August 2024

Rapid Microbiology Testing Market (By Product: Instruments, Reagents and Kits, Consumables; By Method: Growth-Based Rapid Microbiology Testing, Cellular component-Based Rapid Microbiology Testing, Nucleic Acid-Based Rapid Microbiology Testing, Viability-Based Rapid Microbiology Testing; By Applications) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

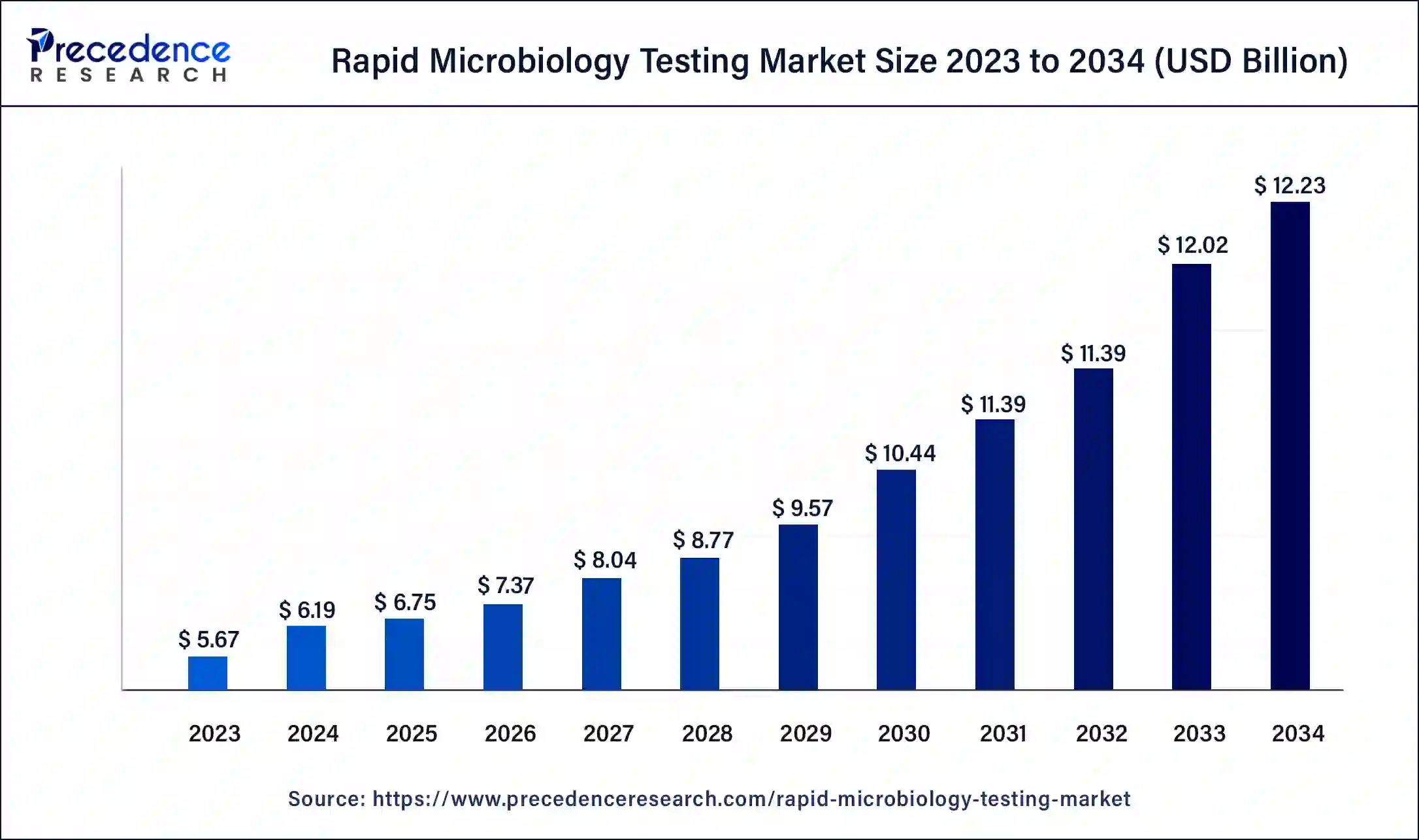

The global rapid microbiology testing market size was USD 5.67 billion in 2023, calculated at USD 6.19 billion in 2024 and is expected to reach around USD 12.23 billion by 2034, expanding at a CAGR of 7% from 2024 to 2034.

The rapid microbiology testing market is a dynamic sector focused on providing fast and accurate methods for detecting and analyzing microorganisms in various industries, including pharmaceuticals, food and beverage, healthcare, and environmental monitoring. This market has witnessed significant growth due to the increasing demand for quicker and more efficient microbiological testing solutions to ensure product safety and quality. Key technologies driving this market include PCR, immunoassays, microbial enumeration, and molecular diagnostics. Factors such as stringent regulatory requirements, the need for rapid results, and the rising awareness of infection control have propelled the expansion of this market, with promising opportunities for future growth.

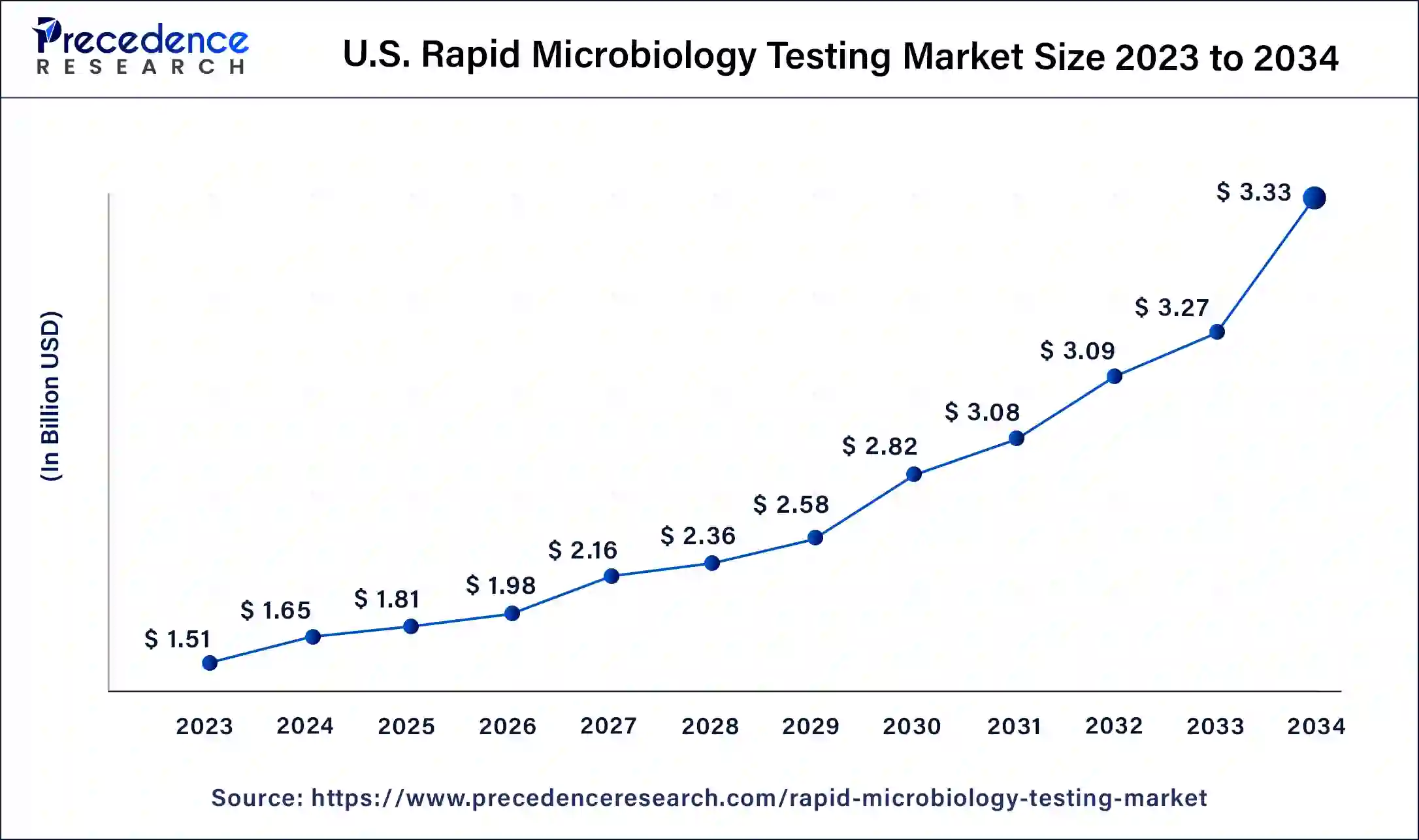

The U.S. rapid microbiology testing market size was valued at USD 1.51 billion in 2023 and is estimated to reach around USD 3.33 billion by 2034, growing at a CAGR of 7.25% from 2024 to 2034.

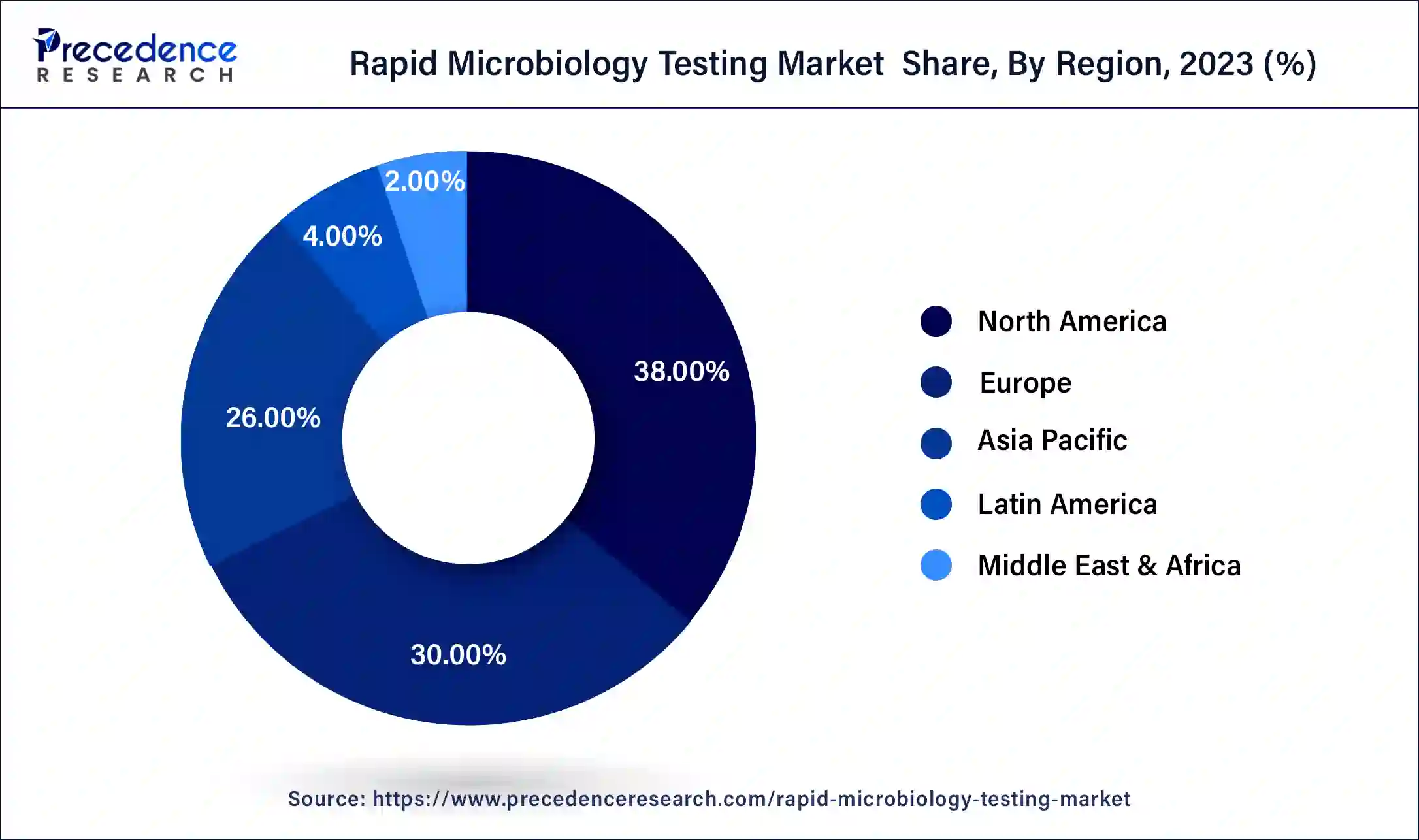

North America has held the largest revenue share 38% in 2023. North America dominates the rapid microbiology testing market due to several factors. The region's advanced healthcare infrastructure, stringent regulatory environment, and strong emphasis on food safety drive the demand for rapid microbiology testing. Additionally, the presence of major pharmaceutical and biotechnology companies, coupled with substantial R&D activities, spurs innovation in testing technologies.

Moreover, the region's responsiveness to emerging healthcare challenges, like the COVID-19 pandemic, has accelerated the adoption of rapid testing solutions. These factors, along with a well-established market ecosystem, position North America as a major player in the rapid microbiology testing market.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region holds significant growth in the rapid microbiology testing market due to several key factors. First, the region's substantial population and rapid urbanization have led to increased demand for food safety and healthcare, driving the adoption of rapid microbiology testing methods in these sectors. Second, the expanding pharmaceutical and biotechnology industries in countries like China and India require stringent microbiological quality control, further boosting the market. Lastly, government initiatives promoting technological advancements and healthcare infrastructure development contribute to the region's market dominance. These factors collectively position Asia-Pacific as a major growth leader in the rapid microbiology testing market.

The rapid microbiology testing market is a rapidly evolving sector dedicated to providing swift and reliable methods for the detection and analysis of microorganisms across diverse industries, including pharmaceuticals, food and beverages, healthcare, and environmental monitoring. This market has witnessed substantial expansion due to the escalating demand for more efficient microbiological testing solutions, ensuring product safety and quality. Key technologies like Polymerase Chain Reaction (PCR), immunoassays, microbial enumeration, and molecular diagnostics have played pivotal roles in driving this market.

One prominent trend in the rapid microbiology testing market is the continuous advancement of automation and robotics in testing processes. This automation not only enhances testing efficiency but also reduces the risk of human error. Additionally, the COVID-19 pandemic has underscored the importance of rapid and accurate microbiological testing, further catalyzing market growth. Increasing regulatory requirements and consumer demand for safe products are driving industries to adopt rapid microbiology testing methods to maintain compliance and build trust among their customers.

Despite its growth, the rapid microbiology testing market faces challenges related to the cost of implementing these advanced technologies, which can be prohibitive for smaller businesses. Moreover, ensuring the standardization and validation of rapid testing methods can be a complex and time-consuming process. Maintaining the accuracy and reliability of these methods also remains a challenge, as false negatives or positives can have significant consequences, especially in healthcare and food safety applications.

Amid these challenges, numerous opportunities abound in the rapid microbiology testing market. Companies that can develop cost-effective and easy-to-use testing solutions stand to gain a competitive edge. Expanding applications of rapid microbiology testing in emerging economies provide a vast untapped market for growth. Collaborations between technology providers, regulatory bodies, and industry players can help streamline validation processes and establish standardized protocols. Furthermore, continuous research and development efforts to improve the speed, sensitivity, and specificity of these tests will open doors to new business prospects.

In conclusion, the rapid microbiology testing market is driven by the imperative need for faster and more reliable microorganism detection methods across industries. While industry trends and growth drivers are propelling its expansion, challenges related to cost, validation, and accuracy persist. The market's future lies in capitalizing on emerging business opportunities, such as expanding into new geographic regions and developing innovative, cost-effective testing solutions to meet evolving industry demands.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.23 Billion |

| Market Size in 2023 | USD 5.67Billion |

| Market Size in 2024 | USD 6.19 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Method, Applications, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Consumer demand for safety

The burgeoning consumer insistence on safety is a pivotal force propelling the expansion of the rapid microbiology testing market. Modern consumers are exceptionally attuned to the safety and quality aspects of products they consume, spanning pharmaceuticals, foodstuffs, beverages, and healthcare services. This heightened consciousness translates into a heightened demand for uncompromising safety standards.

The significance of rapid microbiology testing in meeting these consumer expectations cannot be overstated. Consumers now expect the products they utilize to be devoid of hazardous microorganisms and pathogens, and they gravitate toward goods that have been subjected to exhaustive testing to guarantee their safety. Consequently, industries such as food and beverage and pharmaceuticals are increasingly embracing rapid microbiology testing approaches to address these exacting demands.

Furthermore, in today's age of instantaneous communication and social media, news regarding safety lapses or contamination can disseminate with astonishing speed, causing severe damage to brand reputation and financial setbacks. Rapid microbiology testing empowers companies to proactively supervise and uphold product safety, thereby elevating consumer confidence and loyalty. Consequently, the market for rapid microbiology testing thrives as enterprises discern the imperative of aligning with consumer safety preferences and regulatory prerequisites.

Validation and standardization

Validation and standardization represent significant restraints in the growth of the rapid microbiology testing market. Validation is a critical process to demonstrate that a testing method consistently produces reliable and accurate results. Achieving validation for rapid microbiology testing methods can be time-consuming, resource-intensive, and complex. This hurdle often deters companies from adopting these innovative approaches, especially in highly regulated industries like pharmaceuticals and healthcare. Standardization is equally challenging. Establishing universally accepted protocols and standards for rapid microbiology testing is an ongoing effort that involves collaboration between industry stakeholders and regulatory bodies.

The absence of standardized methods can lead to confusion and inconsistency in results, hindering wider adoption. Furthermore, regulatory compliance is contingent on validation and standardization. Companies must align their testing procedures with evolving regulatory requirements, adding another layer of complexity and uncertainty. In summary, the lack of streamlined validation and standardization processes can deter businesses from embracing rapid microbiology testing, limiting its growth potential and hampering its broader adoption in critical industries where safety and quality are paramount.

Pharmaceutical manufacturing

Pharmaceutical manufacturing is a catalyst for significant opportunities in the rapid microbiology testing market. The stringent regulatory requirements and the critical need for uncompromising product quality make rapid microbiology testing an essential component of pharmaceutical production. Opportunities abound in the development of advanced and specialized rapid testing solutions tailored to the pharmaceutical sector's unique demands, such as real-time monitoring of aseptic processes, microbial contamination control, and sterility testing.

Additionally, as pharmaceutical companies strive to expedite product development and time-to-market, rapid microbiology testing methods can streamline quality assurance processes, reducing production delays and costs. Collaborations between technology providers and pharmaceutical manufacturers are fostering innovation in this space, leading to the creation of more sophisticated and automated testing platforms. As the pharmaceutical industry continues to expand globally, the demand for robust and efficient rapid microbiology testing solutions is poised to grow, offering ample opportunities for market players to meet these evolving needs.

Impact of COVID-19

The COVID-19 pandemic has significantly impacted the rapid microbiology testing market. With the urgent need for widespread testing, particularly in healthcare settings, there has been a surge in demand for rapid testing solutions, such as PCR-based assays and point-of-care devices, to detect the virus. This has accelerated the development and adoption of rapid microbiology testing methods. However, disruptions in supply chains and regulatory challenges have also posed obstacles. Beyond the pandemic, the experience gained in deploying rapid testing has highlighted the importance of these technologies in healthcare and other industries, leading to continued growth and innovation in the rapid microbiology testing market.

The Instruments sector has held 43% revenue share in 2023. The Instruments segment holds a major share in the rapid microbiology testing market due to its pivotal role in facilitating accurate and efficient testing processes. Instruments encompass a wide range of technologically advanced devices, including PCR machines, automated microbial identification systems, and microscopes, which offer speed, precision, and scalability. These instruments streamline sample preparation, analysis, and data management, making them indispensable in industries like healthcare and pharmaceuticals.

As the demand for rapid, reliable testing grows, the Instruments segment continues to dominate, driven by ongoing technological advancements and the need for high-throughput testing capabilities.

The consumables segment is anticipated to expand at a significant CAGR of 11.7% during the projected period. The consumables segment holds a significant share in the rapid microbiology testing market primarily because of its recurrent usage and necessity in testing processes. Consumables like test kits, reagents, and culture media are essential components for each test conducted, ensuring the accuracy and reliability of results.

As microbiological testing is routinely performed across industries such as healthcare, pharmaceuticals, and food production, the demand for consumables remains consistently high. Additionally, advancements in consumable technologies, such as pre-filled cartridges and disposable testing components, have further boosted their adoption, contributing to the segment's dominant market position.

The growth-based rapid microbiology testing sector had the highest market share of 40.2% in 2023 based on the method. The growth-based rapid microbiology testing segment holds a major share in the rapid microbiology testing market due to its established history and reliability. Growth-based methods, such as microbial culture and colony counting, have been the industry standard for decades. They offer a well-understood and trusted approach for detecting and quantifying microorganisms. While newer technologies like molecular diagnostics have gained traction, growth-based methods remain essential in various industries, including pharmaceuticals, food, and healthcare, as they provide vital data for quality control and compliance. Their proven track record and regulatory acceptance contribute to their continued dominance in the market.

The viability-based rapid microbiology testing is anticipated to expand at the fastest rate over the projected period. Viability-Based rapid microbiology testing holds a significant growth in the market due to its fundamental role in assessing microbial viability, which is critical in ensuring product safety and quality across various industries. This segment utilizes advanced techniques like ATP bioluminescence and impedance to provide rapid, real-time data on microorganism viability.

It enables swift decision-making, allowing for timely interventions when contamination is detected, reducing production downtime, and enhancing overall efficiency. Additionally, stringent regulatory requirements in industries like pharmaceuticals and food safety mandate viability assessment, further driving the demand for this segment's solutions and consolidating its market dominance growth.

The clinical disease diagnostics segment held the largest revenue share of 25% in 2023. The clinical disease diagnostics segment commands a substantial growth in the rapid microbiology testing market due to its pivotal role in diagnosing infectious diseases. The segment's prominence is driven by the increasing global burden of diseases like COVID-19, which necessitates rapid and accurate diagnostic methods for timely treatment and containment.

Furthermore, heightened healthcare awareness and the demand for point-of-care testing in clinical settings have boosted the adoption of rapid microbiology testing. As a result, this segment continues to dominate the market, with significant investments in research and development to enhance diagnostic accuracy and speed.

The research applications segment is anticipated to grow at a significantly faster rate, registering a CAGR of 12.7 % over the predicted period. The Research Applications segment commands significant growth in the rapid microbiology testing market due to its widespread use in various scientific research disciplines. Researchers heavily rely on rapid microbiology testing methods to expedite their studies and experiments, allowing for quicker analysis of microbial populations, facilitating drug discovery, and enhancing biotechnology research. These methods provide researchers with precise and timely results, enabling them to make informed decisions promptly.

Additionally, the continuous advancements in research technologies and the pursuit of scientific innovation contribute to the sustained dominance growth of the Research Applications segment in the market.

Segments Covered in the Report

By Product

By Method

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

February 2025

January 2025