February 2025

Recombinant Antibodies Market (By Type: Chimeric Antibody, Full Human Antibody, Humanized Antibody, Single Chain Antibody, Bispecific Antibody; By Application: Pharmaceutical & Biotechnology, Hospitals & Diagnostic Laboratories, Research Institutes, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

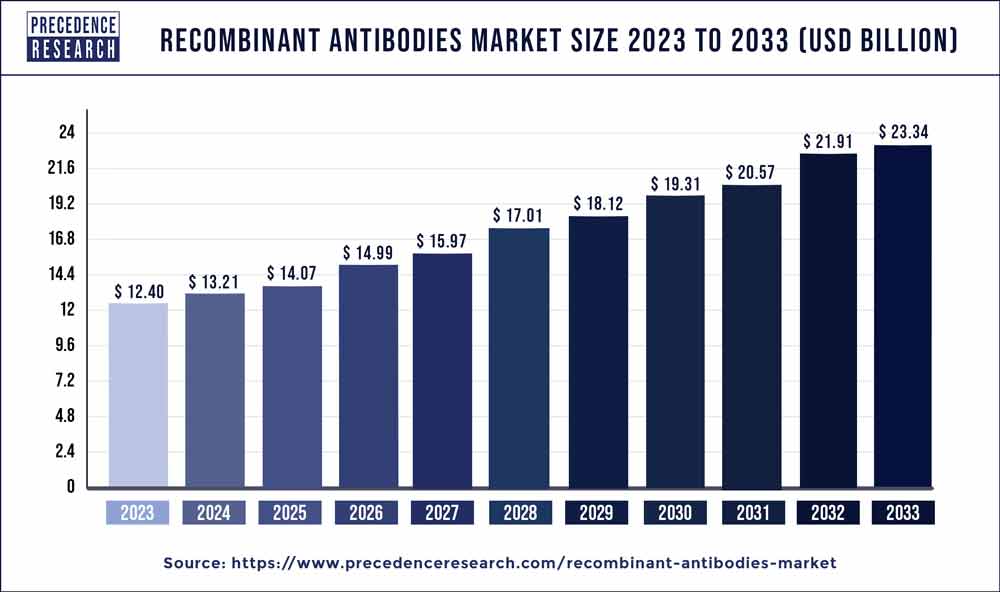

The global recombinant antibodies market size was valued at USD 12.40 billion in 2023 and is estimated to hit around USD 23.34 billion by 2033 growing at a CAGR of 6.53% from 2024 to 2033.

Recombinant Antibodies Market Overview

Recombinant DNA technology creates synthetic monoclonal antibodies, known as recombinant antibodies, which are produced in vitro as an alternative to the conventional hybridoma-based method of producing monoclonal antibodies. Since synthetic genes are used to produce recombinant antibodies outside of the immune system, animal vaccination is not necessary for their creation. Because of their great specificity, sensitivity, and repeatability, these synthetic antibodies are superior to conventional animal-derived antibodies in several ways and may be employed in any application.

The recombinant antibodies market offers services amplifying antibody genes from antibody-producing cells or synthesizing them artificially, then cloning them into phage vectors to encode heavy and light chain immunoglobulin fragments. Then, to produce the functional antibody, these vectors are inserted into expression hosts like yeast, bacteria, or mammalian cells. There are several forms of recombinant antibodies, such as full-length immunoglobulins (Ig), monovalent antibody fragments like fragment antigen-binding (Fab) and single-chain fragment variable (scFv), and multimeric formats like diabodies (dimeric scFvs) or triabodies (trimeric scFvs).

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.53% |

| Global Market Size in 2023 | USD 12.40 Billion |

| Global Market Size by 2033 | USD 23.34 Billion |

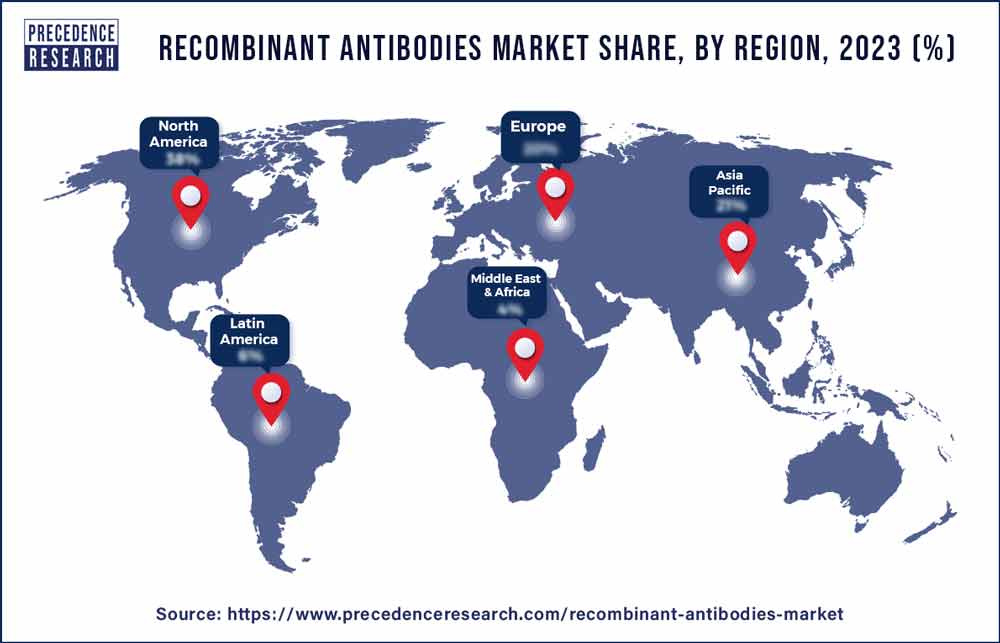

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Rising cases of cancer and infectious disease

The increasing cases of cancer and other infectious disease across the globe are expected to propel the recombinant antibodies market during the forecast period. Recombinant antibodies are designed to specifically target cancer cells by recognizing and binding to antigens expressed on the surface of these cells. This targeted appsroach minimizes damage to healthy cells, reducing side effects compared to traditional chemotherapy. In addition, this can be used for passive immunization, providing immediate protection against infectious agents. They are designed to mimic the immune response and can be administered to individuals at risk or exposed to pathogens, such as in the case of certain viral outbreaks.

Restraint: High production cost and complex manufacturing process

The production of recombinant antibodies can be costly, involving sophisticated biotechnological processes. High production costs may impact the affordability of these therapeutic agents, limiting their widespread adoption. Moreover, the manufacturing of recombinant antibodies involves intricate processes, including cell culture, protein expression, ysuhand purification. The complexity of these processes can pose challenges in terms of scalability, efficiency, and process optimization.

Opportunity: Growing partnership

The increasing partnership in the industry is expected to offer a lucrative opportunity to the recombinant antibodies market during the forecast period. For instance, in September 2023, as part of Project NextGen, which aims to improve our readiness for COVID-19 strains and variations, the U.S.

Department of health and human services (HHS) revealed additional information about its agreement with regeneron to prolong its public-private cooperation to produce life-saving monoclonal antibodies. The goal of the HHS is to make drugs more affordable for all citizens. In keeping with that pledge, HHS and Regeneron declared that their long-running collaboration to create life-saving monoclonal antibodies will continue.

Under HHS's Project NextGen, Regeneron's contract with the Biomedical Advanced Research and Development Authority of the Administration for Strategic Preparedness and Response (ASPR) has been modified. The $326 million modification supports the advanced development of a next-generation monoclonal antibody for COVID-19 prevention.

The single chain antibody segment dominated the recombinant antibodies market in 2023. Single chain antibodies are engineered using recombinant DNA technology, allowing for the customization of binding specificity and affinity. This feature enhances their versatility in targeting specific antigens associated with various diseases. Compared to traditional antibodies, scFv molecules have a smaller size and a simplified structure, making them advantageous for certain applications. Their smaller size can facilitate better tissue penetration, potentially improving therapeutic outcomes.

Additionally, the growing FDA approvals are expected to drive the segment growth. For instance, in July 2023, the FDA authorized BeyfortusTM (nirsevimab-alip) by Sanofi and AstraZeneca to prevent lower respiratory tract disease (LRTD) caused by the respiratory syncytial virus (RSV) in newborns and infants born during or about to enter their first RSV season, as well as in children up to 24 months of age who are still susceptible to severe RSV disease during their second RSV season. The firms want to release Beyfortus in the United States in time for the 2023–2024 RSV season.

The bispecific antibody segment is expected to grow at the highest CAGR in the recombinant antibodies market during the forecast period. Bispecific antibodies can simultaneously target two different antigens, which may be on the surface of target cells or within the tumor microenvironment. This dual targeting enables a more precise and potent therapeutic effect. In cancer treatment, bispecific antibodies have shown promise in redirecting immune cells to target cancer cells. For example, some bispecific antibodies engage T cells by binding to both cancer cells and T cells, facilitating targeted killing of the cancer cells. Thereby, driving the segment growth.

The pharmaceutical & biotechnology segment held the dominating share of the recombinant antibodies market and the segment is observed to sustain the position throughout the forecast period. Major pharmaceutical and biotechnology companies invest heavily in research and development activities related to recombinant antibodies. This includes efforts to discover novel targets, optimize antibody structures, and improve manufacturing processes.

In addition, many pharmaceutical companies have developed and marketed monoclonal antibody (mAb) products, which are a prominent subset of recombinant antibodies. Examples include rituximab, trastuzumab, and adalimumab, used in the treatment of cancer, autoimmune diseases, and inflammatory conditions.

Moreover, the growing investment by the pharmaceutical industry is expected to offer a lucrative opportunity for segment expansion. For instance, in March 2023, the CDMO of cytotoxic and non-cytotoxic pharmaceuticals, BSP Pharmaceuticals, with headquarters in Latina, Italy, is planning to invest EUR 320 million ($349 million) to expand its facility. The extensions are expected to be fully operational by the end of 2025.

The new investment cycle will consist of a new sterile suite fully contained for sterile liquid and vials; an additional conjugation suite at 6,500 g/batch a monoclonal antibody (mAb) scale; and a new building with an approximate 22,000 square foot footprint for future expansion for the manufacturing of cytotoxic coIn order to produce sterile liquid vials (non-cytotoxic projects) for biologicals and small molecules for immuno-oncology and immunotherapy projects, three more sterile suites with full containment are scheduled to be constructed.

Besides, the research Institutes segment is expected to grow at a rapid rate in the recombinant antibodies market over the projected period. Research institutes are instrumental in developing and refining novel platforms and technologies related to recombinant antibodies. This may include advancements in protein expression systems, antibody design, and screening methodologies. Thereby, driving the segment growth.

North America, in 2023, held the dominating share of the recombinant antibodies market. Several major pharmaceutical and biotechnology companies headquartered in North America are actively involved in the development, manufacturing, and commercialization of recombinant antibodies. These companies contribute significantly to the growth and innovation within the market.

Additionally, the region is a hub for clinical trials related to recombinant antibody therapies. Clinical research facilities in the region conduct trials to evaluate the safety and efficacy of novel antibody-based treatments across various therapeutic areas, including oncology, immunology, and infectious diseases. Thus, this is expected to propel the recombinant antibodies market in the region.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

June 2024

July 2024