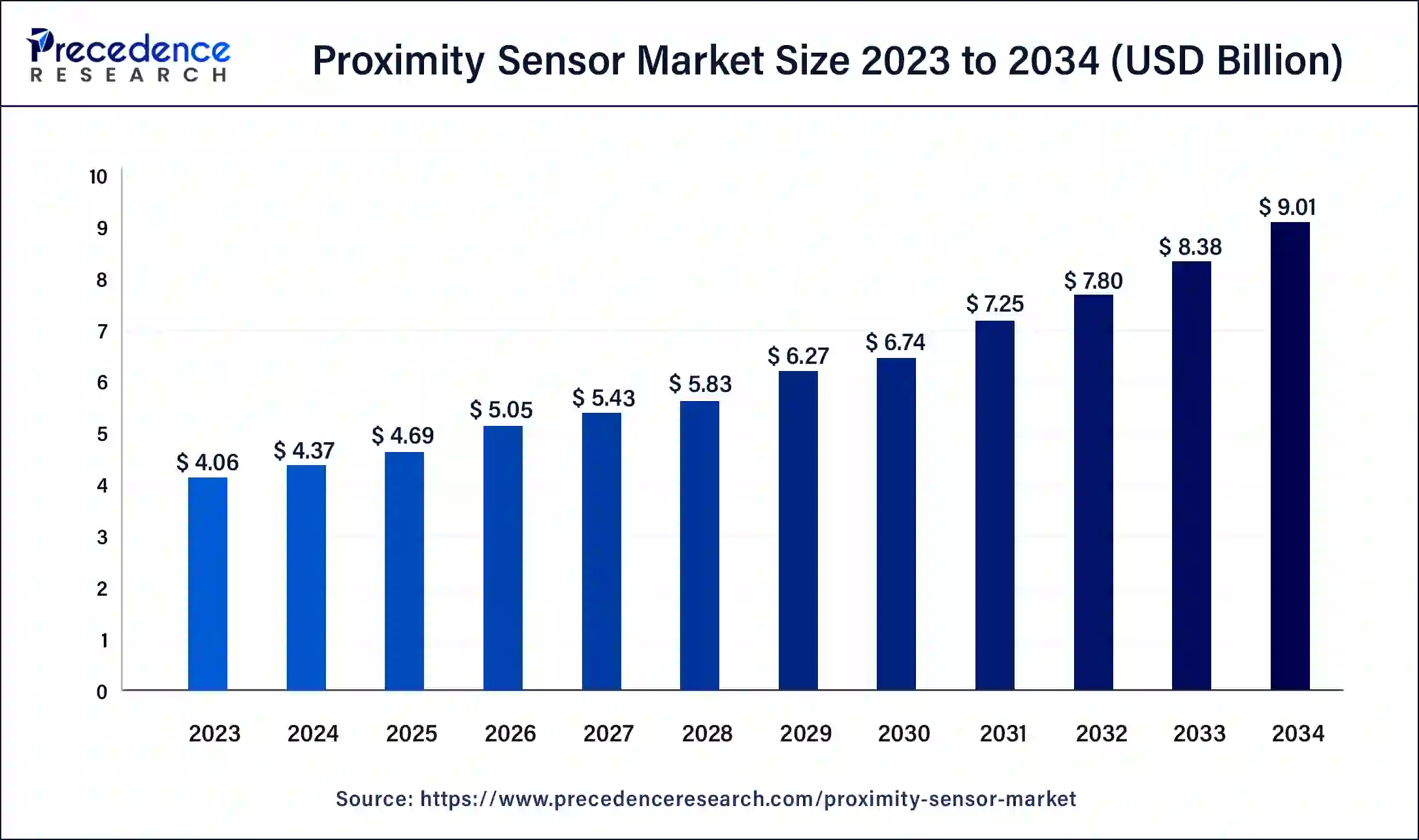

The global proximity sensor market size was USD 4.06 billion in 2023, estimated at USD 4.37 billion in 2024 and is expected to reach around USD 9.01 billion by 2034, expanding at a CAGR of 7.52% from 2024 to 2034.

The global proximity sensor market size is worth around USD 4.37 billion in 2024 and is anticipated to reach around USD 9.01 billion by 2034, growing at a solid CAGR of 7.52% over the forecast period 2024 to 2034. Rapid advancements in technology, such as the development of miniaturized sensors in the electronic industry, are projected to offer lucrative growth opportunities for the expansion of the proximity sensor market.

A proximity sensor is a sensor that can used to detect the presence or absence of objects without physical contact within a defined range. These sensors then convert the information regarding the presence or movement of an object into an electrical signal. As technological advancements continue to evolve globally, the proximity sensor market is gaining immense popularity across various industries.

There are several different types of proximity sensors, including inductive sensors, capacitive sensors, photoelectric, and magnetic sensors. A proximity sensor often uses light, sound, infrared radiation (IR), or electromagnetic fields to detect a target. It is also widely known as a proximity switch.

AI Integration in the proximity sensors

The rapid growth of the AI-powered sensor has been phenomenal and is gaining immense popularity across various sectors, including the proximity sensor market. AI-powered sensors are widely used in smartphones, wearables, tablets, smartwatches, and other consumer electronics, automotive, industrial sectors, and healthcare. AI-powered sensors play an indispensable role in Internet of Things (IoT) devices, enabling them to make prompt and intelligent decisions based on the data they collect. In today's fast-paced world, automotive technology continues to evolve robustly. The integration of artificial intelligence (AI) into proximity sensors holds immense promise for improving road safety and reducing the number of accidents. In recent years, the smartphone market has increasingly offered AI-driven proximity sensor market solutions.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.01 Billion |

| Market Size in 2024 | USD 4.06 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.52% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, End-user Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing emphasis on automation

The emphasis on automation is anticipated to drive the growth of the proximity sensor market during the forecast period. The increasing use of automation across various industries, including manufacturing, automotive, and healthcare, increases the demand for proximity sensors and represents the prime driver for the significant growth of the market. The emergence of the Internet of Things (IoT) plays a critical role as sensors become important for proximity-based interactions and object recognition. Proximity sensors are most widely used in manufacturing and industrial automation.

Proximity sensors can detect the presence or absence and position of objects on conveyor belts, which ensures the smooth production process and facilitates more safety if something unintended ends up on the conveyor belt. Proximity sensors also play an integral role in ensuring the quality and alignment of components in the assembly process. Moreover, firms are heavily investing in automation to reduce manufacturing costs, improve efficiency, and boost product quality. Such supportive factors are driving the growth of the proximity sensor market during the forecast period.

Limitations in sensing capabilities

Limitations in sensing capabilities are anticipated to hamper the market's growth. Proximity sensors often have limitations in sensing capabilities. Additionally, the easy availability of alternative sensors at a lower cost may restrict the expansion of the global proximity sensor market during the forecast period.

Growing demand for consumer electronics

The growing demand for consumer electronics around the world is projected to create a lucrative growth opportunity for the proximity sensor market during the forecast period. Proximity sensors are increasingly common in consumer electronics such as smartphones, tablets, smartwatches, laptops, smart home devices, cameras, and others, further aiding in industry expansion. Proximity sensors are extensively used in touchless interactions, including automatic screen dimming or disabling touch input on smartphones when it is closer to the face during a phone call. These sensors also play an integral role in energy-saving features by turning off the screen when the device is not in use. Thus, a rise in consumer electronics demand may spur the demand for proximity sensors in the coming years.

The inductive segment held the largest share of the proximity sensor market in 2023. Inductive proximity sensors use electromagnetic fields to detect metallic objects, including copper, iron, aluminum, brass, and others. When a metallic object enters the sensor’s range, it induces a current in the sensor, which in turn triggers a signal and makes them effective tools for detecting metallic objects. Inductive proximity sensors are used in various automation applications, including security-related applications, product counting, and sorting applications. These sensors are required to be installed carefully to ensure that their performance is not affected by the surrounding environment.

The ultrasonic segment is expected to grow at the fastest rate in the proximity sensor market during the forecast period. Ultrasonic sensors use high-frequency sound waves to detect objects and obstructions. Ultrasonic proximity sensors are widely used in applications that include obstacle detection and distance measurement. Thus driving the growth of the segment.

The automotive segment accounted for the dominating share of the proximity sensor market in 2023. Modern cars come with a variety of sensor devices. A proximity sensor in cars makes everything much simpler. Automobile proximity sensors can detect the presence of nearby objects without making any physical contact with them. These sensors detect and provide information to occupants about nearby items in and around the car. Electromagnetic and ultrasonic sensors are the two most widely used sensors in cars for assisting in parking and several other safety features. The range of their functions is gradually expanding significantly. Ultrasonic sensors are generally the parking sensors that inform when the car is getting too close to an object near the car. Sonar is used by ultrasonic sensors to determine how far away the car is from an object. Proximity sensors are extensively used in the automotive industry for several applications, including position detection, assembly line automation, welding, PaintShop, and others. The benefits offered by these proximity sensors include cost savings, improved efficiency, reduced labor requirements, and enhanced safety. Proximity sensors can also automatically unlock car doors when the driver is nearby. Car security systems also use these sensors to detect if someone is trying to break into or tamper with the car. Additionally, Autonomous driving has the potential to transform transportation. AD can create massive value for the automotive industry in the coming future.

The smart manufacturing segment is expected to witness significant growth in the proximity sensor market during the forecast period. Proximity sensors are often integrated into an extensive range of appliances in smart homes. These sensors can detect when a person has entered or exited a room in smart homes, allowing for lighting to be turned off or on. To enhance the home’s security, proximity sensors can also be placed around the windows or doors to detect whether they are closed or opened. They can also heat or cool to offer comfort and enhance energy.

Asia Pacific held the dominant share of the proximity sensor market in 2023 and is observed to witness prolific growth during the forecast period. The growth of the region is driven by the presence of prominent market leaders, increasing penetration of IoT across various sectors, the rapid progress of industrialization, increasing awareness of innovative technology, rising production of consumer electronics, the increasing popularity of Industry 4.0, ongoing research and development for the deployment of sensors, and supportive regulatory policies of the government. The digital transformation of industries enables real-time decision-making, boosts productivity, enhances flexibility, and revolutionizes manufacturing and supply chain processes, which increases the adoption of the proximity sensor. Several developing countries, including China, India, and Japan, are experiencing significant growth in industrial automation, which facilitates the rising use of proximity sensors in factory automation and safety devices.

North America is observed to expand at the fastest rate in the proximity sensor market during the forecast period. The market dominance in the region is attributed to the presence of tech-driven infrastructure, rising consumer inclination for smart homes, the rising emphasis on industrial automation, rising demand for consumer electronics, and rapid advancements in autonomous systems and automotive vehicles. In automotive, proximity sensors are widely used to detect the physical closeness of other vehicles and assist in parking. The rising use of sensing technology across various fields such as healthcare, automotive, aerospace, defense, and other industries for a variety of works, including data transmission, threat detection, and monitoring physical movements. In addition, the rising implementation of IoT and the adoption of Industry 4.0 are anticipated to spur the demand for proximity sensors. Furthermore, the strong presence of prominent market players and rapid advancements in sensor technologies are expected to fuel the market expansion in the region.

Segments Covered in the Report

By Technology

By End-user Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

November 2024

October 2024